Ltd Company Tax Free Allowances Find out about tax reliefs and allowances available from HMRC if you run a business employ people or are self employed

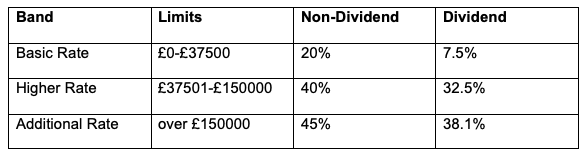

Above the standard tax free Personal Allowance 12 570 for the 2024 25 tax year you will pay the following rates of Income Considering all the taxes and allowances together the most tax efficient salary for a limited company director depends on whether you re a sole director or there are more people in the business What

Ltd Company Tax Free Allowances

Ltd Company Tax Free Allowances

https://www.heelanassociates.co.uk/wp-content/uploads/2022/06/144-Co-Tax-Allowances-2022-.jpg

Online Businesses Should Register And Comply With Their Tax Obligations

https://philcpa.org/wp-content/uploads/2020/07/Tax.jpg

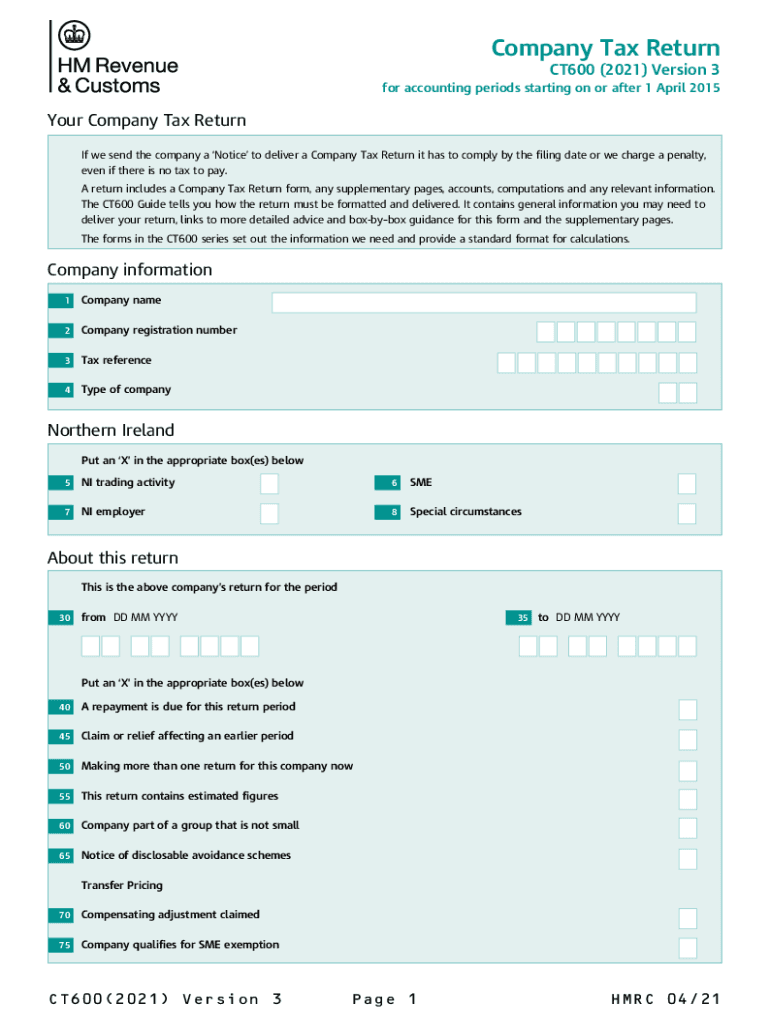

Hmrc Ct600 Online Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/560/820/560820246/large.png

Corporation tax is the main tax that limited companies need to pay Unlike sole traders limited companies do not pay any income tax or national insurance but instead they do pay corporation The Limited Company Tax Calculator allows you to see a breakdown of your tax if you are self employed through a limited company 2023 2024 values are used to show you

You cannot claim expenses if you use your 1 000 tax free trading allowance Contact the Self Assessment helpline if you re not sure whether a business cost is an allowable The current standard tax free Personal Allowance for the current tax year 2023 24 is 12 570 then the following tax bands apply for amounts exceeding this

Download Ltd Company Tax Free Allowances

More picture related to Ltd Company Tax Free Allowances

Types Of Allowances In India Taxable And Non Taxable Allowance 2022 23

https://life.futuregenerali.in/media/ihsk1hd4/types-of-allowances.jpg

New Tax Free Allowances Started On 6 April Robinsons London

https://www.robinsonslondon.com/wp-content/uploads/2017/05/iStock-658596928.jpg

Corporation Tax Ambiance Accountants Sheffield Accountants

https://ambiance-accountants.co.uk/wp-content/uploads/2020/07/Corporation-tax-top-new.png

What is tax relief for limited companies Allowable business expenses reduce the amount of profit on which limited companies pay Corporation Tax So more As a limited company director you are required to pay income tax on the salary you take out of the business The tax free personal allowance for the 2022 23 tax

The Personal Allowance tax free allowance is the amount of money you can earn during a tax year without paying Income Tax on it Currently the standard Currently a tax free allowance of 1 000 applies to dividends which is 50 lower than in 2022 Furthermore this tax relief is set to halve again in 2024 to just 500 How can a

Tax Free Allowances On Trading And Property Income AccountsPortal

https://www.accountsportal.com/img/blog/1092/tax-free-allowances-on-trading-and-property-income-banner.png

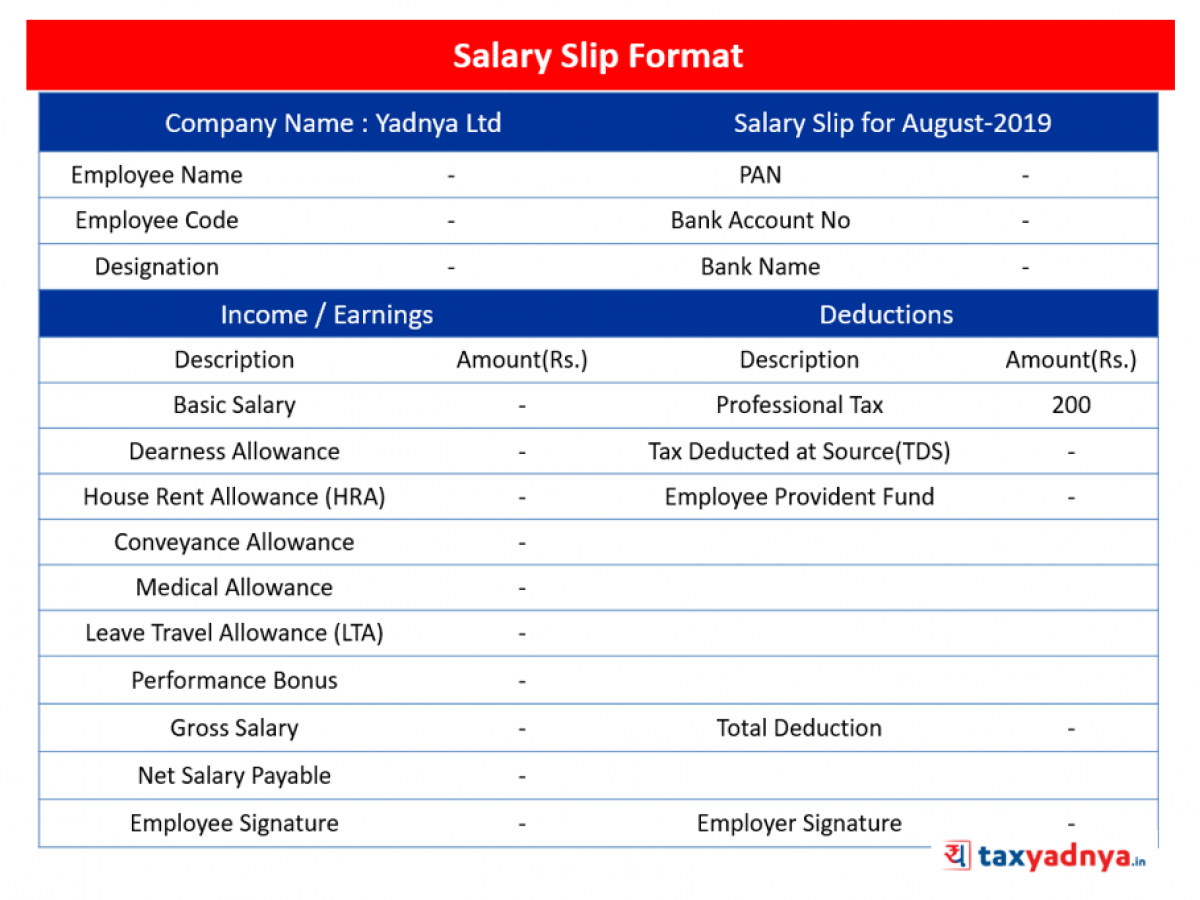

Format Of Salary Slip Communicationslasopa

https://blog.investyadnya.in/wp-content/uploads/2019/08/Salary-Slip-Format-1200x900.png

https://www.gov.uk/guidance/tax-reliefs-and...

Find out about tax reliefs and allowances available from HMRC if you run a business employ people or are self employed

https://www.1stformations.co.uk/blog/…

Above the standard tax free Personal Allowance 12 570 for the 2024 25 tax year you will pay the following rates of Income

Tax Free Allowances Income Tax Act IndiaFilings

Tax Free Allowances On Trading And Property Income AccountsPortal

Tax Free Allowance Use It Or Lose It

CGT Annual Tax free Allowances KP Simpson

Tax Return Clipboard Image

Use Up Your Tax Allowances Early In The Tax Year Broadbent

Use Up Your Tax Allowances Early In The Tax Year Broadbent

What Is The Tax Free Allowance For 6th April 2020 To 5th April 2021

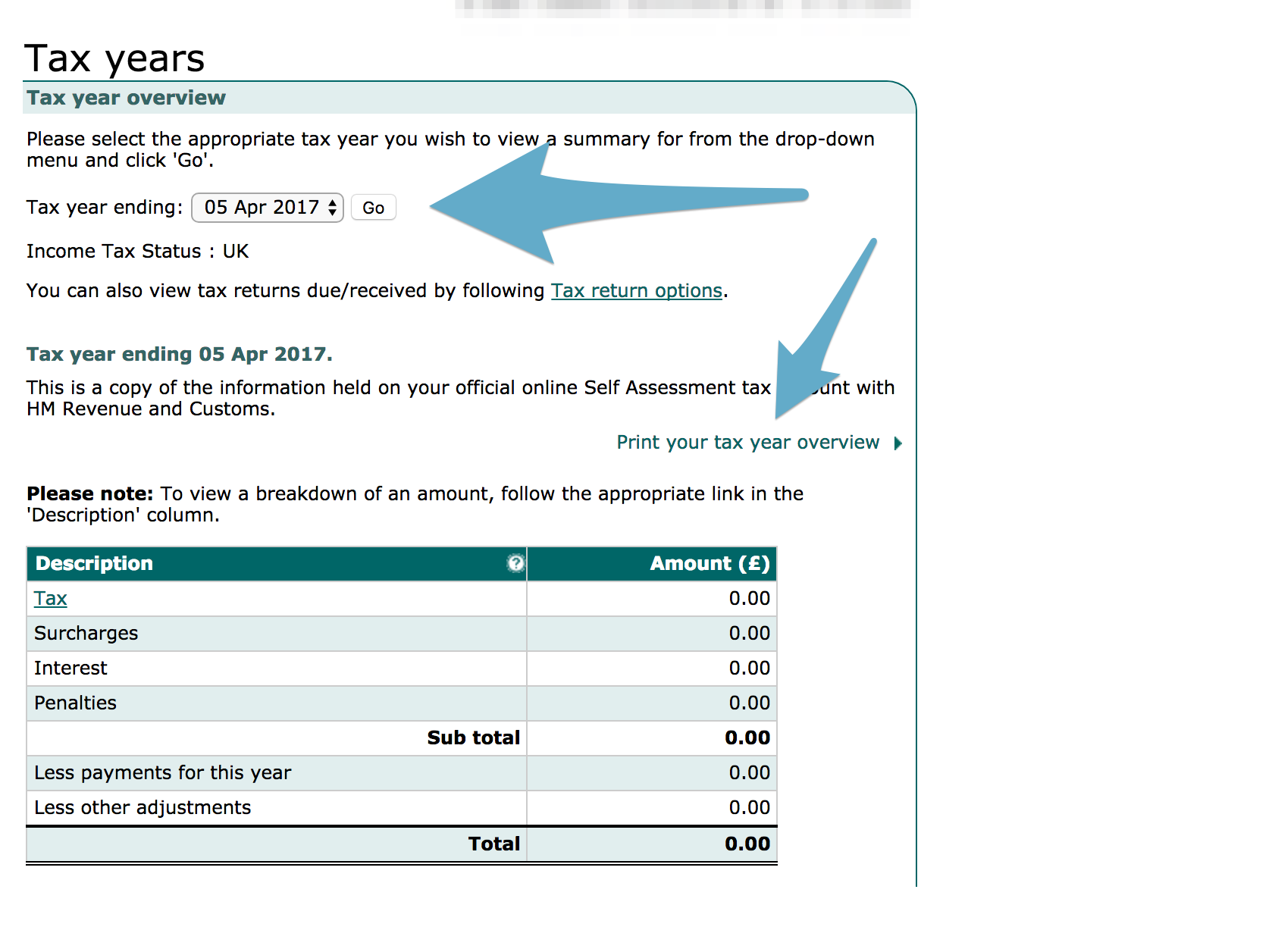

How To Print Your SA302 Or Tax Year Overview From HMRC Love

What Are Tax free Allowances YouTube

Ltd Company Tax Free Allowances - As a UK taxpayer each year you ll have a Personal Allowance any income you receive up to the Personal Allowance is free from Income Tax which was frozen