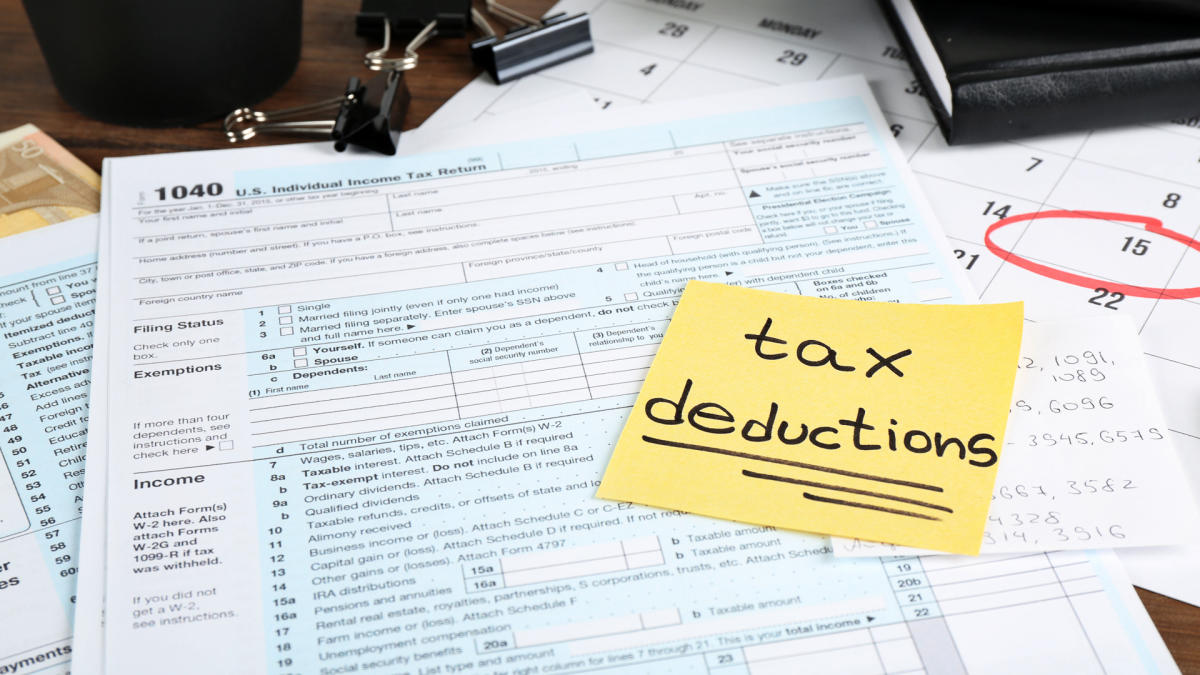

Meaning Of Tax Deductible What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

TAX DEDUCTIBLE definition 1 If an amount of money that you spend is tax deductible it can be taken away from the total Learn more The meaning of TAX DEDUCTIBLE is allowed to be subtracted from the total amount of a person s income before calculating the tax he or she is required to pay allowable as a deduction from taxes How to use tax deductible in a sentence

Meaning Of Tax Deductible

Meaning Of Tax Deductible

https://i.ytimg.com/vi/wJxlQtd1ndA/maxresdefault.jpg

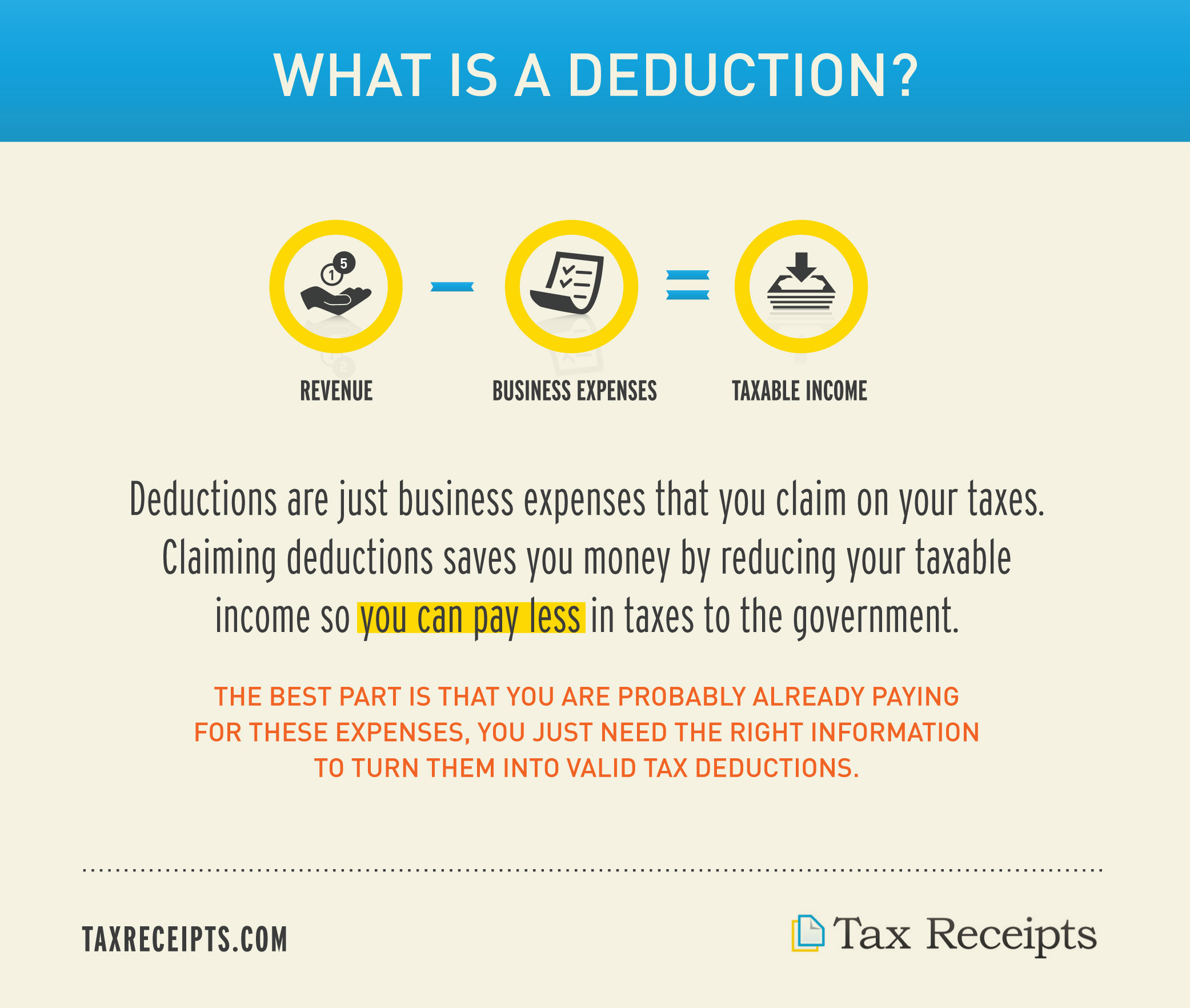

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

What Does Tax Deductible Mean And How Do Deductions Work

https://s.yimg.com/ny/api/res/1.2/4oVLwF5RIk.VRMeiL2y7jA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/homerun/gobankingrates_644/1782921ec4434716597a5408c994ca28

A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of TAX DEDUCTIBLE meaning 1 If an amount of money that you spend is tax deductible it can be taken away from the total Learn more

Tax deductibility refers to the process of reducing an individual s or a business s taxable income by accounting for certain allowable expenses known as tax deductions These deductions can be claimed when filing a federal income tax return effectively lowering the overall amount of income subject to tax Adjective If an expense is tax deductible it can be paid out of the part of your income on which you do not pay tax so that the amount of tax you pay is reduced The cost of private childcare should be made tax deductible

Download Meaning Of Tax Deductible

More picture related to Meaning Of Tax Deductible

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

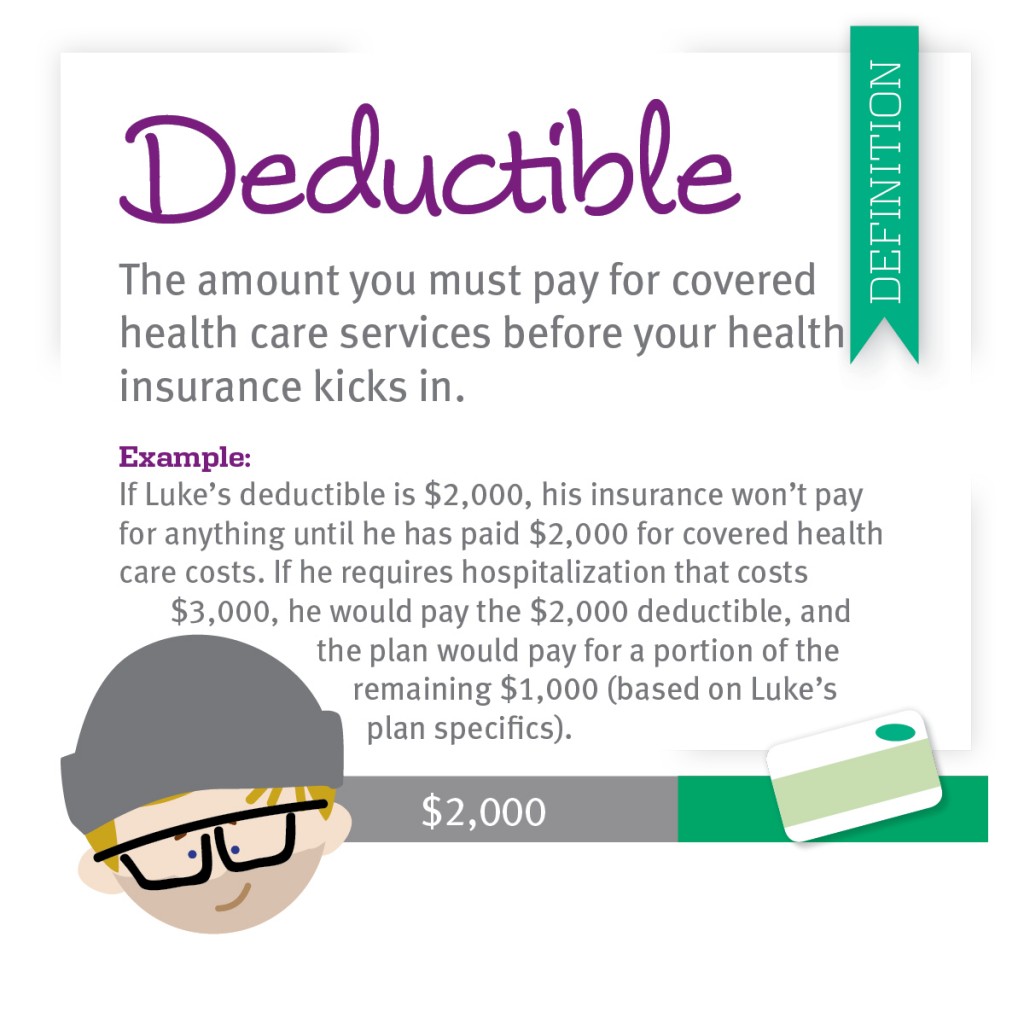

Canonprintermx410 25 Fresh Health Care Plan Deductible Meaning

http://blog.cdphp.com/wp-content/uploads/2015/01/vignettes_deductible-1024x1024.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

A tax deduction is an item you can subtract from your taxable income to lower the amount of taxes you owe Browse Investopedia s expert written library to learn Tax deductions are expenses that can be subtracted from an individual s taxable income effectively reducing the amount of income subject to taxation Tax deductions can help individuals lower their overall tax liability by decreasing their taxable income which in turn may result in a lower tax bill Various tax deductions are available for

[desc-10] [desc-11]

2022 Tax Changes Are Meals And Entertainment Deductible

https://ryanreiffert.com/wp-content/uploads/2022/06/2022-Business-Owner-Update-The-Meals-and-Entertainment-Tax-Deductions.png

Tax Deductible Donations Bold

https://bold-org.ghost.io/content/images/2023/04/tax-deductible-donations-1.jpg

https://corporatefinanceinstitute.com/resources/...

What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

https://dictionary.cambridge.org/dictionary/english/tax-deductible

TAX DEDUCTIBLE definition 1 If an amount of money that you spend is tax deductible it can be taken away from the total Learn more

Tax Deductible Bricks R Us

2022 Tax Changes Are Meals And Entertainment Deductible

Pre tax Deductions Intuit payroll

What Does It Mean When Something Is Tax Deductible Business Partner

Tax Deductions Write Offs To Save You Money Financial Gym

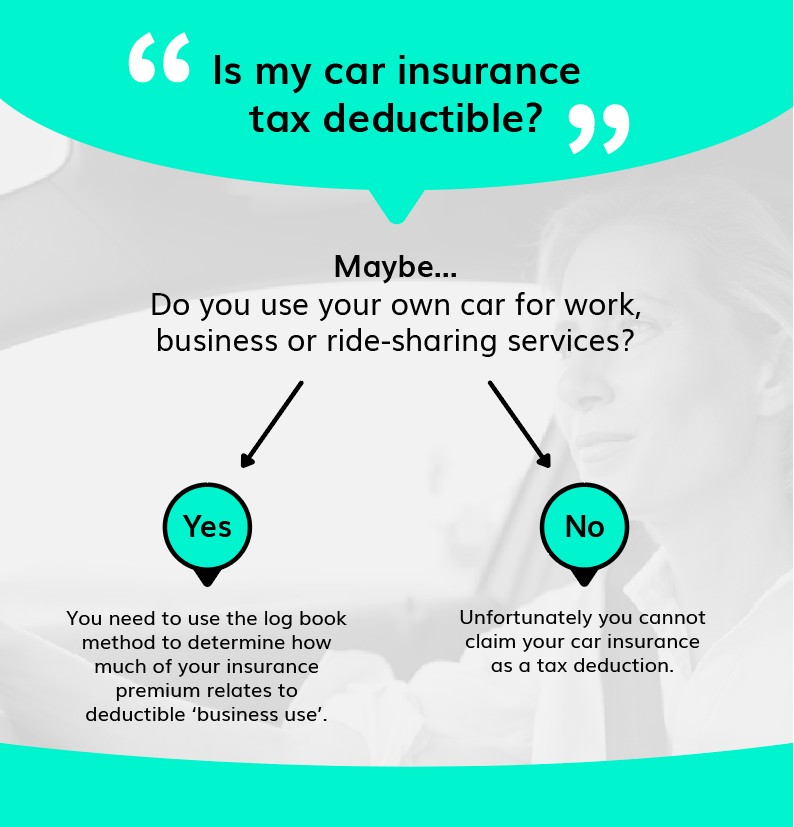

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Canonprintermx410 25 Unique How Is The Deductible Paid In Health Insurance

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

How To Find Average Income Tax Rate Parks Anderem66

Meaning Of Tax Deductible - [desc-13]