Marriage Tax Rebate Claim Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the

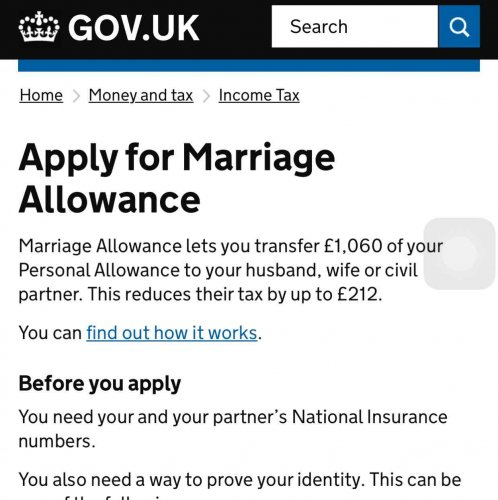

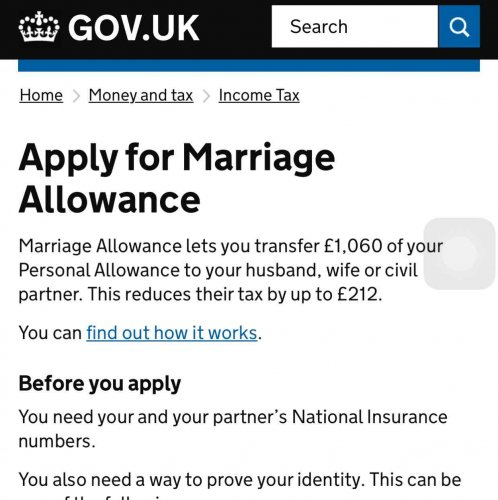

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should

Marriage Tax Rebate Claim

Marriage Tax Rebate Claim

https://i.ibb.co/Tmffpxh/marriage.png

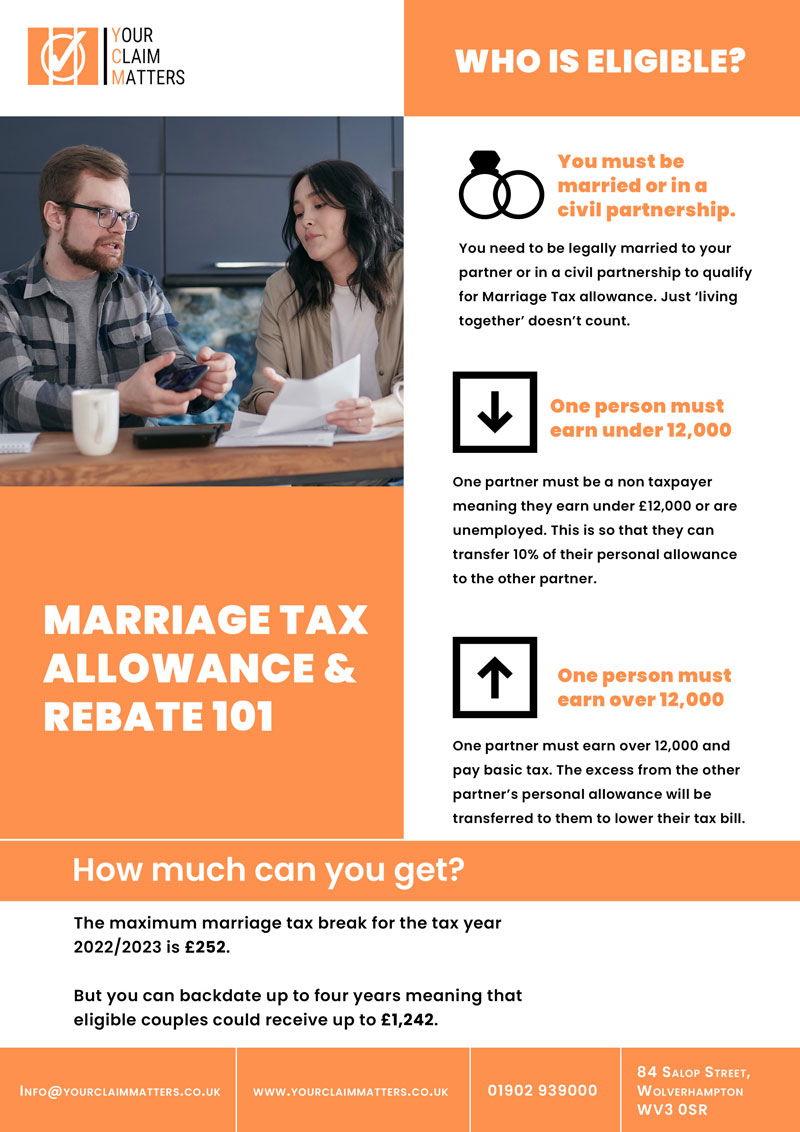

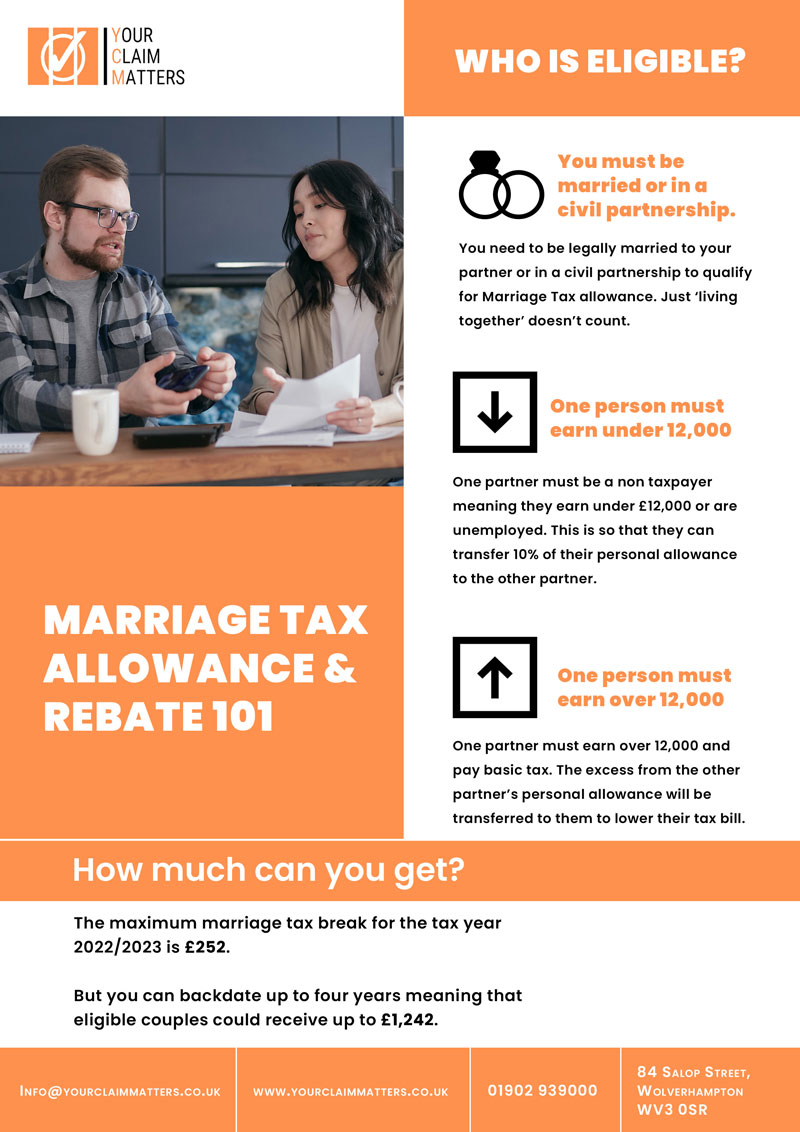

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

Married Couples Allowance It s Here Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they Web You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you was born before

Web Check how to claim a tax refund GOV UK Home Money and tax Income Tax Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too Web Income Tax rates and Personal Allowances Married Couple s Allowance Apply for Marriage Allowance online

Download Marriage Tax Rebate Claim

More picture related to Marriage Tax Rebate Claim

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance-1024x576.jpg

Marriage Tax Claims What Could I Claim This Christmas Gowing Law

https://i.ibb.co/hc1BHHP/Marriage.png

Let s Get Legal Weekly Expert Law Advice Part 1 Gowing Law

https://i.ibb.co/WKxr8p6/Marriage-Tax-1.png

Web Mariage et imp 244 ts en commun Les 233 poux b 233 n 233 ficient d 232 s la premi 232 re ann 233 e du mariage de l imposition commune au titre de L imp 244 t sur le revenu Les charges d 233 ductibles de Web 11 sept 2023 nbsp 0183 32 Money Tax Income tax Updated 13 Apr 2023 Marriage allowance explained Find out about marriage tax allowance what it is how it works and whether you might be eligible to claim it plus other

Web 14 mars 2022 nbsp 0183 32 14 March 2022 The tax year ends on Tuesday 5 April and MoneySavingExpert founder Martin Lewis has an urgent warning Rules state you Web If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Marriage Allowances You Can Claim

https://theoliversmadhouse.co.uk/wp-content/uploads/2017/07/Screenshot-2017-07-13-20.30.36.png

https://www.moneysavingexpert.com/family/m…

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the

https://www.gov.uk/married-couples-allowance/how-to-claim

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC

Marriage Allowance Tax Rebate In UK EmployeeTax

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

Marriage Tax Allowance Rebate My Tax Ltd

Home Tax Rebate Online

How To Take Advantage Of The Marriage Allowance Tax Rebates

Easy Tax Rebates 4u Just Another WordPress Site

Easy Tax Rebates 4u Just Another WordPress Site

Home Tax Rebate Online

Tax Steps To Add To Your Wedding Checklist Wedding Checklist

My Tax Rebate Claim Your Uniform Tax Rebate Marriage Allowance

Marriage Tax Rebate Claim - Web Income Tax rates and Personal Allowances Married Couple s Allowance Apply for Marriage Allowance online