Maximum Child Care Tax Credit 2023 Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves

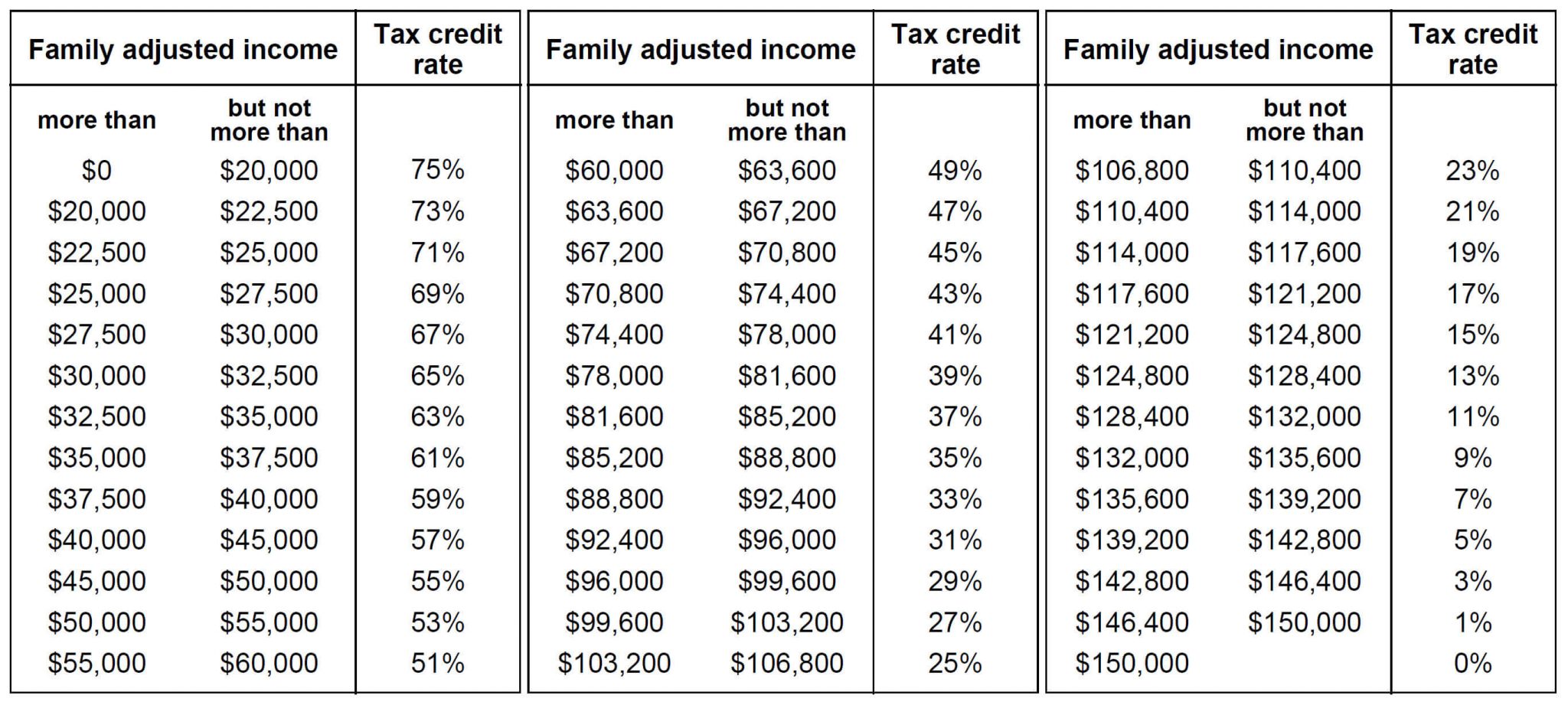

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum child Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Maximum Child Care Tax Credit 2023

Maximum Child Care Tax Credit 2023

https://texasbreaking.com/wp-content/uploads/2023/02/child-tax-credit-in-2023-check-eligibility-how-to-claim.jpg

C mo Solicitar 250 D lares Por Ni o En Connecticut A Partir Del 1 De

https://solodinero.com/wp-content/uploads/sites/8/2022/05/Credito-Tributario-por-Hijos-1.jpg?quality=80&strip=all&w=1200

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married filing jointly or 200 000 or below all You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to report the claim on your tax return LAST UPDATED January 10 2024

Download Maximum Child Care Tax Credit 2023

More picture related to Maximum Child Care Tax Credit 2023

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

How much is the child tax credit for 2023 Let s get down to dollar amounts The maximum amount for each qualifying child is 2 000 with the refundable portion totaling 1 600 per qualifying Understanding the types of Child Care Tax Credits their eligibility criteria and how to claim them can help you make the most of this financial benefit Always consult a tax professional for personalized advice

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

https://www.irs.gov/publications/p503

Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum child

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Child Care Tax Credit Dates Librus

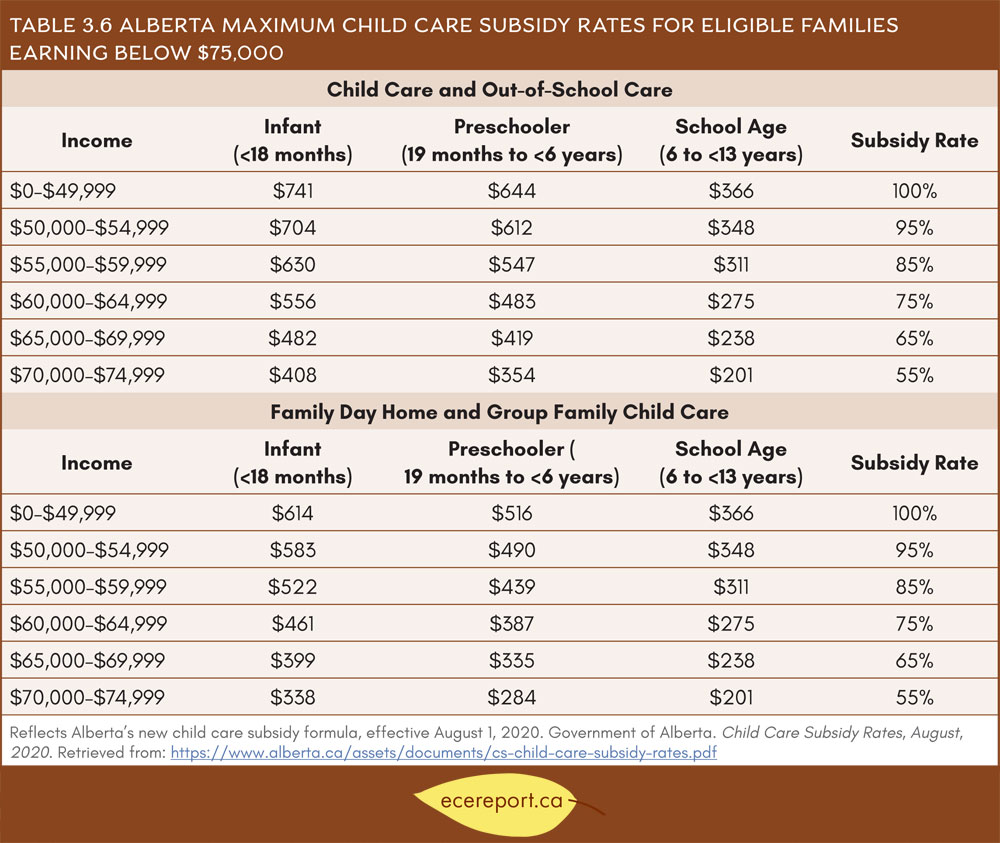

Table 3 6 Alberta Maximum Child Care Subsidy Rates For Eligible

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

2022 Child Tax Credit Refundable Amount Latest News Update

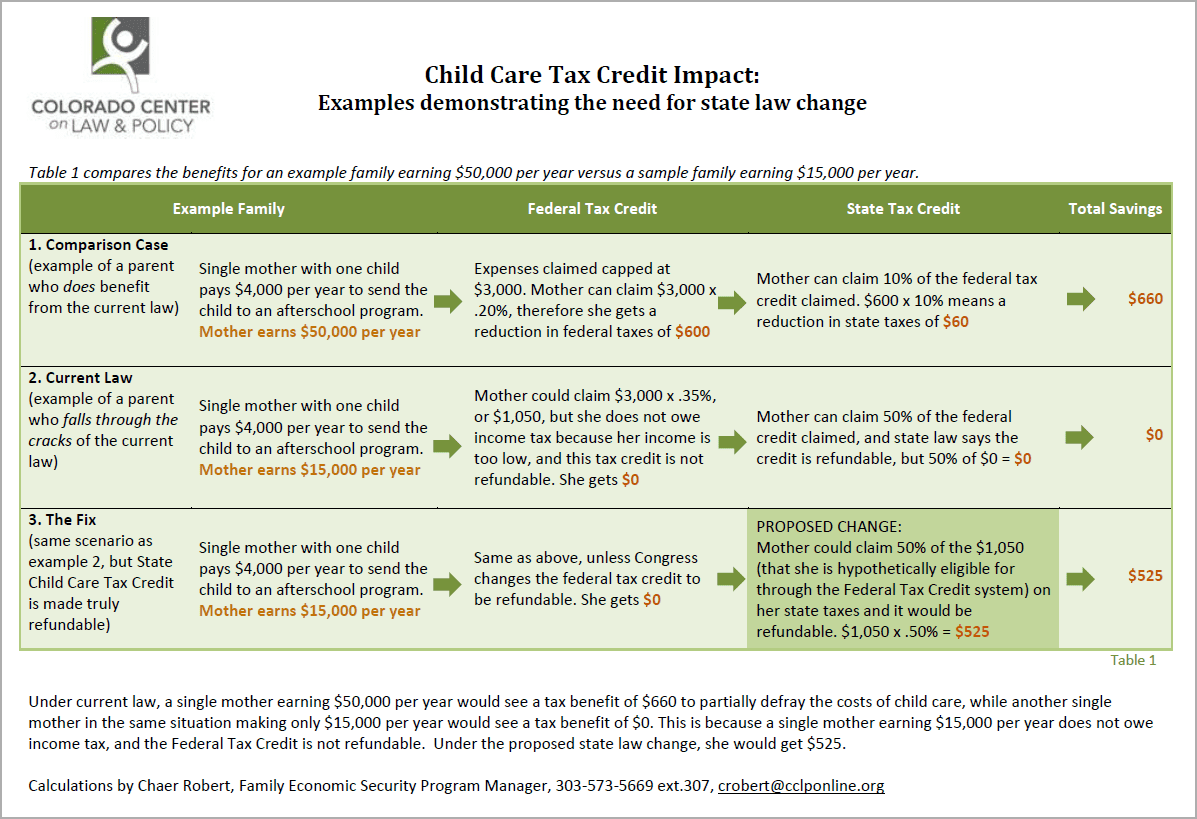

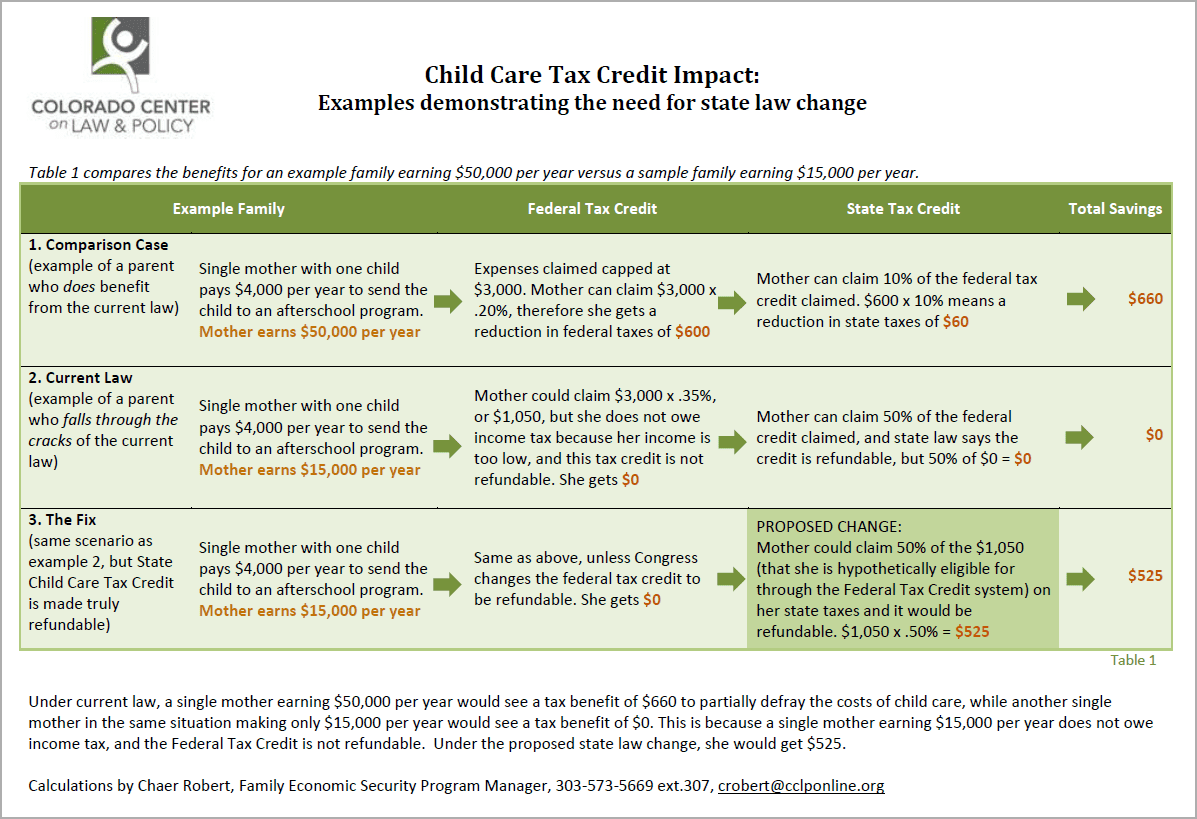

Fixing The Child Care Tax Credit EOPRTF CCLP

Fixing The Child Care Tax Credit EOPRTF CCLP

What Is The Phase Out For Dependent Care Credit Latest News Update

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Tax Credit Or FSA For Child Care Expenses Which Is Better

Maximum Child Care Tax Credit 2023 - Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a