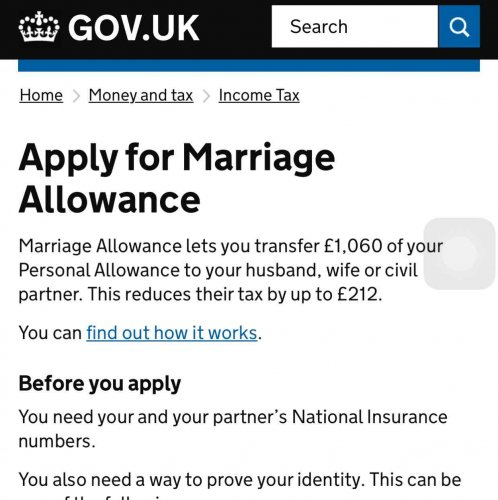

Marriage Allowance Tax Rebate Leicestershire Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

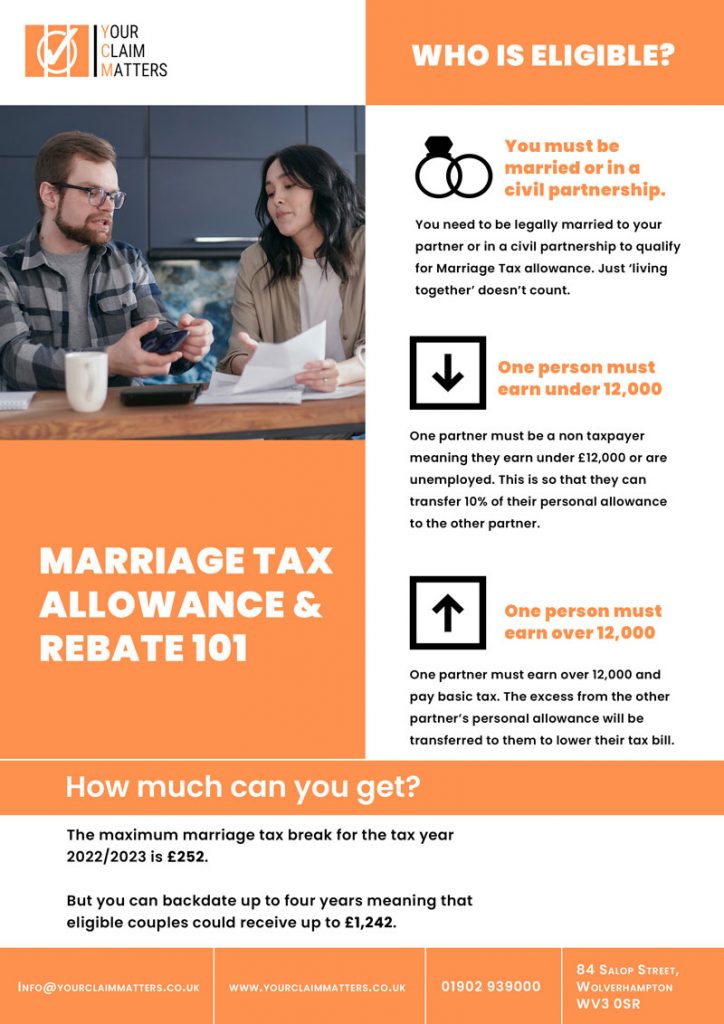

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is

Marriage Allowance Tax Rebate Leicestershire

Marriage Allowance Tax Rebate Leicestershire

https://bradleyaccountingplus.co.uk/wp-content/uploads/2021/09/Marriage-Allowance-768x644.jpg

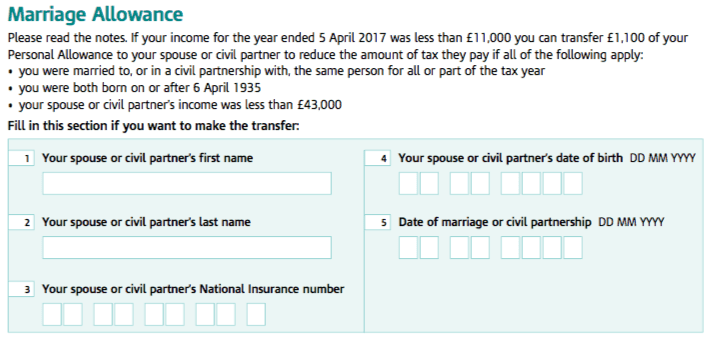

Married Couples Allowance It s Here Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

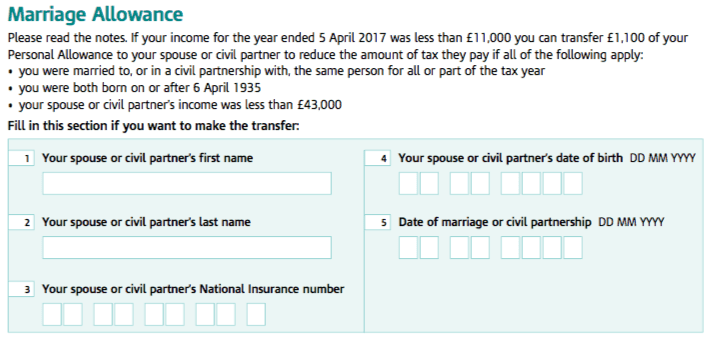

Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Web Millions of eligible couples haven t claimed Don t Miss Out On Marriage Allowance If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called

Web Your partner transferred 163 1 260 to your Personal Allowance making their allowance 163 11 310 and yours 163 13 830 After their death your Personal Allowance stays at 163 13 830 Web 3 Income 4 Personal Information You re just 30 seconds away from finding out if you are eligible for Marriage Rebate No Personal Banking Details Required Are you married

Download Marriage Allowance Tax Rebate Leicestershire

More picture related to Marriage Allowance Tax Rebate Leicestershire

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Tax Claimer Marriage Allowance Tax Rebate

https://taxclaimer.com/wp-content/uploads/2022/01/photo-1591604466107-ec97de577aff-700x467.jpg

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

Web Currently the annual tax free personal allowance is 163 12 500 This means that a person is not charged tax for the first 163 12 500 they earn Marriage tax allowance therefore allows Web Marriage tax allowance was introduced in 2015 and is designed to help out with household bills Don t worry if you haven t claimed it yet We will backdate your claim to 2015

Web Your spouse earns under 163 12k You do not complete a self assessment You can backdate your claim to include any tax year since 5 April 2018 that you were eligible for Marriage Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance.jpg

Marriage Allowance Tax Rebate YouTube

https://i.ytimg.com/vi/mag2FK0B478/maxresdefault.jpg

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.moneysavingexpert.com/family/m…

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the

Marriage Allowance Update AJN Accountants

Marriage Allowance Claim Your 252 Tax Rebate

HMRC Urges Eligible Couples To Claim Marriage Allowance

The 101 Marriage Tax Allowance Rebate And Claim Guide

Leicester Council s Energy Rebate Scheme Under Way To Ease Rising

Marriage Tax Allowance Explained Goselfemployed co

Marriage Tax Allowance Explained Goselfemployed co

Claim The 220 Transferrable Marriage Allowance Today

Tax Claimer Marriage Allowance Tax Rebate

Marriage Allowance Tax Advantages For Married Couples

Marriage Allowance Tax Rebate Leicestershire - Web Millions of eligible couples haven t claimed Don t Miss Out On Marriage Allowance If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called