Married Tax Rebate Uk Web Apply for Marriage Allowance online Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC Web For the 2023 to 2024 tax year it could cut your tax bill by between 163 401 and 163 1 037 50 a year Use the Married Couple s Allowance calculator to work out what you could get If

Married Tax Rebate Uk

Married Tax Rebate Uk

https://i.pinimg.com/736x/72/45/f6/7245f6b2e7538d2957fb46e95e1897c1.jpg

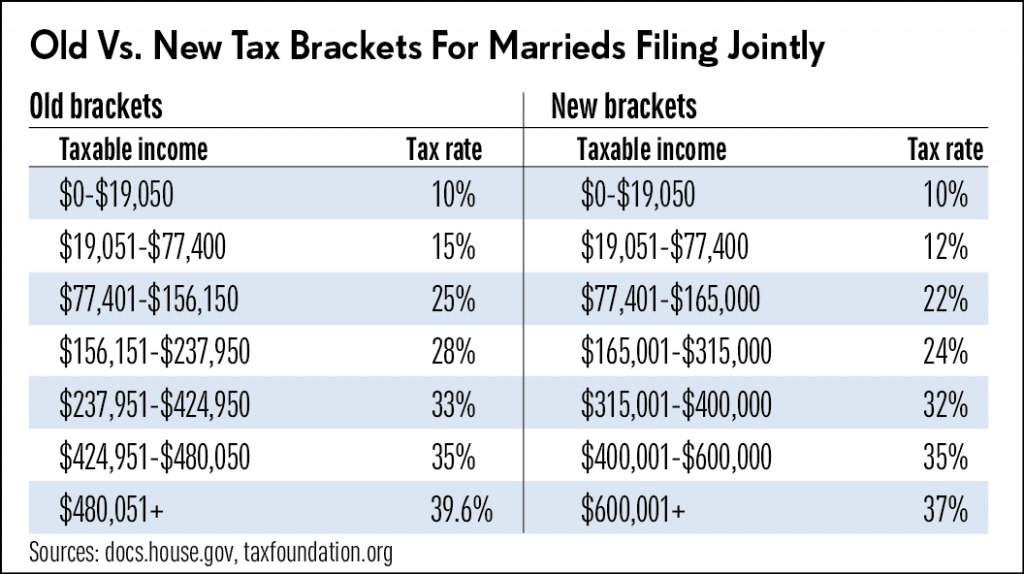

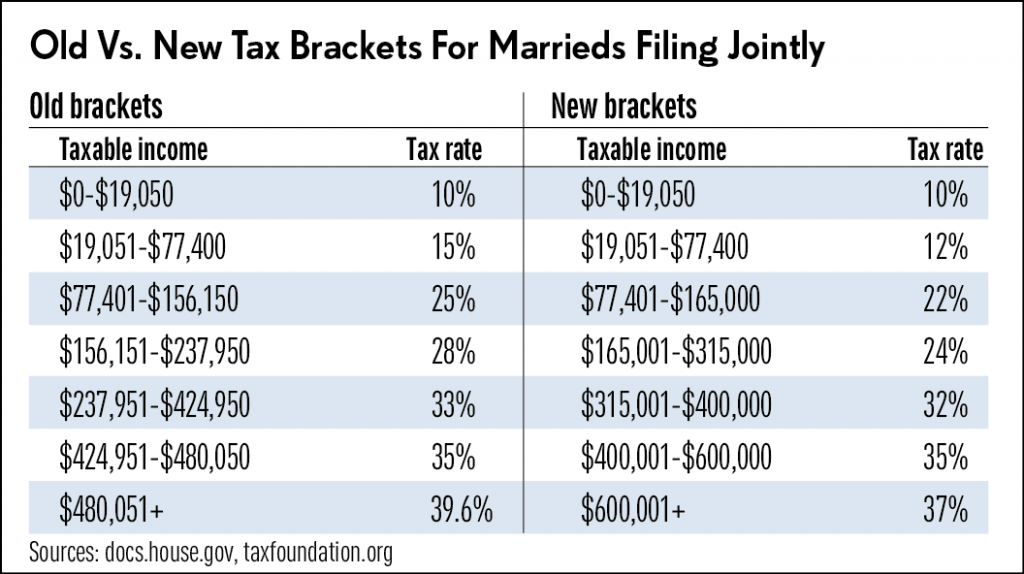

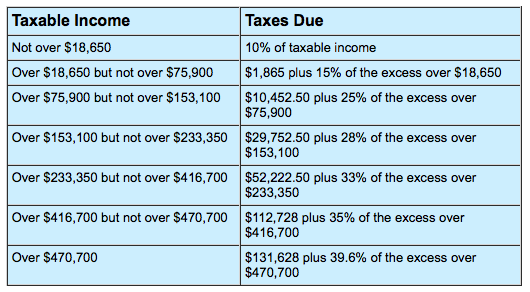

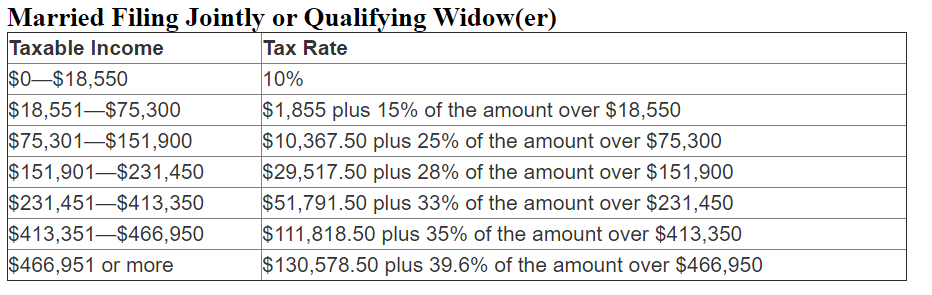

2018 Tax Rates Do You Know Your New Tax Bracket Freidel

https://images.squarespace-cdn.com/content/v1/568f2229d8af1055c06ffd87/1516389645909-PJF0ERUKUICXNAP0F5UE/ke17ZwdGBToddI8pDm48kJfXdim-OvTpTPcj8I9TOfsUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcAJJBAEM8fS3Lq1cLrlT8vvXbWioCfSWr1AnW9Hmm2oWAHS2_u2hcO5NA3AWRBnS6/Tax+Brackets+Married.png

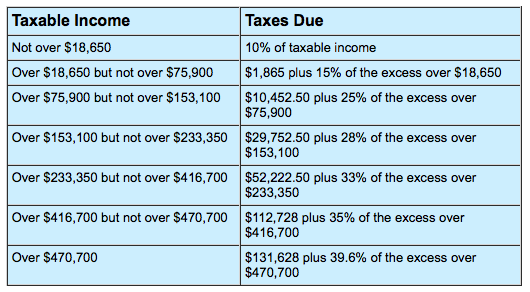

Married Tax Brackets 2021 Westassets

https://tfophoenix.com/wp-content/uploads/2020/12/Screen-Shot-2020-12-14-at-3.39.02-PM.jpg

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the Web 2 janv 2022 nbsp 0183 32 Marriage tax allowance enables eligible Britons to transfer 163 1 260 of their personal allowance to their spouse or civil partner to cut their yearly tax bill and claims

Web Eligibility You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance to their partner The higher earning

Download Married Tax Rebate Uk

More picture related to Married Tax Rebate Uk

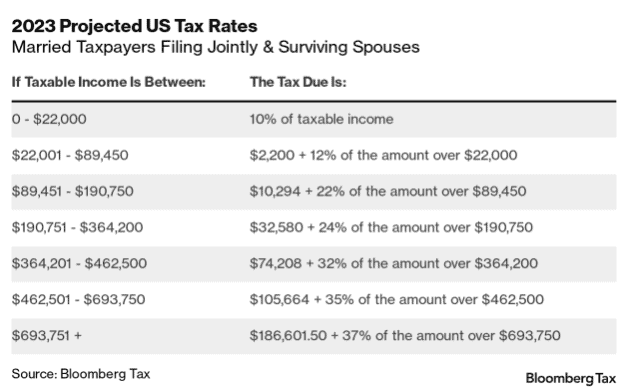

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately.png

Married Tax Brackets 2021 Westassets

https://i2.wp.com/wpdev.abercpa.com/wp-content/uploads/2018/06/married-filing-jointly-tax-brackets.png

2023 Trucker Per Diem Rates Per Diem Plus

https://www.perdiemplus.com/wp-content/uploads/2022/10/2023-Married-Tax-Bracket.png

Web You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should make the Web 4 nov 2019 nbsp 0183 32 0 163 0 It is possible to backdate your claim by up to four years This means that eligible couples who have been married or in a civil partnership for the past five years

Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil partner if you both meet Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner

Tax Brackets Married Couple Lang Allan Company CPA PC

https://langallancpa.com/wp-content/uploads/2017/12/tax-brackets-married-couple.png

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-income-tax-rates-married-filing-jointly.png

https://www.gov.uk/apply-marriage-allowance

Web Apply for Marriage Allowance online Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage

https://www.gov.uk/married-couples-allowance/how-to-claim

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC

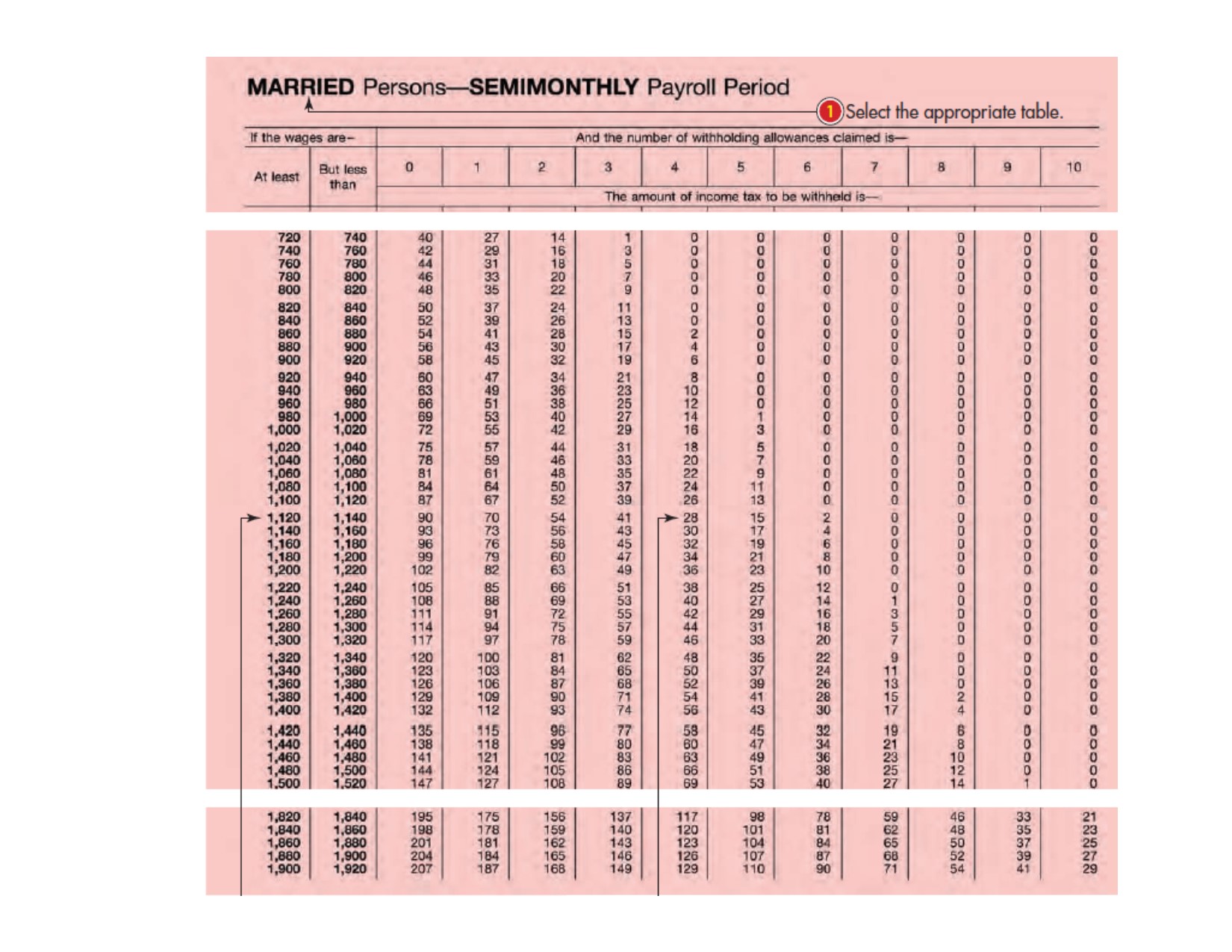

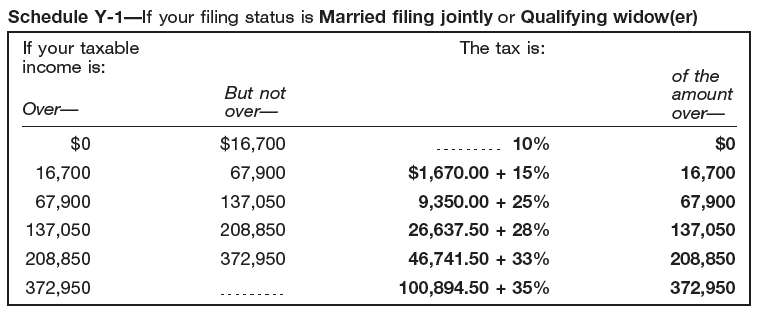

Blog Archives Coach Tarpley

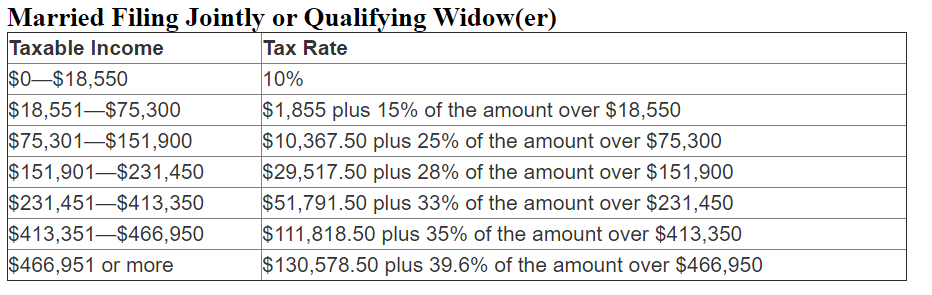

Tax Brackets Married Couple Lang Allan Company CPA PC

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

Marriage Penalty Brackets Tardy Co PC

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

Roth IRA Conversion 2016 Reasons To Convert And Reverse Your

Roth IRA Conversion 2016 Reasons To Convert And Reverse Your

Average Tax Rates For Married Couples With One Income 2009

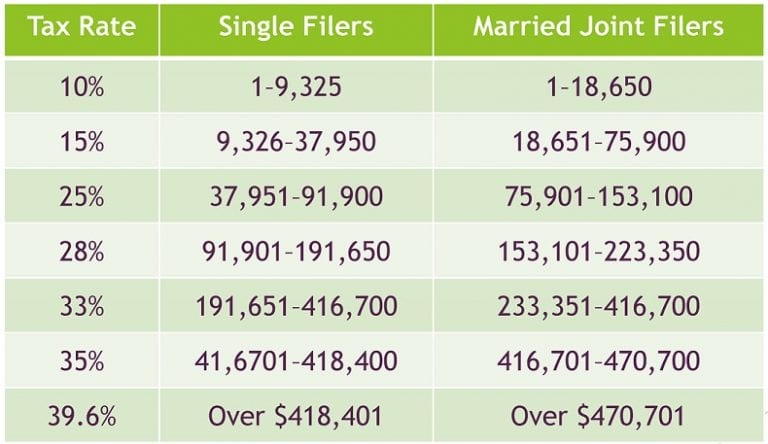

Tax Single Married Graphic TFO Phoenix Inc

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

Married Tax Rebate Uk - Web Eligibility You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you