Maximum Tuition Fee Rebate In Income Tax Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees

Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India Web 27 janv 2023 nbsp 0183 32 It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40

Maximum Tuition Fee Rebate In Income Tax

Maximum Tuition Fee Rebate In Income Tax

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/02/02/785703-incometax-istock-020219.jpg

Maximum Tuition Schechter Manhattan

https://www.schechtermanhattan.org/wp-content/uploads/2021/12/IMG_0233-2-2-admissions.jpg

Fact Check BJP Leaders Claim That AAP Govt Is Reimbursing Fees Of

https://cdn.thewire.in/wp-content/uploads/2022/05/25130410/2022-05-21-14_26_55-3727_33_dt_12052022.pdf-—-Mozilla-Firefox.jpg

Web 1 d 233 c 2022 nbsp 0183 32 The deduction is 0 2 000 or 4 000 depending on your Modified Adjusted Gross Income MAGI 4 000 deduction for MAGI of 65 000 or less 130 000 or less Web 13 mai 2022 nbsp 0183 32 The maximum amount you could claim for the tuition and fees adjustment to income was 4 000 per year The deduction was further limited by income ranges

Web 22 juil 2021 nbsp 0183 32 Worth a maximum benefit of up to 2 500 per eligible student Only for the first four years at an eligible college or vocational school For students pursuing a degree Web 10 sept 2018 nbsp 0183 32 Rs 80 000 under Section 80C of the ITA sums paid towards PPF LIP Balance Rs 70 000 for tuition fees 150 000 80 000 or vice versa In other words the

Download Maximum Tuition Fee Rebate In Income Tax

More picture related to Maximum Tuition Fee Rebate In Income Tax

Income Tax Deductions For Consultants In India

https://www.relakhs.com/wp-content/uploads/2020/06/Income-Tax-Deductions-List-FY-2020-21-Latest-Tax-exemptions-for-AY-2021-2022-tax-saving-options-chart-tax-rebate.jpg

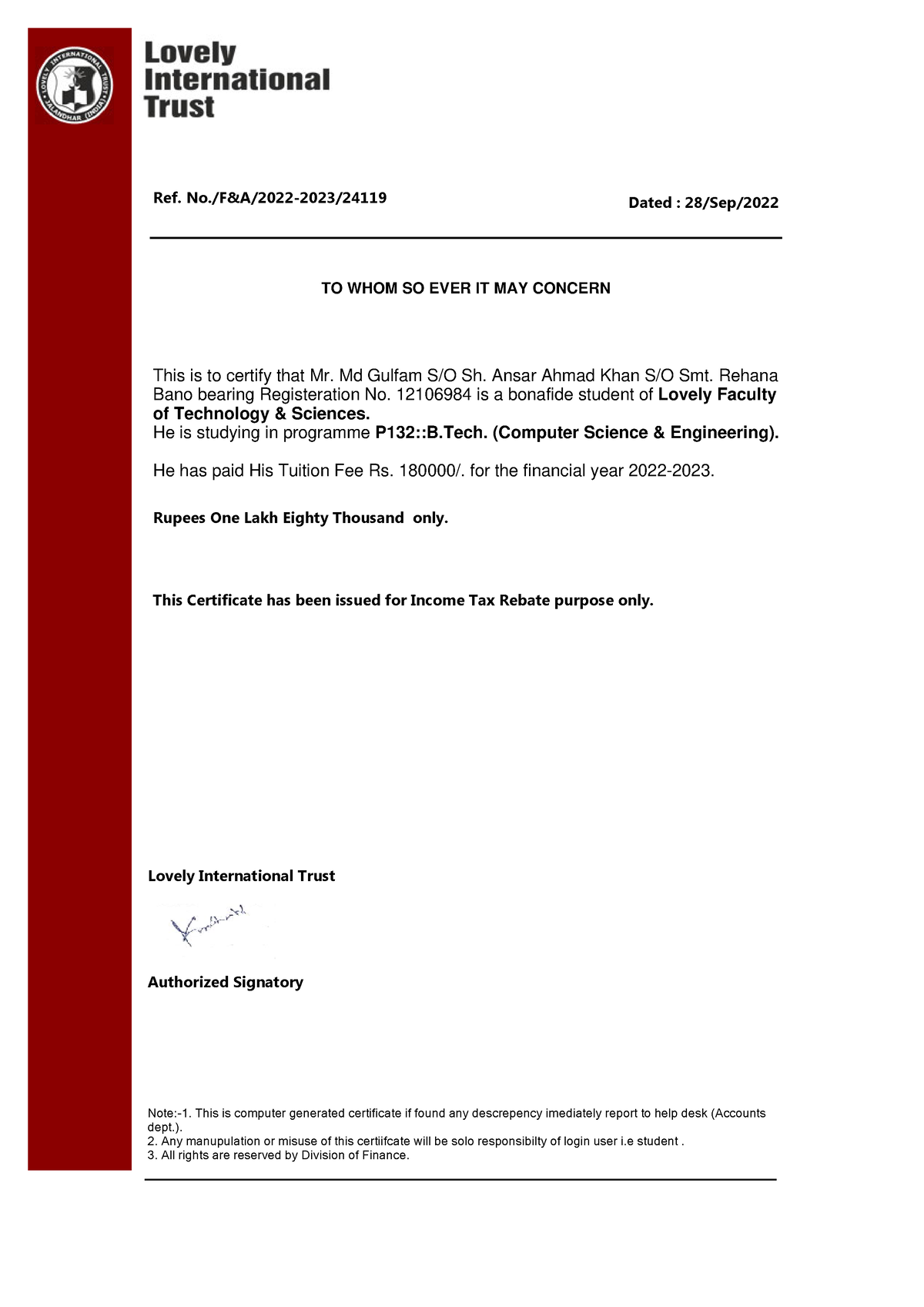

Request Letter For Bonafide Certificate For Income Tax How To Write

https://i.ytimg.com/vi/4en1cSpHF6M/maxresdefault.jpg

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

https://image.ibb.co/jBQewm/taxrebateonline.jpg

Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children

Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Web Apart from Children s Education Allowance a separate tax deduction is allowed on tuition fees paid u s 80C Section 80 C has provisions for tax deduction benefits for tuition fees

Australian Universities Offer Tuition Fee Rebates To Offshore

https://insiderguides.com.au/wp-content/uploads/2020/11/Tuition_Rebates_Insider_Guides-1.jpg

UK Students Ask For 30 Tuition Fee Rebate

https://s3-eu-west-1.amazonaws.com/sendmybag/media/cms/blog/uk-students-ask-for-30-tuition-fee-rebate-header.jpg

https://instafiling.com/tuition-fees-exemption-in-income-tax-2022-23

Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

Employee Salary Tax Calculator RhionnaLetty

Australian Universities Offer Tuition Fee Rebates To Offshore

Income Tax Deduction Exemption FY 2021 22 WealthTech Speaks

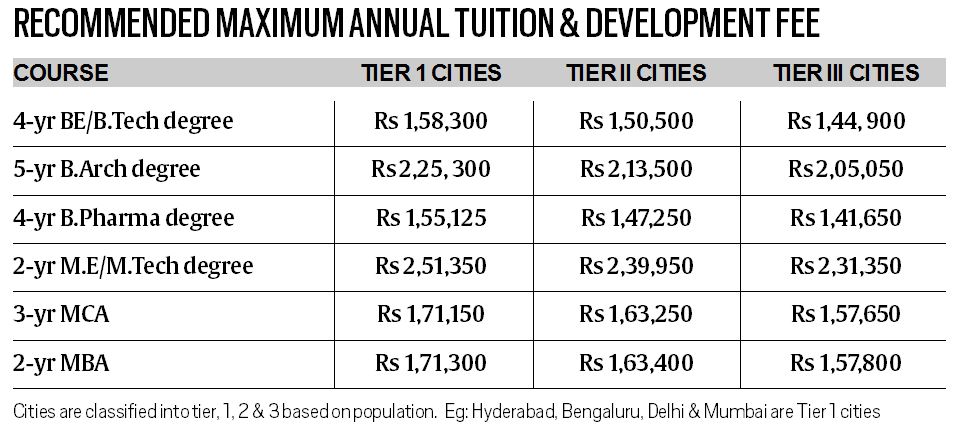

Govt Panel Suggests Cap On Fee For MBA Engineering Courses In Private

Top Notch Income Tax Calculation Statement How To Prepare A Cash Flow

5 Rebate Income Tax YouTube

5 Rebate Income Tax YouTube

CWTS Tuition

Tuition Fee Certificate This Is To Certify That Mr Md Gulfam S O Sh

Tuition Fee Income Tax Rebate YouTube

Maximum Tuition Fee Rebate In Income Tax - Web 29 ao 251 t 2023 nbsp 0183 32 Credits An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less