Meaning Of Tax Credit This means that even if a taxpayer owes no tax they can still receive the excess credit as a refund providing additional financial support to individuals and families who may need it most Claiming Non Refundable Tax Credits Non refundable tax credits are also claimed on the taxpayer s income tax return However unlike refundable tax

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state 1 It may also be a credit granted in recognition of taxes already paid or a form of state discount applied in certain cases Another way to think of a tax credit is as a rebate How Do Tax Credits Work in Practice Suppose a taxpayer Chris who has one dependent has a tax liability of 1 300 prior to credits A tax credit would reduce the amount owed dollar for dollar unlike a deduction which reduces taxable income In this case Chris may be able to claim the Child Tax Credit which is valued at a maximum of

Meaning Of Tax Credit

Meaning Of Tax Credit

https://www.austaxpolicy.com/wp-content/uploads/2019/02/7134294207_4beca17693_b.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

What Is A Tax Credit DaveRamsey

https://cdn2.ramseysolutions.net/dynamic/media/b2b/elp/blog/what-are-tax-credits.jpg/960w.jpg

TAX CREDIT definition 1 an amount of money that is taken off the amount of tax you must pay 2 an amount of money that Learn more The earned income tax credit EITC is fully refundable the child and other dependent tax credit commonly referred to as the child tax credit or CTC is refundable only if the filer s earnings exceed a 2 500 threshold The refundable portion of the CTC is commonly called the Additional child tax credit Most Popular Tax Credits

Refundable Credits Eligible taxpayers entitled to tax refunds will get the balance credit amount if any It benefits the taxpayers as they can enjoy the full value of the credits Working Tax Credit is a type of refundable credit In the above example the taxpayer gets a reduction of 1000 on the tax they owe and also receives a 200 refund A tax credit is an amount of money that taxpayers are permitted to subtract dollar for dollar from the income taxes that they owe Tax credits are more favorable than tax deductions because they

Download Meaning Of Tax Credit

More picture related to Meaning Of Tax Credit

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

Business Tax Credits Types Of Credits Available How To Claim

https://www.patriotsoftware.com/wp-content/uploads/2019/03/Tax-Credit-1.png

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

TAX CREDIT meaning 1 an amount of money that is taken off the amount of tax you must pay 2 an amount of money that Learn more This means that any unused tax credits in a pay period will be used in later pay periods in the same tax year You cannot get a refund of any unused tax credits or carry them over into another tax year You can divide your tax credits between your jobs if you have a second or multiple jobs

[desc-10] [desc-11]

Pricing Tax Credit Community

https://taxcreditcommunity.com/wp-content/uploads/2022/03/Tax_Credit_final_logo_colour_blue_background-03.png

Child Tax Credit

https://hansonattorney.com/wp-content/uploads/2023/04/taxes-file-contains-taxation-reports-and-documents-SBI-300168771.jpg

https://www.financestrategists.com › tax › tax-planning › tax-credits

This means that even if a taxpayer owes no tax they can still receive the excess credit as a refund providing additional financial support to individuals and families who may need it most Claiming Non Refundable Tax Credits Non refundable tax credits are also claimed on the taxpayer s income tax return However unlike refundable tax

https://en.wikipedia.org › wiki › Tax_credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state 1 It may also be a credit granted in recognition of taxes already paid or a form of state discount applied in certain cases Another way to think of a tax credit is as a rebate

How Are Income Taxes Calculated The Tech Edvocate

Pricing Tax Credit Community

Tax Deduction Vs Tax Credit What s The Difference With Table

New Tax Credit To Fully Offset The Cost For Small Businesses Who

/single-word-taxes-on-wooden-block-1132754811-f3ef431cc47a4be3a49223b20774845f.jpg)

Net Of Tax Definition

Individual Tax WEC CPA Blog

Individual Tax WEC CPA Blog

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

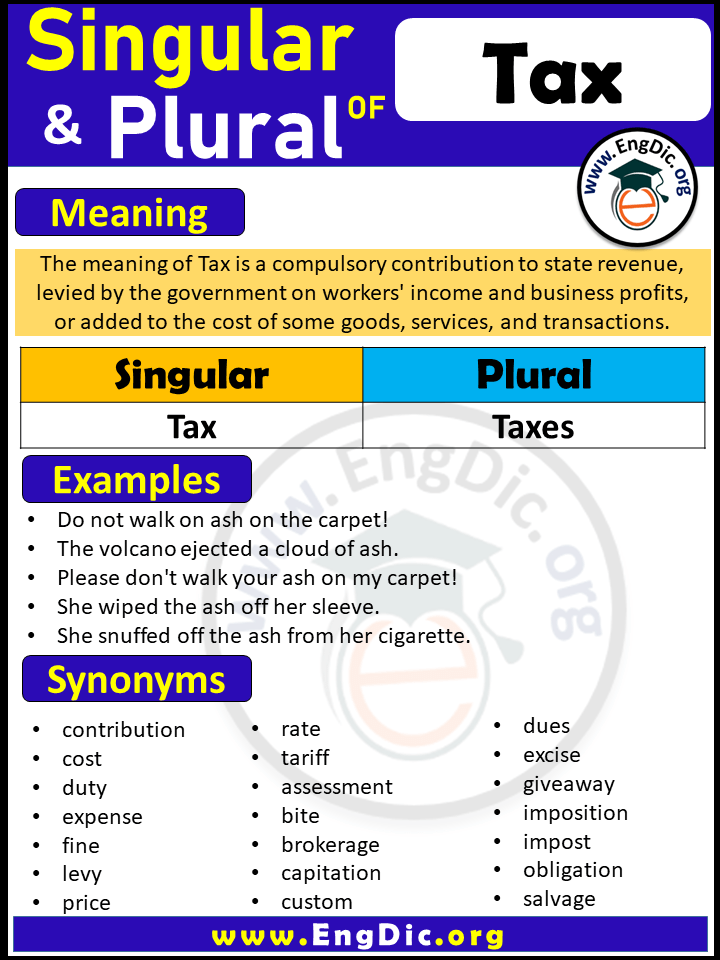

Tax Meaning In English Archives EngDic

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Meaning Of Tax Credit - [desc-13]