Maximum Solar Tax Credit Per Year Web 28 Aug 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

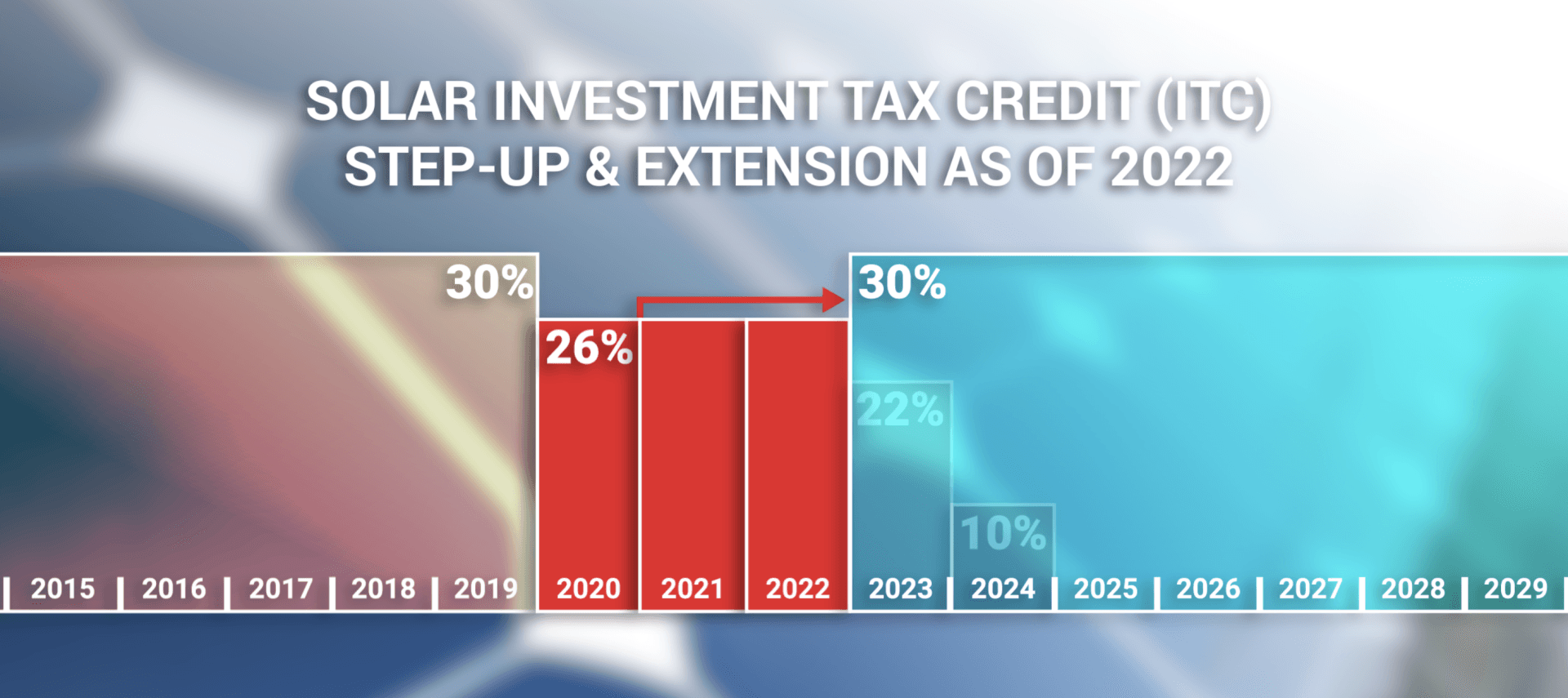

Web 29 Dez 2023 nbsp 0183 32 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Web 13 Dez 2023 nbsp 0183 32 The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Maximum Solar Tax Credit Per Year

Maximum Solar Tax Credit Per Year

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

How The Federal Solar Tax Credit Works In 2021 2022 Get Custom Solar

https://getcustomsolar.com/wp-content/uploads/2022/04/Federal-Tax-Credit-21-22-web-FULL-1536x1028.jpg

Web As of 2012 the feed in tariff FiT costs about 14 billion US 18 billion per year for wind and solar installations The cost is spread across all rate payers in a surcharge of 3 6 ct 4 6 162 per kWh approximately 15 of the total domestic cost of electricity Web The 30 tax credit applies to the total cost of a residential solar energy system including labor and equipment The tax credit also applies to solar panel batteries As of January 1 2023 that includes standalone backup batteries

Web 8 Sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed a system in 2022 your tax credit has increased from 22 to 30 if you haven t already claimed it Web 19 Okt 2023 nbsp 0183 32 If the system cost 10 000 the 30 credit would be 3 000 and you could claim 25 of that or 750 10 000 system cost x 0 30 30 credit 3 000 full credit amount 3 000 credit amount x 0 25 25 of the year 750 partial credit amount

Download Maximum Solar Tax Credit Per Year

More picture related to Maximum Solar Tax Credit Per Year

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

What Solar Tax Form Is Used To Claim Credits

https://www.skippingstonesdesign.com/wp-content/uploads/2022/03/load-image-2022-03-29T235018.174-1536x1024.jpg

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

Web In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit expires starting in 2024 unless Congress renews it There is no maximum amount that can be claimed Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Web In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 Web 21 Dez 2022 nbsp 0183 32 Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost Fuel Cells Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water heaters Biomass stoves Geothermal

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 Aug 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 29 Dez 2023 nbsp 0183 32 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Everything You Need To Know About The Solar Tax Credit

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

Solar For Your Home Solar Synergy

The Federal Solar Tax Credit Increased Extended Solaria

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

Understanding The Solar Tax Credit Or Investment Tax Credit Get Solar

How Does The Solar Tax Credit Work Advanced Solar

Maximum Solar Tax Credit Per Year - Web As of 2012 the feed in tariff FiT costs about 14 billion US 18 billion per year for wind and solar installations The cost is spread across all rate payers in a surcharge of 3 6 ct 4 6 162 per kWh approximately 15 of the total domestic cost of electricity