Medical Allowance Exemption Limit Under the said clause exemption is available to any medical allowance received by an employee not exceeding 10 percent of the basic salary of the employee of reimbursement of actual

Medical allowance i Where any benefit reimbursement of medical charges or hospital charges or both incurred by an employee is provided for under the terms of employee s employment agreement and the employee provides NTN of the hospital or clinic and the medical or hospital bills are also certified and attested by the employer such FINANCE ACT 2022 SIGNIFICANT CHANGES Tax burden for income below Rs 2 9M has been reduced whereas the burden increases above this income point Profit on debt paid on loans acquired for purchase or construction of house no more deductible from taxable income

Medical Allowance Exemption Limit

Medical Allowance Exemption Limit

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Salary/Allowance for Salary.jpg

Medical Allowance Is Taxable Or Exempt

https://i.ytimg.com/vi/Di3V70KcKZc/maxresdefault.jpg

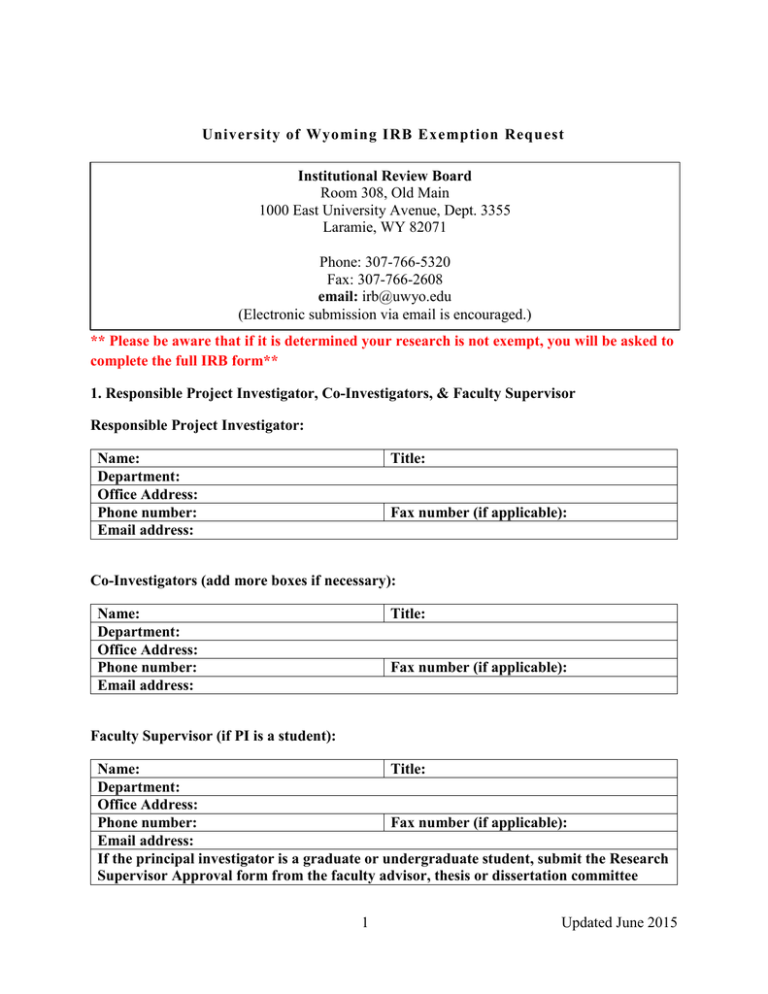

Exemption Request Form June 2015

https://s2.studylib.net/store/data/015426834_1-65bfca52b0937b0852d7580bb2be5837-768x994.png

How to Calculate Medical Allowance An employee can claim a maximum tax benefit of Rs 15 000 for medical expenses incurred For instance Jaya a 30 year old business analyst is eligible for medical reimbursement of 25 000 Jaya therefore has to produce medical bills worth 25 000 to claim reimbursement Slight changes on account of traveling allowance of newspapers employees free supply of food or other perquisites etc and salary of seafarers that was wholly exempt have been proposed for rationalization of salary tax regime rather than as revenue generation measure

Brochure IR IT 03 Updated April 2014 Introduction To reduce the effective tax rate for the deserving and to provide incentive for charitable donations investments etc a number of tax reductions rebates and credits are allowed by the Income Tax Ordinance 2001 Medical Allowance The exemption limit for medical allowance is Rs 15 000 per annum Conveyance Allowance The exemption limit for conveyance allowance is Rs 1 600 per month Apart from the allowances and perquisites mentioned earlier there are certain other allowances and perquisites which are also exempt under Section 10 14 i

Download Medical Allowance Exemption Limit

More picture related to Medical Allowance Exemption Limit

Medical Allowance Exemption For Salaried Is It Allowed In ITR For AY

https://www.financialexpress.com/wp-content/uploads/2023/06/cropped-medical-allowance-exemption.png?w=640

The Allowance Game Teach Your Kids About Money Planning To Save

https://planningtosave.com/wp-content/uploads/2014/01/Allowance.jpg

What Is An IRS Group Exemption Who Can Qualify

https://cullinanelaw.com/wp-content/uploads/2012/10/group-exemption-umbrella-cullinane-law.jpg

Under the Income Tax Act medical reimbursement falls under Section 80D and the maximum amount allowed per year is Rs 15 000 It s crucial for employees to timely submit their medical reimbursement bills as failure to do so may result in 30 of the Rs 15 000 becoming taxable Under this clause exemption is available to any medical allowance received by an employee not exceeding 10 percent of the basic salary of the employee for reimbursement of actual expenses with proof The only benefit of medical reimbursement or free medical facility left with the salaried class is being withdrawn by the government

[desc-10] [desc-11]

Allowances Family Money Values

http://blog.familymoneyvalues.com/wp-content/uploads/2013/04/allowance.jpg

Exemption

https://steamcdn-a.akamaihd.net/steam/apps/1073960/ss_466caa4befc84dc78ec526fa0ae85536d91a1974.1920x1080.jpg?t=1559249843

https://www.brecorder.com/news/40102871

Under the said clause exemption is available to any medical allowance received by an employee not exceeding 10 percent of the basic salary of the employee of reimbursement of actual

https://download1.fbr.gov.pk/Docs/20101211012416152002cir12.htm

Medical allowance i Where any benefit reimbursement of medical charges or hospital charges or both incurred by an employee is provided for under the terms of employee s employment agreement and the employee provides NTN of the hospital or clinic and the medical or hospital bills are also certified and attested by the employer such

HRDF Exemption 2021 Aug 17 2021 Johor Bahru JB Malaysia Taman

Allowances Family Money Values

DISABILITY ALLOWANCE APPLICATION FORM

Recovery Of Excess Payment Of FMA Fixed Medical Allowance And To

Authors Alliance Petitions For New Exemption To Section 1201 Of The

No Exemption For Transport Allowance And Medical Allowance U s 10 For

No Exemption For Transport Allowance And Medical Allowance U s 10 For

CLLA Bankruptcy Blog Debtor Not Allowed To Claim Exemption On Proceeds

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

Grant Of Transport Allowance At Double The Normal Rates To Persons With

Medical Allowance Exemption Limit - Medical Allowance The exemption limit for medical allowance is Rs 15 000 per annum Conveyance Allowance The exemption limit for conveyance allowance is Rs 1 600 per month Apart from the allowances and perquisites mentioned earlier there are certain other allowances and perquisites which are also exempt under Section 10 14 i