Medical Aid Tax Rebate Calculation Web 5 avr 2023 nbsp 0183 32 Le montant de cet abattement est pour les revenus de 2022 impos 233 s en 2023 de 2 620 euros si le revenu net global du foyer fiscal est inf 233 rieur 224 16 410 euros

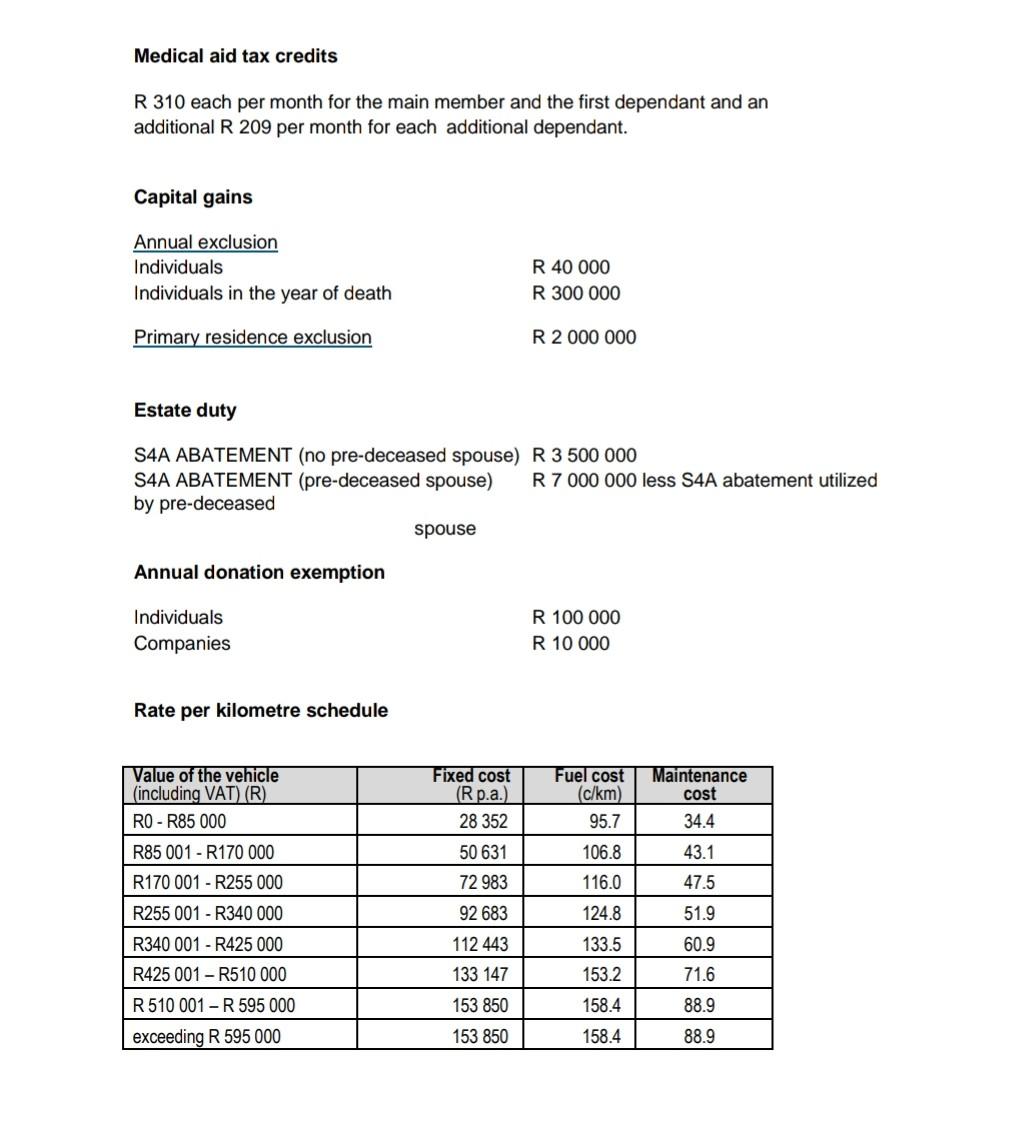

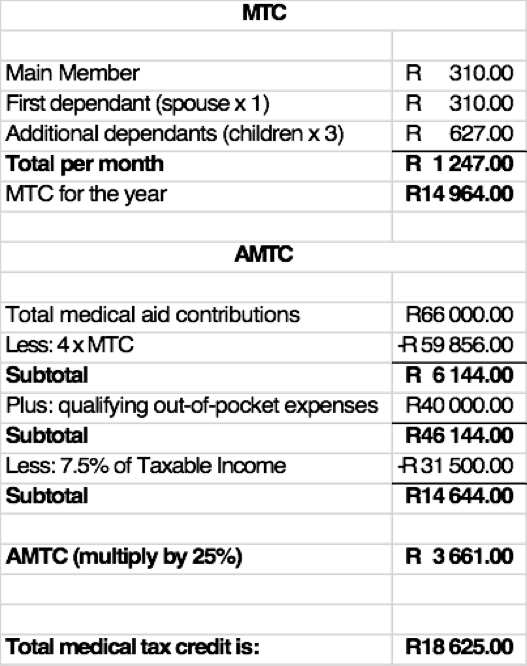

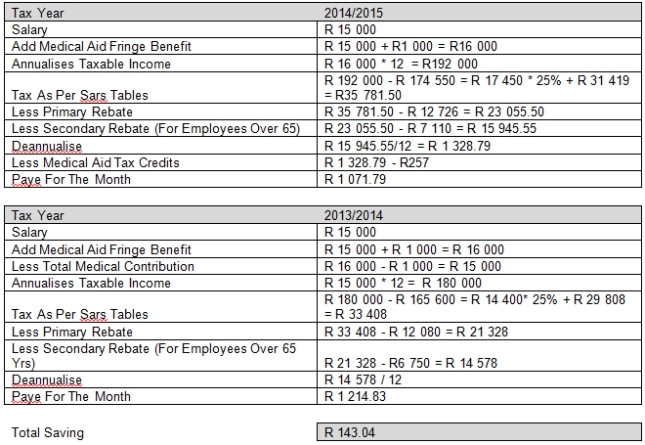

Web 8 juin 2023 nbsp 0183 32 Que vous soyez parent ou proche d un enfant handicap 233 ou vous m 234 me handicap 233 les contrats de rente survie et d 233 pargne handicap vous permettent Web 22 f 233 vr 2023 nbsp 0183 32 Medical tax credits Medical Aid Contributions SARS calls this rebate the Medical Schemes Fees Tax Credit and it applies to the fees paid by a taxpayer to a

Medical Aid Tax Rebate Calculation

Medical Aid Tax Rebate Calculation

https://justonelap.com/wp-content/uploads/2018/09/Medical-aid-calculation.png

In SA Tax Credits For Medical Aid Contributions eBiz Money

http://www.ebizradio.com/wp-content/uploads/2014/03/tax.jpg

How Can I Adjust Medical Aid Tax Credits For Previous Periods

https://www.sagecity.com/resized-image/__size/900x600/__key/communityserver-discussions-components-files/387/MED_5F00_AID.JPG

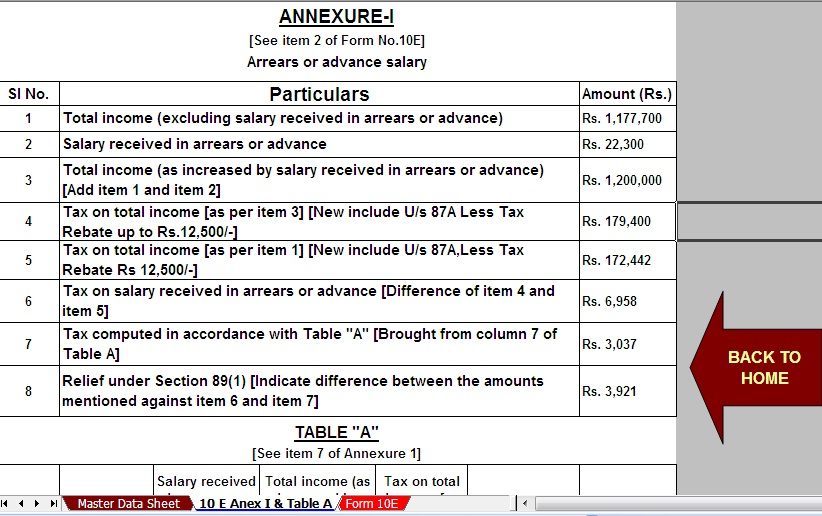

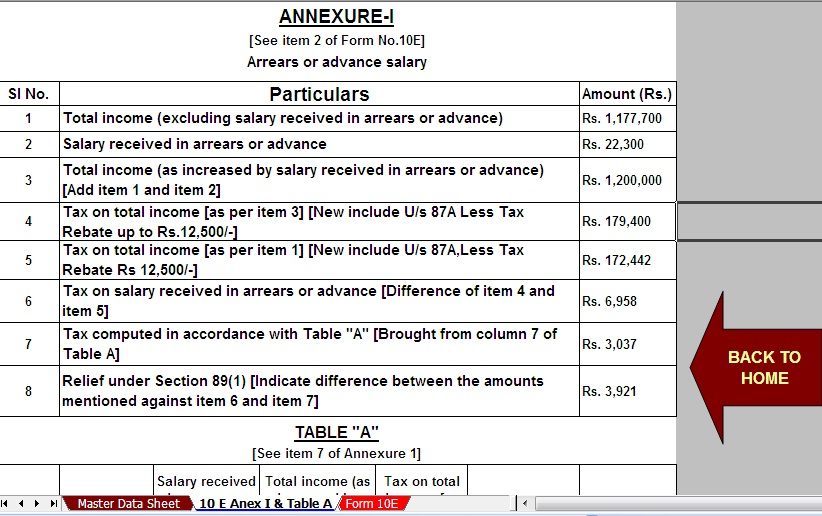

Web 14 juin 2021 nbsp 0183 32 1 Medical aid contributions The Medical Schemes Fees Tax Credit provides for a standard monthly credit against your tax owing to Sars As the primary medical aid Web The AMTC can be calculated as follows Under 65 years of age without a disability Total medical aid scheme contributions minus 4 x the MTC plus qualifying medical

Web Calculation of AMTC A R46 900 contributions to a medical scheme or fund B R11 136 MTC C R22 123 qualifying medical expenses of R19 432 R2 691 D R324 Web 22 f 233 vr 2023 nbsp 0183 32 The MTC applies to fees paid by a taxpayer to a registered medical scheme or similar fund outside South Africa for that taxpayer and any dependants as defined

Download Medical Aid Tax Rebate Calculation

More picture related to Medical Aid Tax Rebate Calculation

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

https://media.cheggcdn.com/study/ae2/ae2e3510-2d3b-40ee-8f9c-99f39b17ccc4/image

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

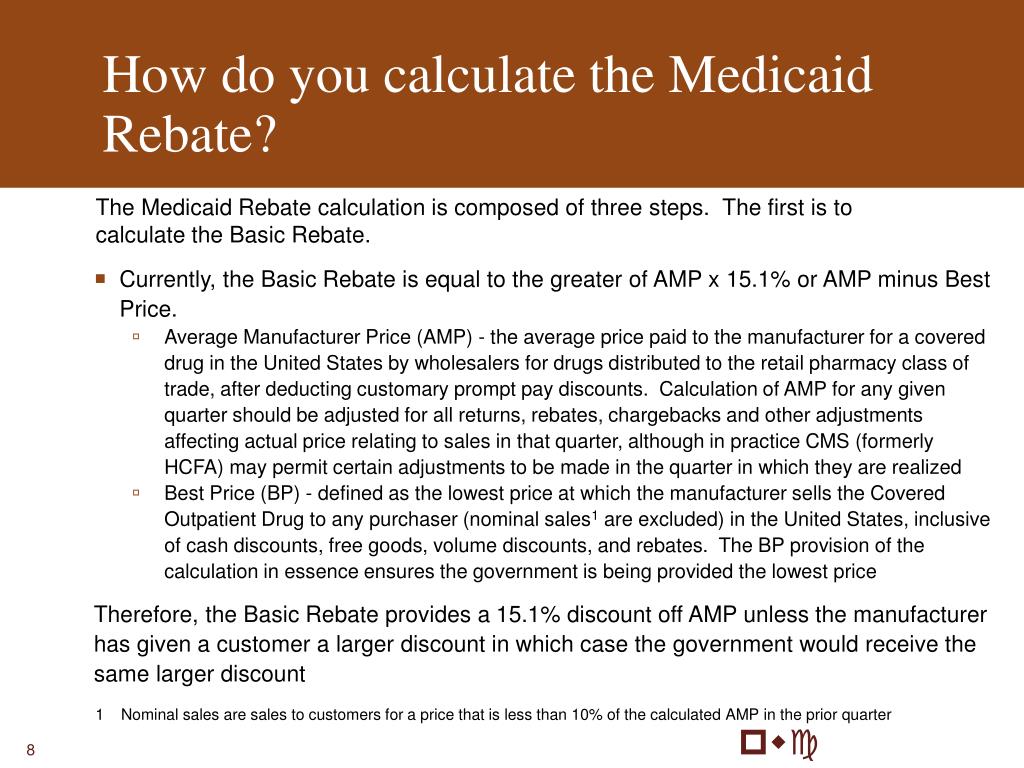

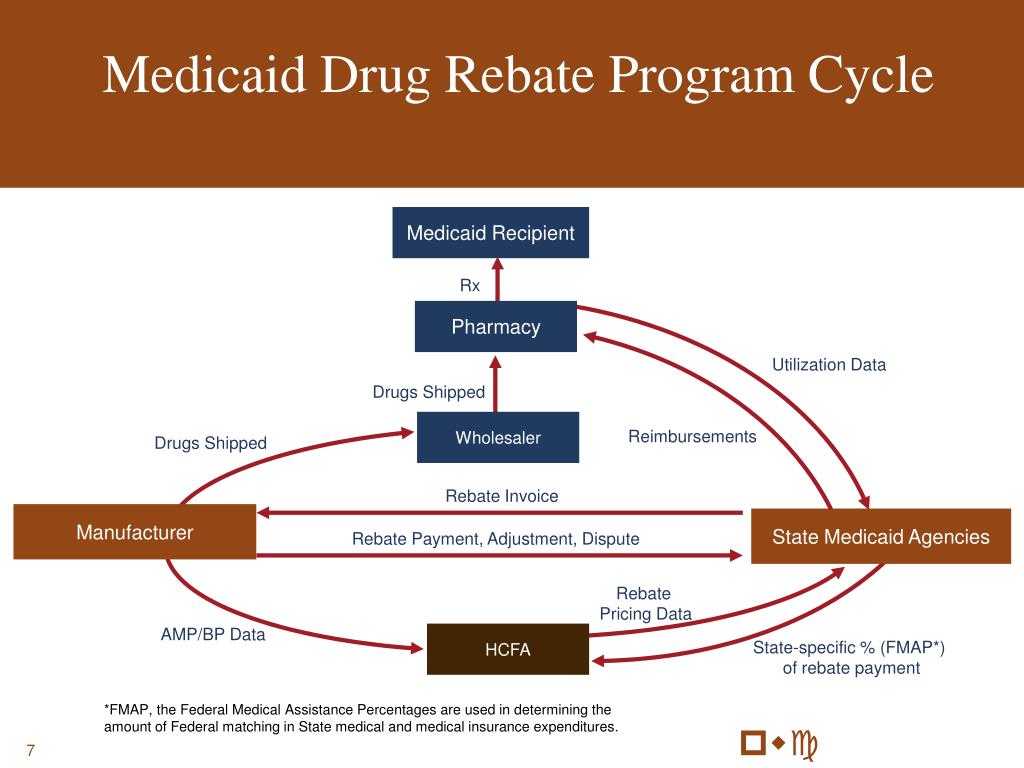

PPT Pwc PowerPoint Presentation Free Download ID 577141

https://image.slideserve.com/577141/how-do-you-calculate-the-medicaid-rebate-l.jpg

Web R364 per month for the first dependant on the scheme R246 per month for each additional dependant on the scheme What is the additional medical expenses tax credit This is a Web Extra credits for those in this category are determined by taking their total medical aid payments minus four times their medical scheme fees credit plus their out of pocket

Web 24 mai 2018 nbsp 0183 32 Unless you are an accountant it can be difficult to wrap your mind around tax the calculation for your Medical scheme tax rebate has many facets to it so let s look Web This transaction will calculate the maximum amount of Medical aid tax credits based on the number of beneficiaries added to the Masterfile Check if the code 8000 Medical Aid

Health Care Tax Rebate Calculator 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/revised-tax-rebate-under-sec-87a-after-budget-2019-with-automated.jpg

Sars Yearly Tax Tables 2019

https://www.itweb.co.za/static/pictures/2014/05/resized/-fs-Sage-Tables.xl.jpg

https://www.capital.fr/votre-argent/fiscalite-handicap-1353867

Web 5 avr 2023 nbsp 0183 32 Le montant de cet abattement est pour les revenus de 2022 impos 233 s en 2023 de 2 620 euros si le revenu net global du foyer fiscal est inf 233 rieur 224 16 410 euros

https://www.service-public.fr/particuliers/vosdroits/F18

Web 8 juin 2023 nbsp 0183 32 Que vous soyez parent ou proche d un enfant handicap 233 ou vous m 234 me handicap 233 les contrats de rente survie et d 233 pargne handicap vous permettent

2020 Budget In A Nutshell Nel Van Ass And Associates PTY Ltd

Health Care Tax Rebate Calculator 2022 Carrebate

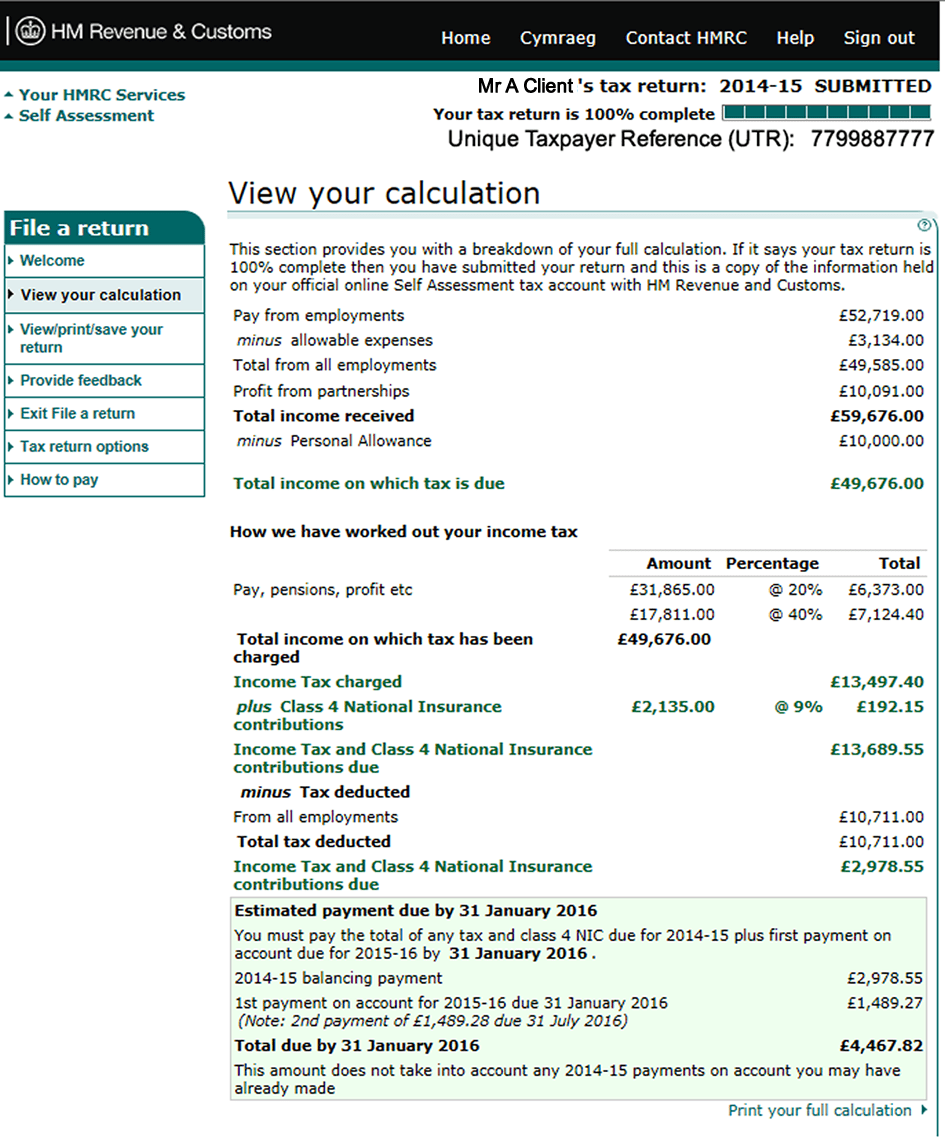

Downloading Your SA302s And Tax Year Overviews From The HMRC Website

Everything You Should Know About Medical Tax Credits In South Africa

Everything You Should Know About Medical Tax Credits In South Africa

Loading A Private Medical Aid Sage 300 People General Discussion

Loading A Private Medical Aid Sage 300 People General Discussion

PPT Pwc PowerPoint Presentation Free Download ID 577141

Medical Deductions Tax Policy Center

Tds Slab Rate For Ay 2019 20

Medical Aid Tax Rebate Calculation - Web 14 juin 2021 nbsp 0183 32 1 Medical aid contributions The Medical Schemes Fees Tax Credit provides for a standard monthly credit against your tax owing to Sars As the primary medical aid