Marriage Tax Rebate Contact Web Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for advice on your savings

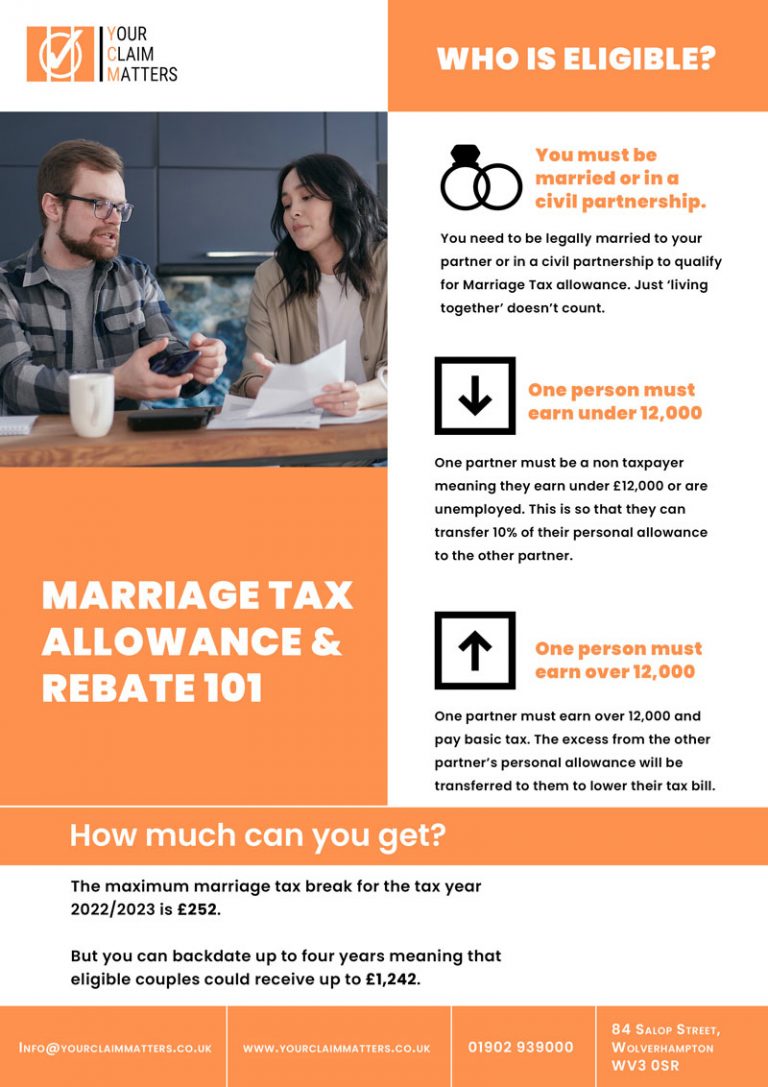

Web Home Money and tax Income Tax Apply for Marriage Allowance online Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or Web How Much Can I Claim If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying

Marriage Tax Rebate Contact

Marriage Tax Rebate Contact

https://www.fosb.co.uk/_webedit/cached-images/129.jpg

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

Web Marriage Allowance allows you to transfer some of your Personal Allowance to your husband wife or civil partner what you get and how to apply for free Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they

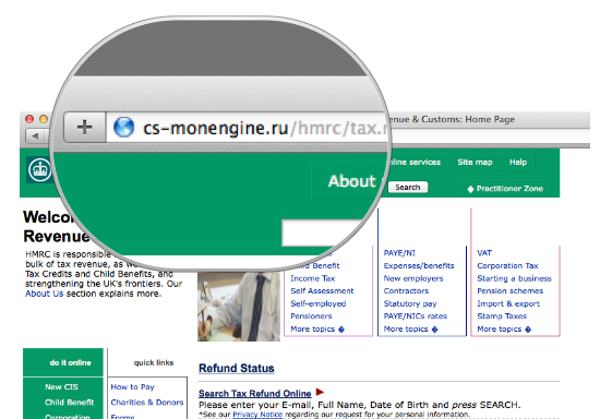

Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Web By phone Contact Marriage Allowance enquiries to cancel or get help Marriage Allowance enquiries Telephone 0300 200 3300 Telephone from outside the UK 44 135 535

Download Marriage Tax Rebate Contact

More picture related to Marriage Tax Rebate Contact

Tax Claimer Marriage Allowance Tax Rebate

https://taxclaimer.com/wp-content/uploads/2022/01/GettyImages-498799284-2000-1536x1024.jpg

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header.jpeg

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/work-2-2048x2048.png

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the marriage tax allowance something around 2 1 million qualifying couples miss out Web 14 juil 2023 nbsp 0183 32 Samantha Partington Updated July 14 2023 If you are married or in a civil partnership where one partner earns less than 163 12 570 a year and the other is a basic rate taxpayer you may be able

Web Just visit the government website or call HMRC on 0300 200 3300 Key information needed to apply for Marriage Tax Allowance When applying for Marriage Allowance you or Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-1024x288.png

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance.jpg

https://www.gov.uk/government/organisations/hm-revenue-customs/cont…

Web Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for advice on your savings

https://www.gov.uk/apply-marriage-allowance

Web Home Money and tax Income Tax Apply for Marriage Allowance online Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or

The Dividend Allowance Is Being Halved Tax Rebate Services

Marriage Allowance Tax Rebate In UK EmployeeTax

The 101 Marriage Tax Allowance Rebate And Claim Guide

NEW TAX YEAR 2023 Things You Need To Know About In 2023 24 Your

The 101 Marriage Tax Allowance Rebate And Claim Guide

WHAT IS PLEVIN PPI Marriage Tax Your Claim Matters

WHAT IS PLEVIN PPI Marriage Tax Your Claim Matters

Care Worker Tax Rebate Email Address 2023 Carrebate

What Is The Marriage Tax Allowance A Million Couples Missing Out On

Guide Des Formalit s Pr alables Au Mariage Mariage tat Civil

Marriage Tax Rebate Contact - Web Marriage Allowance allows you to transfer some of your Personal Allowance to your husband wife or civil partner what you get and how to apply for free