Low Income Tax Rebate Web 1 juil 2020 nbsp 0183 32 For 2023 full the Low Income Tax Offset is valued at 700 on low incomes up to 37 500 The offset is withdrawn at the rate of 5 of income above 37 500 up to

Web Low income tax offset LITO The amount of low income tax offset LITO you receive will depend on your taxable income If you earned 37 500 or less you will get the Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Low Income Tax Rebate

Low Income Tax Rebate

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

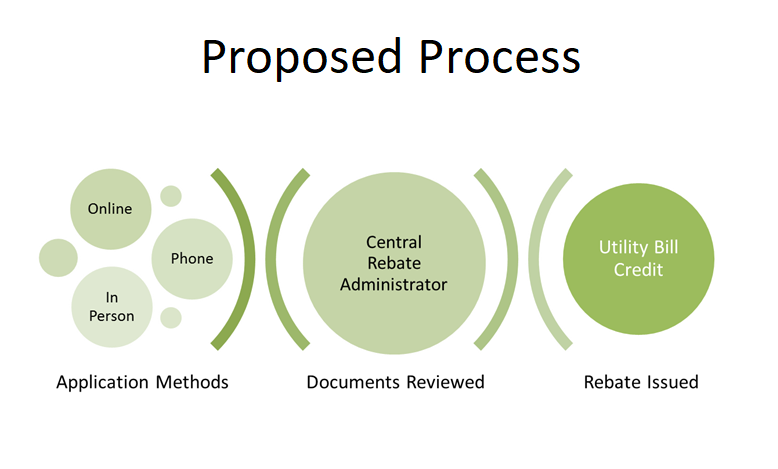

Longmont City Council Decides To Move Forward With City Tax Rebates For

https://www.vmcdn.ca/f/files/longmontleader/import/2018_12_rebates.png;w=960

Carbon Tax Rebate 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Carbon-Tax-Rebate-2022-Income-Information.png

Web 9 juil 2023 nbsp 0183 32 Your income and deductions are different from last year But the most likely culprit for a low refund or even a tax bill is the discontinuation of the low and Web 22 mars 2023 nbsp 0183 32 The 700 Low Income Tax Offset LITO combined with the tax free threshold of 18 200 effectively allows working Australians to earn up to 21 884 for the

Web 11 mai 2021 nbsp 0183 32 Treasurer Josh Frydenberg is set to extend the tax rebate known as The Lamington in Tuesday s budget delivering a tax cut worth up to 2160 for couples The Web Worksheet 1 Working out your rebate income Row Calculation Amount a Your taxable income from Taxable income or loss on your tax return excluding any assessable

Download Low Income Tax Rebate

More picture related to Low Income Tax Rebate

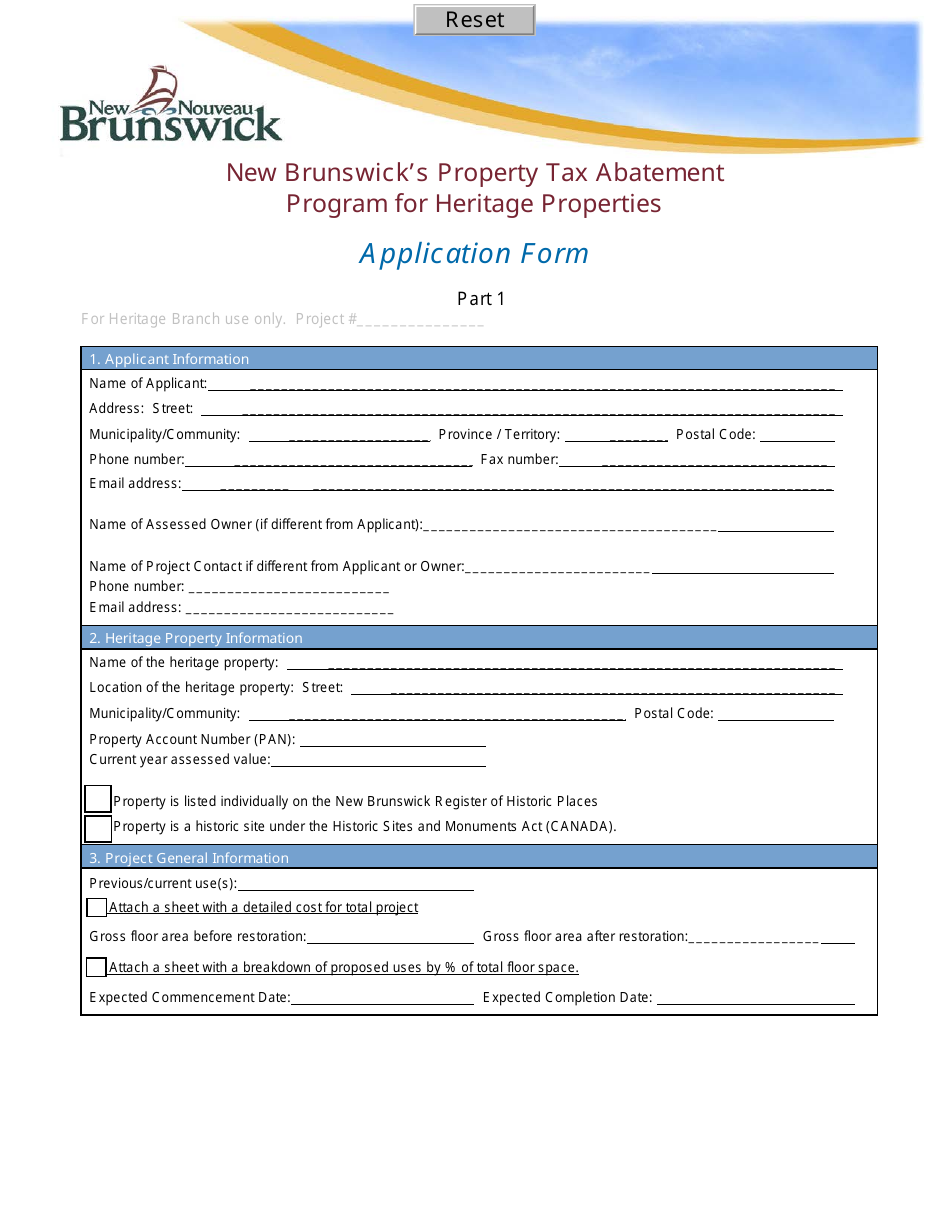

New Brunswick Canada New Brunswick s Property Tax Abatement Program For

https://data.templateroller.com/pdf_docs_html/1871/18719/1871964/new-brunswick-s-property-tax-abatement-program-for-heritage-properties-application-form-new-brunswick-canada_print_big.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

https://www.pennlive.com/resizer/m4KwUD7bWaXPCpyOB7MZ4BmTwYs=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/U5MVCZVZI5COTCDGVU3MWDQABQ.png

Web 3 sept 2022 nbsp 0183 32 The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or Web 15 janv 2021 nbsp 0183 32 IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Income Tax Credit EITC In 2020 the IRS

Web 2 juin 2021 nbsp 0183 32 Tax return How to claim 1080 refund payment news au Australia s leading news site More than half of Aussies don t think they will get a bigger tax refund Web 22 f 233 vr 2022 nbsp 0183 32 Despite being called the low and middle income tax offset very low earners would get nothing Those on less than 18 200 had no tax to refund The rest would get

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

https://atotaxrates.info/tax-offset/low-income-tax-offset

Web 1 juil 2020 nbsp 0183 32 For 2023 full the Low Income Tax Offset is valued at 700 on low incomes up to 37 500 The offset is withdrawn at the rate of 5 of income above 37 500 up to

https://www.ato.gov.au/.../low-and-middle-income-earner-tax-offsets

Web Low income tax offset LITO The amount of low income tax offset LITO you receive will depend on your taxable income If you earned 37 500 or less you will get the

2007 Tax Rebate Tax Deduction Rebates

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Visulattic Your Infographics Destination Countries With The Lowest

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

Retirement Income Tax Rebate Calculator Greater Good SA

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Georgia Income Tax Rebate 2023 Printable Rebate Form

Section 87A Tax Rebate Under Section 87A

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Low Income Tax Rebate - Web From 1 July 2017 the government introduced the low income super tax offset LISTO to assist low income earners to save for their retirement If you earn an adjusted taxable