Marriage Allowance Tax Rebate Contact Number Web Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for advice on your

Web Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services Web Online You can cancel Marriage Allowance online You ll be asked to prove your identity using information HMRC holds about you By phone Contact Marriage Allowance

Marriage Allowance Tax Rebate Contact Number

Marriage Allowance Tax Rebate Contact Number

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Married Couples Allowance It s Here Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

Marriage Allowance Tax Advantages For Married Couples

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

Web If you have come to the UK and you do not plan to work or study you cannot get a National Insurance number Phone the Income Tax helpline to apply for Marriage Allowance Web Marriage Allowance allows you to transfer some of your Personal Allowance to your husband wife or civil partner what you get and how to apply for free

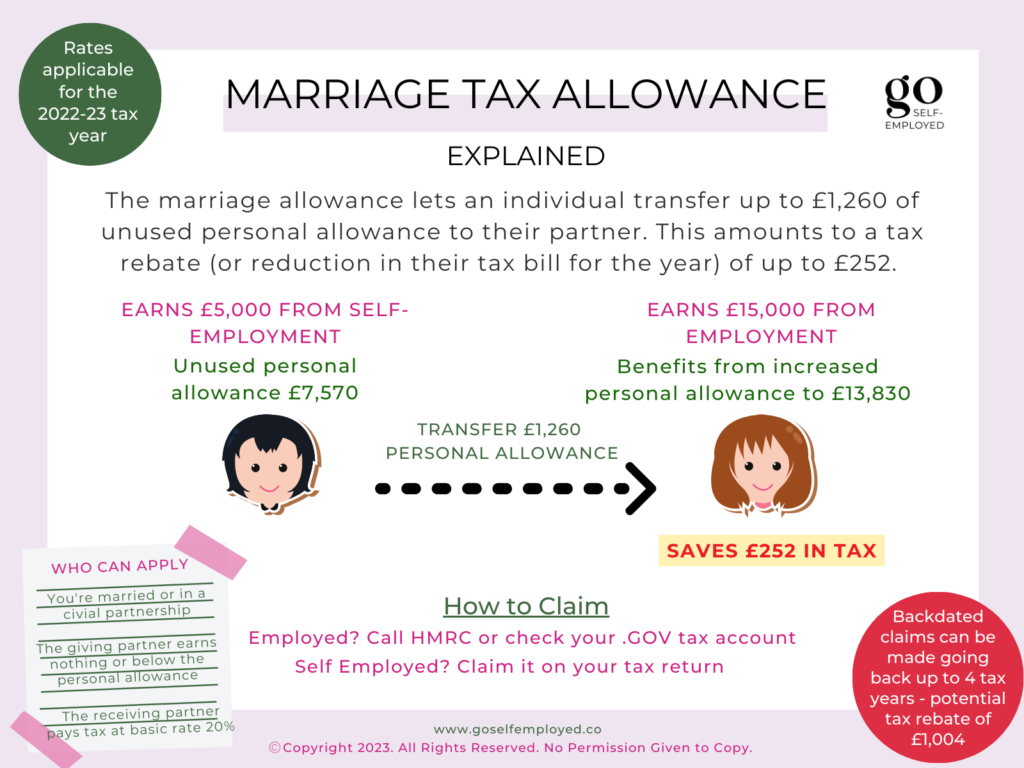

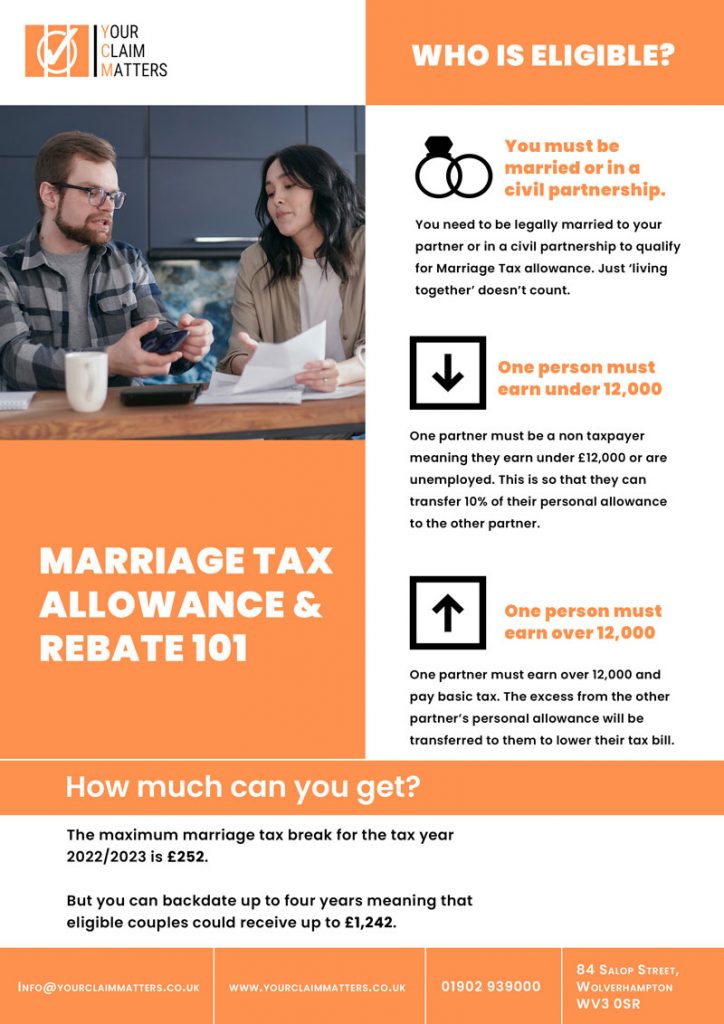

Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a

Download Marriage Allowance Tax Rebate Contact Number

More picture related to Marriage Allowance Tax Rebate Contact Number

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

Marriage Allowance GOV UK Marriage Allowance

https://i.pinimg.com/originals/0b/0b/95/0b0b9560b95c5b083f88be27d64d6a0d.png

Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Web Who can claim a marriage allowance tax rebate To make a claim with us you must meet the following criteria You are married or in a civil partnership You earn between 163 12k

Web Marriage Allowance Rebate HMRC Rebates amp Refunds Rebate Gateway Millions of eligible couples haven t claimed Don t Miss Out On Marriage Allowance If you re Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance

Marriage Allowances You Can Claim

https://theoliversmadhouse.co.uk/wp-content/uploads/2017/07/Screenshot-2017-07-13-20.30.36.png

HMRC Are Reminding Married Couples And Civil Partnerships To Sign Up

https://www.northern-times.co.uk/_media/img/JQB4KDWSHN80N59HECXL.jpg

https://www.gov.uk/government/organisations/hm-revenue-customs/cont…

Web Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for advice on your

https://www.gov.uk/contact-hmrc

Web Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

Marriage Tax Allowance Tax Rebate Online

Marriage Allowances You Can Claim

Marriage Allowance Claim Your 252 Tax Rebate

Marriage Allowance Transfers Bradley Accounting

Marriage Allowance Tax Rebate In UK EmployeeTax

Marriage Allowance Tax Rebate YouTube

Marriage Allowance Tax Rebate YouTube

Marriage Tax Allowance Rebate My Tax Ltd

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

Marriage Allowance Tax Rebate Contact Number - Web 8 juin 2023 nbsp 0183 32 Verified 08 June 2023 Legal and Administrative Information Directorate Prime Minister Are you married or past Your couple is subject to common taxation