Max Federal Tax Deduction 2023 Canada The federal income tax thresholds have been indexed for 2023 The federal Canada Employment Amount CEA has been indexed to 1 368 for 2023 The Ontario income thresholds personal

The Tax tables below include the tax rates thresholds and allowances included in the Canada Tax Calculator 2023 Canada provides an annual Basic Personal Amount that is deducted For 2023 the marginal rate for 165 430 to 235 675 is 29 32 because of the above noted personal amount reduction through this tax bracket The additional 0 32 is calculated as 15 x 15 000 13 520 235 675 165 430

Max Federal Tax Deduction 2023 Canada

Max Federal Tax Deduction 2023 Canada

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

For 2023 the marginal rate for 165 430 to 235 675 is 29 32 because of the above noted personal amount reduction through this tax bracket The additional 0 32 is calculated as 15 TaxTips ca 2023 Canadian income tax and RRSP savings calculator calculates taxes shows RRSP savings includes most deductions and tax credits

March 1 2023 Deadline to contribute to an RRSP a PRPP or an SPP to deduct against your 2022 income April 30 2023 extended to May 1 2023 since April 30 is a Sunday Deadline to file your return and pay your taxes British Columbia indexes its tax brackets using the same formula as that used federally but uses the provincial inflation rate rather than the federal rate in the calculation The inflation factor for

Download Max Federal Tax Deduction 2023 Canada

More picture related to Max Federal Tax Deduction 2023 Canada

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

Federal and Provincial Territorial Non Refundable Tax Credit Rates and Amounts for 2024 Current as of September 30 2024 How does Canada s personal income tax brackets work How much federal tax do I have to pay based on my income If your taxable income is less than the 53 359

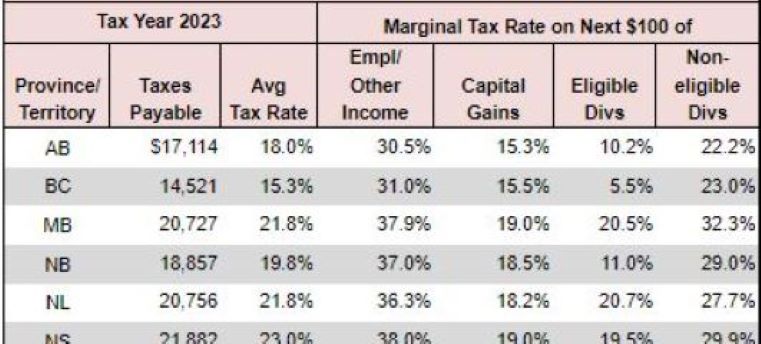

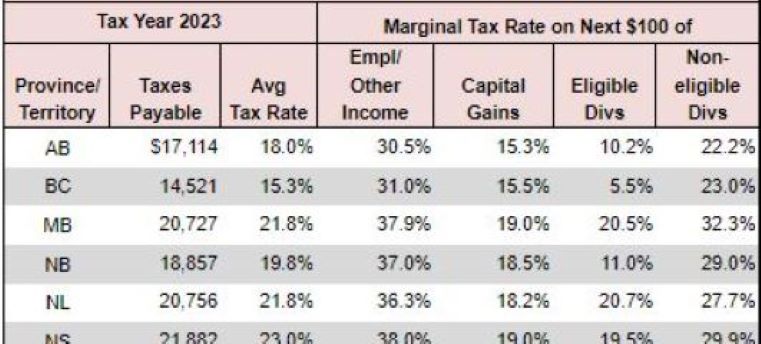

In Canada federal tax rates apply only on the amount you earn within each federal tax bracket This is also how most provincial tax brackets work as well we ll get to those below In 2023 The latest 2023 tax rate card puts the most up to date marginal tax rates and tax brackets by taxable income source non refundable tax credits and much more all in one place This

Capital Gains On Sale Of Vacant Land Canadian Money Forum

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

https://www.canada.ca › ... › cra-arc › tx › bsnss › tpcs › pyrll

The federal income tax thresholds have been indexed for 2023 The federal Canada Employment Amount CEA has been indexed to 1 368 for 2023 The Ontario income thresholds personal

https://ca.icalculator.com › income-tax-rates

The Tax tables below include the tax rates thresholds and allowances included in the Canada Tax Calculator 2023 Canada provides an annual Basic Personal Amount that is deducted

Max Credit Union Routing Number mymax Credit Union Near Me

Capital Gains On Sale Of Vacant Land Canadian Money Forum

2022 Federal Tax Brackets And Standard Deduction Printable Form

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Section 179 Tax Deductions Infographic GreenStar Solutions

2020 Standard Deduction Over 65 Standard Deduction 2021

2020 Standard Deduction Over 65 Standard Deduction 2021

Tax Brackets Chart 2023 IMAGESEE

Tax Deductions You Can Deduct What Napkin Finance

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Max Federal Tax Deduction 2023 Canada - TaxTips ca 2023 Canadian income tax and RRSP savings calculator calculates taxes shows RRSP savings includes most deductions and tax credits