Medical Bill Rebate In Income Tax Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax Act

Section 80D offers tax deductions up to Rs 25 000 for health insurance premiums paid by individuals and HUFs in a financial Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

Medical Bill Rebate In Income Tax

Medical Bill Rebate In Income Tax

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

1 Medical treatment of specified ailments under section 80DDB Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be Income Tax Medical Bills Exemption If you are a salaried professional you can save huge chunks and portions of your income by claiming for a medical reimbursement or your medical bill Every employer provides a

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If

Download Medical Bill Rebate In Income Tax

More picture related to Medical Bill Rebate In Income Tax

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

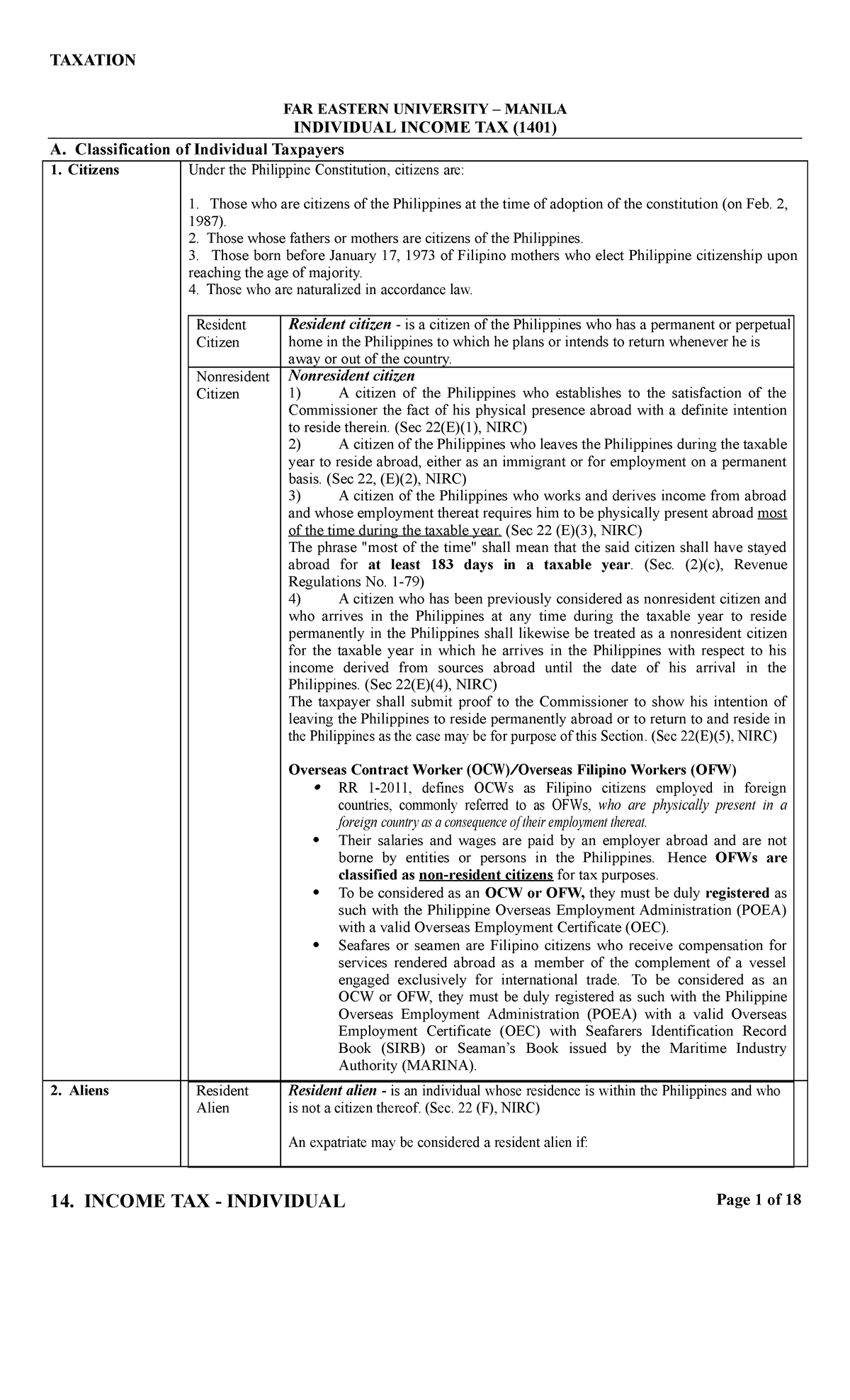

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

All about taxability of medical reimbursement received and medical expenses paid from income Tax perspective All of us in our day to day life are incurring medical expenses either for ourself or for the You cannot deduct the first 7 500 7 5 100 000 but you can deduct the remaining 2 500 in spending Households with very significant medical bills may get

If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may deduct only the amount of your medical Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other

What Is A Rebate In Income Tax

https://www.mudranidhi.com/wp-content/uploads/2023/12/What-is-a-Rebate-in-Income-Tax-1024x576.jpg

How To Get Tax Rebate In Income Tax

https://lh3.googleusercontent.com/-jJ4zZZJpzu4/XkYh5zpW4bI/AAAAAAAALlw/03vDaCyfckIn2RjNTnWAHgi9ClX_V6MrACLcBGAsYHQ/s1600/Image_1.jpeg

https://cleartax.in/s/income-tax-benefit-employee...

Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax Act

https://tax2win.in/guide/section-80d-ded…

Section 80D offers tax deductions up to Rs 25 000 for health insurance premiums paid by individuals and HUFs in a financial

Income Tax Rebate Astonishingceiyrs

What Is A Rebate In Income Tax

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Income Tax Slabs 2022 Sitharaman Proposes Increase Of Employees Tax

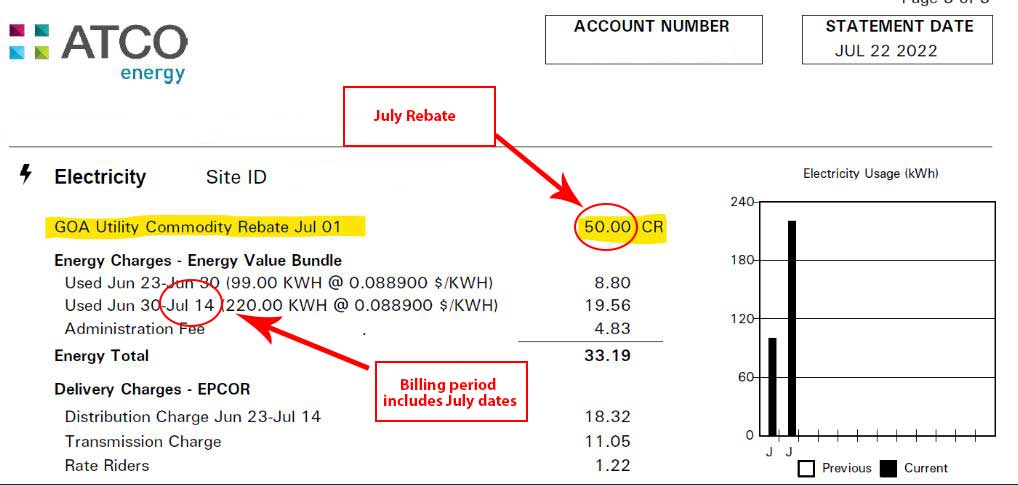

Utilities Consumer Advocate Electricity Rebate Program

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Sappy 1954

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

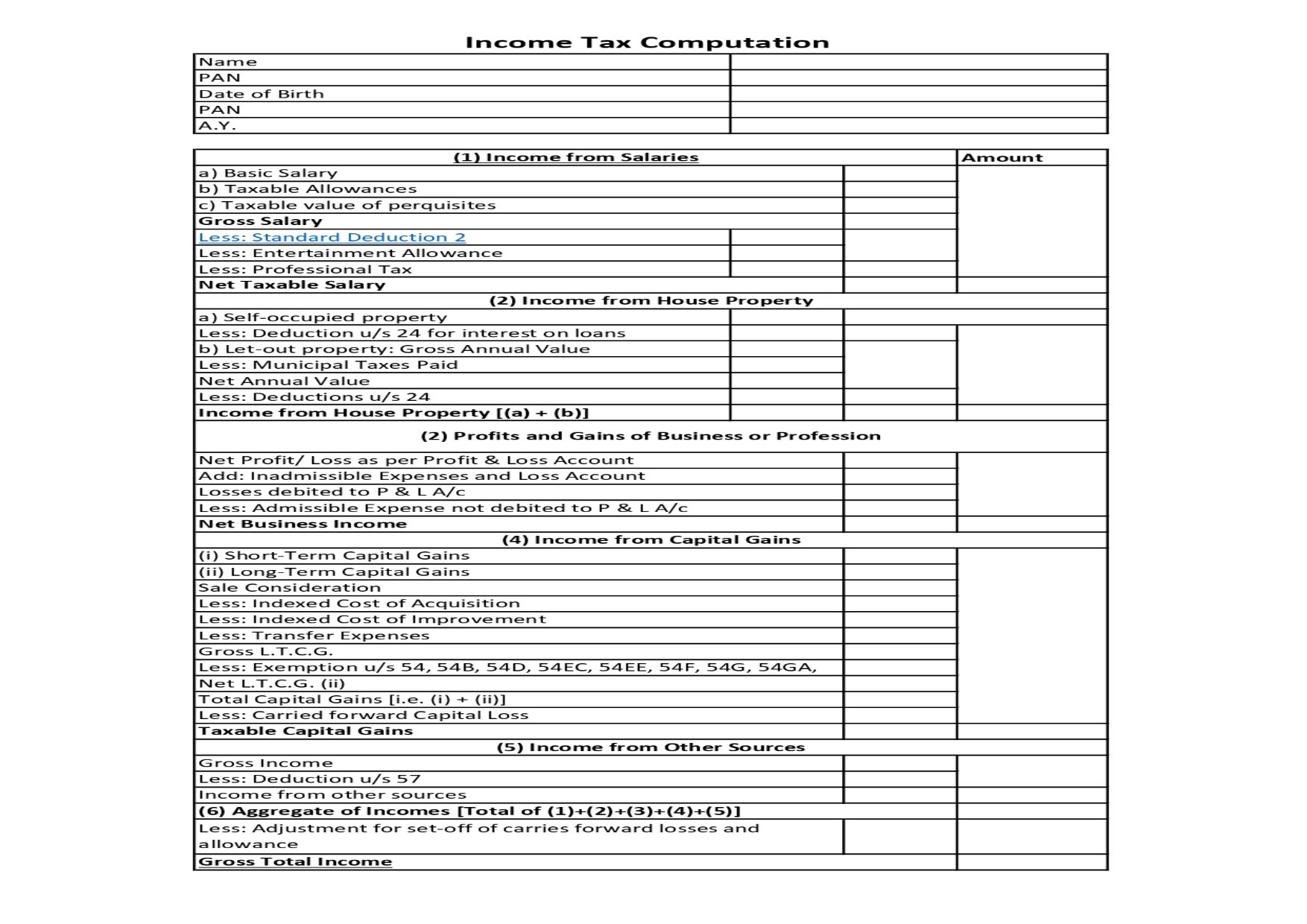

Income Tax Computation Format PDF A Comprehensive Guide

Medical Bill Rebate In Income Tax - Income Tax Medical Bills Exemption If you are a salaried professional you can save huge chunks and portions of your income by claiming for a medical reimbursement or your medical bill Every employer provides a