Maryland Estate Tax Exemption 2022 The Maryland estate tax exemption is 5 million and it also has an inheritance tax The federal government also has its own estate tax

Maryland estate tax exemption under certain circumstances The exclusion amounts set by legislation enacted in 2014 for decedents dying prior to January 1 2019 remain the same There you will find everything you need to know about that 1099G you got in the mail filing requirements residency filing status exemptions credits deductions checkoffs filing

Maryland Estate Tax Exemption 2022

Maryland Estate Tax Exemption 2022

https://i.pinimg.com/originals/ce/ad/8a/cead8a95463848ce1b3f531f26fb6d2c.jpg

2022 Estate Tax Exemption PB Elder Law

https://www.pbelderlaw.com/wp-content/uploads/2022/01/GettyImages-1304677572.jpg

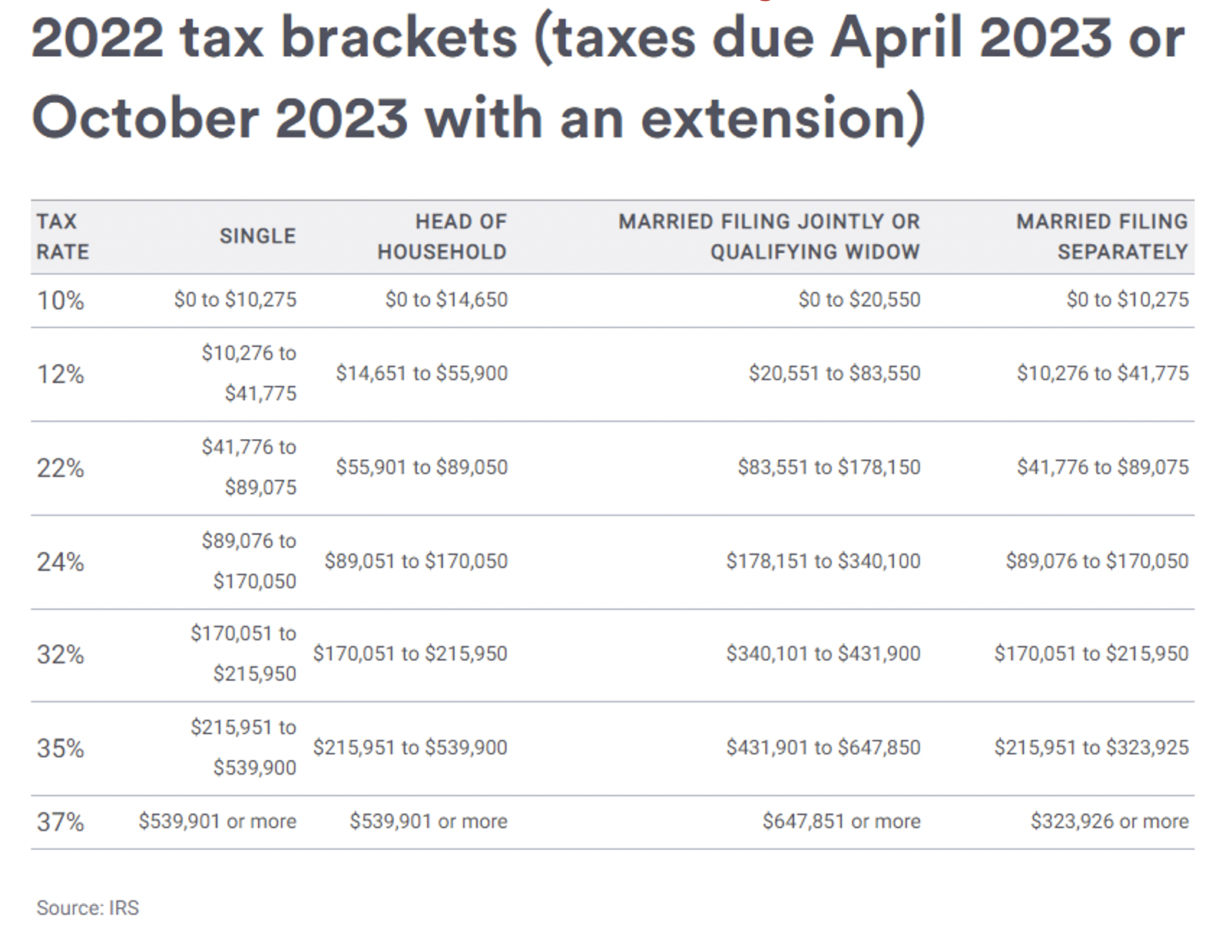

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM.png

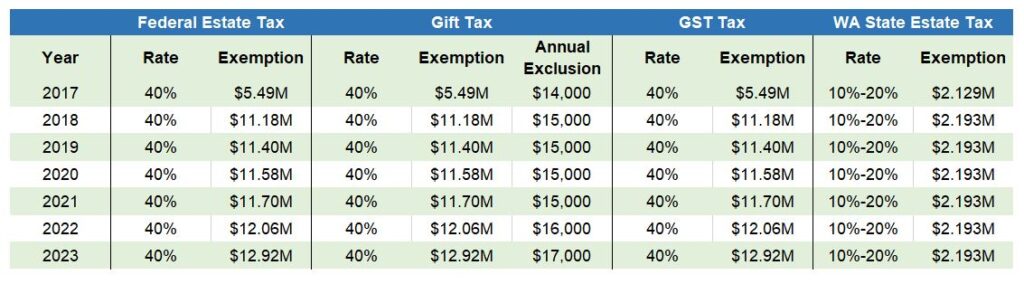

In 2022 the exemption was 12 06 million The exemption is increased each year based on inflation which is why the increase for 2023 is so large In Maryland the estate tax Learn how federal and state estate tax thresholds change in 2022 and how they affect beneficiaries Find out how to file tax returns and pay taxes during probate with an

What is the Maryland estate tax exemption The Maryland estate tax exemption is 5 million Unlike the IRS exemption the amount is not annually adjusted for inflation The Maryland individual estate tax exemption amount is currently 5 million not indexed for inflation Maryland also permits portability a surviving spouse can elect to

Download Maryland Estate Tax Exemption 2022

More picture related to Maryland Estate Tax Exemption 2022

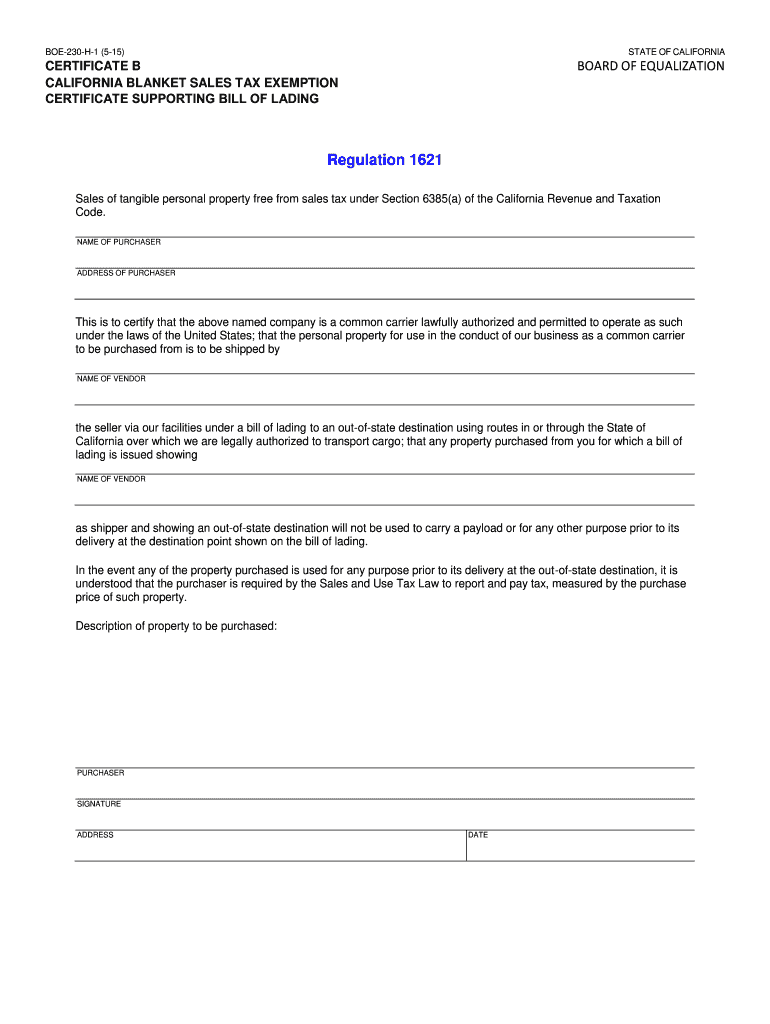

Mississippi Sales And Use Tax Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/17-lovely-florida-tax-exempt-certificate.png

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

Annual Individual Gift Tax Exclusion Chart My XXX Hot Girl

https://www.helsell.com/wp-content/uploads/23-EP-Table-1024x284.jpg

When the estate tax applies it ranges from 0 to 16 based on graduated thresholds above the 5 million exemption amount Maryland s estate tax is portable between a Except as provided in subsection b of this section the Maryland estate tax does not apply to the transfer of personal property in an estate of a nonresident decedent if at the time of

First in Maryland there is a 5 million estate tax exclusion What that means is that if you pass away with anything less than 5 million there is no estate tax owed to Maryland We can often double this number for married With the adjustment the 2022 exemption amount is projected to be approximately 4 254 000 Unlike the federal exemption there is no provision for portability of the DC estate

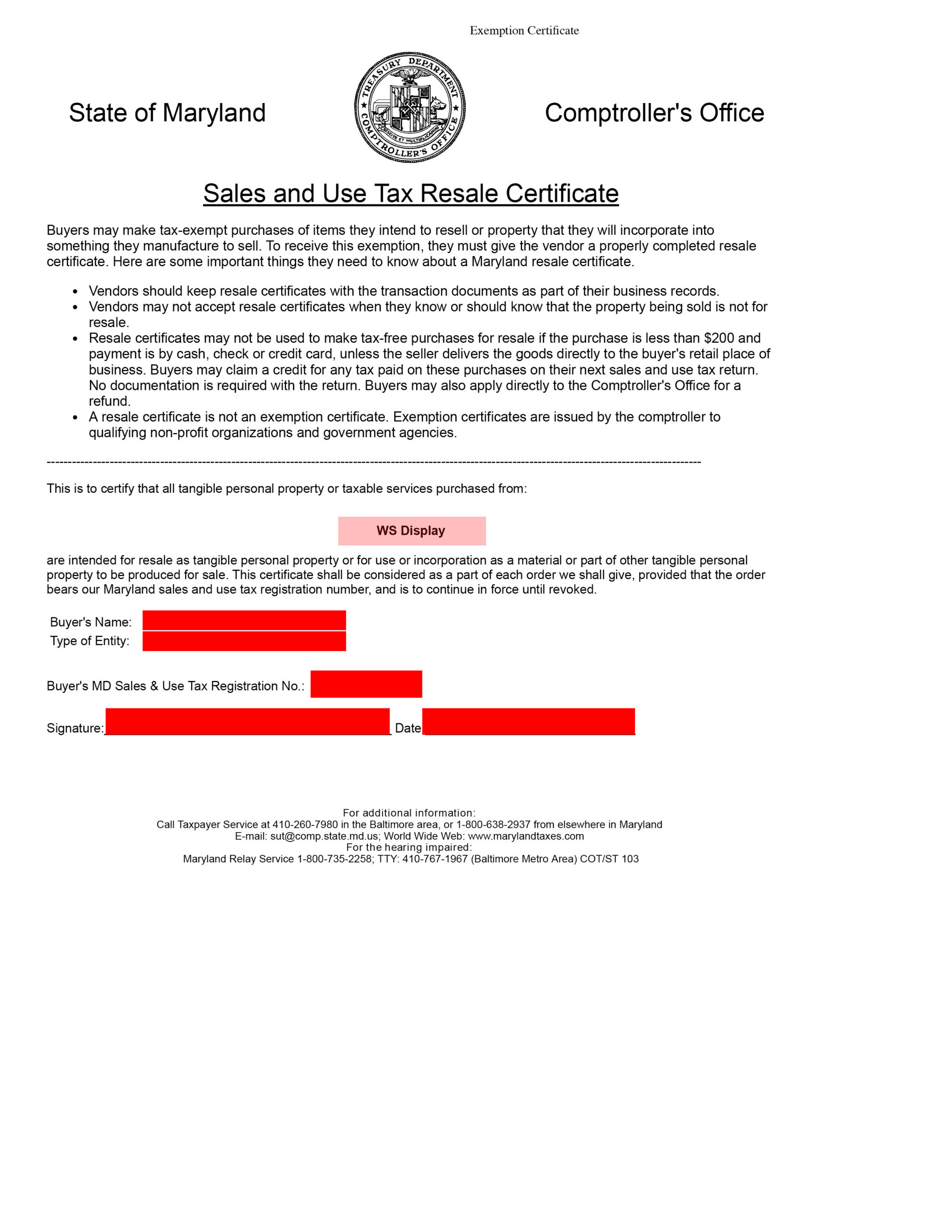

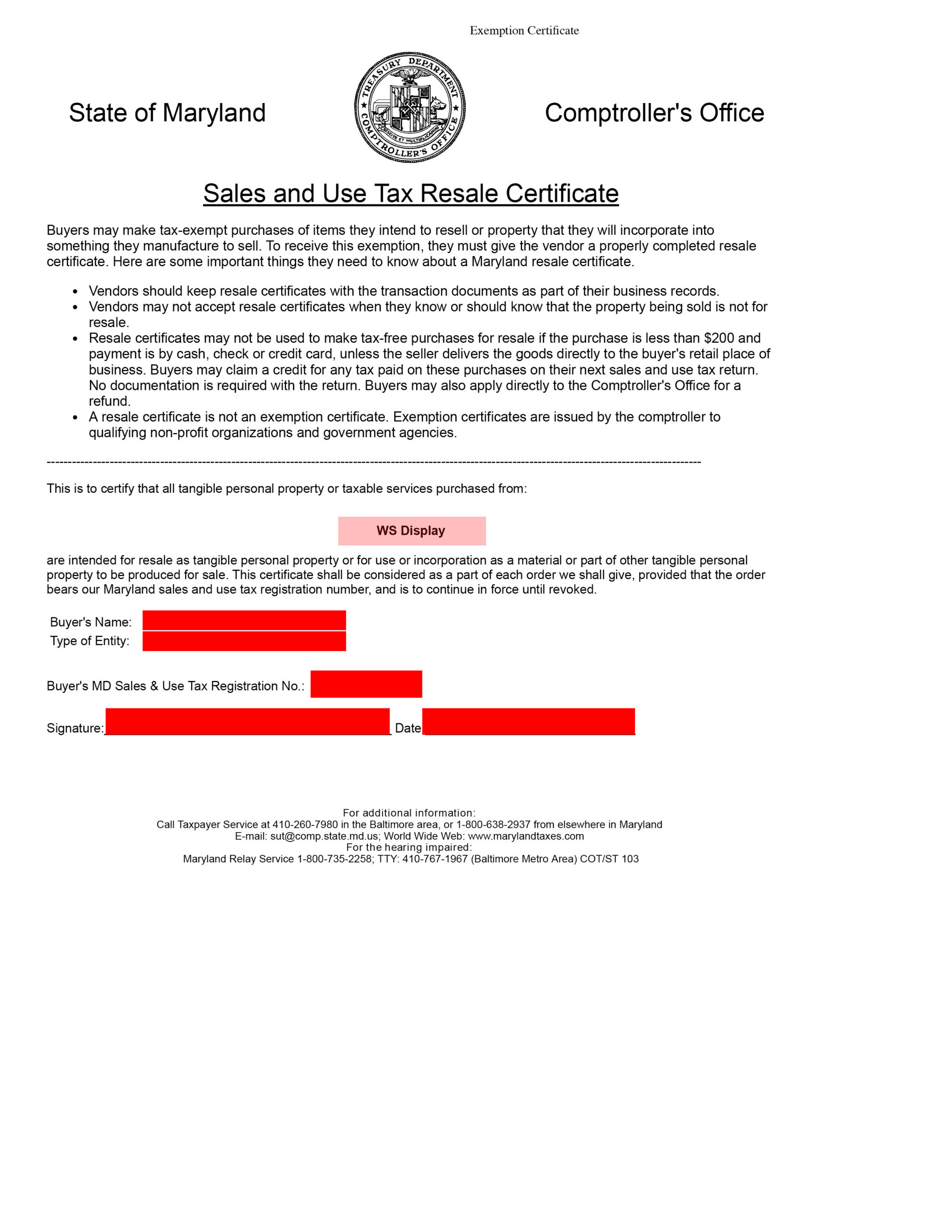

Maryland Sales And Use Tax Exemption Certificates

https://www.yumpu.com/en/image/facebook/48026114.jpg

Important Changes To Estate Tax Exemption For 2022 AmeriEstate

https://ameriestate.com/wp-content/uploads/2022/10/pexels-photo-8962476-1024x683.jpeg

https://smartasset.com › ... › maryland-esta…

The Maryland estate tax exemption is 5 million and it also has an inheritance tax The federal government also has its own estate tax

https://www.marylandtaxes.gov › forms › Personal_Tax...

Maryland estate tax exemption under certain circumstances The exclusion amounts set by legislation enacted in 2014 for decedents dying prior to January 1 2019 remain the same

E Filing Due Date 2022 Malaysia Tax Compliance And Statutory Due

Maryland Sales And Use Tax Exemption Certificates

New 2019 Changes To Estate Tax Exemption In DC And Maryland

California Tax exempt Form 2023 ExemptForm

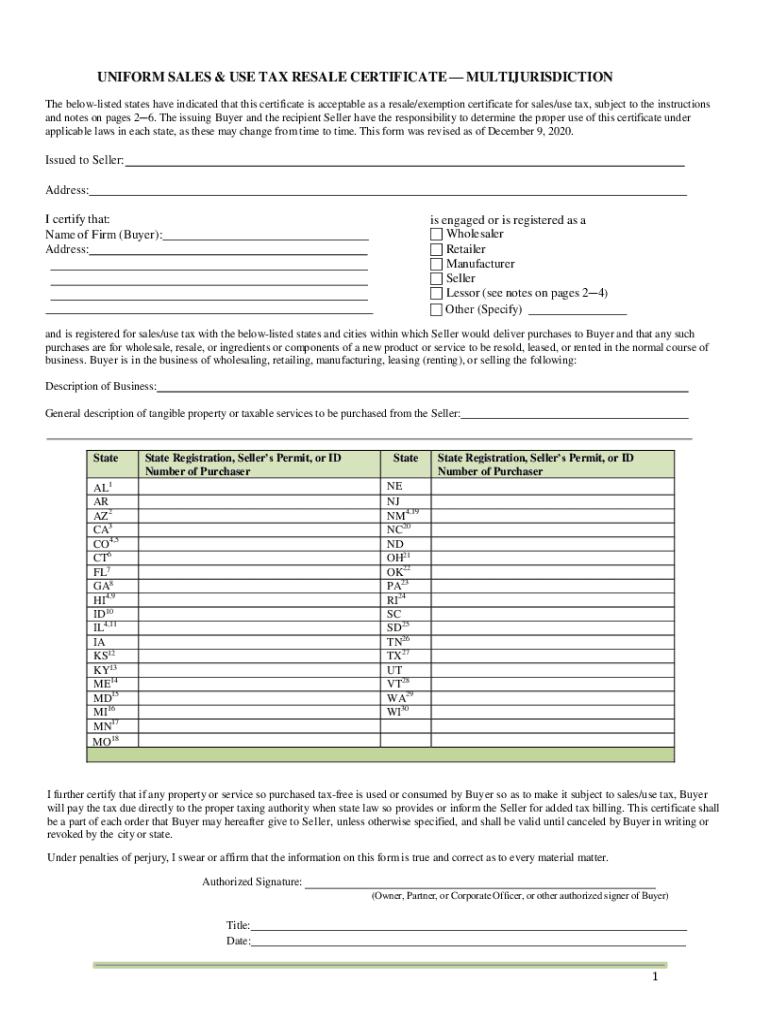

MTC Uniform Sales Use Tax Certificate Multijurisdiction 2020 2022

Maryland Sales Tax Exempt Form 2023 ExemptForm

Maryland Sales Tax Exempt Form 2023 ExemptForm

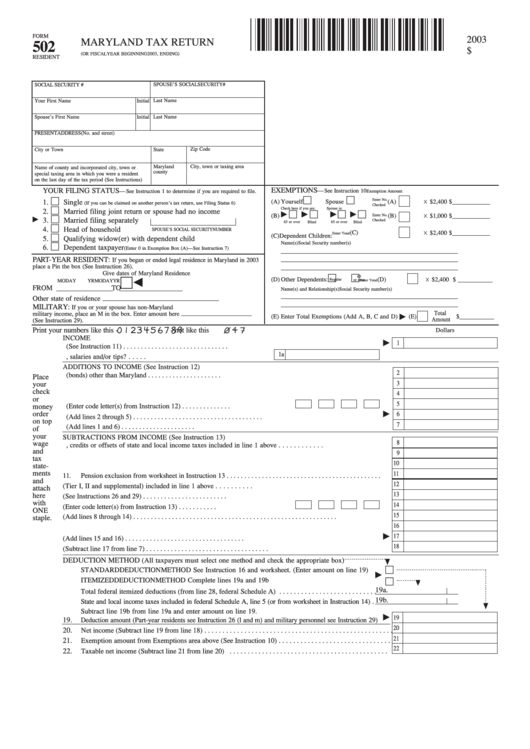

Blank Fillable Maryland Tax Return 502 Fillable Form 2023

Change To The Maryland Estate Tax Exemption Wills Trusts Estates

Maryland Estate Planning In 2019 Wills Trusts Estates

Maryland Estate Tax Exemption 2022 - In 2022 the exemption was 12 06 million The exemption is increased each year based on inflation which is why the increase for 2023 is so large In Maryland the estate tax