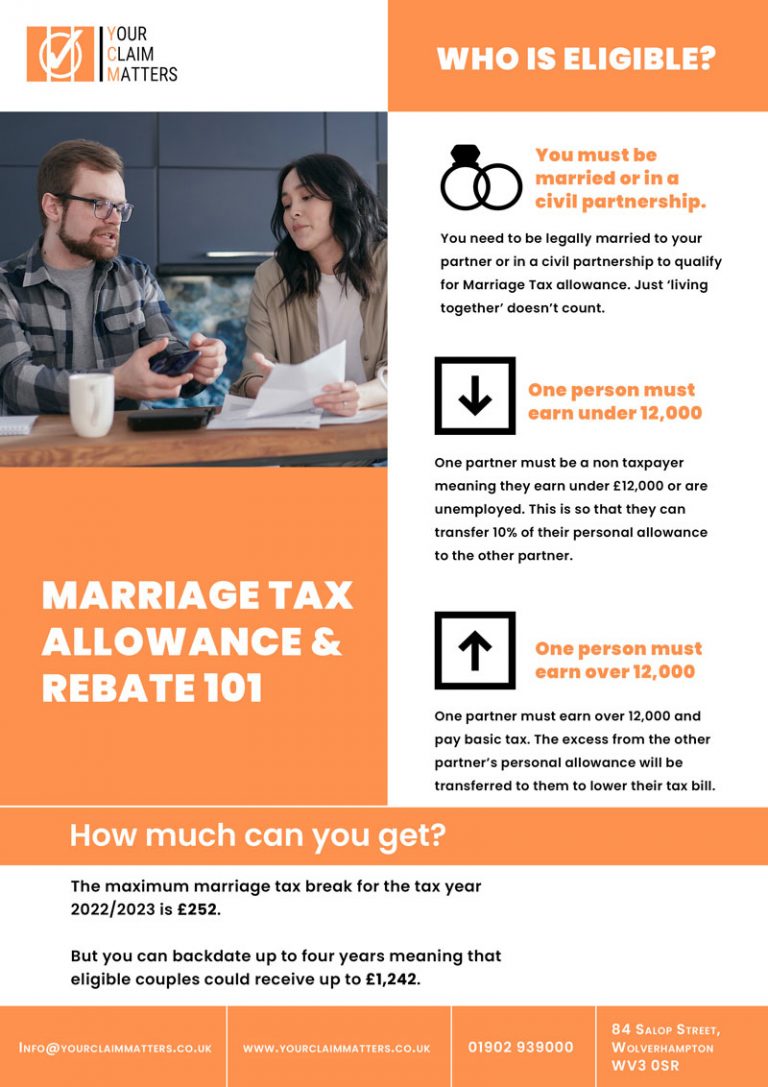

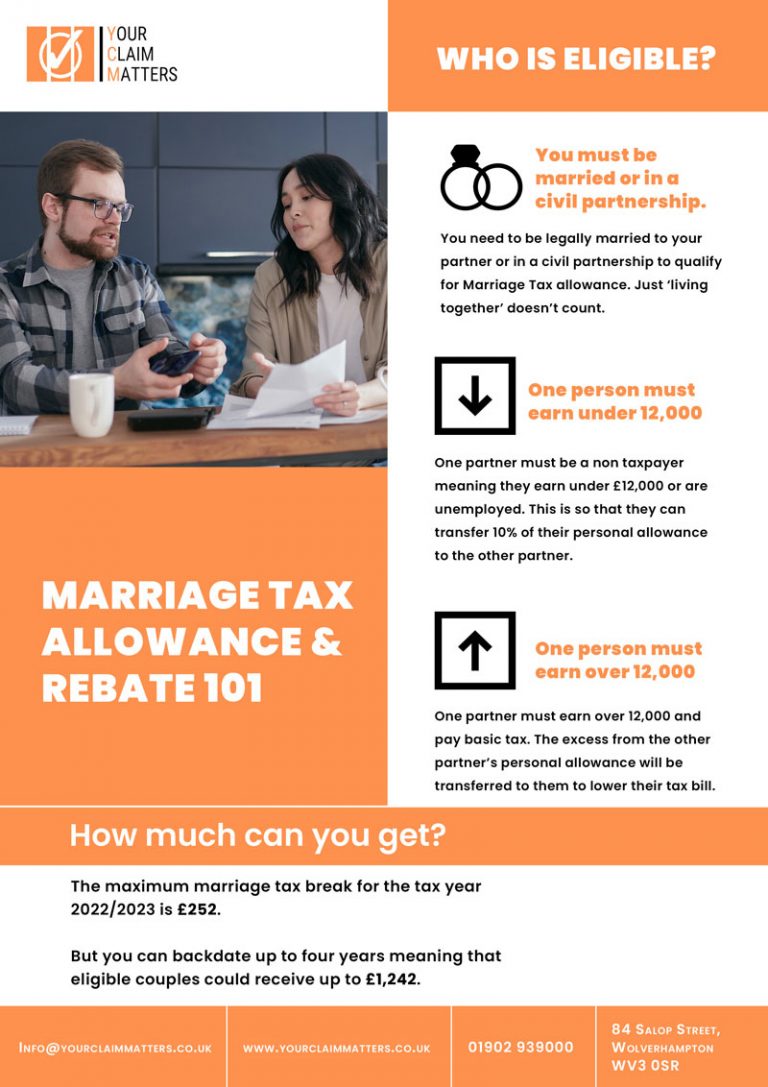

Marriage Tax Allowance Rebate Uk Web It s free to apply for Marriage Allowance This can reduce their tax by up to 163 252 every tax year 6 April to 5 April the next year To benefit as a couple you need to earn less than

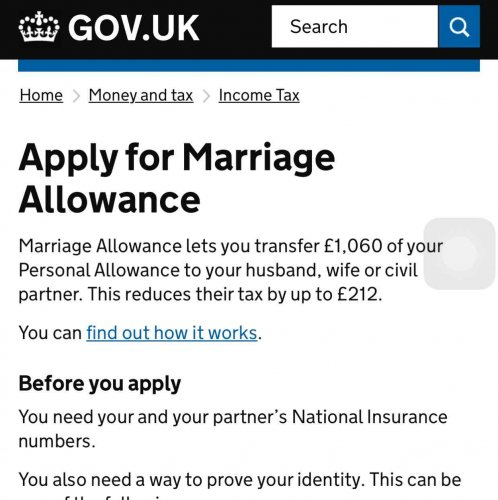

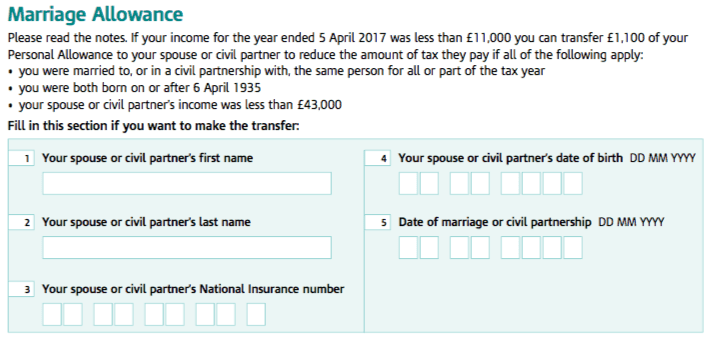

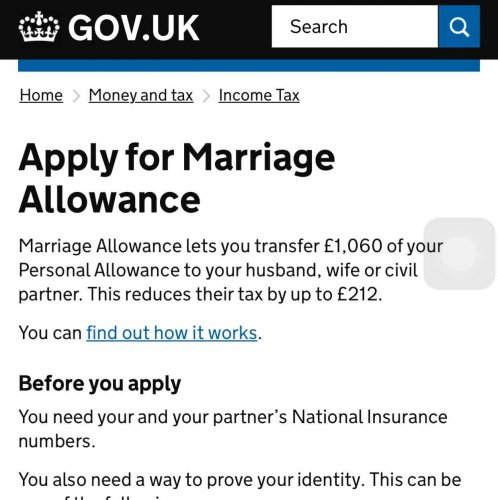

Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self

Marriage Tax Allowance Rebate Uk

Marriage Tax Allowance Rebate Uk

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-768x1087.jpg

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-768x216.png

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the Web Eligibility How to claim Further information What you ll get Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the

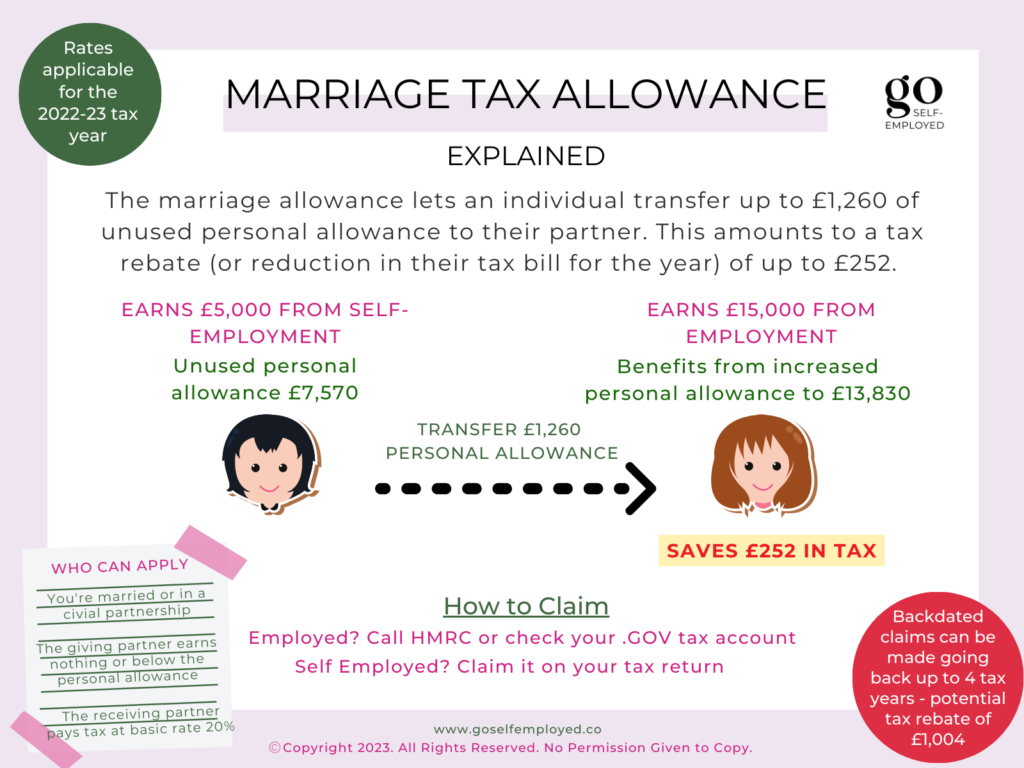

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they

Download Marriage Tax Allowance Rebate Uk

More picture related to Marriage Tax Allowance Rebate Uk

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

Web 11 sept 2023 nbsp 0183 32 Money Tax Income tax Updated 13 Apr 2023 Marriage allowance explained Find out about marriage tax allowance what it is how it works and whether you might be eligible to claim it plus other Web 14 juil 2023 nbsp 0183 32 How much marriage allowance can I claim In the current tax year which runs from 6 April 2023 to 5 April 2024 the annual marriage tax allowance is 163 252 This is the same amount as the previous

Web 4 nov 2019 nbsp 0183 32 Eligible couples who have been married or in a civil partnership for the past five years but haven t yet claimed their allowance could now get a rebate of 163 1 150 Web The marriage allowance will allow you to save a maximum of 163 252 in tax in the 21 22 tax year As shown in the above example it will vary from couple to couple based on their

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

https://i.ibb.co/Tmffpxh/marriage.png

https://www.gov.uk/apply-marriage-allowance

Web It s free to apply for Marriage Allowance This can reduce their tax by up to 163 252 every tax year 6 April to 5 April the next year To benefit as a couple you need to earn less than

https://www.gov.uk/marriage-allowance/how-to-apply

Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should

Marriage Allowance Claim Your 252 Tax Rebate

Easy Tax Rebates 4u Just Another WordPress Site

Marriage Tax Allowance Rebate My Tax Ltd

Marriage Tax Allowance Tax Rebate Online

Marriage Allowance Tax Rebate YouTube

Marriage Allowance Transfers Bradley Accounting

Marriage Allowance Transfers Bradley Accounting

Marriage Allowances You Can Claim

Marriage Allowance GOV UK Marriage Allowance Financial

How To Take Advantage Of The Marriage Allowance Tax Rebates

Marriage Tax Allowance Rebate Uk - Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a