Invite to Our blog, a space where interest satisfies information, and where everyday topics come to be interesting conversations. Whether you're seeking understandings on way of life, modern technology, or a bit of everything in between, you've landed in the ideal place. Join us on this expedition as we dive into the worlds of the ordinary and phenomenal, understanding the world one blog post each time. Your journey into the fascinating and diverse landscape of our Maximum Tax Benefit Under 80c begins below. Explore the captivating material that waits for in our Maximum Tax Benefit Under 80c, where we unravel the ins and outs of numerous subjects.

Maximum Tax Benefit Under 80c

Maximum Tax Benefit Under 80c

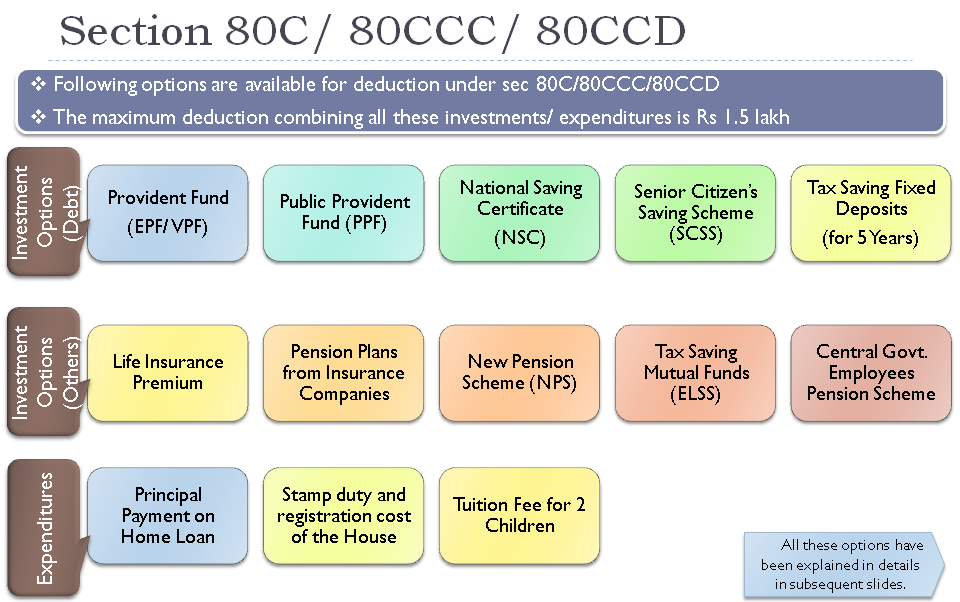

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Gallery Image for Maximum Tax Benefit Under 80c

Tax Benefits Under Section 80C For FY 2015 16 Goodreturns YouTube

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Will All Kinds Of Tuition Fees Qualify For Tax Benefit Under Section

Changes In New Tax Regime All You Need To Know

Budget 2014 Impact On Money Taxes And Savings

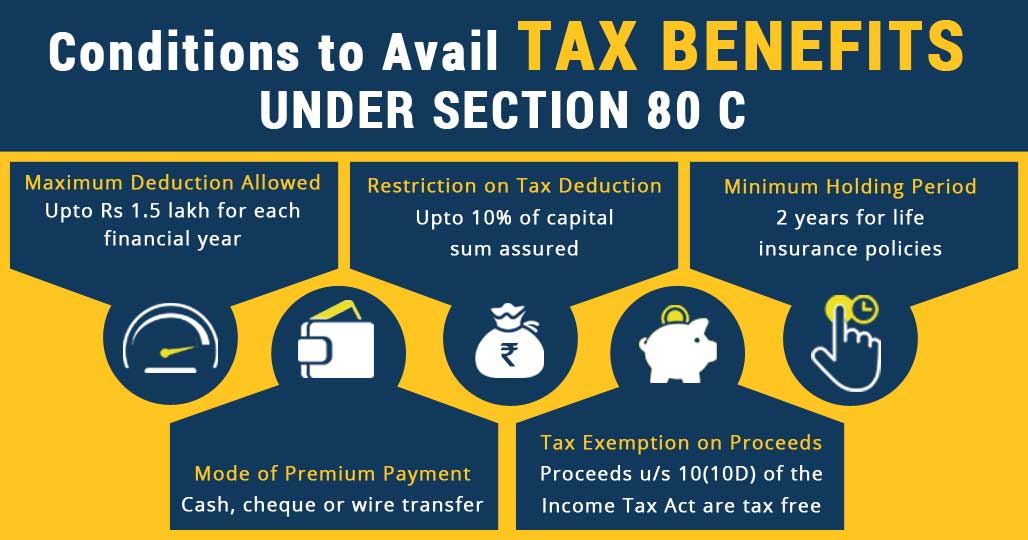

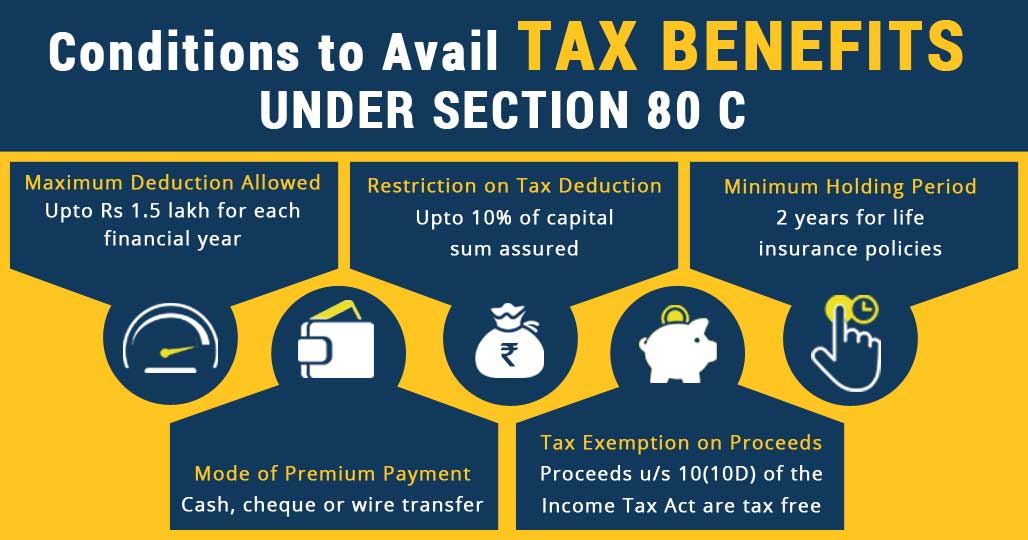

Life Insurance Policy And Tax Benefits ComparePolicy

Life Insurance Policy And Tax Benefits ComparePolicy

25 Income Tax Deductions MCQs 80C To 80 U Income Tax MCQs 2022 23

Thanks for selecting to discover our site. We all the best hope your experience exceeds your expectations, and that you discover all the details and resources about Maximum Tax Benefit Under 80c that you are seeking. Our dedication is to give an user-friendly and informative platform, so feel free to navigate through our pages effortlessly.