Max 179 Deduction 2023 Vehicle For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 890 000

Under the Section 179 tax deduction Heavy SUVs pickups and vans over 6000 lbs and mainly used for business can get a partial deduction and bonus depreciation Typical work vehicles without personal use qualify Cargo vans and box trucks with no passenger seating can qualify For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 890 000 Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in

Max 179 Deduction 2023 Vehicle

Max 179 Deduction 2023 Vehicle

https://www.motorbiscuit.com/wp-content/uploads/2022/10/2023-TOYOTA-Sequoia-Limited-hybrid-suv-1.jpg

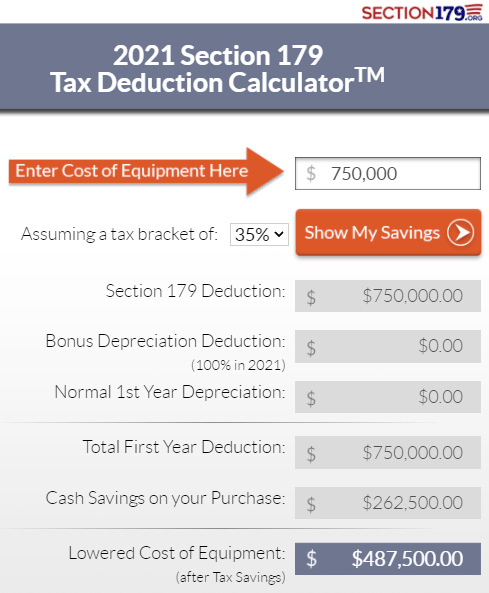

2022 Section 179 deduction example QTE Manufacturing Solutions

https://qtemfg.com/wp-content/uploads/2020/10/2022-Section-179-deduction-example.jpg

Section 179 Vehicle Calculator ZubairKellsey

https://info.blockimaging.com/hs-fs/hubfs/section-179-example-2021.png?width=489&name=section-179-example-2021.png

The maximum deduction under Section 179 is 1 160 000 for the 2023 tax year taxes that were due in 2024 If you placed more than 2 890 000 worth of property in service that would be eligible However the maximum deduction for 2023 is capped at 28 900 It is important to note that the vehicle must be used for business purposes at least 50 of the time

For 2023 a vehicle qualifying in the heavy category has a Section 179 tax deduction limit of 28 900 However these autos are eligible for 80 bonus depreciation in 2023 and 60 in 2024 2 Bonus Depreciation Vehicles with a gross vehicle weight rating GVWR of 6 000 pounds or less have a maximum Section 179 deduction of 12 200 in 2023 Vehicles weighing more than 6 000 but less than 14 000 pounds have a higher

Download Max 179 Deduction 2023 Vehicle

More picture related to Max 179 Deduction 2023 Vehicle

Section 179 Deductions For 2022 Load King

https://www.loadkingmfg.com/wp-content/uploads/2022/10/Section-179-blog-2048x1152.jpg

Deduction Vehicle List 2023 What Vehicles Qualify For Section 179 Marca

https://phantom-marca.unidadeditorial.es/c02143ff60411723892fa162ba342f18/resize/1320/f/jpg/assets/multimedia/imagenes/2023/04/23/16822631716282.jpg

Section 179 Deduction 2023 TopMark Funding

https://www.topmarkfunding.com/wp-content/uploads/2023/08/section_179_Deduction_2023-1024x589-1024x585.jpg

The IRS has announced the 2023 inflation adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger automobiles including vans and trucks in a trade or business For purchased automobiles the limits cap the taxpayer s depreciation deduction Depreciation limits on business vehicles The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2023 is 20 200 if the special depreciation allowance applies or 12 200 if the special depreciation allowance does not apply

[desc-10] [desc-11]

2022 Section 179 Deduction On Vehicles Rush Enterprises

https://search.rushtruckcenters.com/wp-content/uploads/2022/09/DMS-11990-Header.jpg

Section 179 Bonus Depreciation Saving W Business Tax Deductions 2023

https://www.commercialcreditgroup.com/hs-fs/hubfs/2023 Section 179 Flyer Infographic.png?width=413&height=534&name=2023 Section 179 Flyer Infographic.png

https://www.irs.gov/instructions/i4562

For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 890 000

https://www.taxfyle.com/blog/list-of-vehicles-over-6000-lbs

Under the Section 179 tax deduction Heavy SUVs pickups and vans over 6000 lbs and mainly used for business can get a partial deduction and bonus depreciation Typical work vehicles without personal use qualify Cargo vans and box trucks with no passenger seating can qualify

Section 179 Vehicle Deduction

2022 Section 179 Deduction On Vehicles Rush Enterprises

Section 179 Deduction For Property Equipment Vehicles

Section 179 Deduction Property You Can Deduct

Section 179 Deduction 2020 Guide TopMark Funding

Section 179 Deduction Limit Increased For 2023

Section 179 Deduction Limit Increased For 2023

Does My Vehicle Qualify For Section 179 Deduction FlyFin

Section 179 Deduction Vehicle List 2024 Excel Nedi Vivienne

Section 179 Tax Deduction For 2023 Hourly Inc

Max 179 Deduction 2023 Vehicle - [desc-12]