Marriage Tax Rebate Online Web The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply online you can

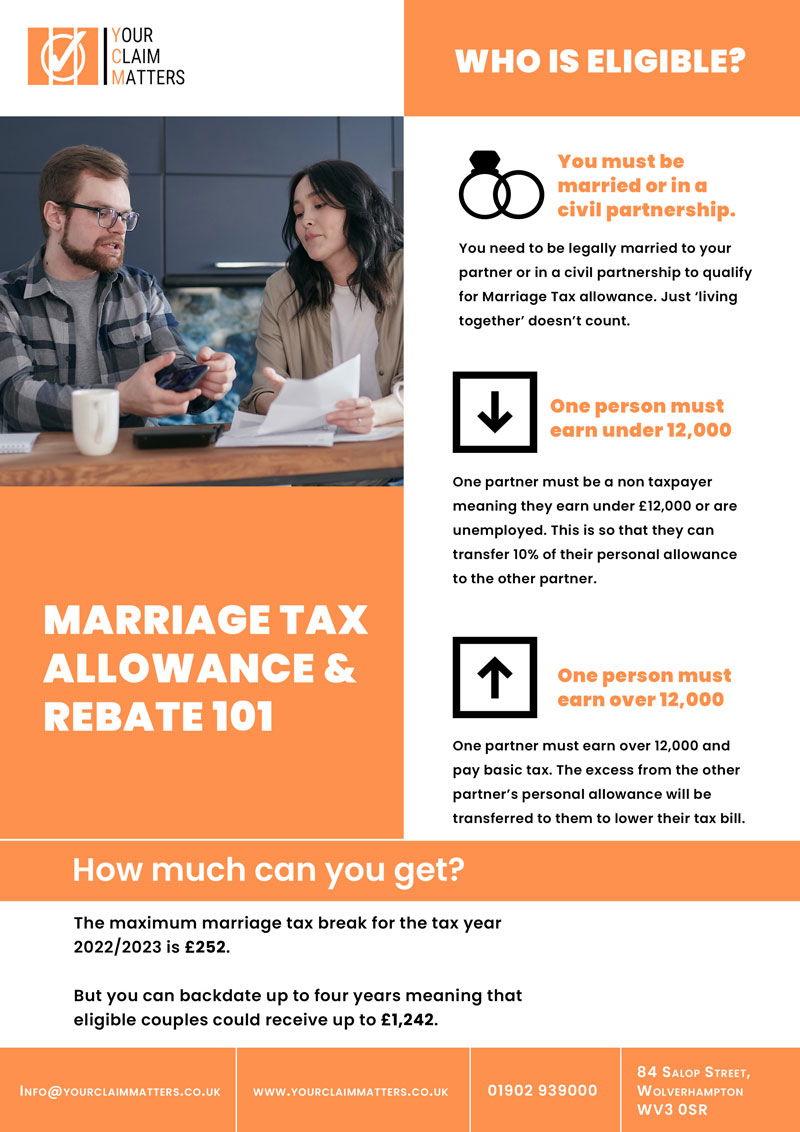

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC

Marriage Tax Rebate Online

Marriage Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header-768x296.jpeg

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/Tax-rebate-online-Points-1536x860.jpg

Tax Refund Calculators Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/09/marriage-info.jpeg

Web If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check Web Of course your rebate is only valid from your marriage date civil partnership also On average if your partner can transfer the full 10 of their Tax Allowance then on

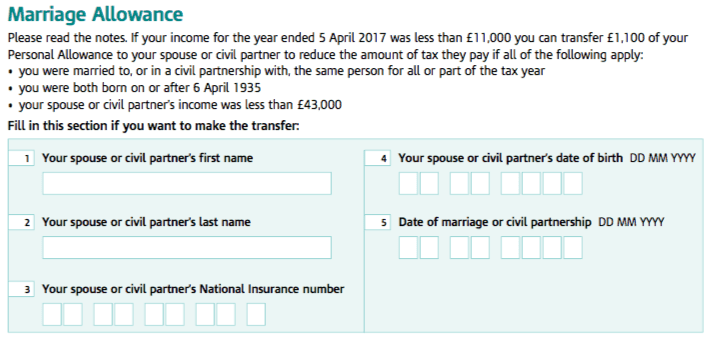

Web 8 juin 2023 nbsp 0183 32 Are you married or past Your couple is subject to common taxation You are entitled to 2 shares of family quotient Your dependants child disabled person and Web You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should make the

Download Marriage Tax Rebate Online

More picture related to Marriage Tax Rebate Online

Marriage Tax Allowance Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header-2.jpeg

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Web 14 juil 2023 nbsp 0183 32 You can give 163 1 260 of your personal allowance to your spouse lowering the amount you can earn tax free to 163 11 310 As you still earn below that new threshold you still remain a non taxpayer Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Web Online You can cancel Marriage Allowance online You ll be asked to prove your identity using information HMRC holds about you By phone Contact Marriage Allowance Web 6 avr 2023 nbsp 0183 32 There is a relatively straightforward online facility to do this on GOV UK that you can use for free To use it you need to have a Government Gateway user ID and

Marriage Family Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2019/04/tax_relief_for_parents-520x400.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

https://www.gov.uk/apply-marriage-allowance

Web The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply online you can

https://www.moneysavingexpert.com/family/m…

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the

Draw Your Signature Marriage Tax Allowance Rebate

Marriage Family Irish Tax Rebates

Can A Married Couple File Single They Can Contribute To A Roth Ira As

How To Take Advantage Of The Marriage Allowance Tax Rebates

Marriage Tax Allowance Rebate My Tax Ltd

Marriage Tax Allowance Avg Refund 1 188 YouTube

Marriage Tax Allowance Avg Refund 1 188 YouTube

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

Menards Rebates Fill Out Sign Online DocHub

Marriage Allowance Claim Your 252 Tax Rebate

Marriage Tax Rebate Online - Web 8 juin 2023 nbsp 0183 32 Are you married or past Your couple is subject to common taxation You are entitled to 2 shares of family quotient Your dependants child disabled person and