Marriage Allowamce Tax Rebate Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax by up

Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is dependent on the Personal

Marriage Allowamce Tax Rebate

Marriage Allowamce Tax Rebate

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Married Couples Allowance It s Here Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

Marriage Allowance Tax Advantages For Married Couples

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

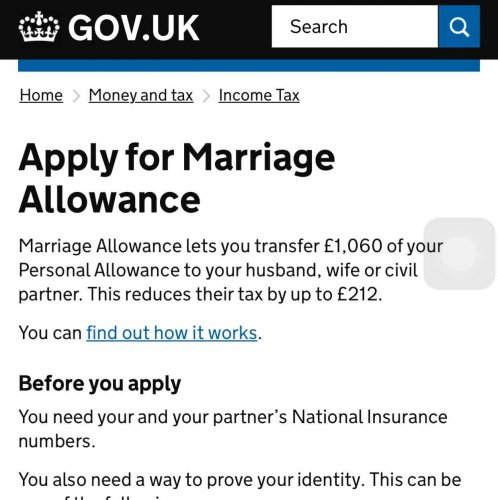

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web Income Tax rates and Personal Allowances Married Couple s Allowance Apply for Marriage Allowance online

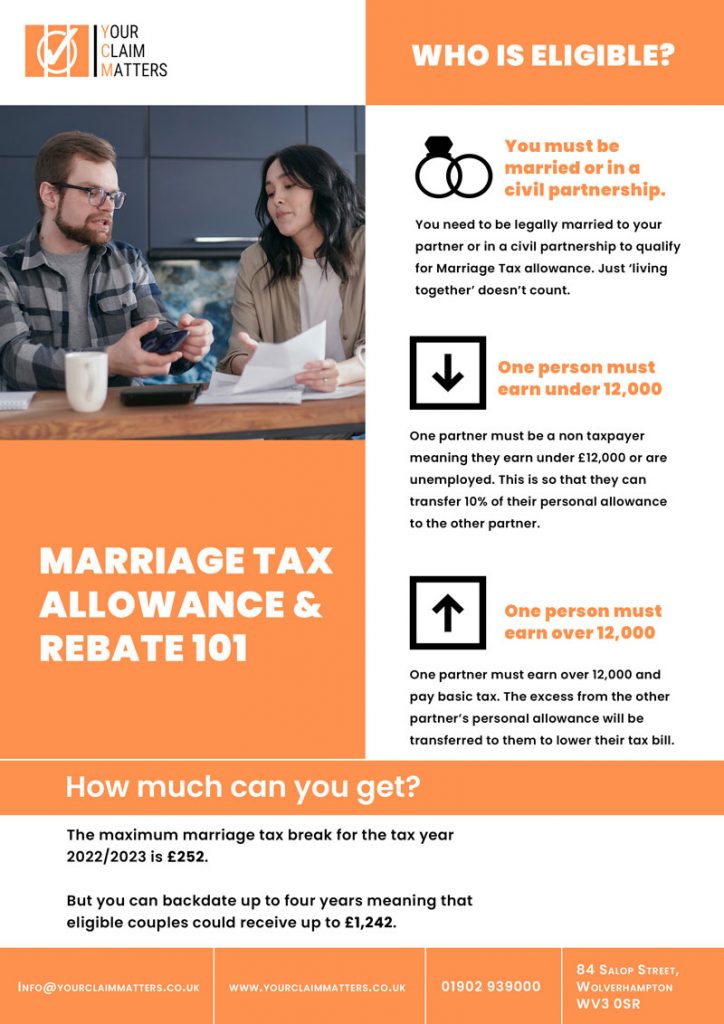

Web Married Couple s Allowance could reduce your tax bill by between 163 401 and 163 1 037 50 a year You can claim Married Couple s Allowance if all the following apply you re married or in a Web Millions of eligible couples haven t claimed Don t Miss Out On Marriage Allowance If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check NOW whether you re eligible

Download Marriage Allowamce Tax Rebate

More picture related to Marriage Allowamce Tax Rebate

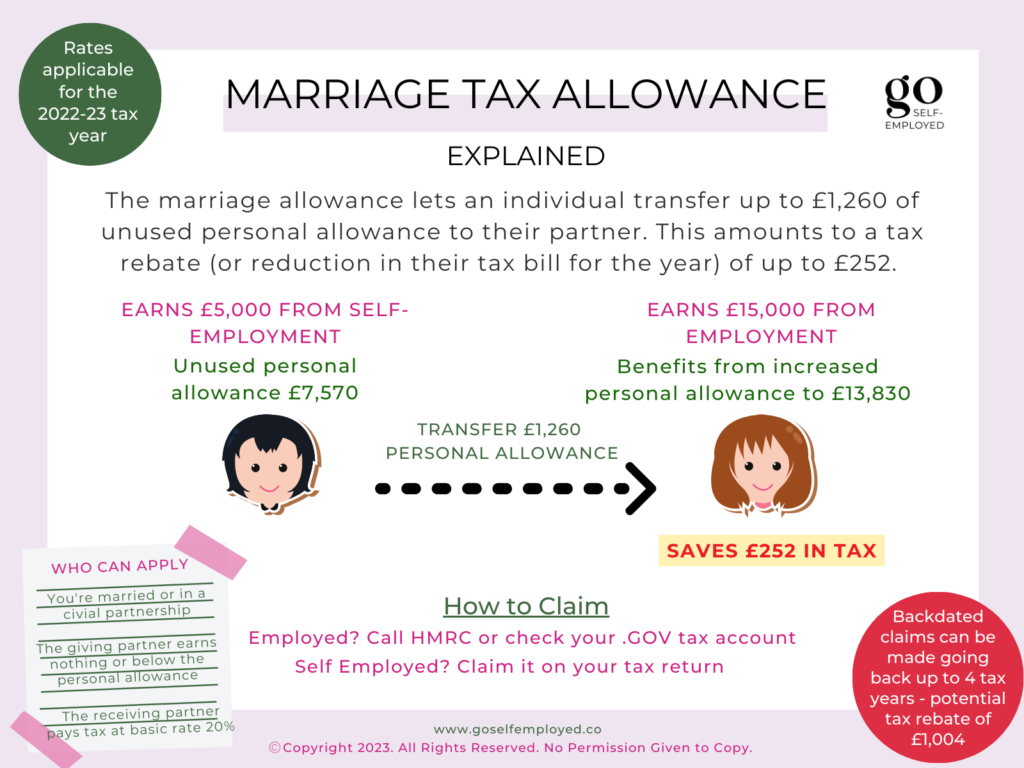

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-1024x288.png

Marriage Allowance Debitam

https://www.debitam.com/wp-content/uploads/2023/05/marriage-allowance-tax.png

Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil partner if you both meet Web How much can Marriage Tax Allowance save you The marriage allowance will allow you to save a maximum of 163 252 in tax in the 21 22 tax year As shown in the above example it will vary from couple to couple

Web 14 f 233 vr 2023 nbsp 0183 32 How Much Can You Claim The marriage allowance reclaim for the tax year 2022 23 is 163 252 This can be increased to a tax rebate amount of 163 1 241 This is possible by back dating your claim up to the maximum of 4 years This is illustrated as follows 2021 22 tax year 163 251 reclaim 2020 21 tax year 163 250 reclaim Web 14 mars 2022 nbsp 0183 32 Martin Lewis Three must dos by 5 April 1 Tax code rebate 2 Marriage tax allowance 3 PPI tax back James Flanders News Reporter 14 March 2022 The tax year ends on Tuesday 5 April and MoneySavingExpert founder Martin

Marriage Allowance Tax Rebate YouTube

https://i.ytimg.com/vi/mag2FK0B478/maxresdefault.jpg

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-724x1024.jpg

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax by up

https://www.moneysavingexpert.com/family/m…

Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be

Draw Your Signature Marriage Tax Allowance Rebate

Marriage Allowance Tax Rebate YouTube

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

Marriage Tax Allowance Tax Rebate Online

Marriage Allowances You Can Claim

Marriage Tax Allowance Rebate My Tax Ltd

Marriage Tax Allowance Rebate My Tax Ltd

Claim The 220 Transferrable Marriage Allowance Today

Marriage Allowance Transfers Bradley Accounting

Marriage Allowance Tax Rebate Testimonial YouTube

Marriage Allowamce Tax Rebate - Web 4 nov 2019 nbsp 0183 32 0 163 0 It is possible to backdate your claim by up to four years This means that eligible couples who have been married or in a civil partnership for the past five years could now claim up to 163 1 150 The table below shows the value of the marriage allowance since it was introduced in 2015 Tax year