Maryland Property Tax Rebate Web 7 f 233 vr 2022 nbsp 0183 32 If a resident has already paid their property taxes and applies by October 1 any tax credit that the homeowner may be eligible for will be refunded by their county finance office In FY21 42 272 eligible homeowners received

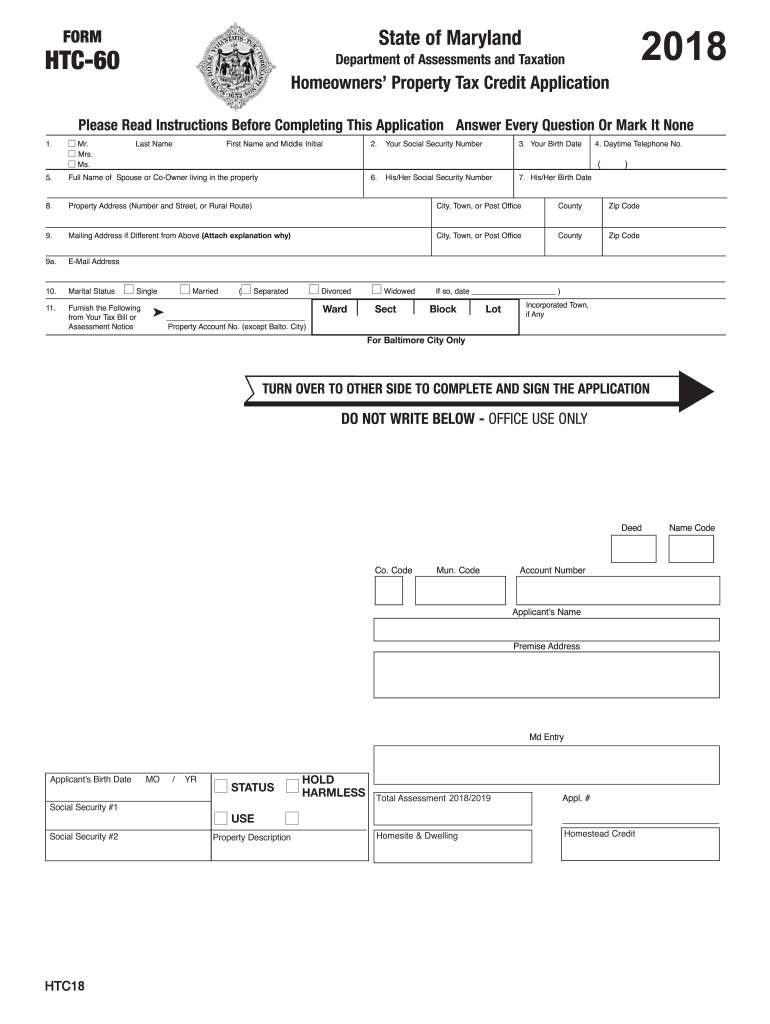

Web The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income For more information please visit our website at https dat maryland gov Pages Tax Credit Programs aspx Eligibility Web The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income For more information please visit our website at https dat maryland gov Pages Tax Credit Programs aspx Eligibility

Maryland Property Tax Rebate

Maryland Property Tax Rebate

https://www.pdffiller.com/preview/466/857/466857170/large.png

Resources Home First Title Group

http://home1sttitle.net/wp/wp-content/uploads/2014/08/taxrates2014.jpg

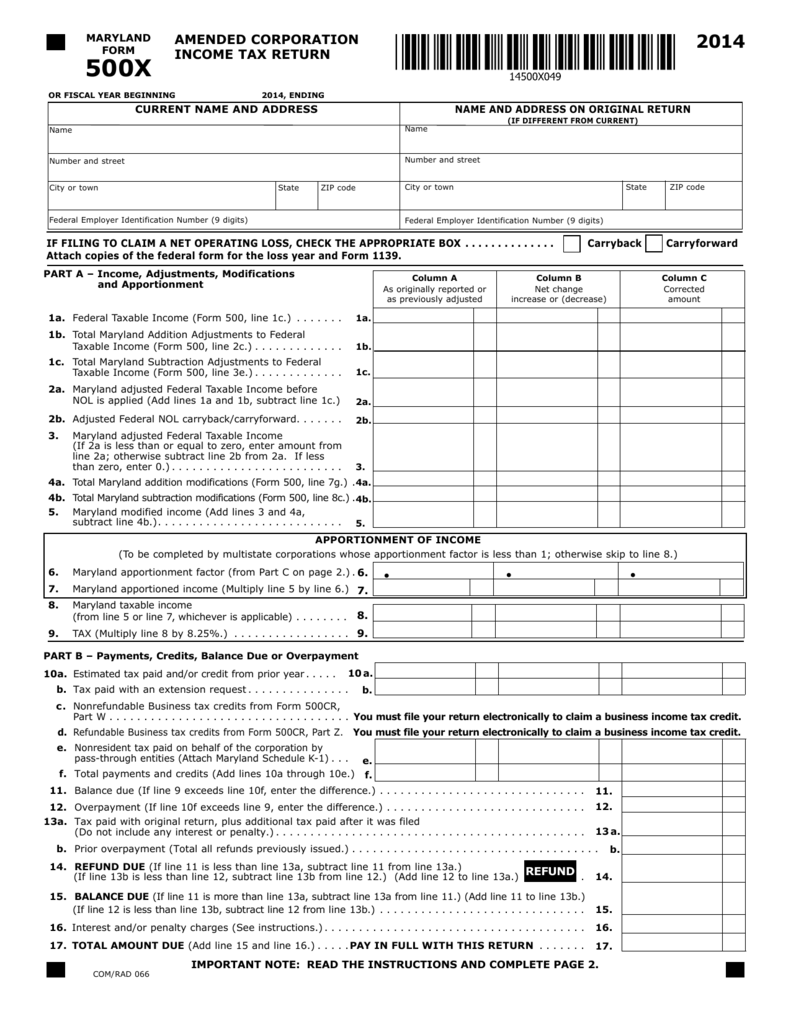

Personal Property Return Maryland 2012 Form Fill Out Sign Online

https://www.pdffiller.com/preview/0/230/230759/large.png

Web 7 f 233 vr 2023 nbsp 0183 32 The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income A new application must be filed every year if the applicant wishes to be considered for a tax credit Web 7 f 233 vr 2023 nbsp 0183 32 The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income View Details Open from Feb 06 2023 at 12 00 am EST to Oct 01 2023 at 11 59 pm EDT 30 90 day approval 0 00 Renters Tax Credit Application Form RTC 2023

Web The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000 Web Pay it Most likely payment of your real property tax is handled through your mortgage lender but you can view local property tax rates on SDAT s Web site You can also view Local Tax Billing amp Collection Offices information Get help if you need it Contact SDAT or visit one of their local assessment offices

Download Maryland Property Tax Rebate

More picture related to Maryland Property Tax Rebate

Maryland First Time Home Buyer Addendum Fill Online Printable

https://www.pdffiller.com/preview/17/90/17090874/large.png

Maryland Tax Forms Printable Printable Forms Free Online

https://s3.studylib.net/store/data/008128723_1-6c787890df48f6cb9ea1b9dbbbe2aa68.png

Residents In These Md Counties Pay The Highest Property Taxes

https://washingtonreianetwork.com/wp-content/uploads/2017/07/countytax.jpg

Web 1 Do any of the following currently apply to you YES NO If YES check all that apply You are on your county s tax sale list Your lien was sold in your county s recent tax sale You are in tax sale foreclosure 2 Do you currently owe your county 7 000 or less YES NO Amount owed 3 Web The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses

Web 24 ao 251 t 2021 nbsp 0183 32 BALTIMORE The Maryland State Department of Assessments and Taxation is notifying thousands of homeowners that they will receive payments due to a property tax credit miscalculation SDAT has identified 5 393 homeowners with total payments amounting to 7 947 531 01 The payments range from 1 61 to 2 076 Web RELIEF Act Stimulus Portal To check your eligibility for a RELIEF Act stimulus payment enter the information below All fields are required If you are eligible for a stimulus payment you will be able to check the status of your payment

Hecht Group The Different Property Tax Rates In Maryland

https://img.hechtgroup.com/1665054887782.png

Maryland Homestead Tax Credit

https://dat.maryland.gov/realproperty/PublishingImages/HomesteadApplicationStatus2023Approved.png

https://dat.maryland.gov/newsroom/Pages/2022-02-07-TaxCreditApps...

Web 7 f 233 vr 2022 nbsp 0183 32 If a resident has already paid their property taxes and applies by October 1 any tax credit that the homeowner may be eligible for will be refunded by their county finance office In FY21 42 272 eligible homeowners received

https://dat.maryland.gov/realproperty/Documents/2021-HT…

Web The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income For more information please visit our website at https dat maryland gov Pages Tax Credit Programs aspx Eligibility

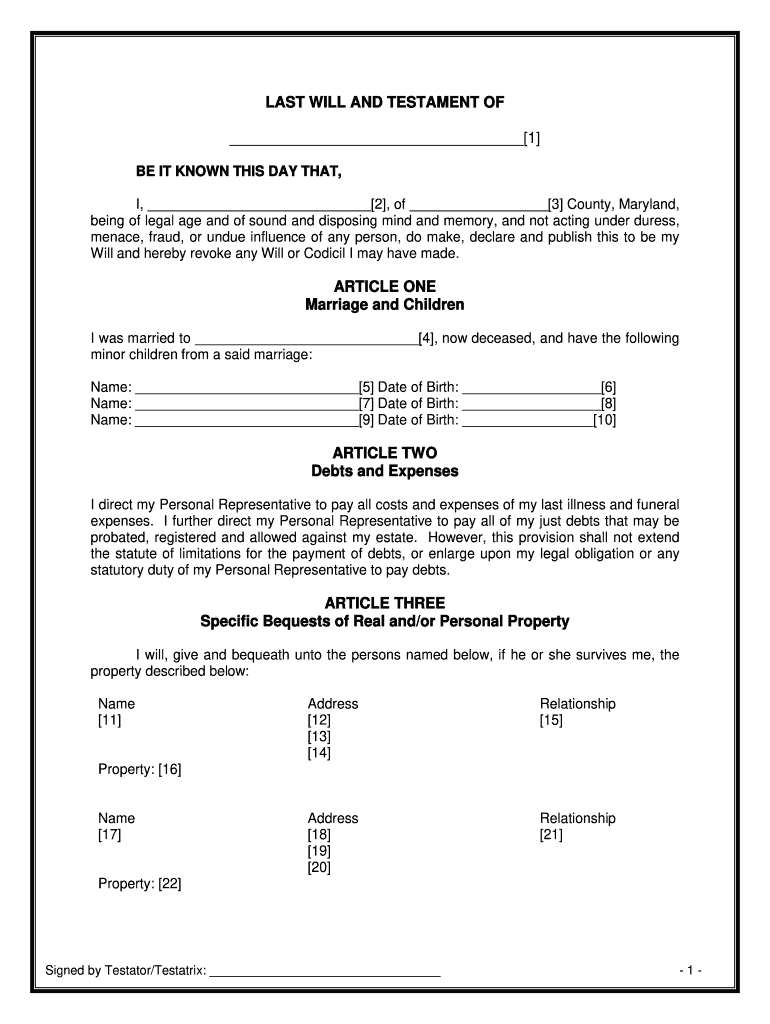

Sample Will Maryland Fill Out Sign Online DocHub

Hecht Group The Different Property Tax Rates In Maryland

Blog Posts Goodsiteuu

Maryland Personal Property Return 2016 Form Property Walls

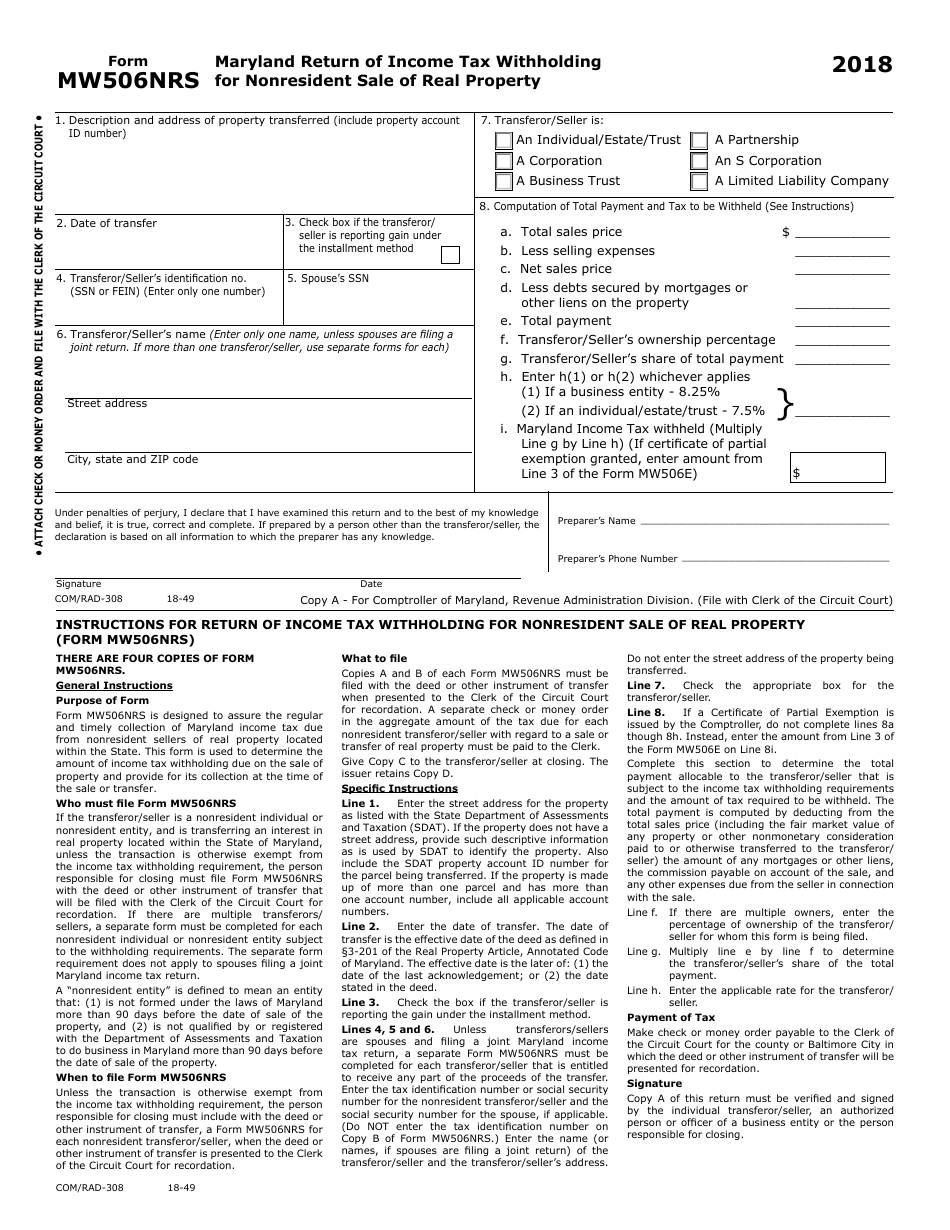

Form MW506NRS Download Fillable PDF Or Fill Online Maryland Return Of

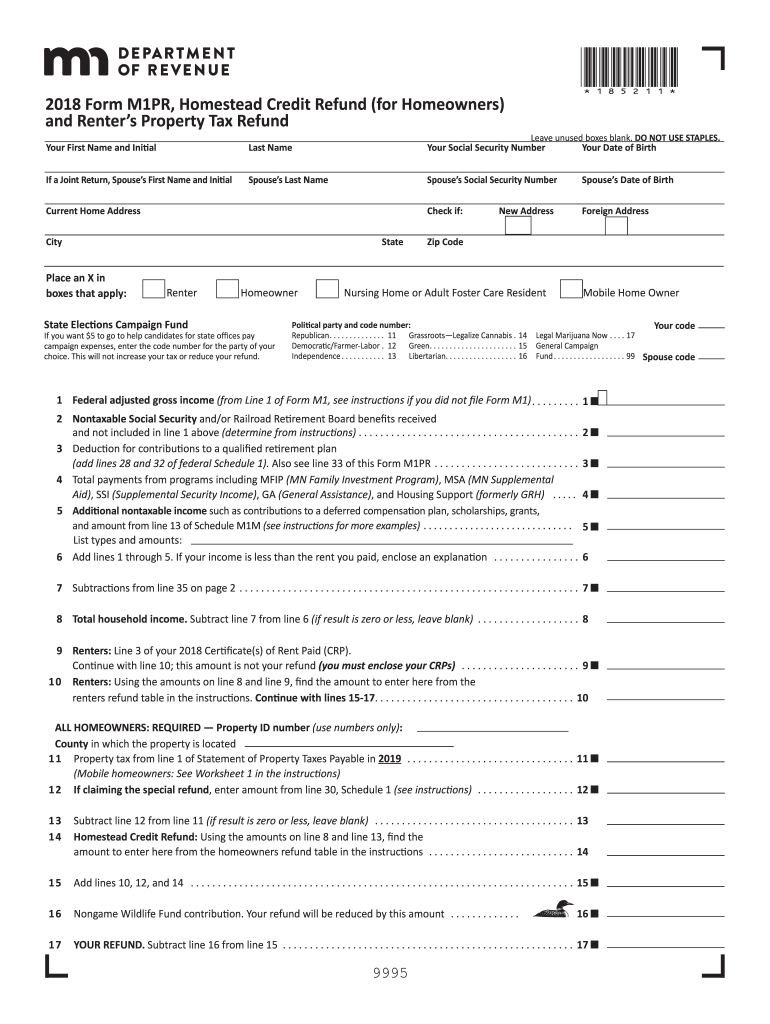

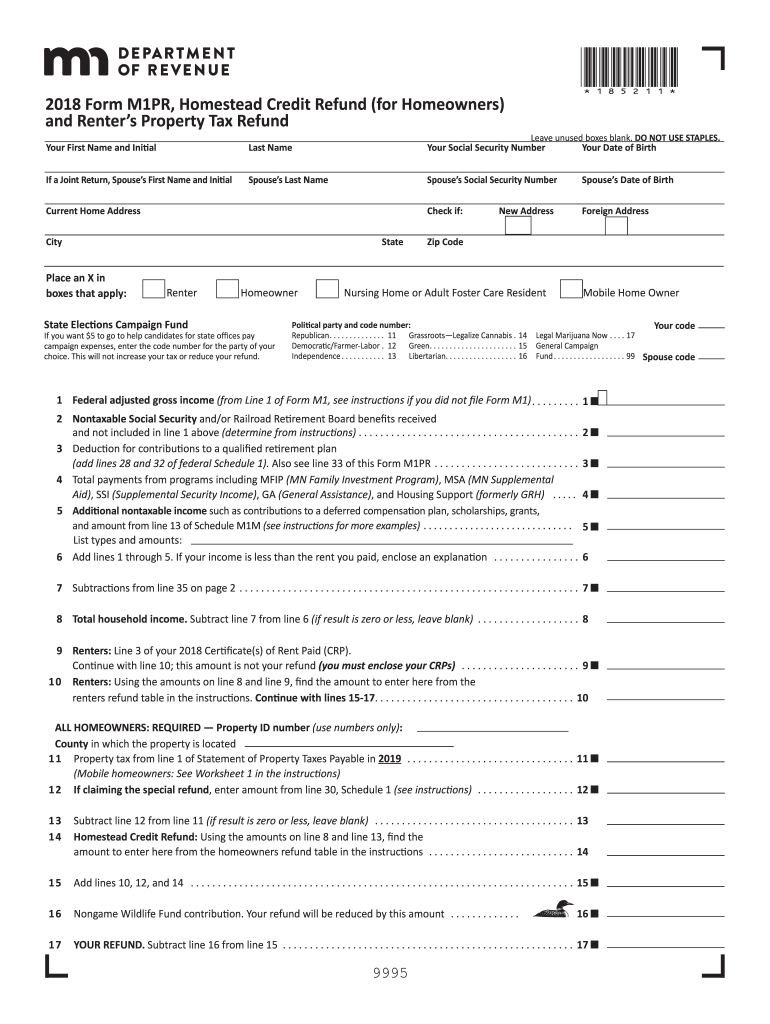

M1pr Form Fill Out Sign Online DocHub

M1pr Form Fill Out Sign Online DocHub

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

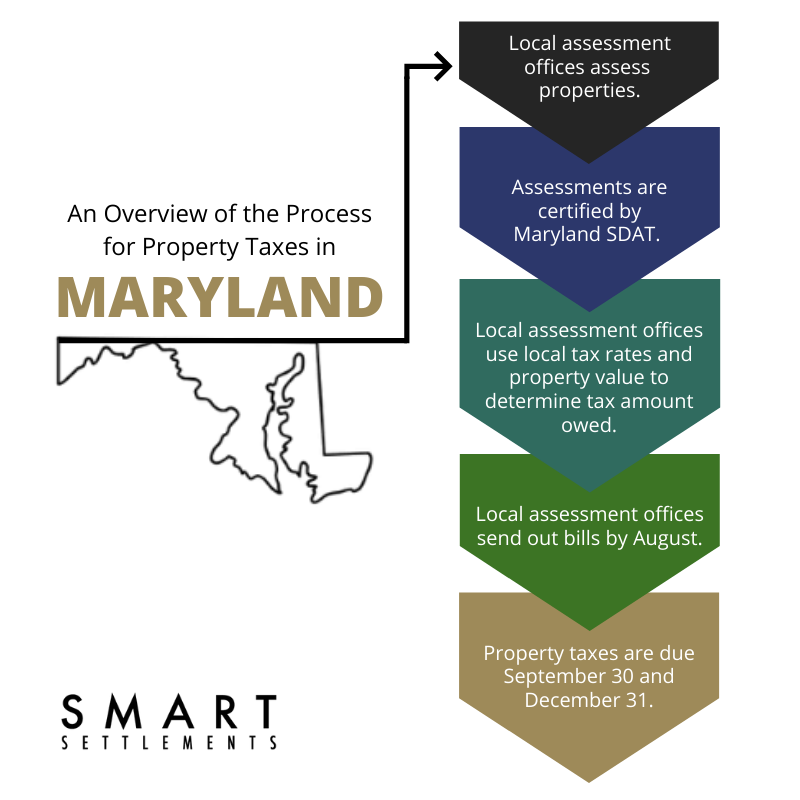

Smart FAQs About Maryland Property Taxes Smart Settlements

2018 2022 Form MD SDAT HTC 60 Fill Online Printable Fillable Blank

Maryland Property Tax Rebate - Web Pay it Most likely payment of your real property tax is handled through your mortgage lender but you can view local property tax rates on SDAT s Web site You can also view Local Tax Billing amp Collection Offices information Get help if you need it Contact SDAT or visit one of their local assessment offices