Malaysia Corporate Income Tax Filing Deadline For balance dates between 1 April 30 September the due date is the seventh day of the fourth month following balance date The filing date for taxpayers linked to a tax agent is extended to 31 March of the following year regardless of balance date 7 February for 31 March 30 September balance dates

Tax returns Under the self assessment system companies are required to submit a return of income within seven months from the date of closing of accounts Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company Tax returns are not required to be filed for specific groups of employees where requirements are met Monthly Tax Deduction will be final tax Individuals with business income

Malaysia Corporate Income Tax Filing Deadline

Malaysia Corporate Income Tax Filing Deadline

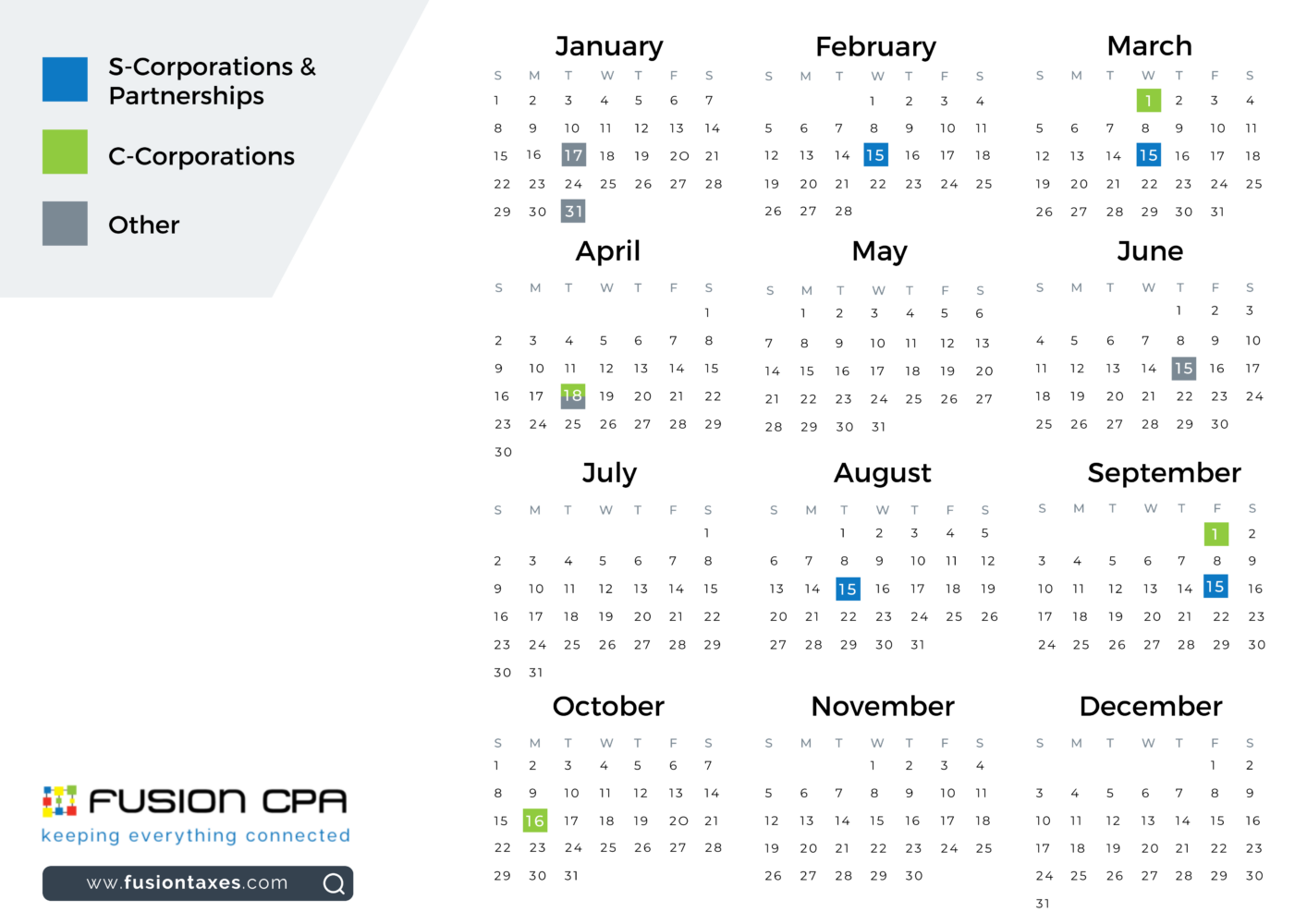

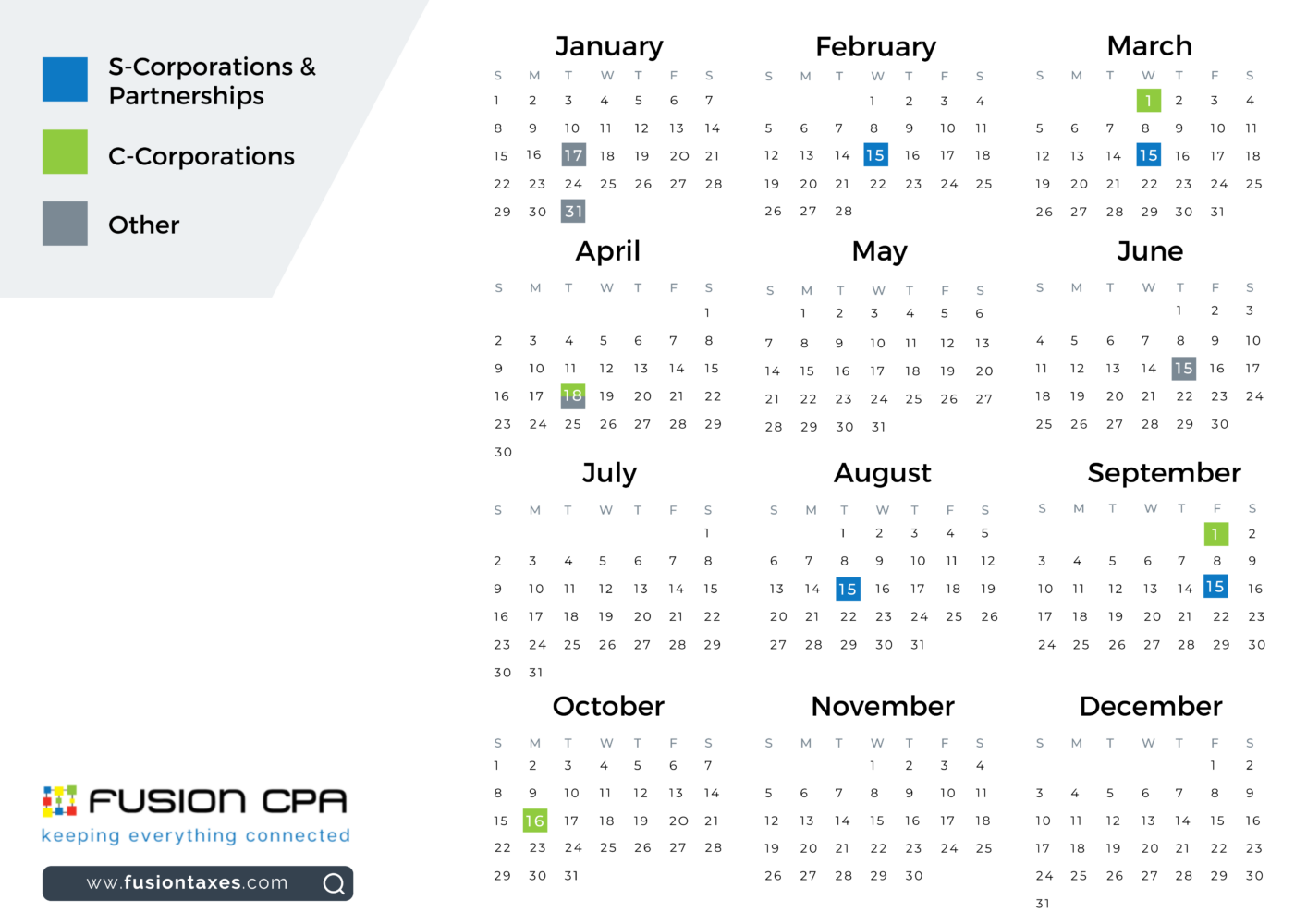

https://s36394.pcdn.co/wp-content/uploads/2022/12/2023-Tax-Calendar-1.png

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259-1536x1024.jpeg

Malaysia Corporate Income Tax Rate Tax In Malaysia

https://www.3ecpa.com.my/wp-content/uploads/2022/03/photo-malaysia-corporate-income-tax-rate-1200x630-1.jpg

Upcoming Malaysia Tax Filing Deadlines for the Year of Assessment YA 2023 Individuals business owners company directors and employers should take note of the new tax filing deadlines and file the tax return before the due date Hantar anggaran cukai secara e Filing e CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual Mulai Tahun Taksiran 2018 anggaran cukai perlu dihantar secara e Filing e CP204

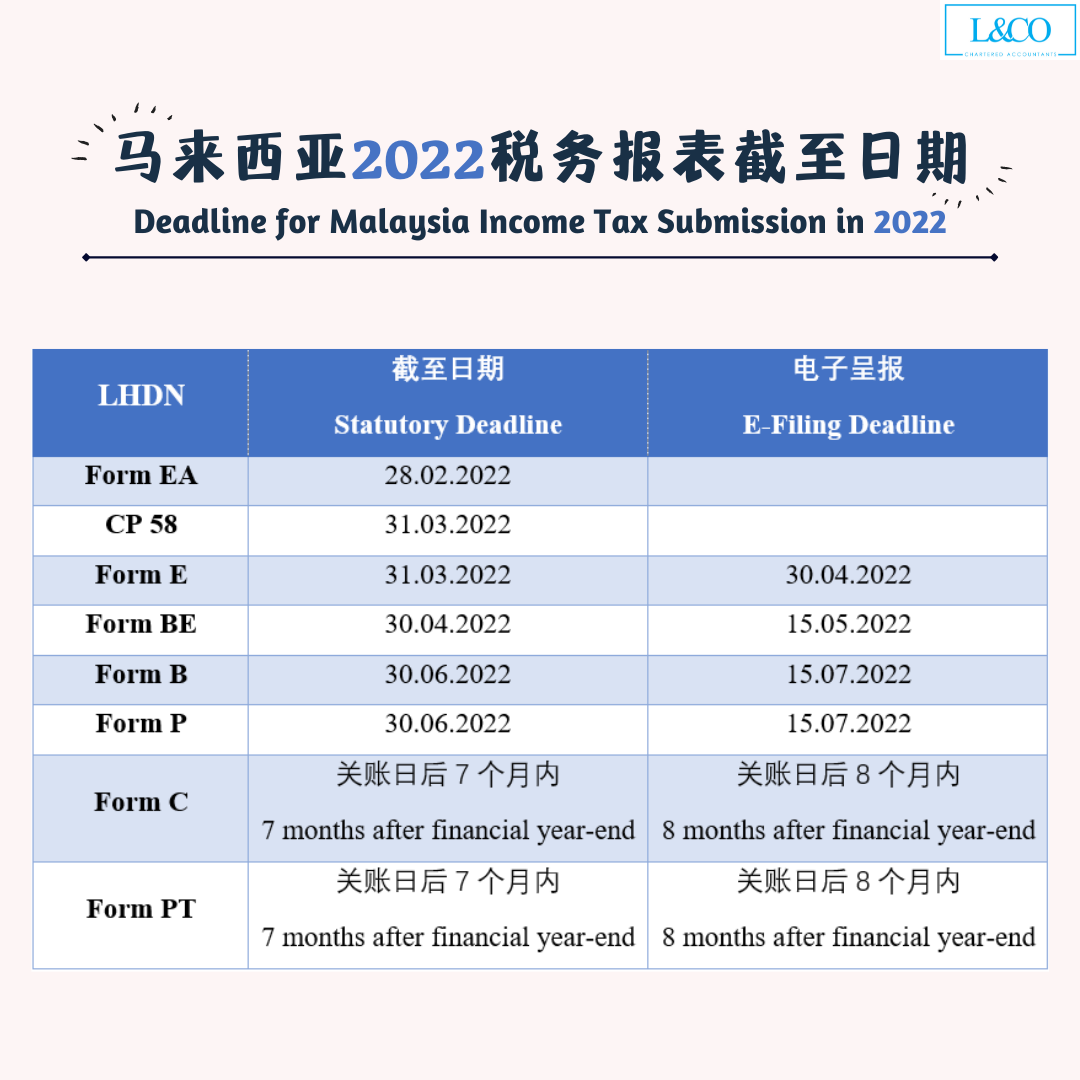

ITRF Deadlines MANUALLY Employment income BE Form on or before 30 th April Business income B Form on or before 30 th June ONLINE Employment income e BE on or before 15 th May Business income e B on or before 15 th July Date of online submission may subject to change In general tax of a non resident company on all income other than income from a business source is collected by means of withholding tax Under the law withholding tax is payable within one month of crediting or paying the non resident company

Download Malaysia Corporate Income Tax Filing Deadline

More picture related to Malaysia Corporate Income Tax Filing Deadline

Deadline For Malaysia Corporate Income Tax Submission In 2023 Swingvy

https://global-uploads.webflow.com/5f783aea952b4abda8b9ff7e/61efcfbcf892846c82362c7c_4Tv639dk6H3yWhwZIITQUcpel-Xn7nUM94AIB7GhfZ0OIzPXejYEnfraHAXtxITgSdMPCp5I-7eDC0w8U4AjWmruMZqRUAqJ7D2pg13ntIZiQkKfv1dNg-KnoktRcpjDa7N-fsyg.png

Deadline For Malaysia Income Tax Submission In 2022 for 2021 Calendar

https://landco.my/wp-content/uploads/2021/02/4-9.png

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/public/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

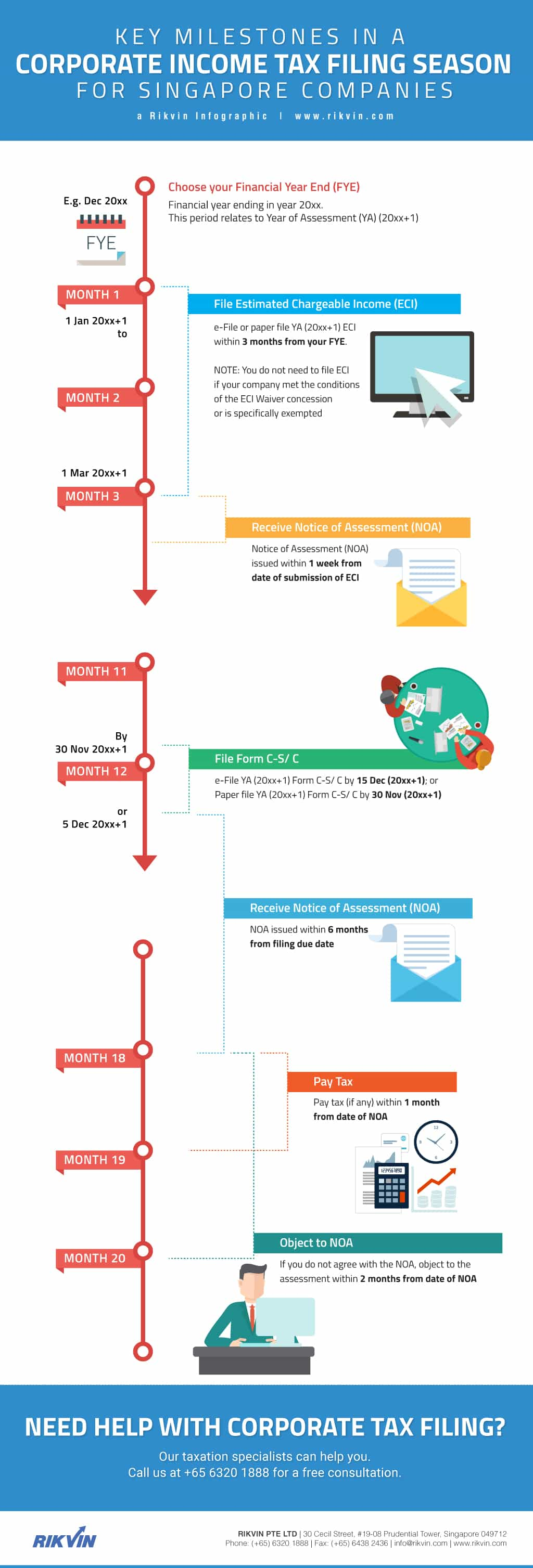

2023 Malaysia Tax Submission Important Timeline Remember to prepare your tax forms on time File your companies employers individuals partnership or association tax hassle free with Cheng Co Tax agents Last reviewed 26 June 2024 For both resident and non resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia Resident companies are also taxed on foreign sourced income received in Malaysia

What are the deadlines for corporate tax filing and payment in Malaysia Corporations in Malaysia must file their tax returns and pay the estimated taxes in monthly instalments starting from the second month of their financial year with final tax settlement upon year end tax return submission Deadline for Malaysia Income Tax Submission in 2024 1 Form EA Annual income statement prepared by company to employees for tax submission purpose Deadline 29 02 2024 2 CP 58 Commission fees statement prepared by company to agents dealers distributors Deadline 31 03 2024

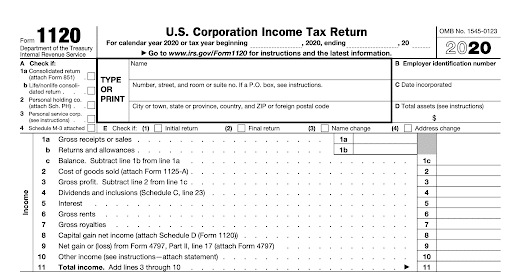

Company Income Tax Returns Services In Pan India ID 23705598055

https://5.imimg.com/data5/SELLER/Default/2021/5/PF/NL/ML/22046360/final-income-tax-return-1000x1000.jpg

Tax Filing Deadline 2021 Jan 08 2021 Johor Bahru JB Malaysia

https://cdn1.npcdn.net/image/161009669810d0235b06bc217b550bffb18c1cd114.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

https://taxsummaries.pwc.com/quick-charts/...

For balance dates between 1 April 30 September the due date is the seventh day of the fourth month following balance date The filing date for taxpayers linked to a tax agent is extended to 31 March of the following year regardless of balance date 7 February for 31 March 30 September balance dates

https://taxsummaries.pwc.com/malaysia/corporate/tax-administration

Tax returns Under the self assessment system companies are required to submit a return of income within seven months from the date of closing of accounts Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company

The October Corporate Tax Deadline What You Need To Know

Company Income Tax Returns Services In Pan India ID 23705598055

Deadline For Malaysia Corporate Income Tax Submission In 2023 Swingvy

E Filing Due Date 2022 Malaysia Tax Compliance And Statutory Due

Corporate Income Tax Filing For Singapore Companies Rikvin Pte Ltd

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

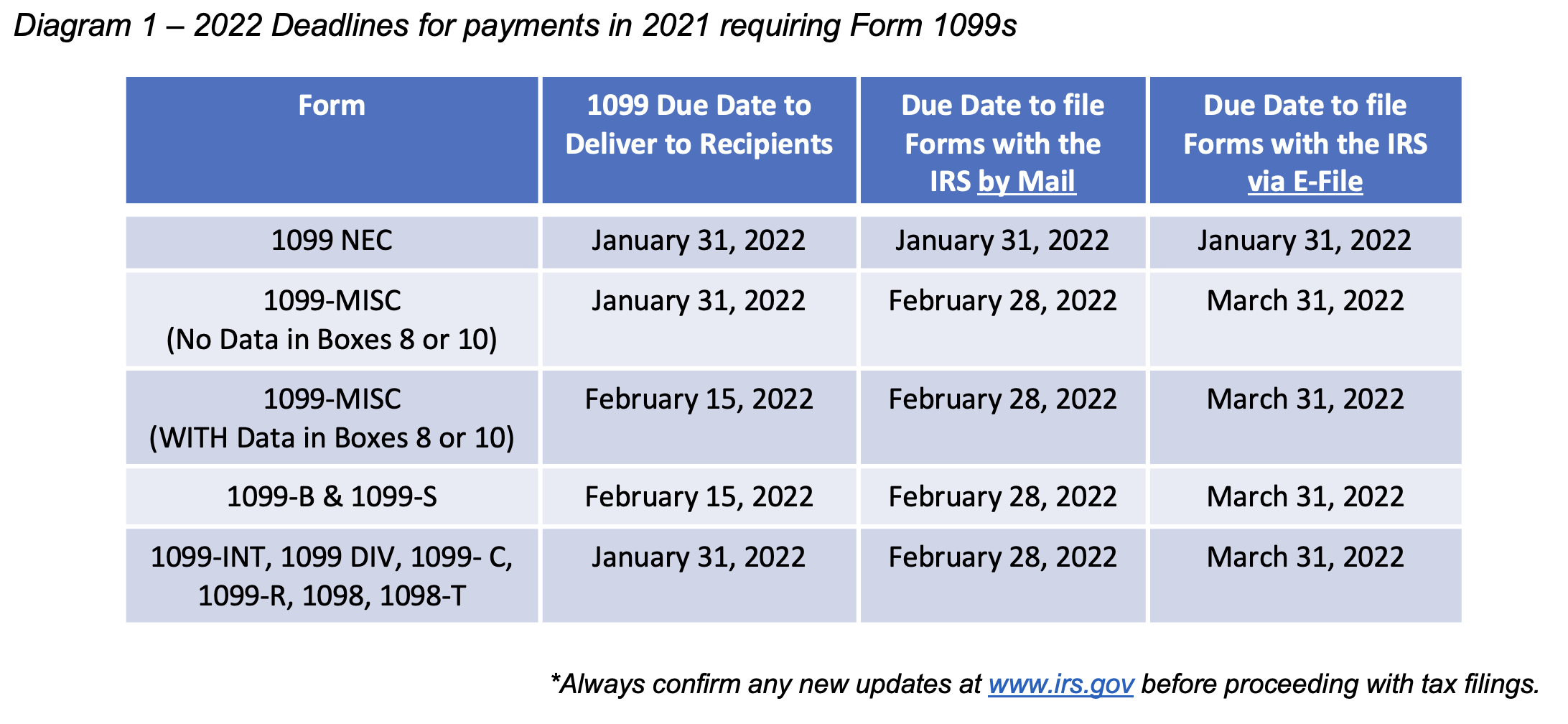

General 7 Who Gets A 1099 Form Top Trending

IncomeTax Handy Guide To Malaysia s Personal Income Tax Filing In

Business Income Tax Malaysia Deadlines For 2021 Swingvy Malaysia

Malaysia Corporate Income Tax Filing Deadline - Guide to essential tax deadlines for Malaysian SME businesses in 2024 From corporate tax to special cases stay informed and meet your LHDN obligations