Mail In Rebate Accounting From an accounting perspective rebates are not considered taxable income but price adjustments Discounts on the other hand are available to all

1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor Rebates At their most basic level customer rebates are price or sales promotions that return a portion of the sales price to the buyer Rebates have gained traction as an

Mail In Rebate Accounting

Mail In Rebate Accounting

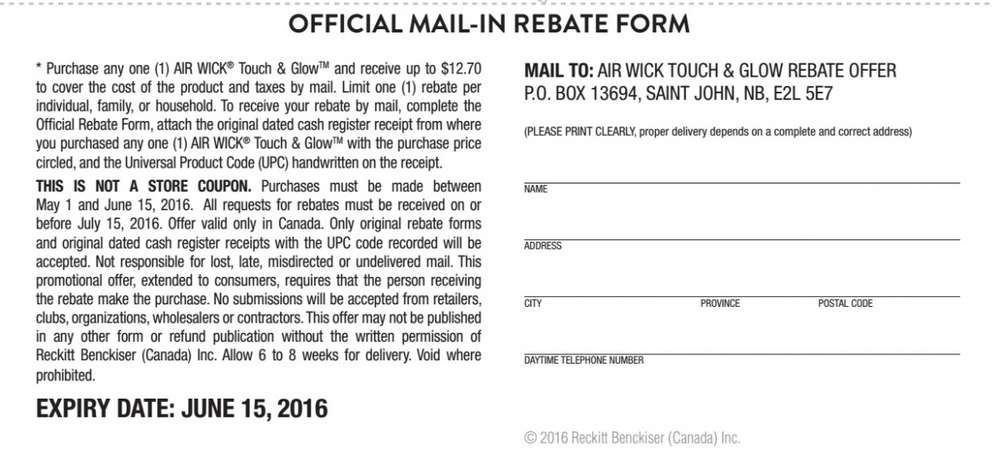

http://forum.smartcanucks.ca/attachments/canadian-shopping-deals-flyers/312954d1464901113-list-current-mail-rebates-untitled.jpg

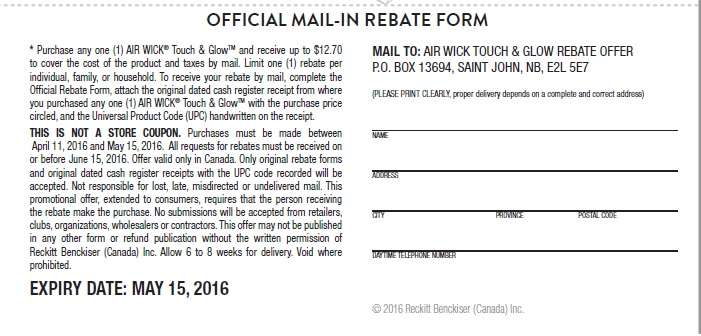

Free After Printable Mail In Rebate Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/250/2504/250426/page_1_thumb_big.png

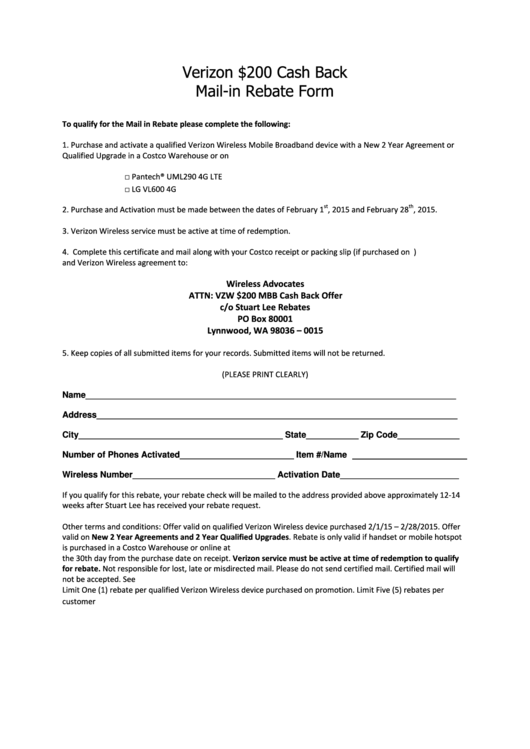

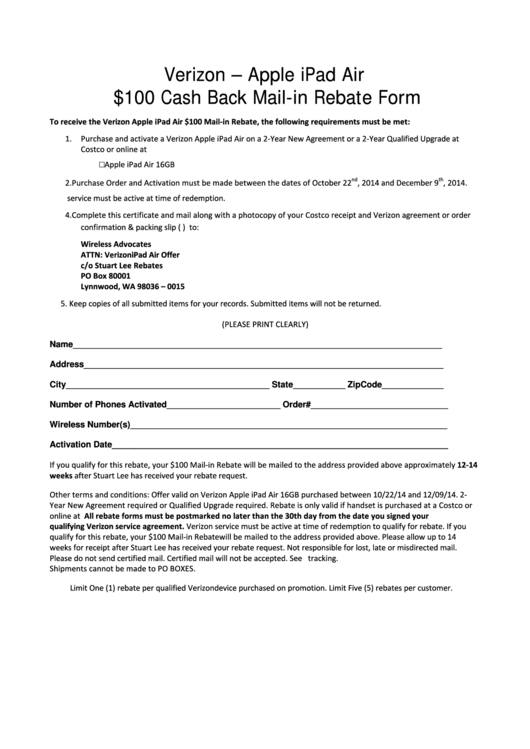

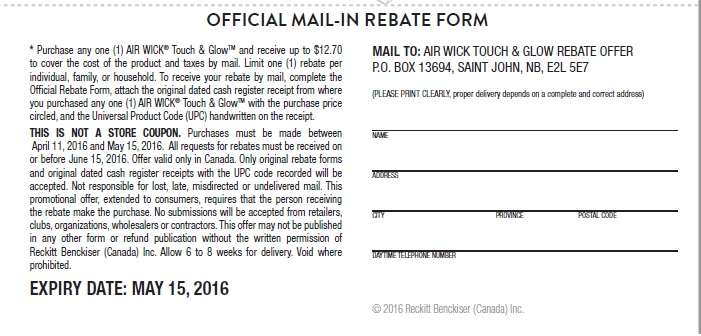

Top 8 Verizon Forms And Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/250/2504/250410/page_1_thumb_big.png

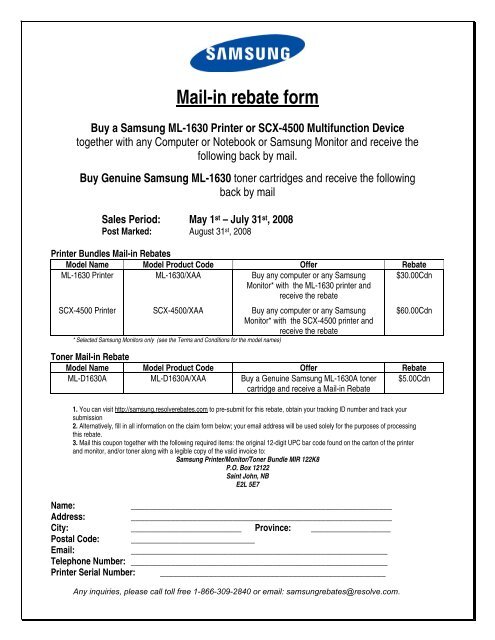

A product rebate usually involves a coupon that the customer must submit to receive a reduction on the price of a purchased item The rebate might be applied immediately at the time of sale or A mail in rebate is an offer that is extended by manufacturers to customers who purchased a specific item and mailed some forms and proof of purchase back to the

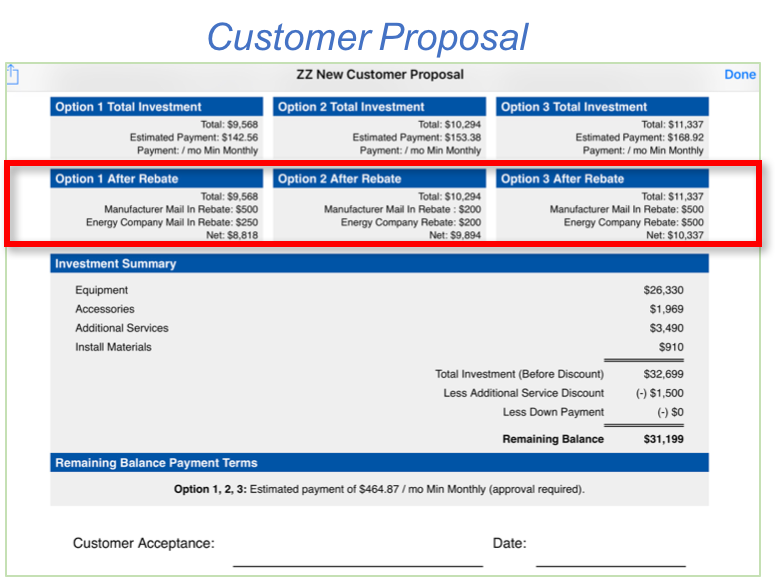

Accounting for Customer Rebates Sales rebates pay the customer back for the sale The rebate could be for some or all of the purchase The rebate has a cash The rebate is not paid until 10 000 units have been ordered by and shipped to the buyer Another example of a rebate is when a buyer uses a coupon

Download Mail In Rebate Accounting

More picture related to Mail In Rebate Accounting

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

https://www.buyvia.com/i/2016/02/mobil-1-rebate-form.png

Mail in Rebate Form

https://img.yumpu.com/287876/1/500x640/mail-in-rebate-form.jpg

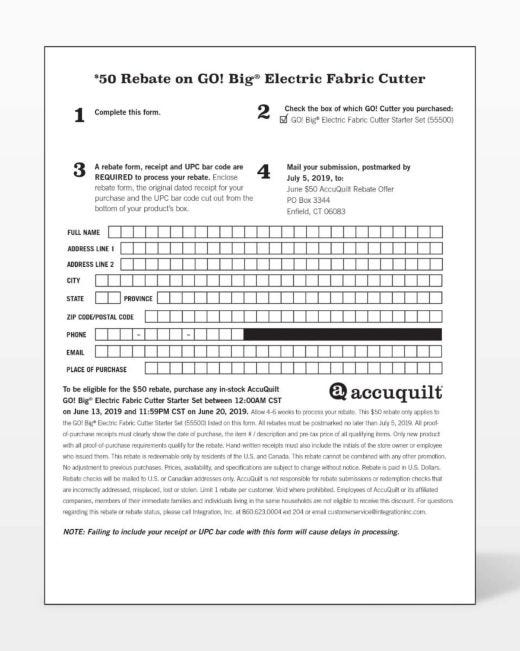

List Of Current Mail In Rebates

http://forum.smartcanucks.ca/attachments/canadian-shopping-deals-flyers/312955d1464901130-list-current-mail-rebates-untitled2.jpg

What is Vendor Rebates Accounting Treatment Vendor rebates exist so that companies can better manage their supplier rebate programs The rebate will specify the terms in which the company qualifies for a What Are Rebates The term rebates in a retail business refers to a portion of compensation given back to customers after what they paid for products or services The buyer receives either a set of a dollar

Rebate is the payback amount that the supplier pay after the customer purchase and settle the payment already The transaction will reduce the cost of products that customers This IFRS Viewpoint provides our views on the purchaser s accounting treatment for the different types of rebate and discount along with some application examples Our view

Bridgestone Mail In Rebate Form Form Resume Examples goVLm552va

http://www.contrapositionmagazine.com/wp-content/uploads/2020/08/bridgestone-mail-in-rebate-form.jpg

Mail in Rebates Newegg Knowledge Base

https://kb.newegg.com/wp-content/uploads/2018/06/MIR5.png

https://bizfluent.com/info-8346017-accounting...

From an accounting perspective rebates are not considered taxable income but price adjustments Discounts on the other hand are available to all

https://www.solvexia.com/blog/rebate-a…

1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor Rebates

Redeeming A Mail In Rebate Is Simple We Break Down The Process For You

Bridgestone Mail In Rebate Form Form Resume Examples goVLm552va

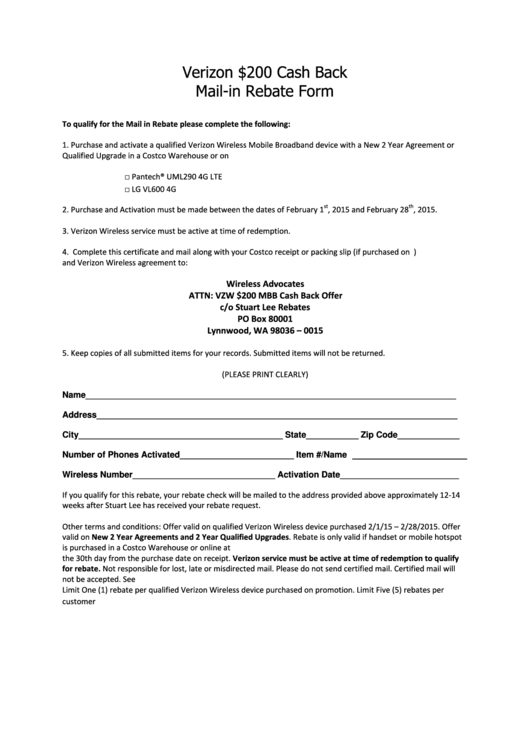

Mail In Rebate Form 50 Off GO Big

Mail in Rebates Newegg Knowledge Base

Is Verizon Wireless Invalidating All Mail in Rebate Submissions Stuarte

Are Mail In Rebates Worth It

Are Mail In Rebates Worth It

Mail in Rebates Newegg Knowledge Base

How Do I Enter Mail In Rebates Release 8 Intelligent Mobile Support

97 Sign In And Out Sheet Page 2 Free To Edit Download Print CocoDoc

Mail In Rebate Accounting - The rebate is not paid until 10 000 units have been ordered by and shipped to the buyer Another example of a rebate is when a buyer uses a coupon