Maximum Deduction Under Section 80ddb Section 80DDB Understand the deduction limit under the Income Tax Act diseases covered how to claim deductions and the required medical certificate for tax benefits

Deduction Under Section 80DDB Section 80DDB of the Income Tax Act offers taxpayers in India a valuable deduction for medical expenses attached to specific serious Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from

Maximum Deduction Under Section 80ddb

Maximum Deduction Under Section 80ddb

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80u.jpg

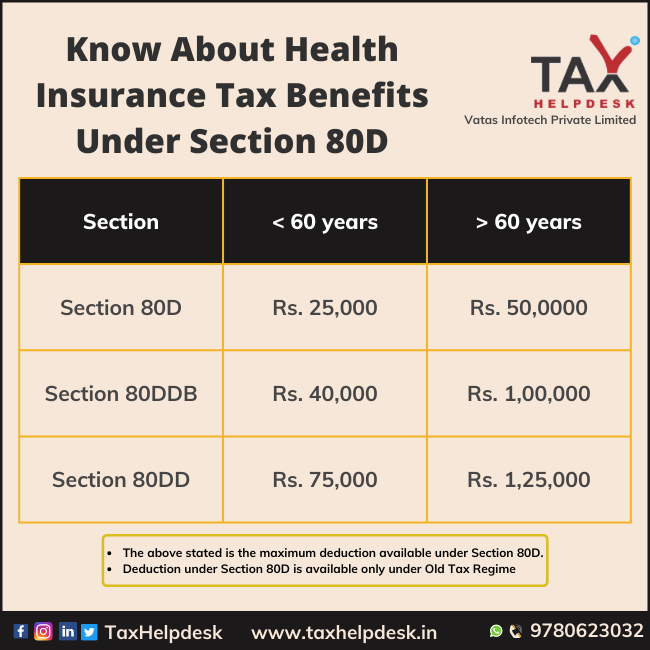

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

All About Section 80DDB Deduction For Treatment Of Specified Disease

https://i.ytimg.com/vi/y48l1MrGE2M/maxresdefault.jpg

Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable For the assessment year of 2022 23 the amount allowed under Section 80DDB income tax deductions is discussed below Rs 40000 or the amount paid which of the two is less

Deduction under section 80DDB of the Income Tax Act is available towards the amount actually paid for the medical treatment of the specified disease The current article The maximum deduction available under Section 80DDB is Rs 40 000 or the actual amount incurred whichever is less This is for individuals below 60 years of age For senior citizens aged 60 years and above the limit

Download Maximum Deduction Under Section 80ddb

More picture related to Maximum Deduction Under Section 80ddb

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

https://life.futuregenerali.in/media/2xjl3phd/section-80dd-tax-deduction.jpg

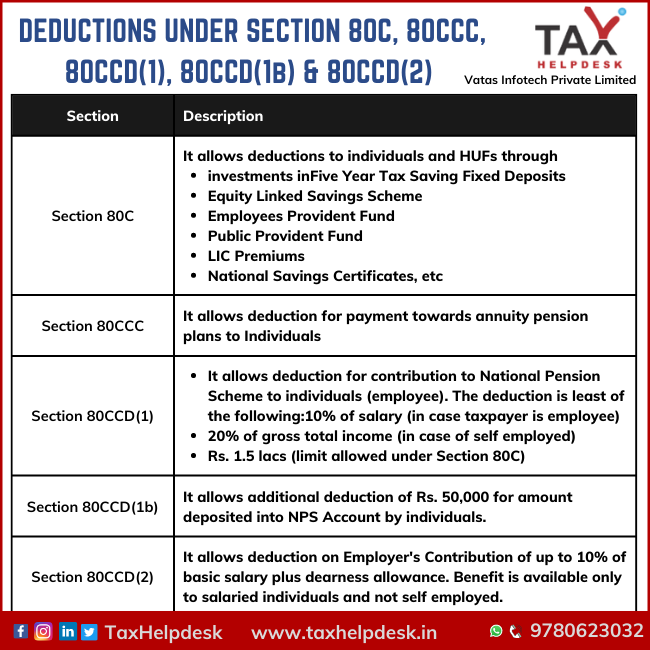

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80DDB-Deductions-1024x762.jpg

Section 80DDB of the Income Tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this Deduction limit for section 80DDB How is the Deduction Calculated Under Section 80DDB Required documents ITR Form Applicable for Section 80DDB FAQs

What is the deduction amount allowed under Section 80DDB The amount of deduction that you can claim under the provisions of Section 80DDB depends on your age If you are aged below What is the Maximum Amount of Deduction allowed under Section 80DD Fixed amount of deductions are allowed under Section 80DD irrespective of the actual

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

https://tax2win.in/guide/section-80ddb

Section 80DDB Understand the deduction limit under the Income Tax Act diseases covered how to claim deductions and the required medical certificate for tax benefits

https://www.smcinsurance.com/income-tax/articles/section-80ddb

Deduction Under Section 80DDB Section 80DDB of the Income Tax Act offers taxpayers in India a valuable deduction for medical expenses attached to specific serious

Section 80D Deduction In Respect Of Health Or Medical Insurance

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Tax Savings Deductions Under Chapter VI A Learn By Quicko

A Quick Look At Deductions Under Section 80C To Section 80U

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deductions Under Section 80DD

Deductions Under Section 80DD

An Overview Of Section 80DDB Of The Income Tax Act IndiaFilings

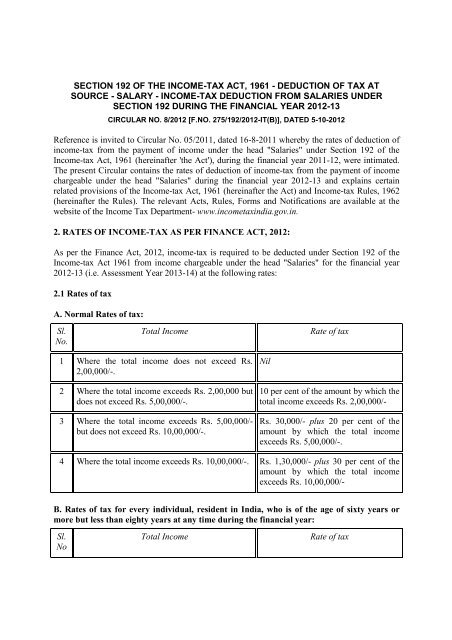

Income tax Deduction From Salaries Under Section

Section 24 Of Income Tax Act House Property Deduction

Maximum Deduction Under Section 80ddb - The tax benefits one forgoes by opting for the new tax regime include deductions under section 80C for a maximum of Rs 1 5 lakh claimed by investing in specified financial