Marriage Tax Rebate Reviews Web I left a review at the beginning of October 2021 advising people to do the claim their self It is very simple and is free to use the government website Marriage allowance check

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the Web 24 mars 2021 nbsp 0183 32 Consumer expert Martin Lewis has warned millions of couples have just days left to take advantage of a 163 220 tax break from HMRC The rebate is through the Marriage Tax Allowance a little

Marriage Tax Rebate Reviews

Marriage Tax Rebate Reviews

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

Can A Married Couple File Single They Can Contribute To A Roth Ira As

https://www.thetaxadviser.com/content/dam/tta/issues/2019/jun/yurko-ex-2.JPG

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

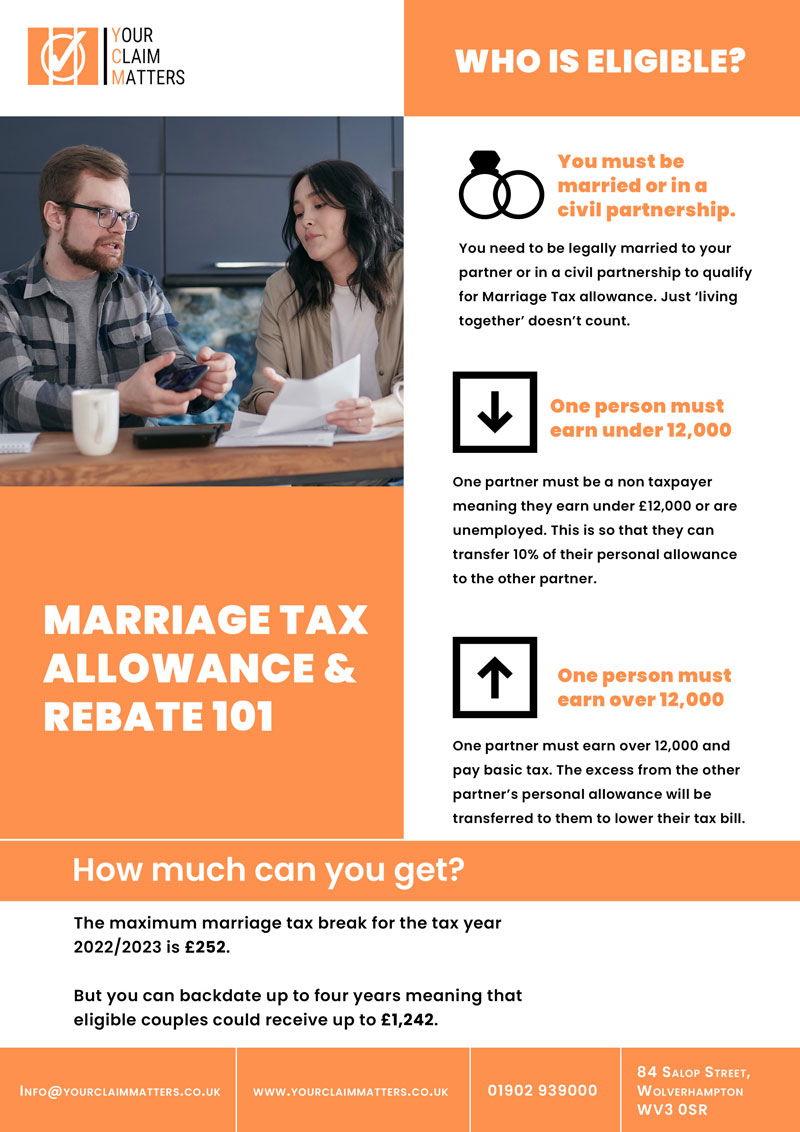

Web How it works Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner This reduces their tax by up to 163 252 in the tax year 6 Web 8 juin 2020 nbsp 0183 32 For the 2020 21 tax year it could save you a modest 163 250 but you can backdate the claim by up to four years meaning you could end up with a payout of more

Web 14 juil 2023 nbsp 0183 32 In the current tax year which runs from 6 April 2023 to 5 April 2024 the annual marriage tax allowance is 163 252 This is the same amount as the previous tax year because the personal tax Web 14 f 233 vr 2023 nbsp 0183 32 February 14 2023 Personal Tax 6 minutes of reading The marriage allowance is a tax free perk which over 2 million couples don t claim We explain how

Download Marriage Tax Rebate Reviews

More picture related to Marriage Tax Rebate Reviews

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance.jpg

Tax Rebates

https://www.fosb.co.uk/_webedit/cached-images/129.jpg

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

Web If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC with details of your marriage or civil partnership ceremony spouse or civil Web 8 nov 2022 nbsp 0183 32 What Is a Marriage Tax Bonus occurs mostly in households where one person makes most of if not all the income By filing jointly they qualify for a lower tax bracket than they would have if they were single

Web Apply for Marriage Allowance online Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Web After going down this route my wife received a rebate from The Inland Revenue of just over 163 800 Three days later I received a tax demand for 163 900 Tax demand more than the

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-1024x288.png

Gallery Popup My Tax Rebate

https://www.mytaxrebate.co.uk/wp-content/uploads/2019/05/portfolio-img-5.jpg

https://uk.trustpilot.com/review/marriageallowancecheck.net

Web I left a review at the beginning of October 2021 advising people to do the claim their self It is very simple and is free to use the government website Marriage allowance check

https://www.moneysavingexpert.com/family/m…

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

Marriage Allowance Tax Rebate In UK EmployeeTax

Gorilla Tax Rebates Reviews Read Customer Service Reviews Of

Home Tax Rebate Online

Marriage Tax Allowance Tax Rebate Online

What Is The Marriage Tax Allowance A Million Couples Missing Out On

What Is The Marriage Tax Allowance A Million Couples Missing Out On

Marriage Family Irish Tax Rebates

The 101 Marriage Tax Allowance Rebate And Claim Guide

Waltonbridge Free Estimate Available Walton Bridge

Marriage Tax Rebate Reviews - Web How it works Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner This reduces their tax by up to 163 252 in the tax year 6