Maximum Deduction For Housing Loan Interest The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the

Be sure to keep records of the square footage involved as well as what income and expenses are attributable to certain parts of the house Therefore the mortgage isn t a secured debt and Palmer can t deduct any of the interest paid on it as home mortgage interest

Maximum Deduction For Housing Loan Interest

Maximum Deduction For Housing Loan Interest

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

https://www.taxontips.com/wp-content/uploads/2020/04/interest-on-housing-loan.jpg

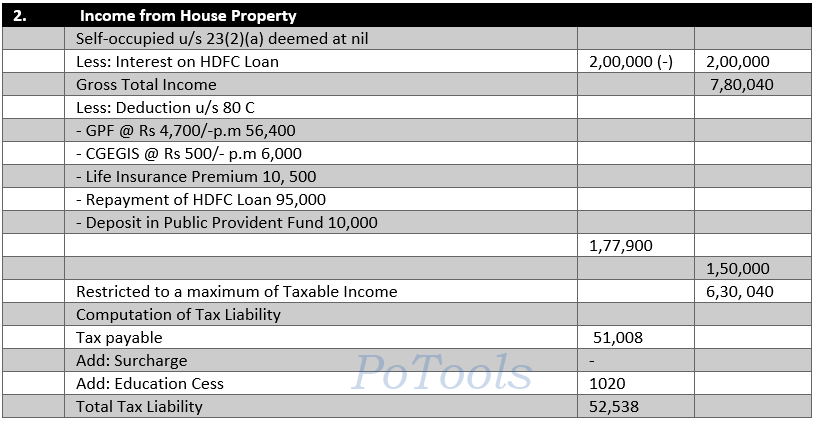

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up Should you claim the mortgage interest deduction when you file your federal tax return

With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a 6 020 in favor of standard deduction

Download Maximum Deduction For Housing Loan Interest

More picture related to Maximum Deduction For Housing Loan Interest

Deduction Of Interest On Housing Loan In Case Of Co ownership

https://i0.wp.com/financefriend.in/wp-content/uploads/2012/06/Deduction-of-Interest-on-Housing-Loan-in-case-of-co-ownership.png?fit=884%2C309

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

https://freefincal.com/wp-content/uploads/2023/02/Home-Loan-interest-double-tax-deduction-benefit-removed-in-budget-2023.jpg

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/House-Property/Images/Deductions-U-S-24.jpg

The maximum out of pocket expense amount rises to 5 700 increasing from 5 550 in tax year 2024 For family coverage in tax year 2025 the annual deductible is not The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate

Under the default tax regime the individual taxpayers are not entitled to claim deduction in respect of interest on housing loan on self occupied house properties However Generally you claim the mortgage interest tax deduction in the year the interest was accrued For some costs such as mortgage points you can stretch out the deduction

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Interest On Housing Loan Deduction Under Income Tax Section 24 Taxwink

https://www.taxwink.com/uploads/1649326850.jpg

https://cleartax.in/s/home-loan-tax-benefit

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the

https://www.nerdwallet.com/article/taxes/mortgage...

Be sure to keep records of the square footage involved as well as what income and expenses are attributable to certain parts of the house

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Income Tax Benefits On Home Loan Loanfasttrack

Home Loan Interest Deduction Procedure To Claim HomeCapital

Section 24 Of Income Tax Act House Property Deduction

Assessment Of Firm Section 184 28 37 40b Graphical Table Presentation

What Is The Maximum Deduction For Married Filing Jointly WOPROFERTY

What Is The Maximum Deduction For Married Filing Jointly WOPROFERTY

How To Get The Student Loan Interest Deduction NerdWallet

Income Tax Calculation For Interest On Housing Loan And Deduction U s

Eligibility Of Interest On Housing Loan For Double Deduction

Maximum Deduction For Housing Loan Interest - 6 020 in favor of standard deduction