Married Person Tax Allowance Rebate Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be

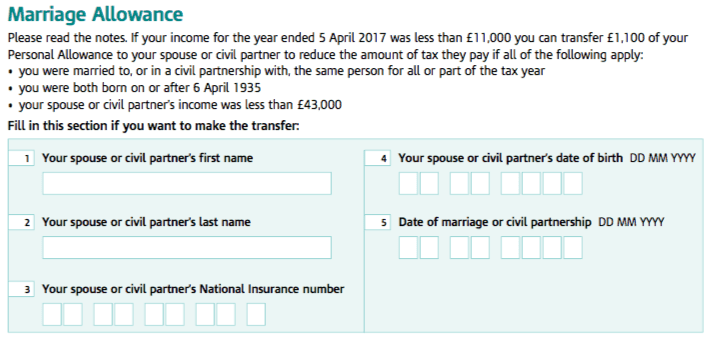

Web Married Couple s Allowance could reduce your tax bill each year you re married or in a civil partnership if one of you was born before before 6 April 1935 Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is

Married Person Tax Allowance Rebate

Married Person Tax Allowance Rebate

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

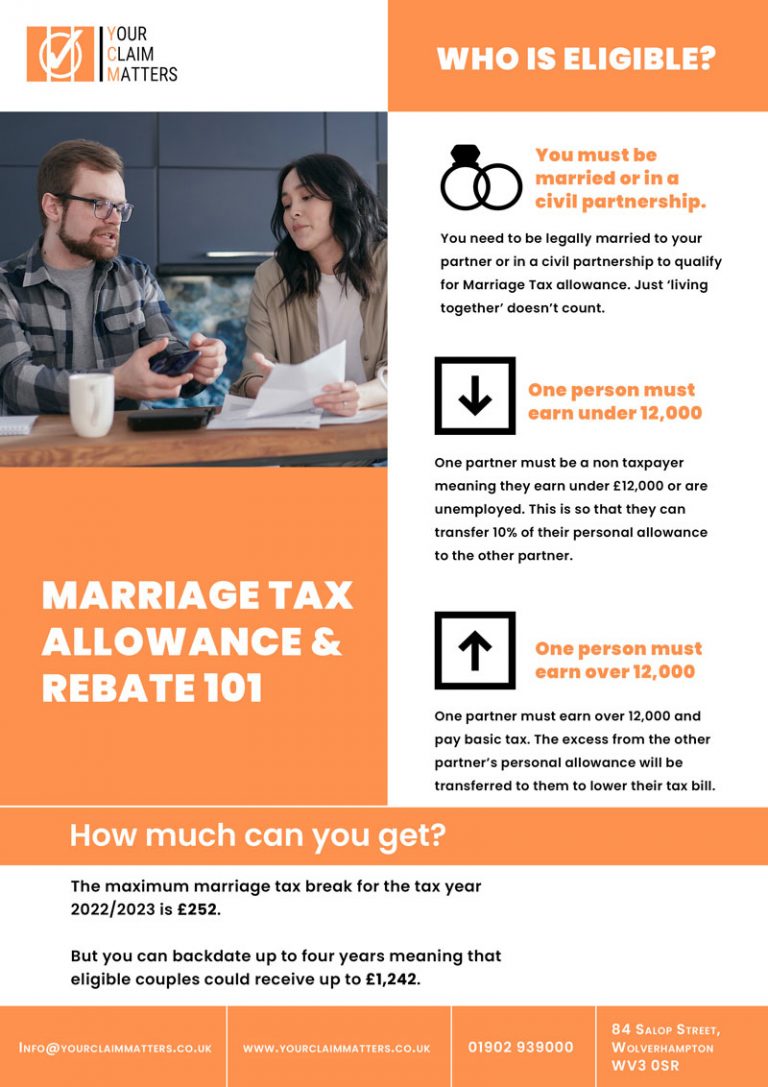

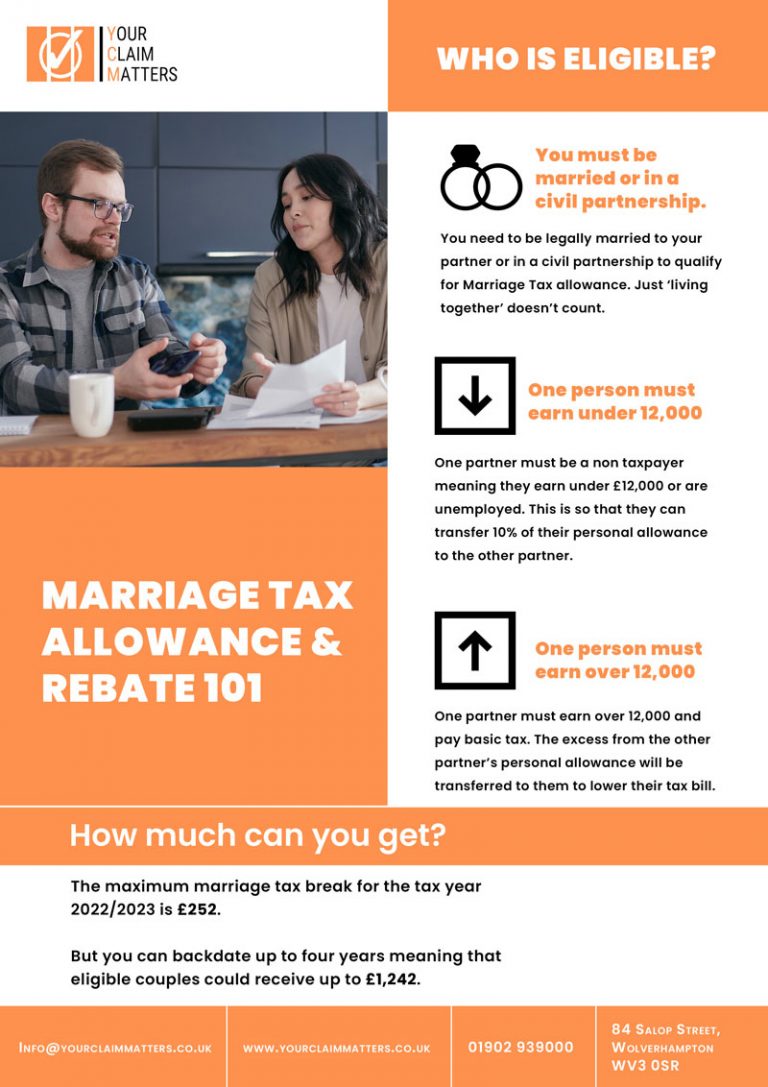

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-768x1087.jpg

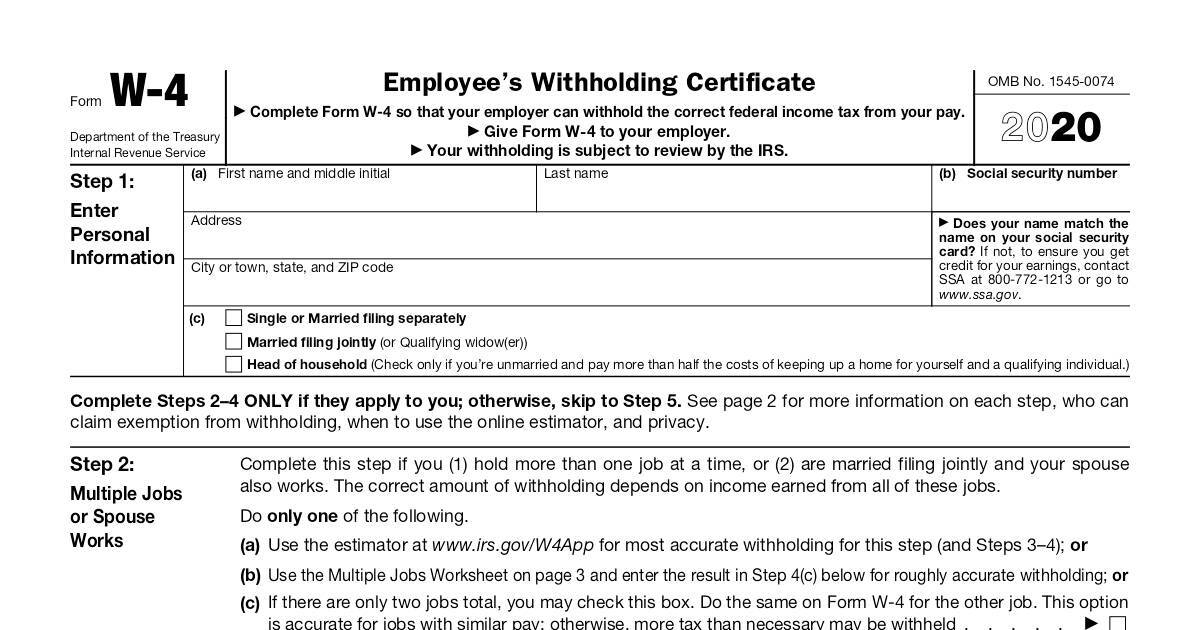

How Many Allowances To Claim If Married Filing Jointly 3pointsdesign

https://dochub.com/musiccityprotection/8YZWO9NV82Qkk2ZRzEAy30/employee-withholding-certificate-w4.jpg?dt=jon-ekUza2rfsC6sjaxM

Web Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to 2024 tax year it could cut your tax bill by between Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web 14 juil 2023 nbsp 0183 32 You can give 163 1 260 of your personal allowance to your spouse lowering the amount you can earn tax free to 163 11 310 As you still earn below that new threshold you still remain a

Download Married Person Tax Allowance Rebate

More picture related to Married Person Tax Allowance Rebate

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

https://i.ibb.co/Tmffpxh/marriage.png

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

Marriage Tax Allowance Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header-2.jpeg

Web Eligibility You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should

Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance to their partner Web 14 mars 2022 nbsp 0183 32 Marriage tax allowance Apply now or lose 163 230 quot Now marriage tax allowance the next one again you do need to get on with this This is if you are a non

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

Calculating Withholding Allowances Contractor Licensing Blog

https://y2u7z9e4.stackpathcdn.com/images/academic/Married_Person_Weekly_Payroll_Period_TWIN.png

https://www.moneysavingexpert.com/family/m…

Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be

https://www.gov.uk/married-couples-allowance/how-to-claim

Web Married Couple s Allowance could reduce your tax bill each year you re married or in a civil partnership if one of you was born before before 6 April 1935

Marriage Allowance Tax Rebate In UK EmployeeTax

Marriage Tax Allowance Rebate My Tax Ltd

Illinois Withholding Allowance Worksheet How To Fill It Out Downey Holdia

Married Couples Tax Allowance Claim Form Blank Template Imgflip

How Do I Claim A Tax Rebate Tax Rebate Services

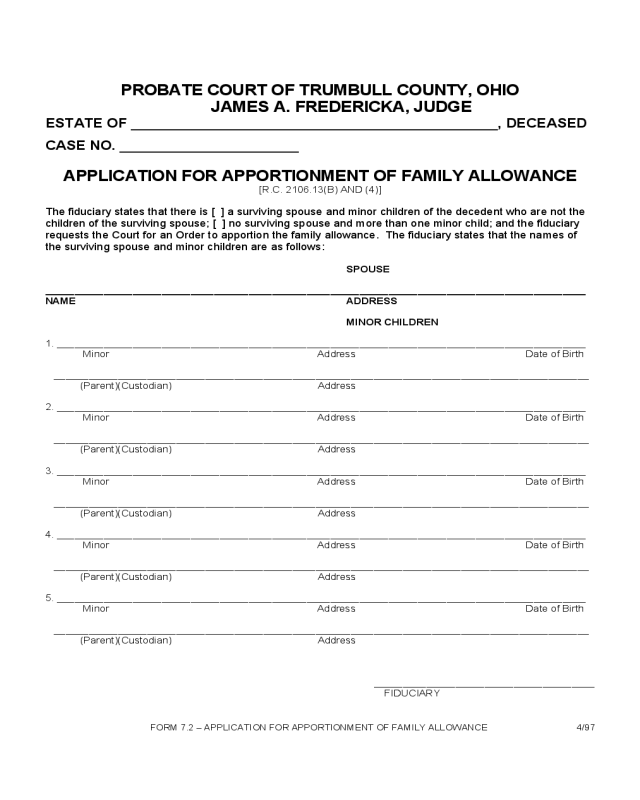

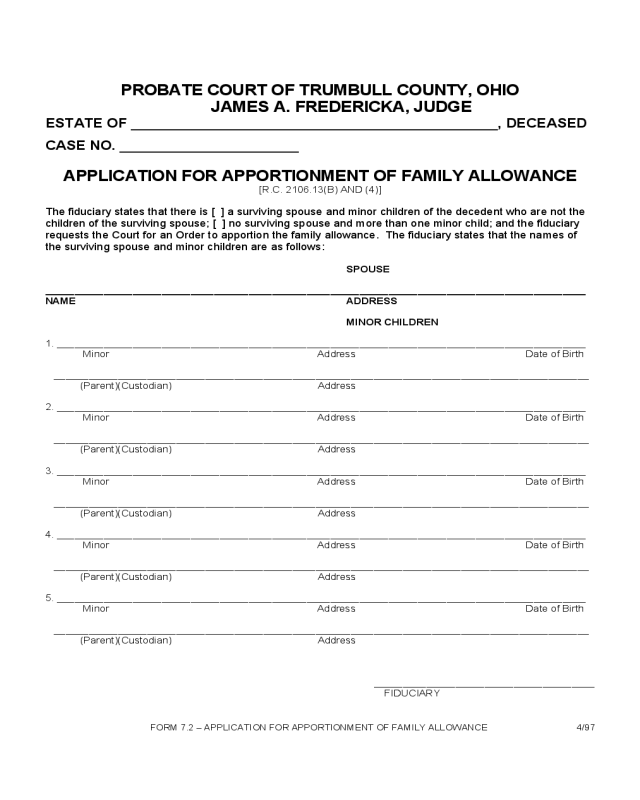

2022 Family Allowance Form Fillable Printable PDF Forms Handypdf

2022 Family Allowance Form Fillable Printable PDF Forms Handypdf

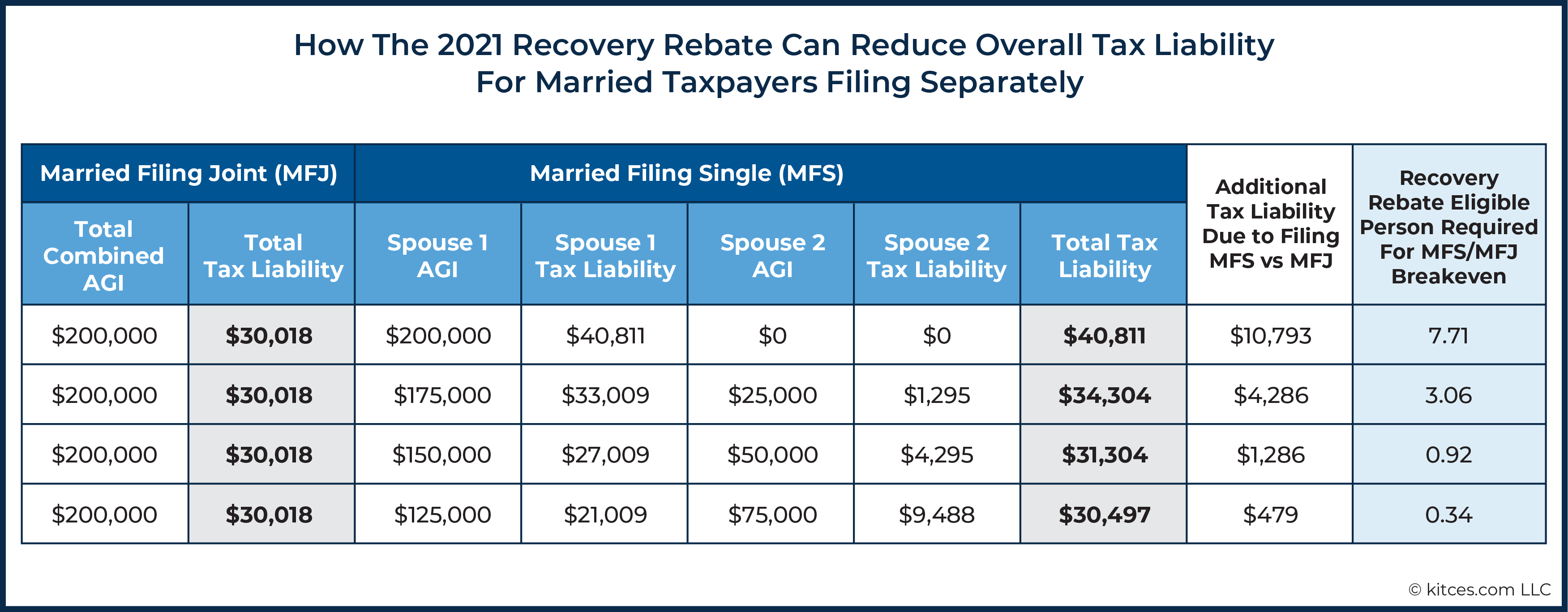

Strategies To Maximize The 2021 Recovery Rebate Credit

As A Married Man In The UK Am I Entitled To PL Accounts

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

Married Person Tax Allowance Rebate - Web Tax relief for the Married Couple s Allowance is 10 The benefit has upper and lower limits for both the amount of tax that can be claimed and how much that can be earned