Maximum Tuition Fees Rebate In Income Tax Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition Web 10 sept 2018 nbsp 0183 32 Rs 80 000 under Section 80C of the ITA sums paid towards PPF LIP Balance Rs 70 000 for tuition fees 150 000 80 000 or vice versa In other words the

Maximum Tuition Fees Rebate In Income Tax

Maximum Tuition Fees Rebate In Income Tax

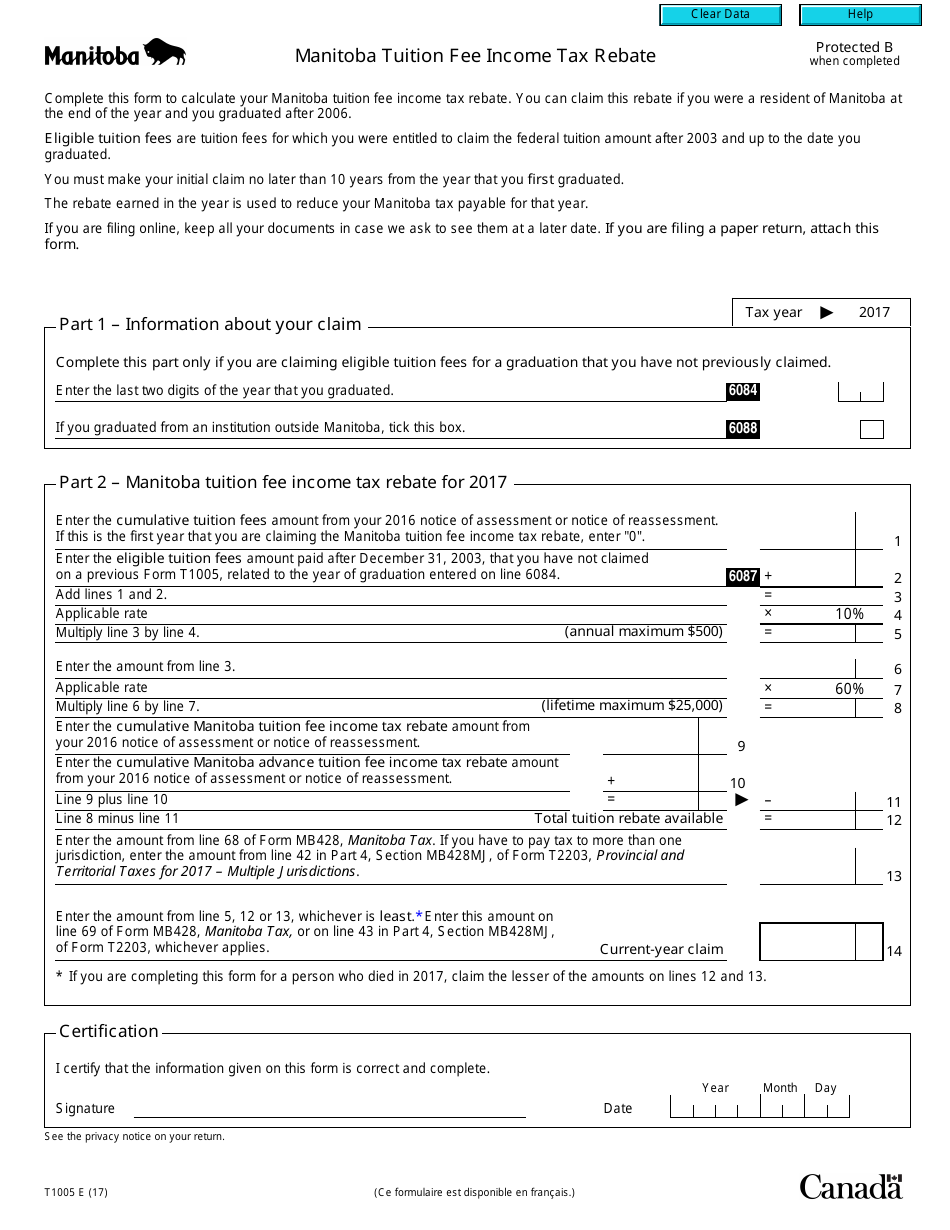

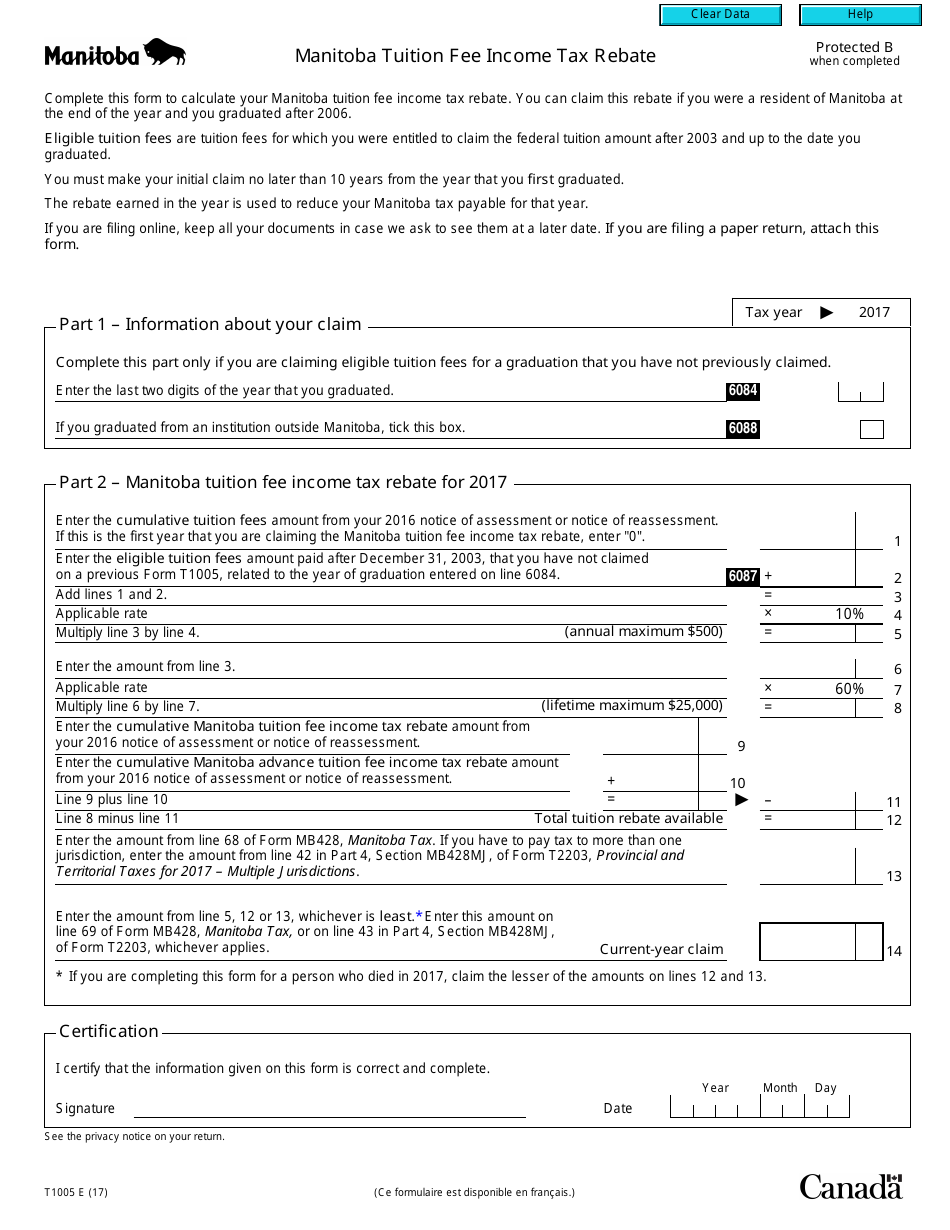

https://data.templateroller.com/pdf_docs_html/1868/18689/1868960/form-t1005-manitoba-tuition-fee-income-tax-rebate-canada_print_big.png

Fillable Online Drake Drake Tuition Rebate Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/16/197/16197361/large.png

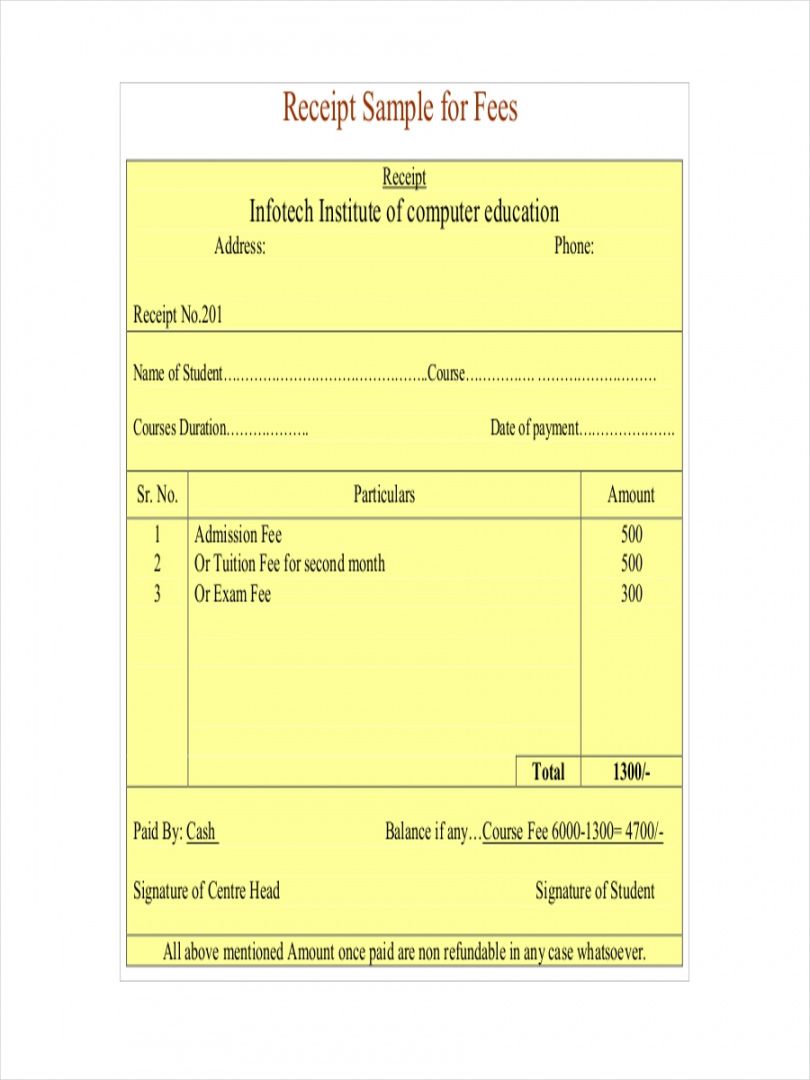

Editable 5 Tuition Receipt Templates Pdf Free Premium Templates

https://i.pinimg.com/originals/bf/12/39/bf1239938e99faa94fedc6d2c10fc3f6.jpg

Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children Web 14 juil 2022 nbsp 0183 32 The amount paid as tuition fees qualifies for tax benefit under section 80C up to a maximum limit of Rs 1 5 lakh per annum Tuition fees paid by parents for their kid s

Web 13 f 233 vr 2023 nbsp 0183 32 The credit is calculated as 100 of the first 2 000 of qualifying expenses plus 25 of the next 2 000 making the maximum credit 2 500 per student Eligible Web 13 mai 2022 nbsp 0183 32 2020 Tuition and Fees Deduction Thresholds Since Expired and Not Applicable for the 2021 Tax Year MAGI Maximum Deduction 65 000 or less

Download Maximum Tuition Fees Rebate In Income Tax

More picture related to Maximum Tuition Fees Rebate In Income Tax

Tuition Fee Receipt Template EmetOnlineBlog

http://www.emetonlineblog.com/wp-content/uploads/2019/03/6-school-receipt-examples-samples-examples-tuition-fee-receipt-template-pdf.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Tuition And Fees Deduction 2023 Maximum

https://cdn.guru99.com/images/DigitalMarketing/071514_0519_GiveMe2hour4.png

Web 7 sept 2023 nbsp 0183 32 Federal and provincial personal tax credits are available to students for tuition fees and 2018 TCC 126 Also see Income Tax Folio S1 F2 C2 Tuition Tax Web 7 sept 2023 nbsp 0183 32 You can also transfer all or part of your current year s federal tuition fees or other education amounts to your spouse or common law partner your parent or your

Web Deduct higher education expenses on your income tax return as for example a business expense and also claim a lifetime learning credit based on those same expenses Claim Web Maximum benefits allowed Each parent or guardian can apply for a maximum deduction of Rs 1 5 Lakh each year According to existing provisions under Sections 80C 80CCC

Tuition Fee Receipt School Forms

https://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

The U S Leads The World In Tuition Fees Infographic

https://blogs-images.forbes.com/niallmccarthy/files/2017/09/20170912_Tuition_Fees.jpg

https://www.toutsurmesfinances.com/impots/frais-de-scolarite-quel-a...

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

https://instafiling.com/tuition-fees-exemption-in-income-tax-2022-23

Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition

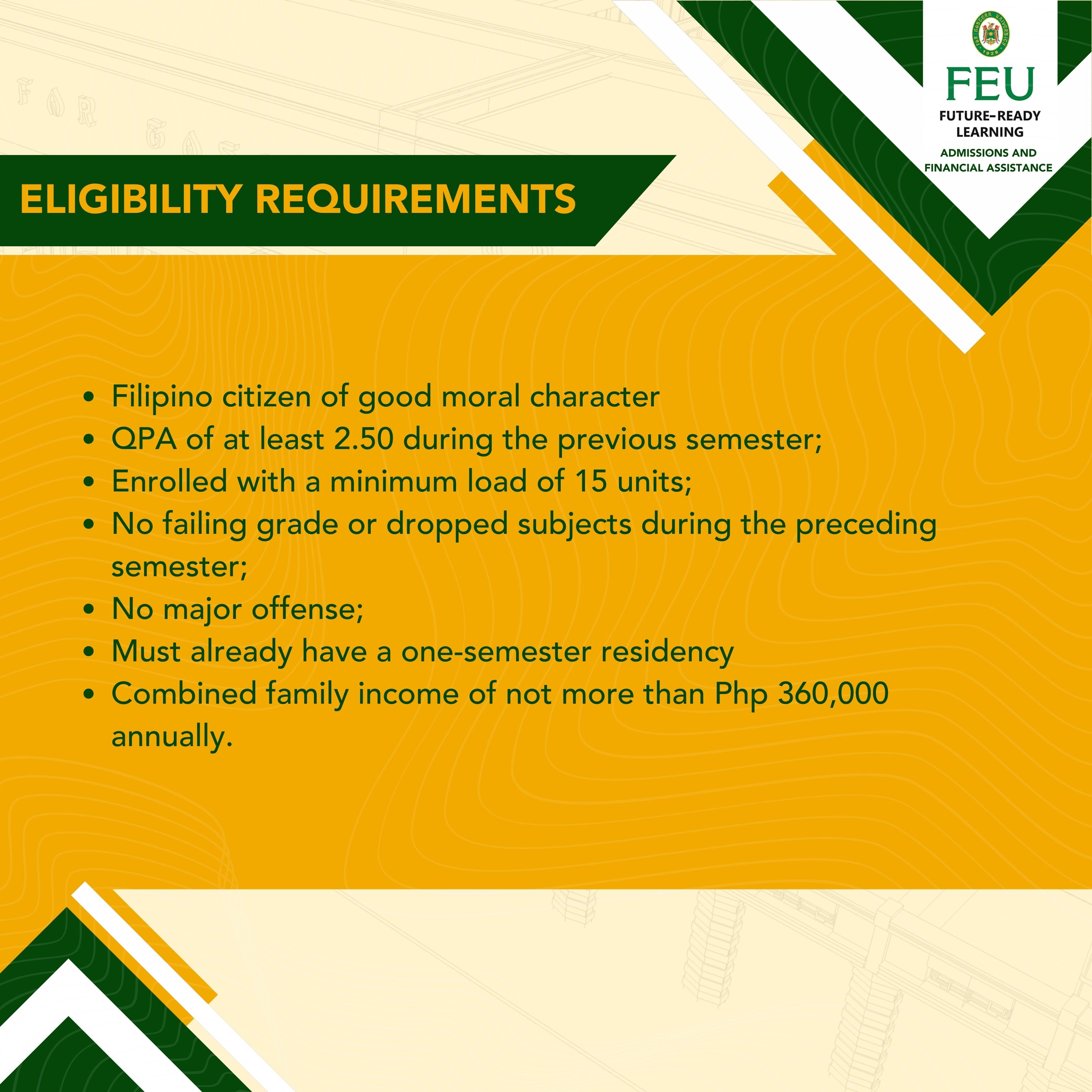

FEU TUITION DISCOUNT Far Eastern University

Tuition Fee Receipt School Forms

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Province Of Manitoba Tuition Fee Income Tax Rebate

Form 8917 Tuition And Fees Deduction 2014 Free Download

Sample Tuition Payment Agreement How To Draft A Tuition Payment

Sample Tuition Payment Agreement How To Draft A Tuition Payment

How To Solve For Income Tax Amy Fleishman s Math Problems

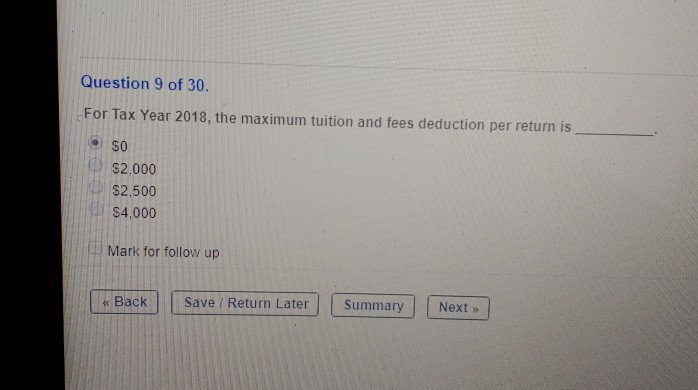

Solved Question 9 Of 30 For Tax Year 2018 The Maximum Chegg

Income Tax Rebate U s 87A For The Financial Year 2022 23

Maximum Tuition Fees Rebate In Income Tax - Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax