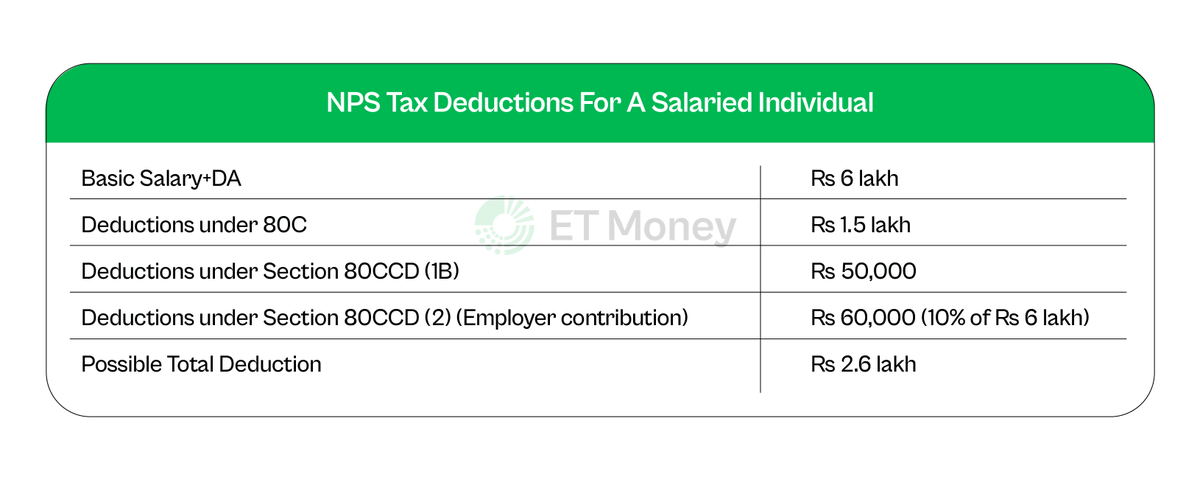

Maximum Exemption Under 80ccd 1b Is Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions

Overall Limit Combined with Sections 80C and 80CCC the maximum deduction under Section 80CCE is 1 5 lakh per financial year 2 Section 80CCD 1B Introduced to provide additional As per Sec 80CCE aggregate deduction u s 80C 80CCC and 80CCD 1 is restricted to maximum of Rs 1 50 000 Therefore in current regime Rs 90 000 is allowed u s

Maximum Exemption Under 80ccd 1b Is

Maximum Exemption Under 80ccd 1b Is

https://www.taxledgeradvisor.com/wp-content/uploads/2023/01/nps-tax-exemption.jpg

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/11/Section-80GGC.jpg

Real Returns Of NPS 50000 Investment Under 80CCD 1B For Extra Tax

https://i.ytimg.com/vi/9Zlgve4NhTU/maxresdefault.jpg

Section 80CCD 1B was introduced in the 2015 Budget to supplement the deductions available under Section 80CCD 1 It allows taxpayers to claim an additional deduction of up to 50 000 Section 80CCD 1 is a deduction for employees as well as self employed for making contributions to the National Pension scheme An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary plus

Section 80 CCD 1B The 80CCD1B limit is Rs 50 000 This is an additional benefit The total tax benefit that you can claim from your contributions to pension fund schemes is Rs 2 lakh Rs Under Section 80CCD 1B salaried and self employed individuals and NRIs can claim tax deductions for the investments made into the government pension schemes The tax benefit is

Download Maximum Exemption Under 80ccd 1b Is

More picture related to Maximum Exemption Under 80ccd 1b Is

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

https://i.ytimg.com/vi/PbIdrmlETqQ/maxresdefault.jpg

Section 80CCD 2 Employer s Contribution To NPS NPS In New Tax

https://i.ytimg.com/vi/EpqXDIqNGX0/maxresdefault.jpg

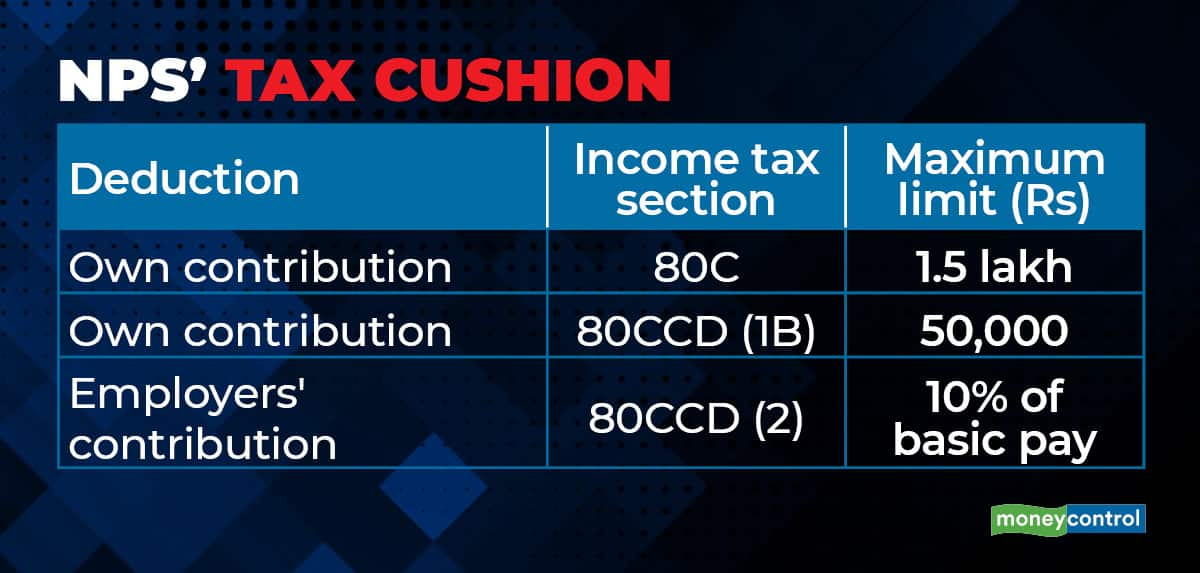

What Are The Tax Benefits That NPS Offers

http://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Section 80CCD 1B Additional exemption up to Rs 50 000 in NPS is eligible for income tax deduction Taxpayers in the highest tax bracket of 30 per cent can save Rs 15 000 by investing Rs 50 000 in the NPS Under Section 80CCD 1 the exemption limit is INR 1 5 lakhs One can claim an additional exemption of INR 50 000 under Section 80CCD1B An individual who is employed after 1st January 2004 by the Central

Total maximum deduction under Section 80CCD 1 and 80CCD 1B is Rs 2 lakh If the taxpayer suddenly passes away the nominee can close the NPS account and get the An individual who has made investments under specific instruments under 80C up to the maximum limit of 1 50 Lakhs can make an investment under NPS to claim an additional

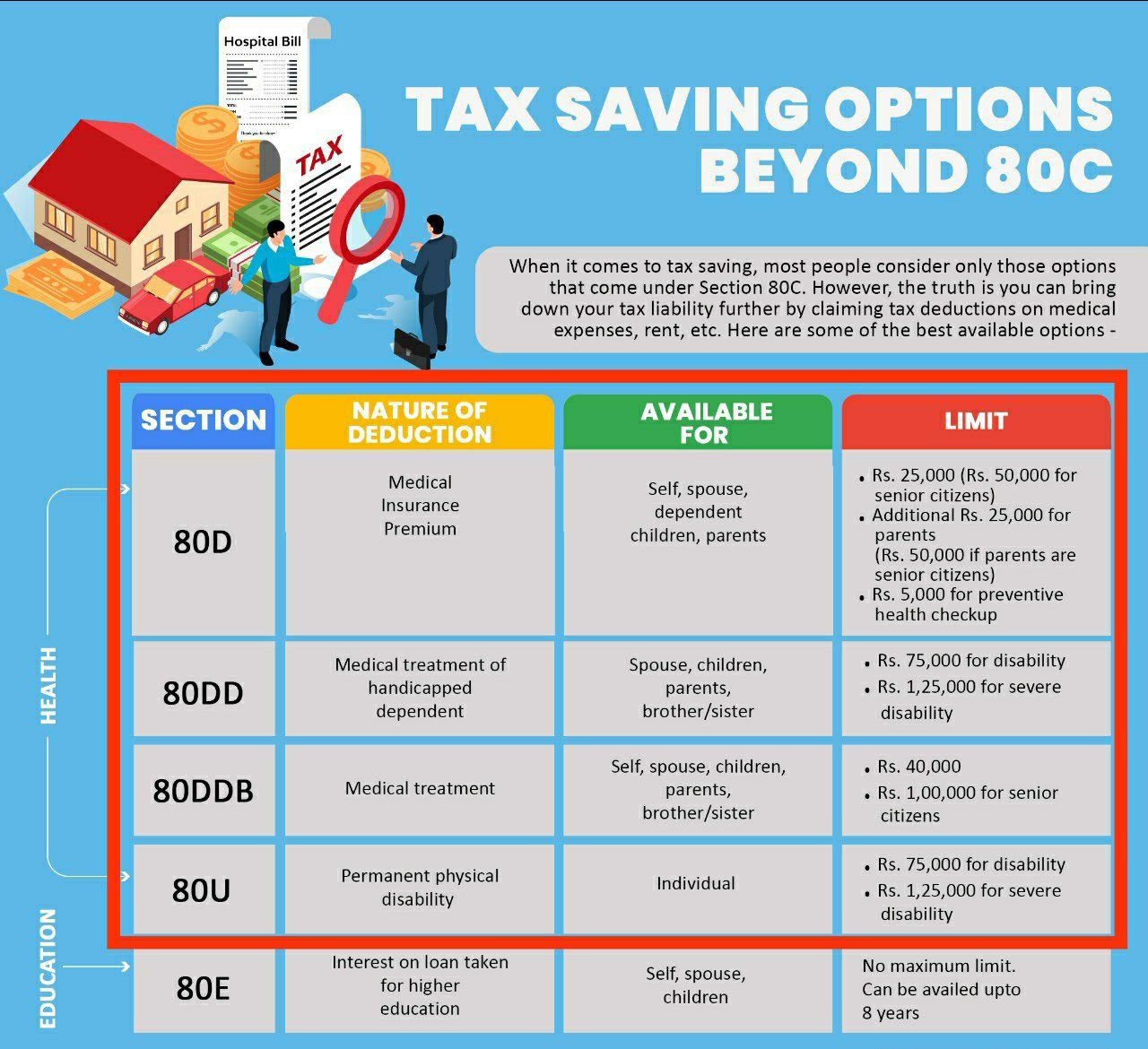

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

https://cleartax.in

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions

https://ardhorajiya.com

Overall Limit Combined with Sections 80C and 80CCC the maximum deduction under Section 80CCE is 1 5 lakh per financial year 2 Section 80CCD 1B Introduced to provide additional

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

80CCD 1B Tax Exemption Explained Society Biz

New Auto Index Launched In HK Stock Market With Constituents Including

New Auto Index Launched In HK Stock Market With Constituents Including

Tax Planning Should Be An Integral Part Of Your Overall Financial

NPS Building Tomorrow s Stability Today Pension For A Secure

What Is Dcps In Salary Deduction Login Pages Info

Maximum Exemption Under 80ccd 1b Is - The additional deduction of Rs 50 000 under Section 80CCD 1B is available to assess over and above the benefit of Rs 1 50 Lakhs available as a deduction under Sec