Mark R P60 Tax Refund Example A P60 tax refund refers to money owed back to you based on the tax and income information shown on your P60 form There are two common reasons you might

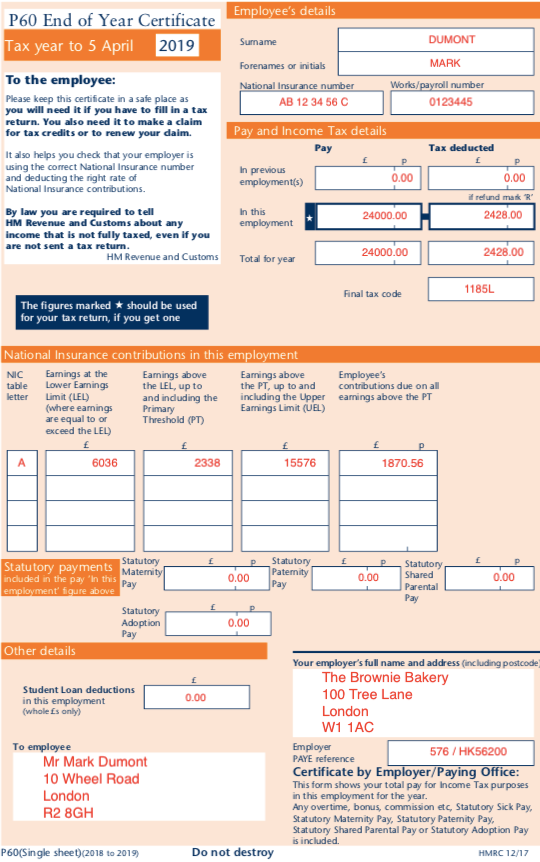

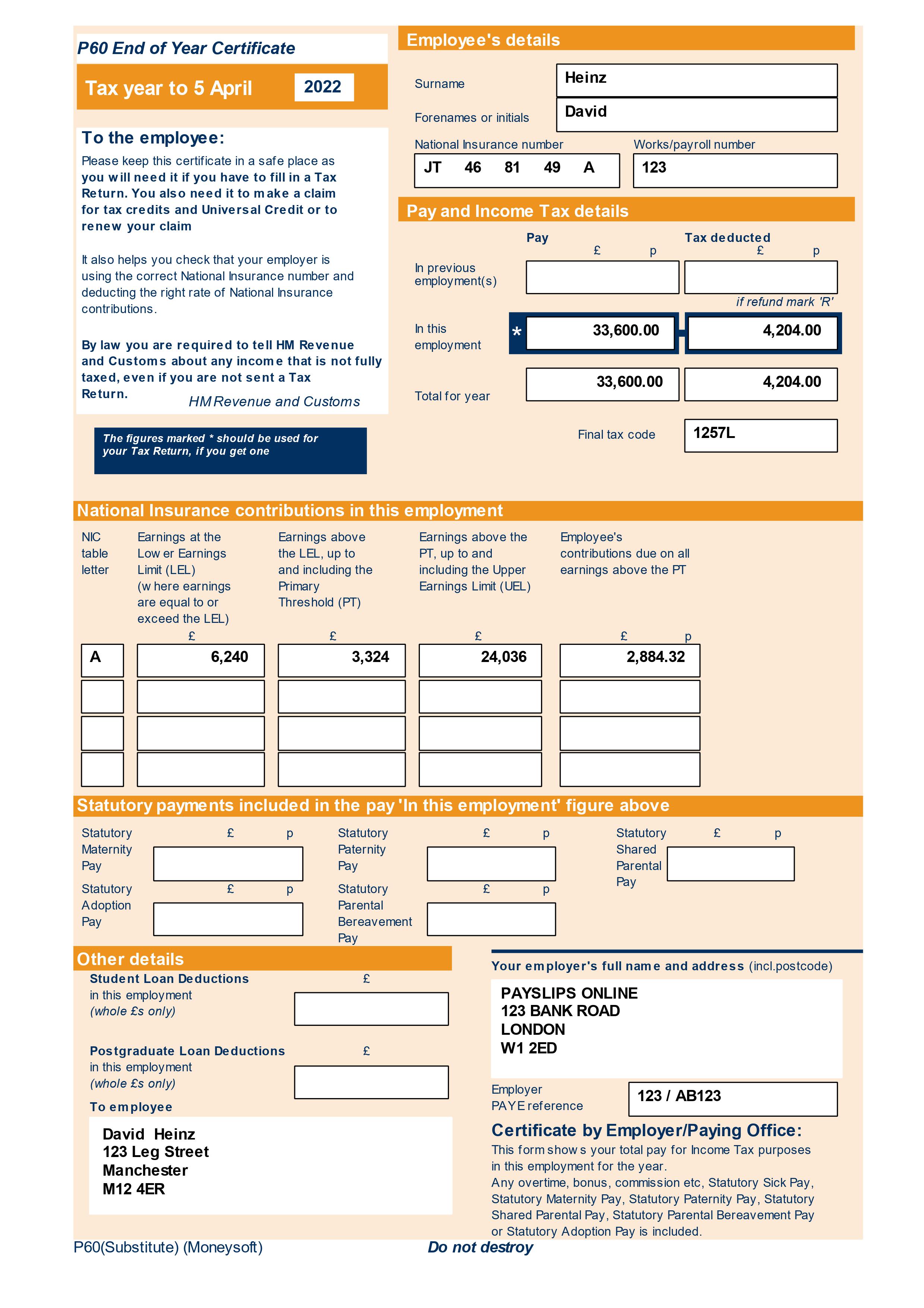

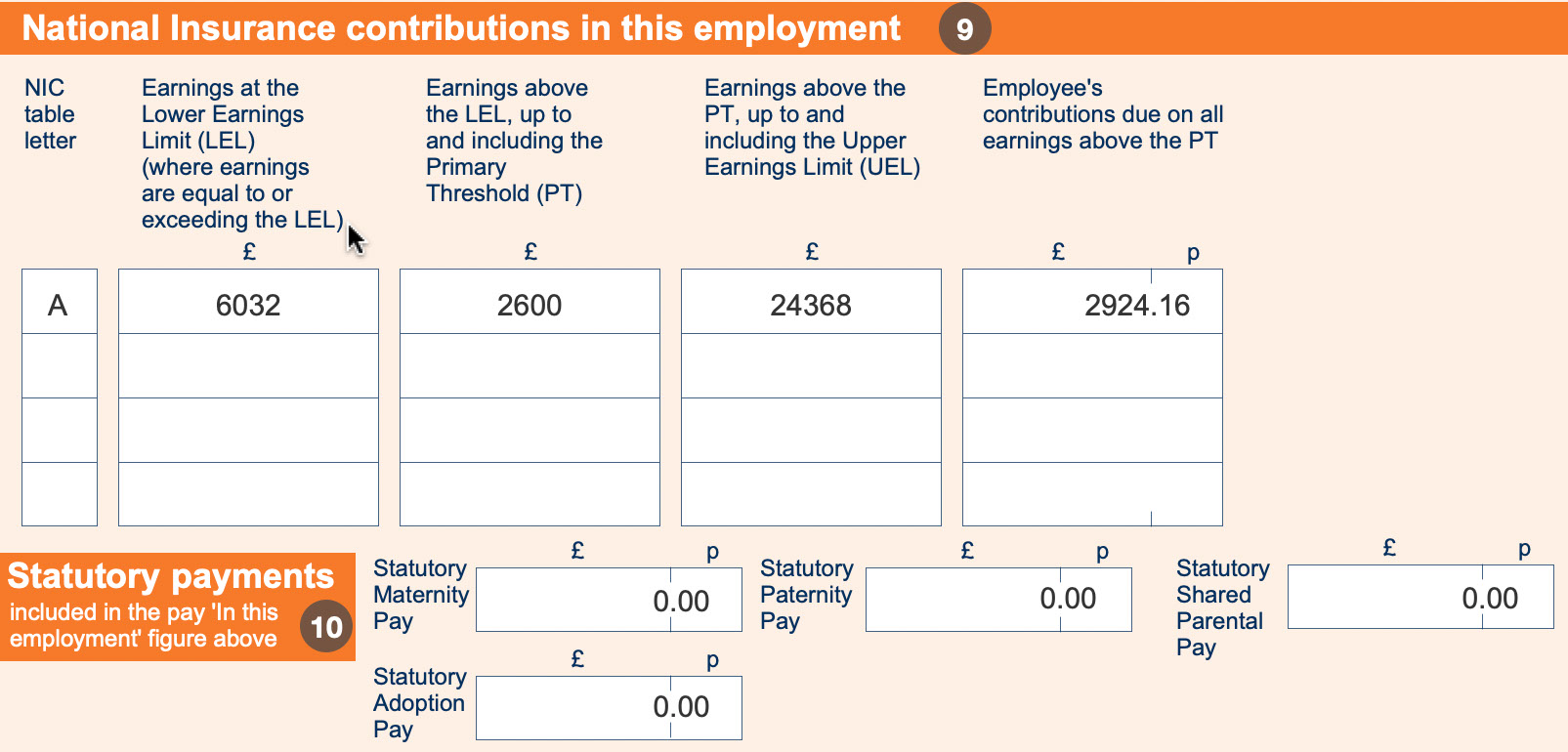

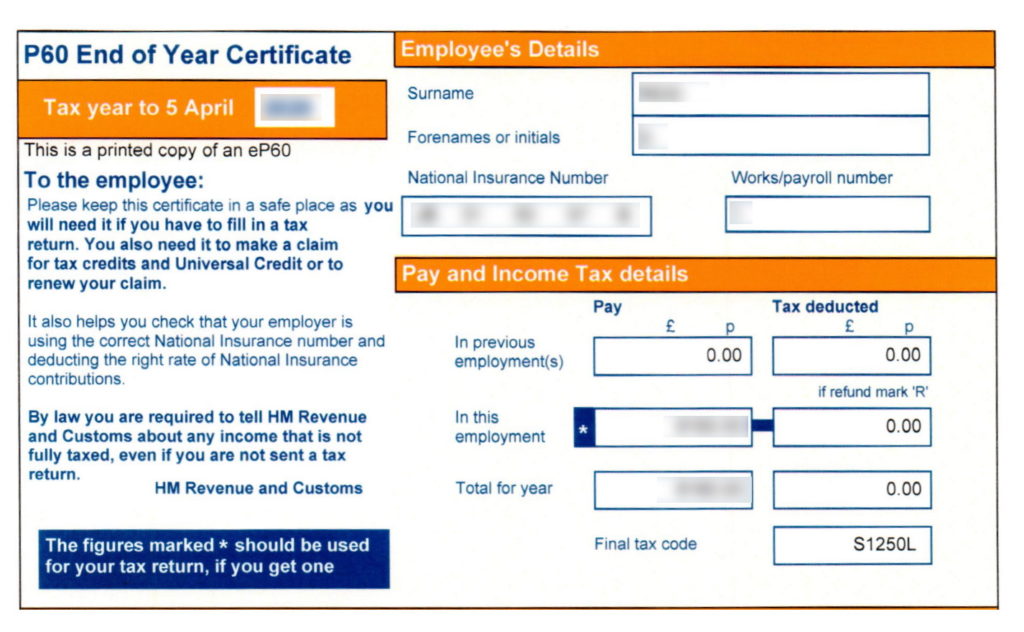

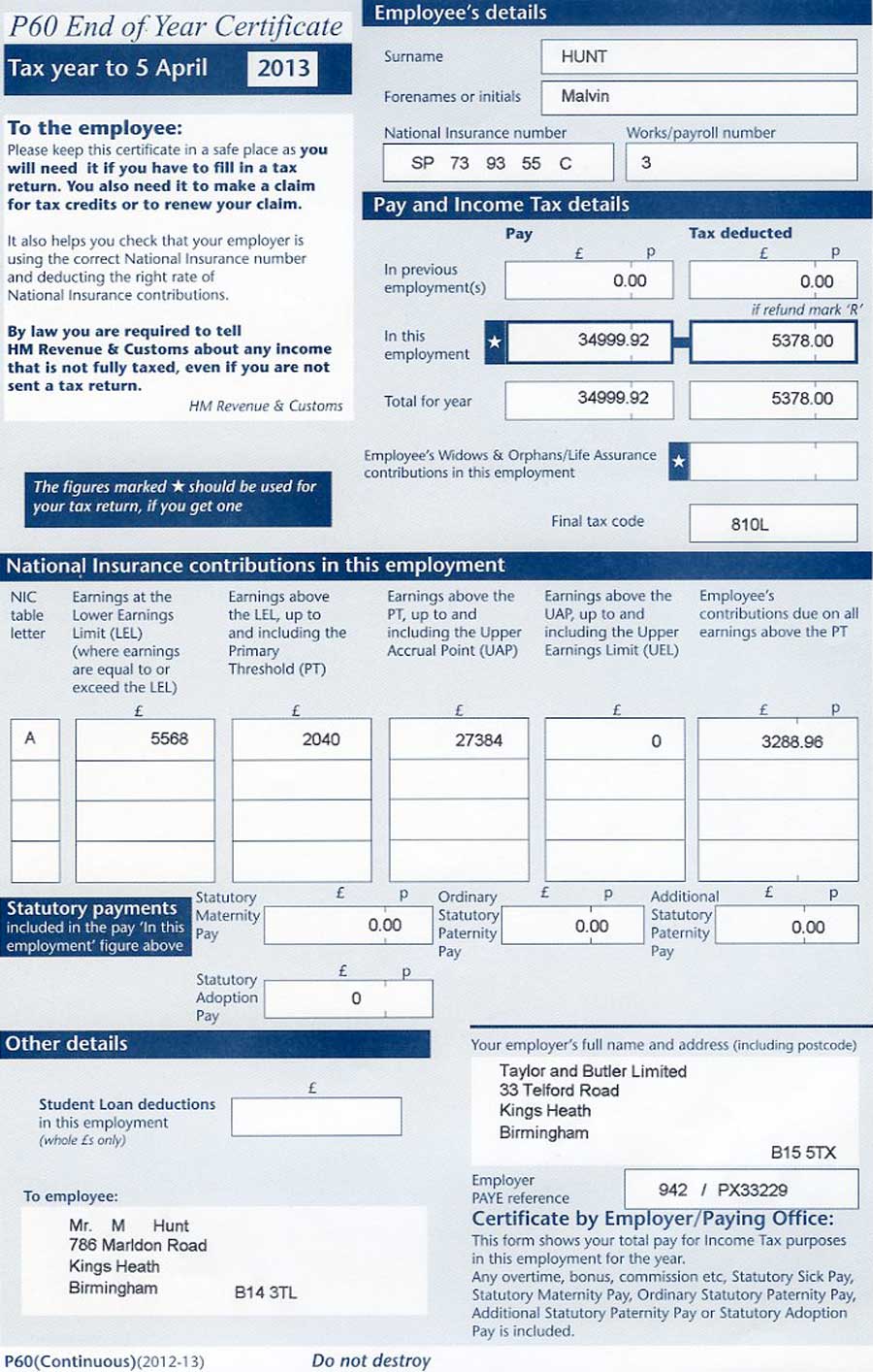

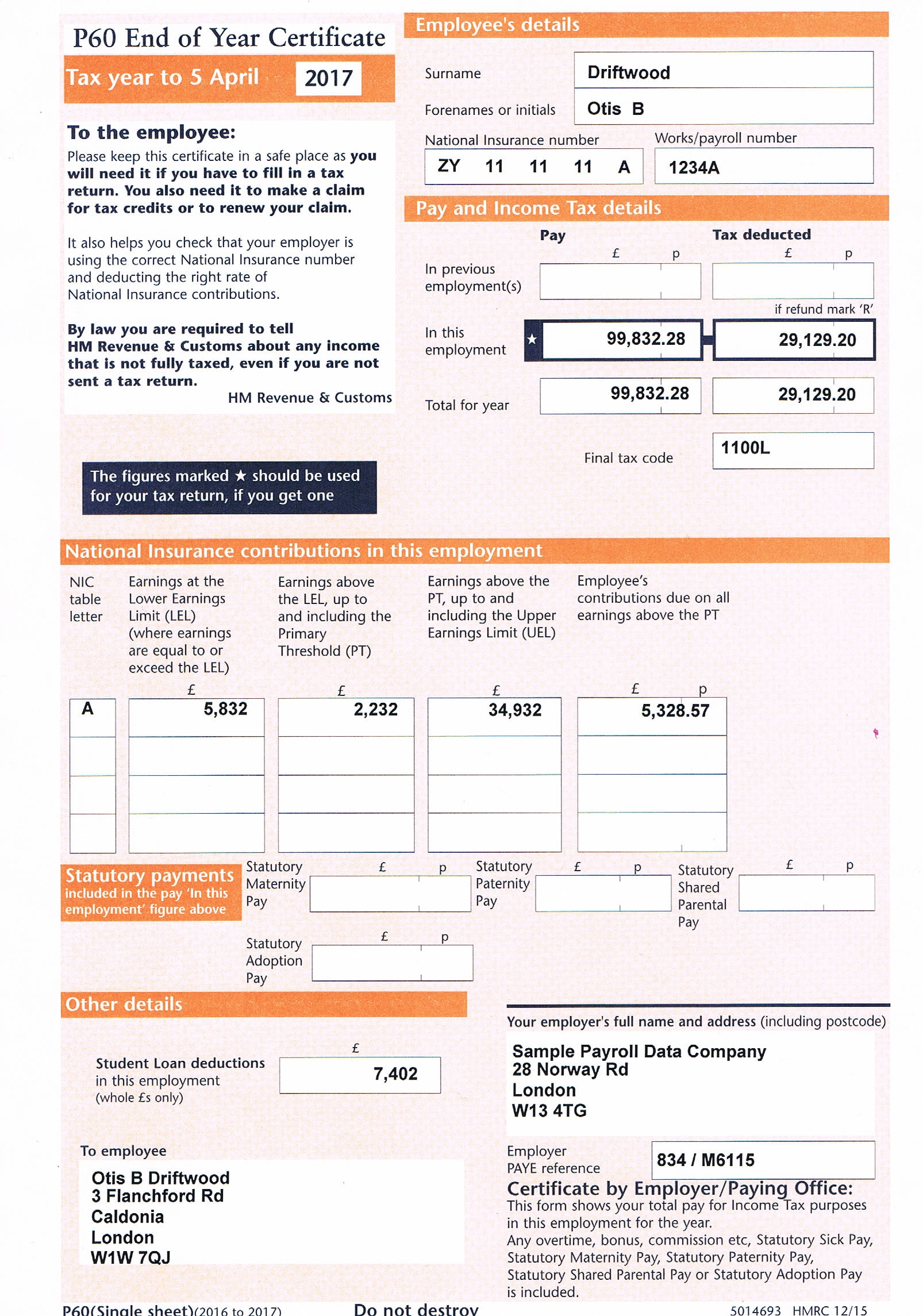

A P60 is evidence of your income for previous tax years and may be useful if you need to Claim a tax refund Prove gross income If the tax paid figure on your P60 is accompanied by the letter R it indicates that you successfully received a tax refund during the tax year through your salary Assuming

Mark R P60 Tax Refund Example

Mark R P60 Tax Refund Example

https://www.sage.com/en-gb/shop/images/ob/stationery/selfsealp60mailers.png

A Guide To UK PAYE Tax Forms P45 P60 And P11D

https://www.sableinternational.com/images/default-source/blog/p60.jpg?sfvrsn=7a7be833_0

What Is A P45 And P60 Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2021/06/Slide4.png

If you paid too much tax You will see the letter R in your P60 indicating that a Refund is due You should then receive a letter from HMRC confirming the refund amount and a What is P60 tax refund A tax refund is for those have overpaid income tax HMRC will send a P800 calculation by the end of November to allow individuals to

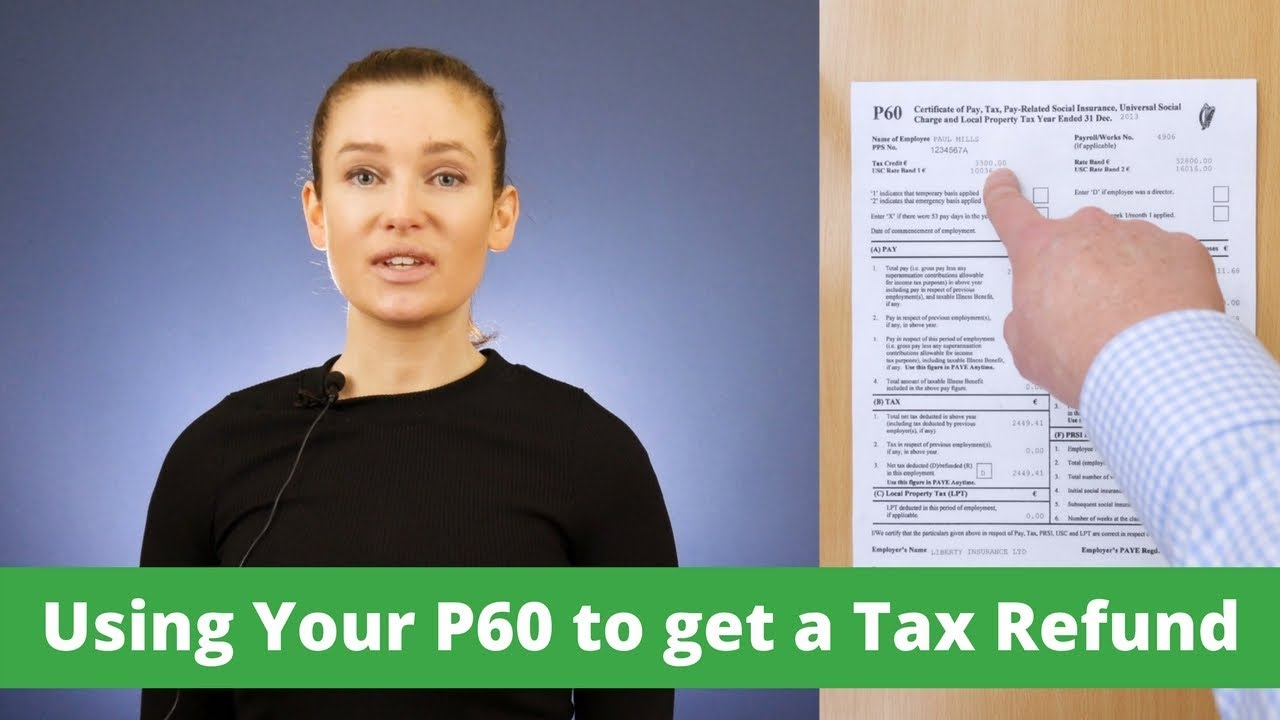

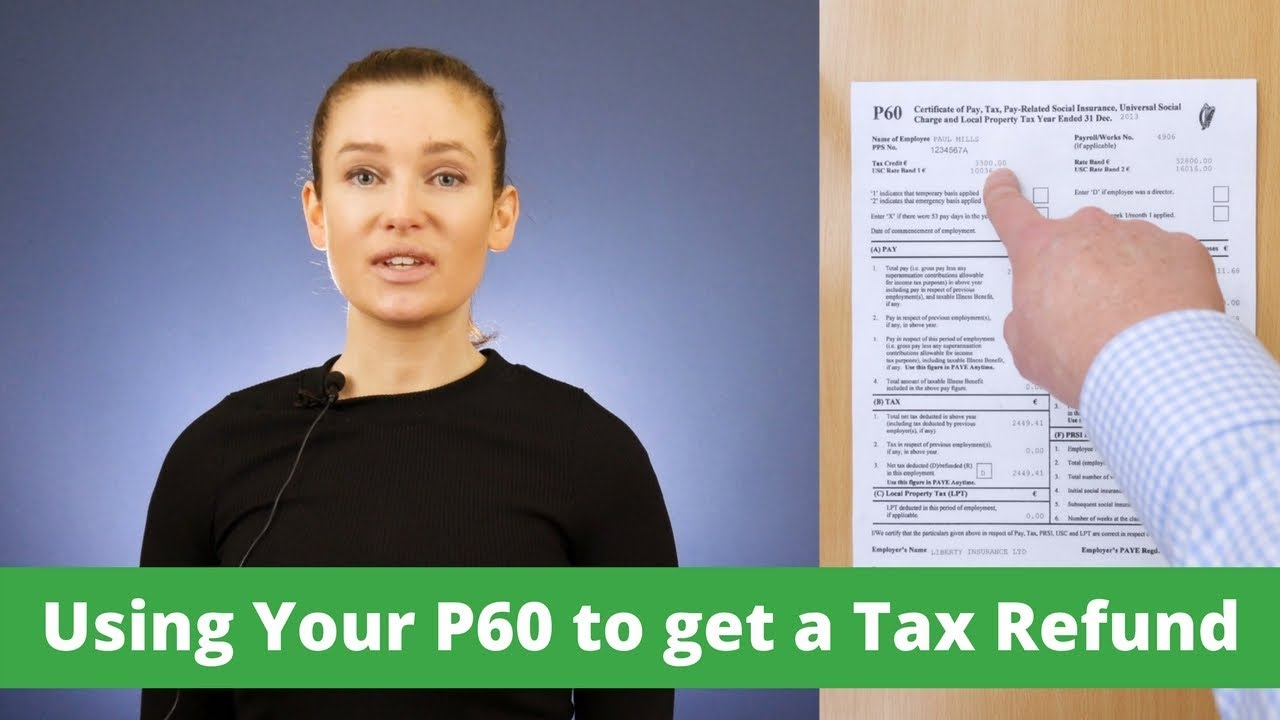

How do I use my P60 to get a tax refund Your P60 serves as evidence of the tax you have paid throughout the year By comparing the information on your P60 Why is a P60 Important Proof of Income Essential for loan mortgage or rental applications Tax Rebate Claims Necessary for claiming overpaid tax back from

Download Mark R P60 Tax Refund Example

More picture related to Mark R P60 Tax Refund Example

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

P60 Document 2023 Free Sample EMail Post Copies

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/63c00b62157cc60ae818848e_P60_Document_2023_01_Top-p-2000.jpeg

P60

https://osome.com/content/images/size/w380/2019/11/--------------2019-10-25---16.55.02-1.png

A P60 is a record you must provide to your employees once a year They need the form to for example claim a tax refund or provide it as evidence that they are able to pay for a mortgage Once a year You ll need your P60 to prove how much tax you ve paid on your salary for example to claim back overpaid tax to apply for tax credits as proof of your income if you apply for

P60s Tax Refunds The most popular reason for needing to retain your P60 is to sort out a tax refund if applicable Once you have received your P60 you can check the amount of tax you have paid is Please keep this certificate in a safe place as you will need it if you have to fill in a tax return You also need it to make a claim for tax credits or to renew your claim

What Is A P45 And P60 Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2021/06/What_is_a_P45_and_P60-1.png

What Is The Difference Between The Statement Of Earnings P45 P60

https://www.payslipsonline.co.uk/resource/products/88886/596aad0e.jpg

https://realbusiness.co.uk/p60-tax-refund-example

A P60 tax refund refers to money owed back to you based on the tax and income information shown on your P60 form There are two common reasons you might

https://goselfemployed.co/p60-explained

A P60 is evidence of your income for previous tax years and may be useful if you need to Claim a tax refund Prove gross income

What Is A P60 Which

What Is A P45 And P60 Performance Accountancy

OS Payroll Your P60 Document Explained

Free Employment Contract Template UK Farillio Template

HMRC Tax Refunds Tax Rebates 3 Options Explained

Irish P60 Statement Explained YouTube

Irish P60 Statement Explained YouTube

Payslips P60

2017 2020 Form UK HMRC P60 Single Sheet Fill Online Printable

Online Payslips Not Fake Payslips Replacement Wage Slips Payslips

Mark R P60 Tax Refund Example - If your total income is under the 6475 year then you would be entitled to a refund of tax from your BR coded jobs and you need to write to the tax office send your