Marriage Tax Rebate Self Employed Web Self employed If you re self employed your self assessment tax bill will be reduced as HMRC will take into account that you ve now got a

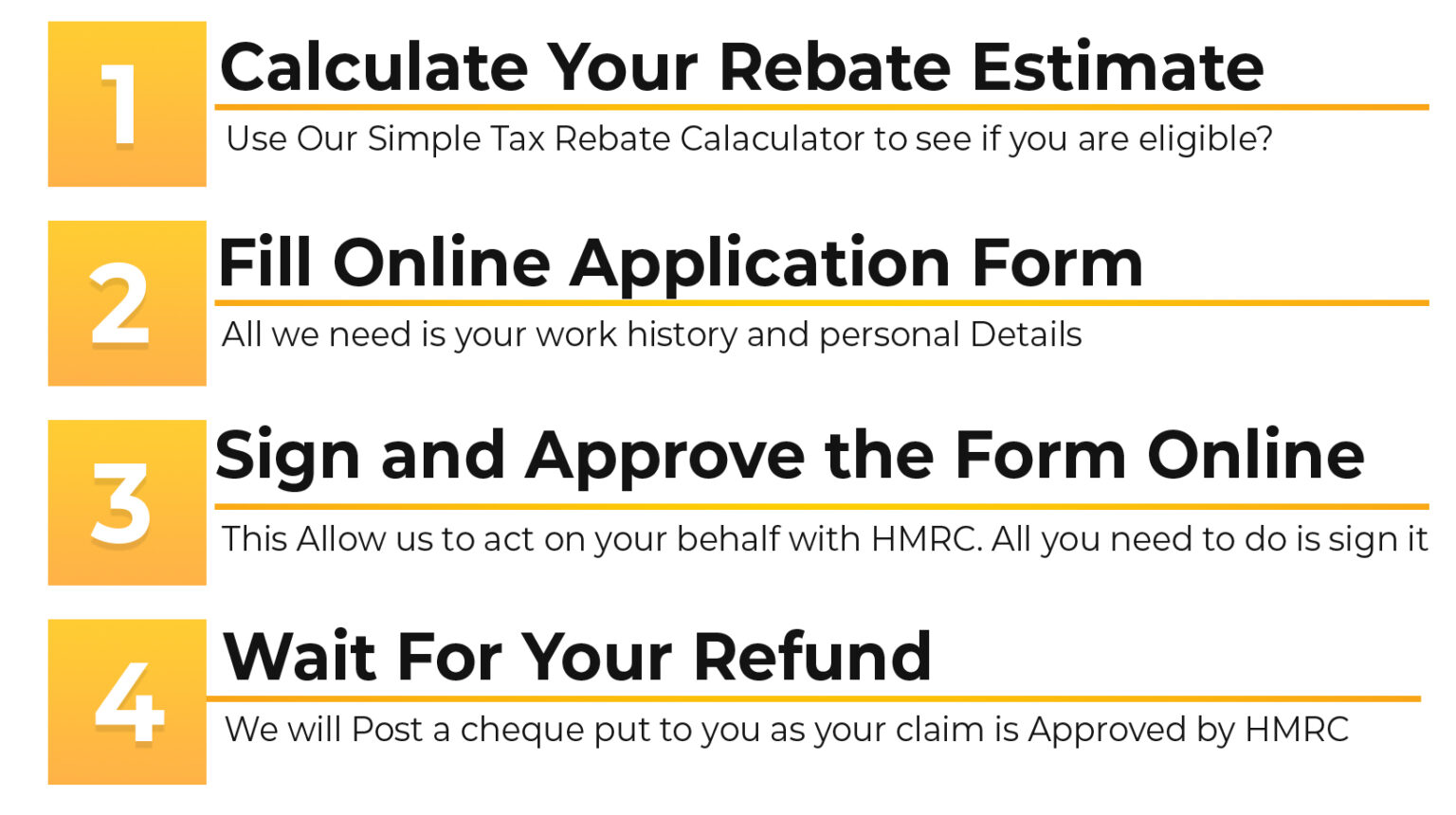

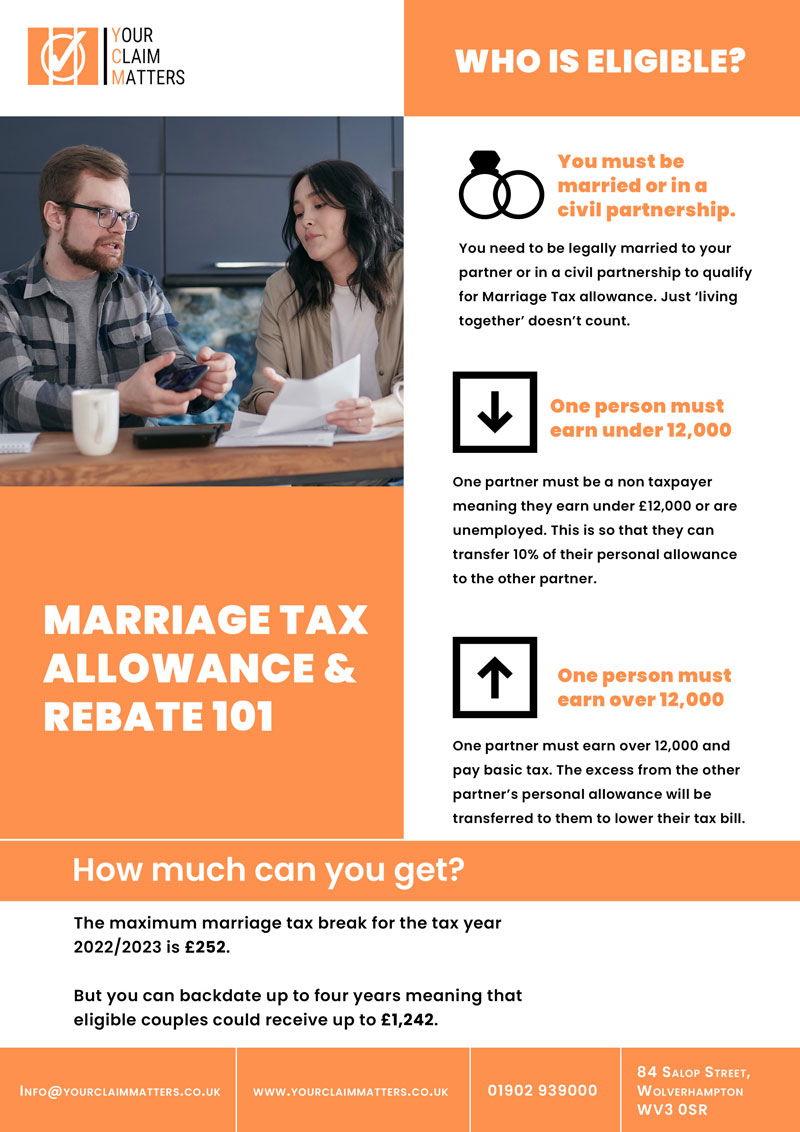

Web Apply online The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply Web Claiming Backdated Marriage Allowance Tax Rebate You can backdate your claim for marriage allowance up to 4 tax years to claim a rebate

Marriage Tax Rebate Self Employed

Marriage Tax Rebate Self Employed

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Married Couples Allowance It s Here Performance Accountancy

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

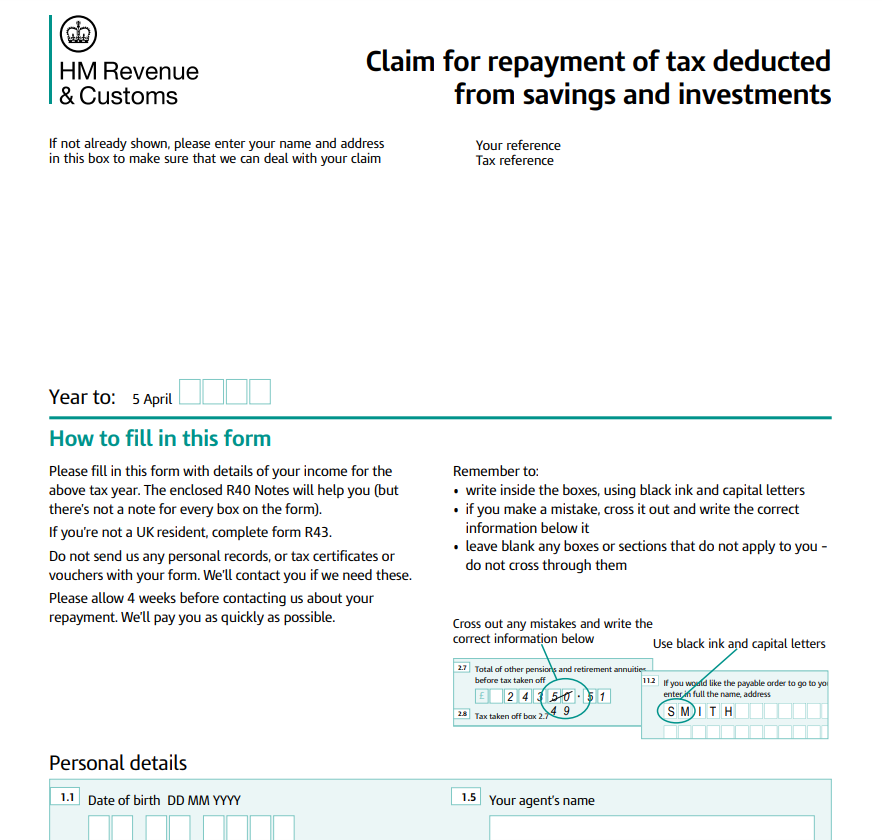

Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should Web If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC with details of your marriage or civil partnership ceremony spouse

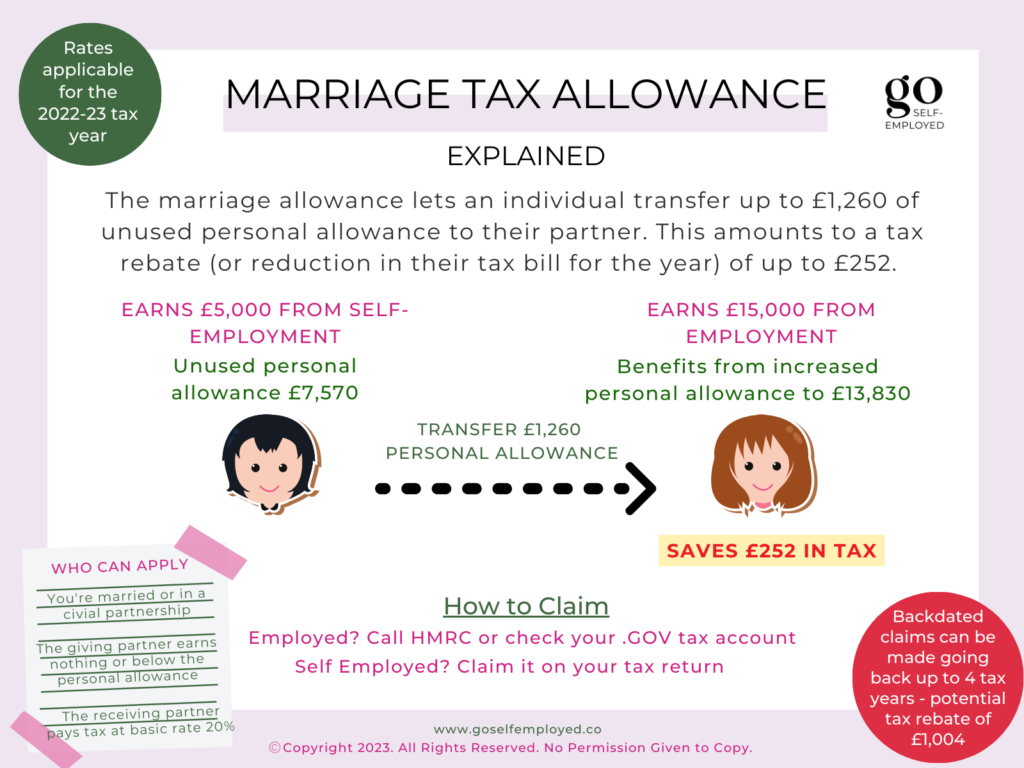

Web You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you was born Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they

Download Marriage Tax Rebate Self Employed

More picture related to Marriage Tax Rebate Self Employed

Claim Now Claim Tax Back

https://www.selfemployedtaxback.com/wp-content/uploads/2015/02/claiming-ppi-yourself.jpg

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Can A Married Couple File Single They Can Contribute To A Roth Ira As

https://www.thetaxadviser.com/content/dam/tta/issues/2019/jun/yurko-ex-2.JPG

Web 20 f 233 vr 2015 nbsp 0183 32 20 February 2015 This was published under the 2010 to 2015 Conservative and Liberal Democrat coalition government The government has today opened Web Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to 2024 tax year it could cut your tax bill by between 163 401

Web 11 sept 2023 nbsp 0183 32 Can self employed people claim the marriage allowance Yes as long as one partner earns less than 163 12 570 and the other earns between 163 12 571 and 163 50 270 If the recipient partner files a self Web 6 avr 2023 nbsp 0183 32 For prior years you will receive a refund cheque from HMRC For the current tax year and going forward your own and your spouse or civil partner s tax codes will be

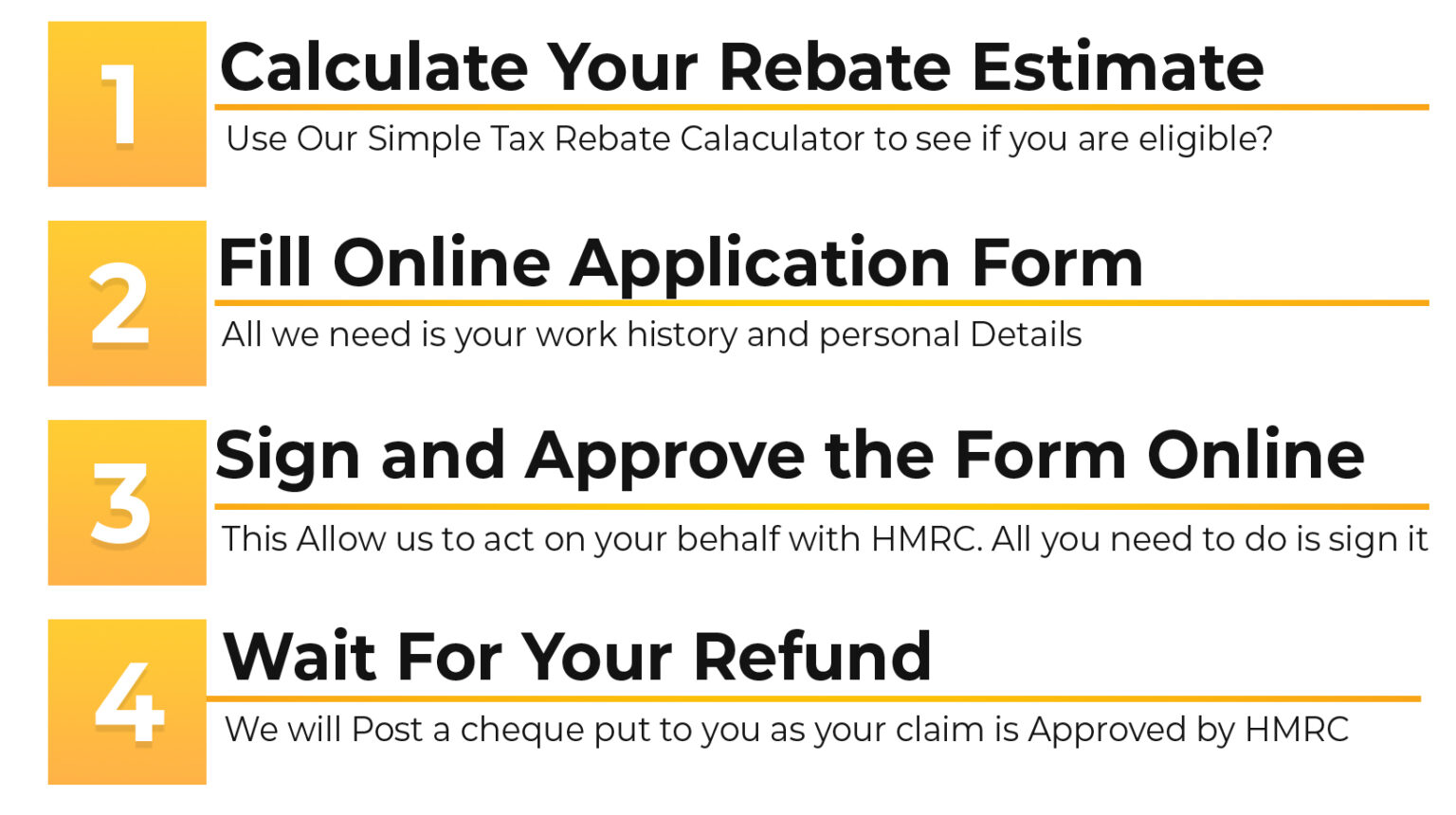

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/Tax-rebate-online-Points-1536x860.jpg

Hmrc Tax Return Self Assessment Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form.png

https://www.moneysavingexpert.com/family/m…

Web Self employed If you re self employed your self assessment tax bill will be reduced as HMRC will take into account that you ve now got a

https://www.gov.uk/apply-marriage-allowance

Web Apply online The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply

The 101 Marriage Tax Allowance Rebate And Claim Guide

Home Tax Rebate Online

How To Take Advantage Of The Marriage Allowance Tax Rebates

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

Marriage Allowance Claim Your 252 Tax Rebate

Marriage Allowance Claim Your 252 Tax Rebate

Self Employed Deductions Worksheet

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

NPS Tax Benefit Sec 80C And Additional Tax Rebate Tax Benefit To

Marriage Tax Rebate Self Employed - Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they