Manitoba Farmland Education Tax Rebate Web INDIVIDUAL APPLICATION FORM If you own property in Manitoba that is classified as farmland on your 2022 Property Tax Statement complete this application to apply for

Web Seniors Education Property Tax Credit Up to 400 Minus 1 0 of family net income Up to 300 Minus 0 75 of family net income Up to 250 Minus 0 625 of family net income Up to 200 Minus 0 5 of family net Web Properties currently classified as farmland in Manitoba to which school taxes apply are eligible to apply for a rebate of up to 50 per cent on the paid 2022 farmland school

Manitoba Farmland Education Tax Rebate

Manitoba Farmland Education Tax Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/education-property-tax-cuts-in-manitoba-examining-bill-71.png?w=569&ssl=1

Province Of Manitoba School Tax Rebate

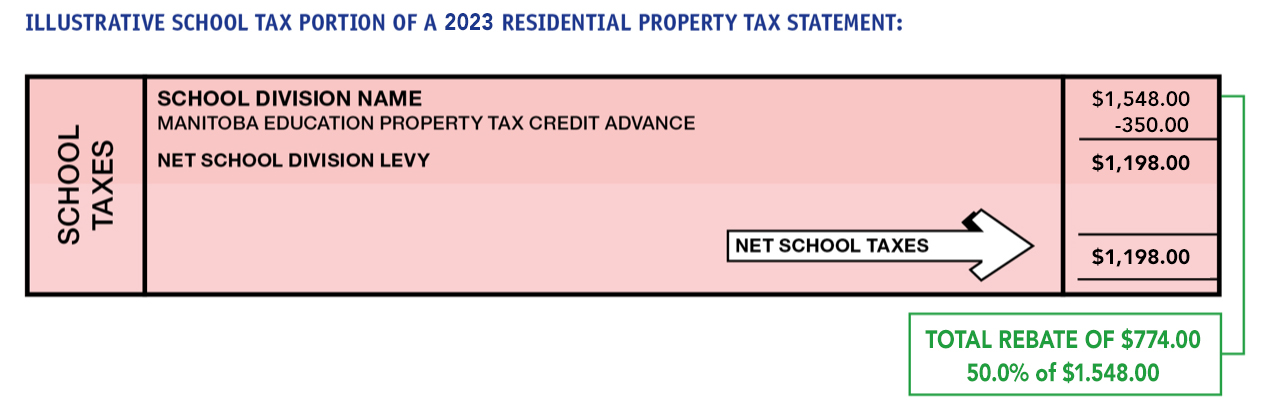

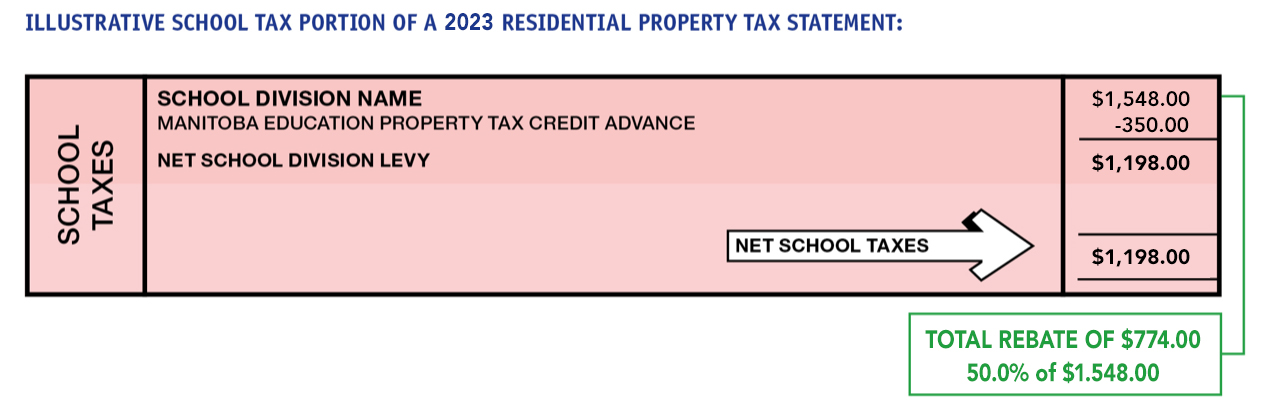

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/school-taxes.png

Province Of Manitoba School Tax Rebate

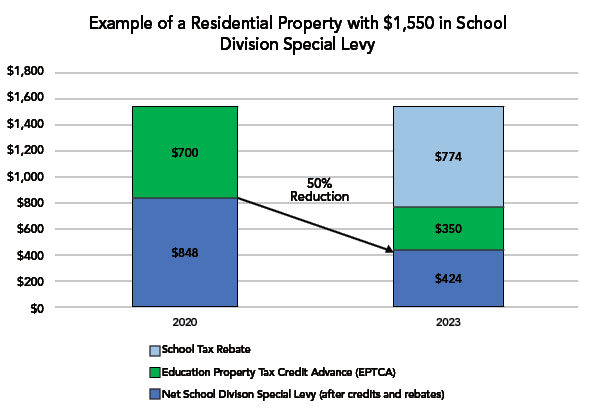

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/residential-example.jpg

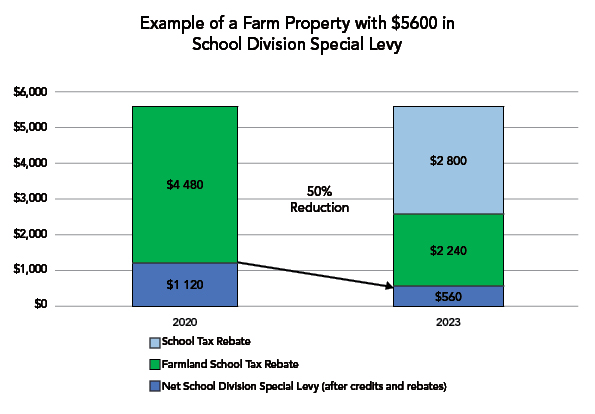

Web For 2023 owners of residential and farm properties will receive a 50 per cent rebate of the school division special levy payable Residential properties include single dwelling units Web The rebate percentage has increased each year and owners of farmland may receive a rebate ranging from 50 to 70 of the school taxes paid on their farmland depending

Web 20 mai 2022 nbsp 0183 32 Residential homeowners and farm property owners are entitled to a rebate of 37 5 per cent of their education property tax this year which is an increase from the 25 Web Use your 2022 Property Tax Bill to calculate your 2022 Farmland School Tax Rebate Enter B and C to see your calculation below B Farmland Assessment Enter the assessment

Download Manitoba Farmland Education Tax Rebate

More picture related to Manitoba Farmland Education Tax Rebate

Farmland School Tax Rebate Debated At AMM Meeting SteinbachOnline

https://golden-west-archive-content.s3.amazonaws.com/content/steinbachonline/images/stories/ag-news/0c5eab0e34.jpeg

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/farm-property-example.jpg

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

Web The Education Property Tax Rebate will automatically be issued to property owners no application form will be necessary Farm property owners will still be required to apply for Web Farm property owners will still be required to apply for the Farmland School Tax Rebate In conjunction with the School Tax Rebate existing education property tax offsets will be

Web Steps to Get this Rebate 1 Fill up the application form available on the website 2 Email to FSTR masc mb ca or submit to 400 50 24th St NW Portage la Prairie Manitoba Web 8 avr 2021 nbsp 0183 32 Whereas in 2020 the Farmland School Tax Rebate was set at 80 per cent with a cap of 5 000 the 2021 Farmland School Tax Rebate will be reduced by 25 per

2013 Farmland School Tax Rebate Application Form Canada Manuals

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/2013-farmland-school-tax-rebate-application-form-canada-manuals.jpg?resize=744%2C1024&ssl=1

Manitoba Budget Highlights Tax Rebates And Credits More Intensive

https://s3.amazonaws.com/socast-superdesk/media/20220412200444/6255e53b023d160907f75f07jpeg.jpg

https://www.masc.mb.ca/masc.nsf/application_fstr_2022_ind…

Web INDIVIDUAL APPLICATION FORM If you own property in Manitoba that is classified as farmland on your 2022 Property Tax Statement complete this application to apply for

https://www.gov.mb.ca/schooltaxrebate

Web Seniors Education Property Tax Credit Up to 400 Minus 1 0 of family net income Up to 300 Minus 0 75 of family net income Up to 250 Minus 0 625 of family net income Up to 200 Minus 0 5 of family net

Manitoba NDP s Promise To Exclude Out of province Billionaires From

2013 Farmland School Tax Rebate Application Form Canada Manuals

Hunter Education Instructors Rebates Rebate2022

Billionaires Companies Benefit From Manitoba Education Property Tax

Billionaires Companies Benefit From Manitoba Education Property Tax

Billionaires Companies Benefit From Manitoba Education Property Tax

Owners Of Pricey Properties Pocketed Big Bucks From Tax Cuts Promised

Manitoba s Education Tax Rebate Misdirected Say Tuxedo Homeowner West

Western Manitoba Farmland Values Up TheRegional

Manitoba Farmland Education Tax Rebate - Web For 2023 owners of residential and farm properties will receive a 50 per cent rebate of the school division special levy payable Residential properties include single dwelling units