Meaning Of Rebate In Income Tax Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 12 500 is available for taxpayers with an annual income of up to Rs 5 lakh as applicable to the financial year 2023 24 for taxpayers who opt the old tax regime

A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the

Meaning Of Rebate In Income Tax

Meaning Of Rebate In Income Tax

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

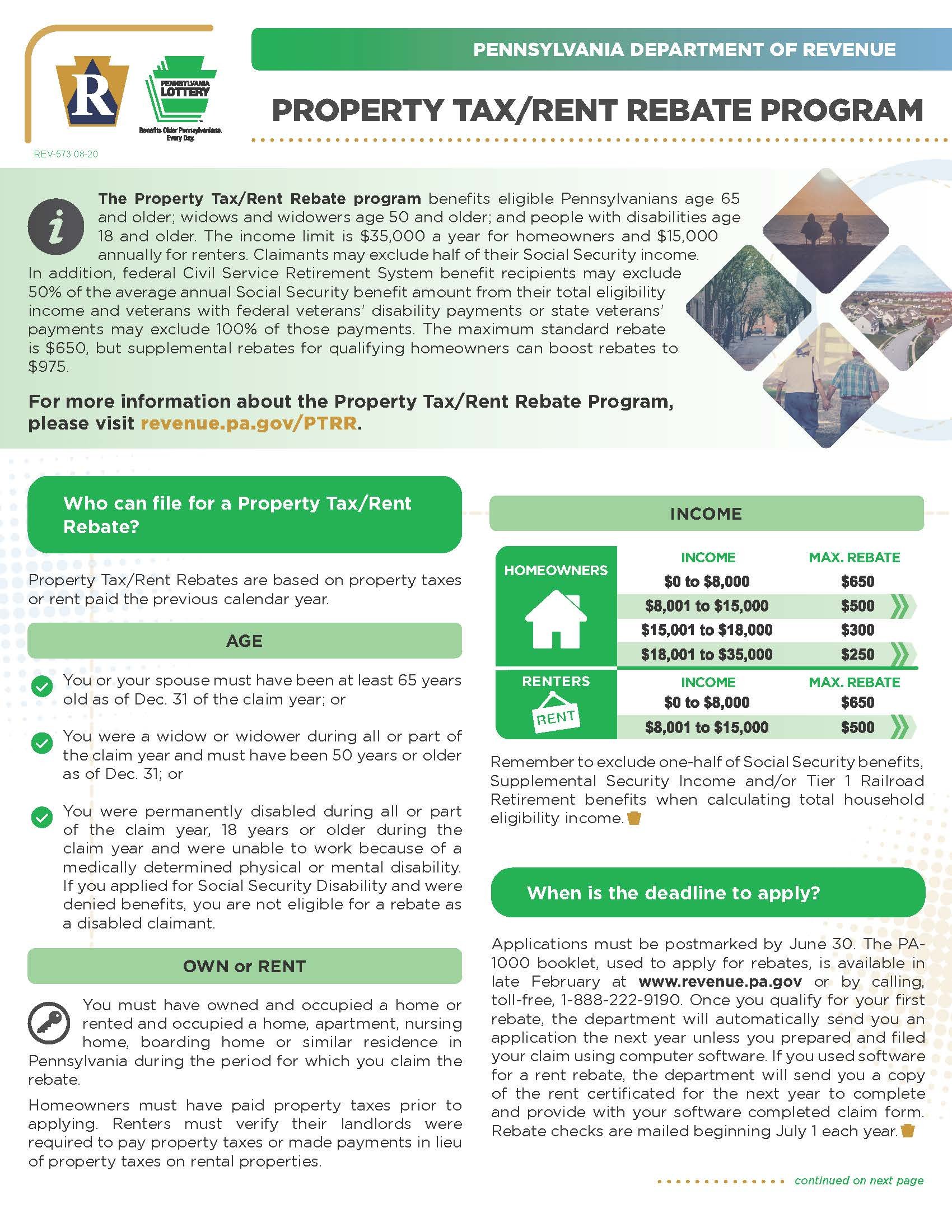

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A An income tax rebate is a refund you can receive if you ve paid more tax than you owe In India the government offers various rebates to encourage savings and investments particularly benefiting middle income earners To claim a rebate you must file your tax returns on time

What is Rebate Section 87 In simple terms rebate is deduction from income tax payable Here Income Tax Payable Tax Payable Cess Surcharge Interest if any TDS Note that Rebate is deduction from tax payable and not from taxable income Aggregate amount of Rebate shall not exceed Income Tax Payable in Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax related debts Tax relief may be in the form of

Download Meaning Of Rebate In Income Tax

More picture related to Meaning Of Rebate In Income Tax

How Can Taxpayers Obtain Income Tax Rebate In India

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

A rebate is an amount by which SARS reduces the actual taxes owing depending on certain circumstances SARS will calculate the amount of tax that you owe to them based on your income and expenses throughout the year then if certain conditions apply they ll reduce the amount due The most common rebate in tax terms is for age The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim points to keep in mind while claiming the rebate Scripbox Recommended Tax Saving Fund

[desc-10] [desc-11]

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

https://cleartax.in/s/difference-between-tax...

Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 12 500 is available for taxpayers with an annual income of up to Rs 5 lakh as applicable to the financial year 2023 24 for taxpayers who opt the old tax regime

https://www.bajajfinserv.in/insights/income-tax-rebate

A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act

Rebate Meaning YouTube

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

How To Get Tax Rebate In Income Tax

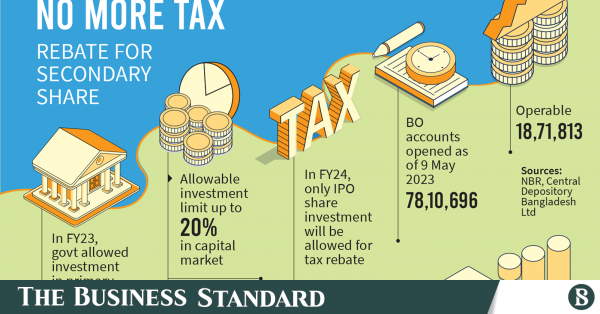

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Province Of Manitoba School Tax Rebate

What Are Rebated Doors How To Fit Them Properly Doors More Guide

Meaning Of Rebate In Income Tax - Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A