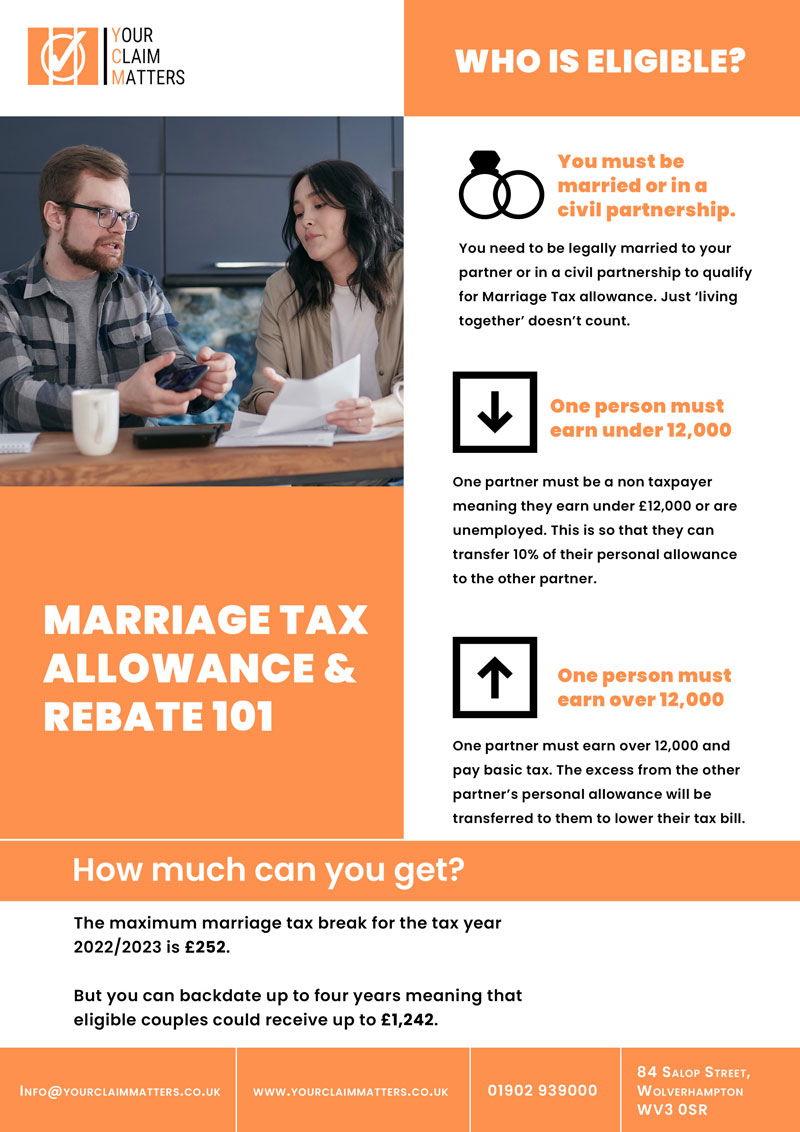

Marriage Allowance Tax Rebate Company Web Get a tax break worth up to 163 1 250 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called

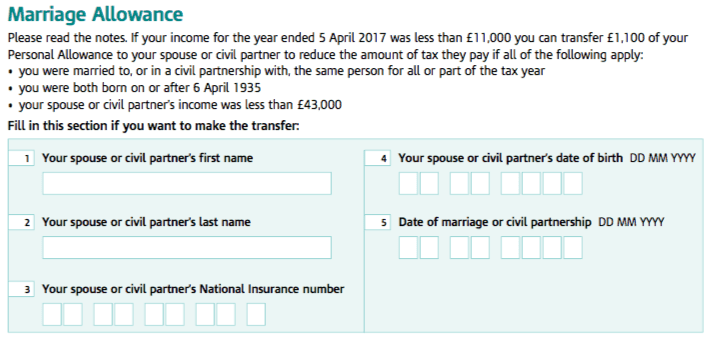

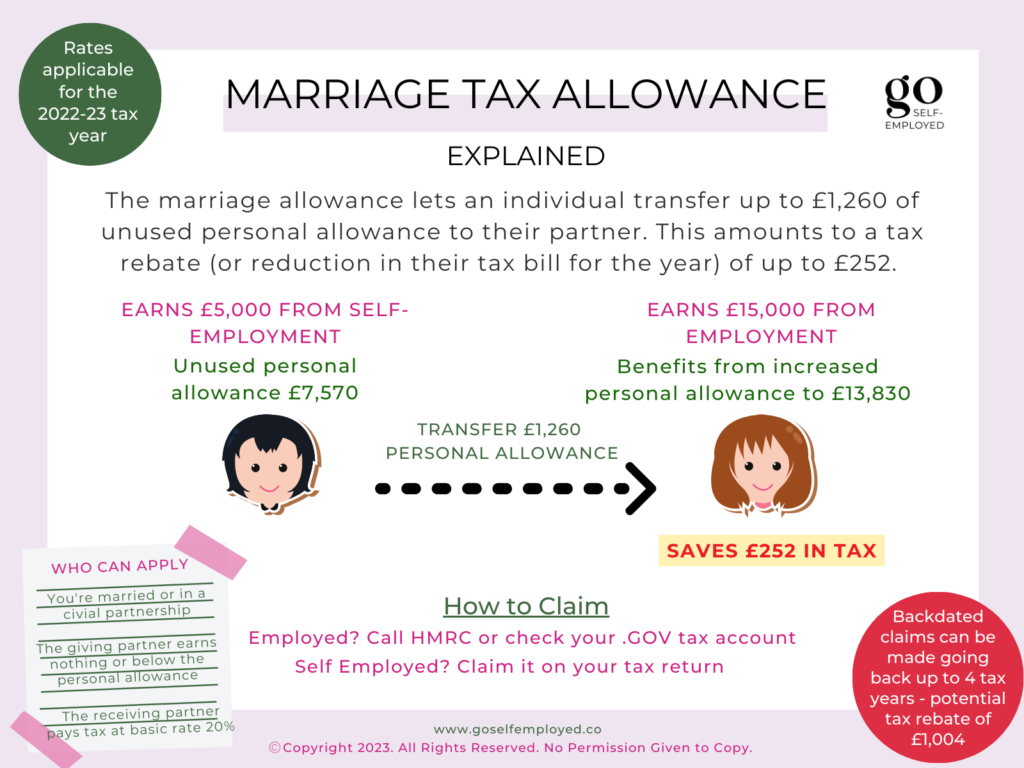

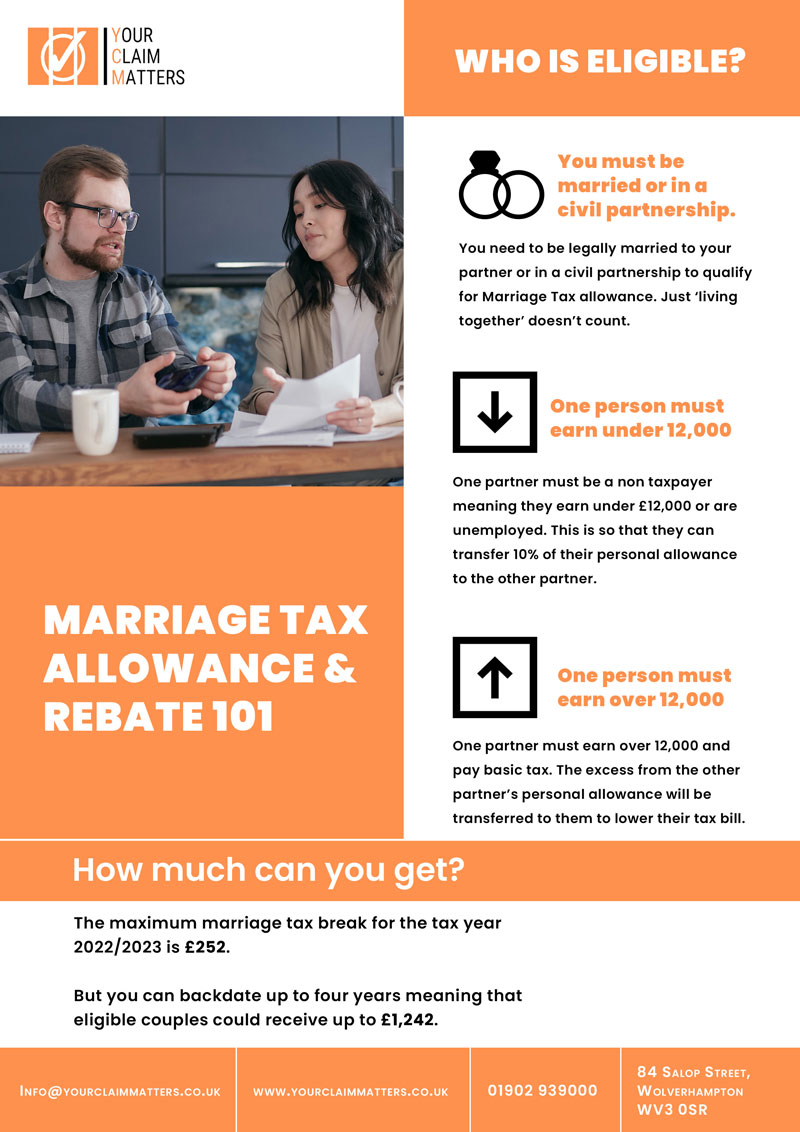

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a

Marriage Allowance Tax Rebate Company

Marriage Allowance Tax Rebate Company

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-768x216.png

Web 11 f 233 vr 2022 nbsp 0183 32 11 February 2022 Married couples and people in civil partnerships could receive extra cash this Valentine s Day as HM Revenue and Customs HMRC Web 14 f 233 vr 2023 nbsp 0183 32 The marriage allowance is a tax free perk which over 2 million couples don t claim We explain how you can claim your 163 252 tax rebate We will explain who qualifies

Web 11 sept 2023 nbsp 0183 32 Money Tax Income tax Updated 13 Apr 2023 Marriage allowance explained Find out about marriage tax allowance what it is how it works and whether you might be eligible to claim it plus other Web 14 mars 2022 nbsp 0183 32 Martin Lewis Three must dos by 5 April 1 Tax code rebate 2 Marriage tax allowance 3 PPI tax back James Flanders News Reporter 14 March 2022 The tax

Download Marriage Allowance Tax Rebate Company

More picture related to Marriage Allowance Tax Rebate Company

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance.jpeg

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs Web Claiming Backdated Marriage Allowance Tax Rebate You can backdate your claim for marriage allowance up to 4 tax years to claim a rebate for any missed tax years This equates to a potential tax saving of 163 1 004

Web 5 avr 2023 nbsp 0183 32 Yes absolutely The Marriage Allowance was introduced in the 2015 16 tax year so you can claim for any tax years during which you and your partner were eligible The value of the allowance each year Web How your Personal Allowances change HM Revenue and Customs HMRC will give your partner the allowance you have transferred to them either by changing their tax code

Marriage Allowance Tax Rebate YouTube

https://i.ytimg.com/vi/mag2FK0B478/maxresdefault.jpg

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

https://www.moneysavingexpert.com/family/m…

Web Get a tax break worth up to 163 1 250 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called

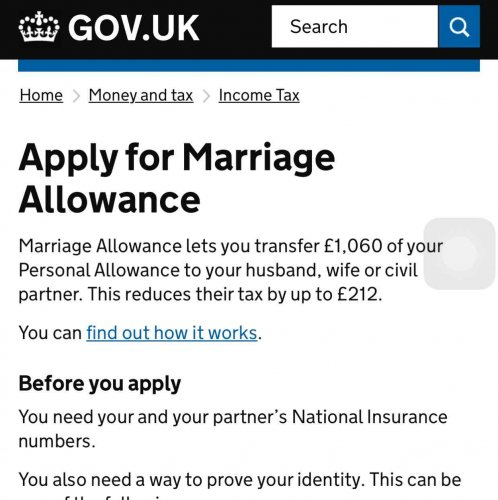

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Marriage Tax Allowance Tax Rebate Online

Marriage Allowance Tax Rebate YouTube

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

Easy Tax Rebates 4u Just Another WordPress Site

Marriage Allowance Tax Advantages For Married Couples

Application To Company Director For Marriage Allowance In MS Word

Application To Company Director For Marriage Allowance In MS Word

Marriage Allowance Transfers Bradley Accounting

Marriage Allowance And How You Can Save On Your Tax Bill Joshua Leigh

Marriage Tax Allowance Rebate My Tax Ltd

Marriage Allowance Tax Rebate Company - Web Marriage tax allowance allows the lower earning partner to transfer their unused allowance up to a max of 10 to the higher earning partner Giving the higher partner