Manitoba Seniors School Tax Rebate Online Application Web Farmland School Tax Rebate Up to 80 of school tax to a maximum of 5 000 Up to 60 of school tax to a maximum of 3 750 Up to 50 of school tax to a maximum of 3 125 Up to 40 of school tax to a

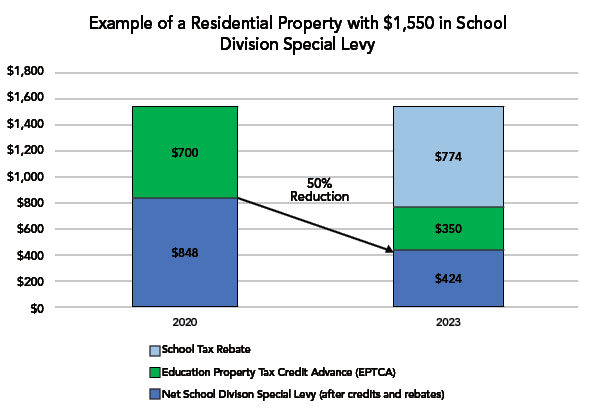

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own Web Tax Credit and Rebate Amounts 2020 2021 2022 2023 Education Property Tax Credit and Advance Up to 700 Up to 525 Up to 438 Up to 350 Seniors School Tax

Manitoba Seniors School Tax Rebate Online Application

Manitoba Seniors School Tax Rebate Online Application

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/schooltaxrebate-header.jpg

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/residential-example.jpg

Web The Seniors School Tax Rebate provides savings for eligible Manitobans age 65 or older who own their own home or are responsible for the payment of school tax on their Web Eligible seniors below the 40 000 income tested threshold may be eligible for a full Rebate depending on the amount of school tax Senior households with a family net income of

Web Manitoba seniors who live in their own homes may be eligible for the Seniors School Tax Rebate Learn more Seniors with income under 40 000 Senior households with Web Rebates available for income tested tenants over the age of 55 to offset the school tax portion of rent costs Coverage Annual rebates of up to 175 00 The rebate is payable

Download Manitoba Seniors School Tax Rebate Online Application

More picture related to Manitoba Seniors School Tax Rebate Online Application

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/farm-property-example.jpg

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Nova Scotia Gov On Twitter RT ns servicens Applications For The

https://pbs.twimg.com/media/FcigJ-UXoAAP6SS.jpg

Web Seniors School Tax Rebate Complete an on line application 2014 Seniors School Tax Rebate on line submission To print an application form 2014 Seniors School Tax Web Do I need to report the Rebate I received on my personal income tax return Yes When completing the Manitoba Income Tax Form MB479 Manitoba Credits you will be

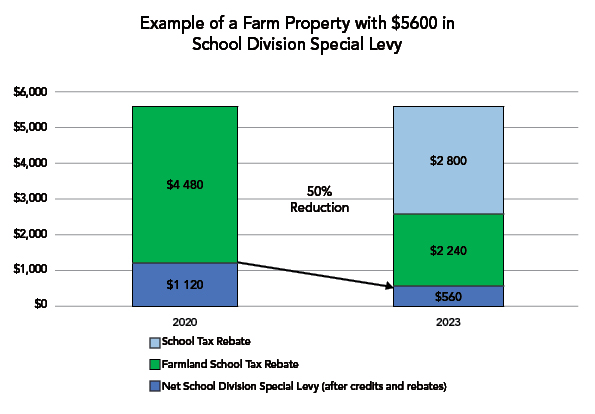

Web The Manitoba 2016 budget retained the increase in the maximum Seniors School Tax Rebate to 470 for the 2016 property tax year and eligibility criteria will be broadened to Web owners will still be required to apply for the Farmland School Tax Rebate In conjunction with the Education Property Tax Rebate existing education property tax offsets will be

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAZZRwK.img?w=1280&h=720&m=4&q=79

Tuition Fee Tax Rebates Cancelled For Manitoba Graduates The Projector

https://theprojector.ca/wp-content/uploads/2018/04/04102018-TAXREBATE-OWCZAR-1080x1620.jpg

https://www.gov.mb.ca/schooltaxrebate

Web Farmland School Tax Rebate Up to 80 of school tax to a maximum of 5 000 Up to 60 of school tax to a maximum of 3 750 Up to 50 of school tax to a maximum of 3 125 Up to 40 of school tax to a

https://www.gov.mb.ca/finance/tao/sstr_faq.html

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own

No Rebate For High income Seniors Under Province s New Tax Plan

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

Dental Nurse Tax Rebate Tax Rebate Online

Manitoba NDP s Promise To Exclude Out of province Billionaires From

2013 Farmland School Tax Rebate Application Form Canada Manuals

Manitoba Government Grants For Homeowners 37 Grants Rebates Tax

Manitoba Government Grants For Homeowners 37 Grants Rebates Tax

Hearing Aid Grant For Manitoba Seniors

Do You Wear A Fast Food Uniform At Work Claim Your Tax Rebate Online

Illinois Tax Rebate Tracker Rebate2022

Manitoba Seniors School Tax Rebate Online Application - Web own own home or be responsibilities for paying the school taxes on respective principal location live with your home and be tenants of Manitoba This maximum Rebate for