Marriage Tax Rebate Gov Web The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply online you can

Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should

Marriage Tax Rebate Gov

Marriage Tax Rebate Gov

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

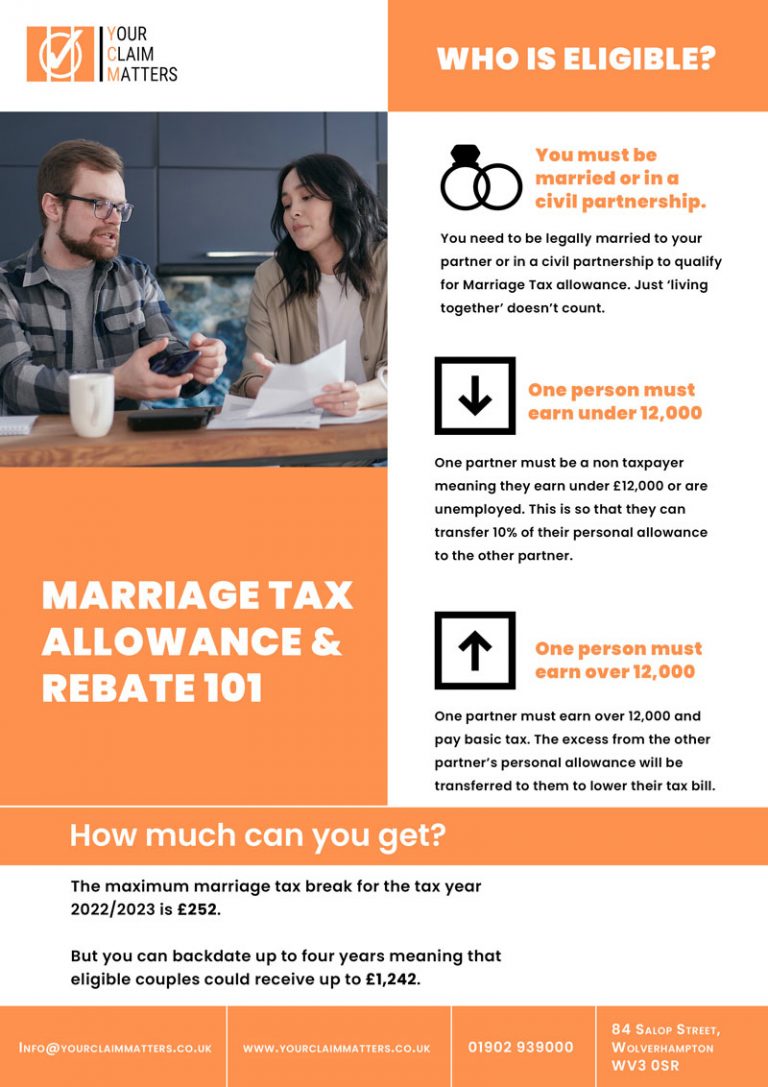

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-768x1087.jpg

Can A Married Couple File Single They Can Contribute To A Roth Ira As

https://www.thetaxadviser.com/content/dam/tta/issues/2019/jun/yurko-ex-2.JPG

Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they Web You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you was born

Web Eligibility How to claim Further information What you ll get Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the Web How to apply If your circumstances change You must cancel Marriage Allowance if any of the following apply your relationship ends because you ve divorced ended dissolved

Download Marriage Tax Rebate Gov

More picture related to Marriage Tax Rebate Gov

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header-768x296.jpeg

Web 20 f 233 vr 2015 nbsp 0183 32 20 February 2015 This was published under the 2010 to 2015 Conservative and Liberal Democrat coalition government The government has today opened Web If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the marriage tax allowance something around 2 1 million qualifying couples miss out on It s really

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web 4 nov 2019 nbsp 0183 32 Brean Horne Around 700 000 couples could be missing out on a tax refund from HM Revenue and Customs Thanks to a tax break known as the marriage

Tax Rebates

https://www.fosb.co.uk/_webedit/cached-images/129.jpg

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-1024x288.png

https://www.gov.uk/apply-marriage-allowance

Web The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply online you can

https://www.gov.uk/married-couples-allowance/how-to-claim

Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self

HMRC Tax Rebates Home Uniform Tax Rebate Marriage Allowance

Tax Rebates

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

Marriage Tax Allowance Tax Rebate Online

What Is The Marriage Tax Allowance A Million Couples Missing Out On

Government Council Tax Rebate Flyer Braintree District Council

Government Council Tax Rebate Flyer Braintree District Council

Individual Income Tax Rebate

The Dividend Allowance Is Being Halved Tax Rebate Services

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Tax Rebate Gov - Web You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you was born