Medical Expenditure Tax Rebate Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

Web 17 juil 2019 nbsp 0183 32 The deduction u s 80DDB for the expenditure on the medical treatment of the specified diseases can be claimed by Resident Individuals Indian or foreign citizen Web 31 oct 2020 nbsp 0183 32 Section 80DDB of the Income Tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

Medical Expenditure Tax Rebate

Medical Expenditure Tax Rebate

https://www.medicalplasticsnews.com/downloads/8916/download/rebatye.png?cb=be44995fbf737dfdeaee6ed4abfecc27

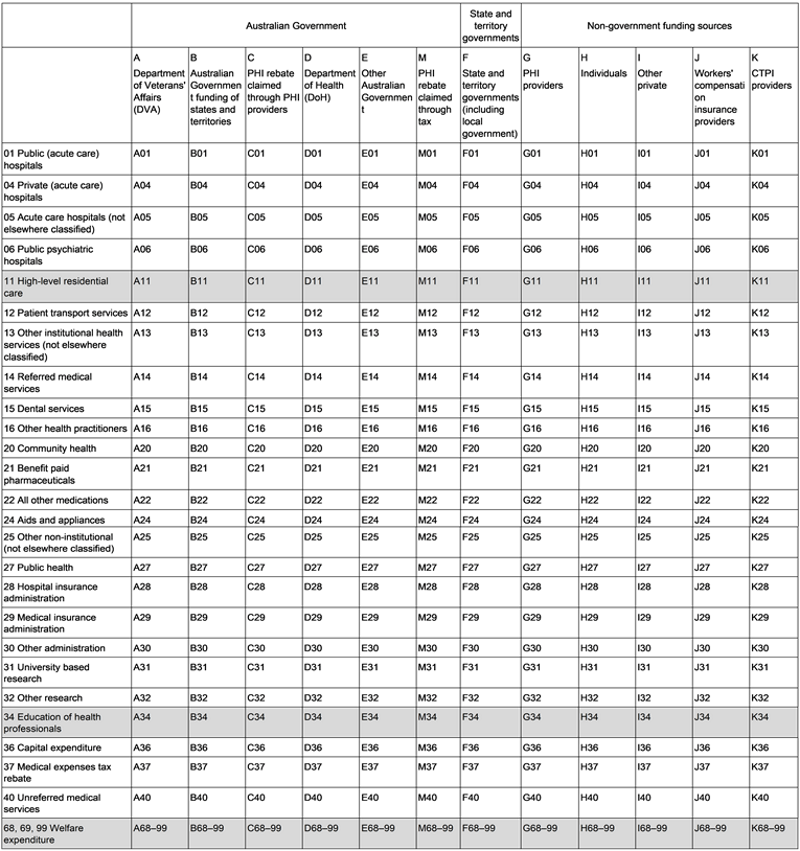

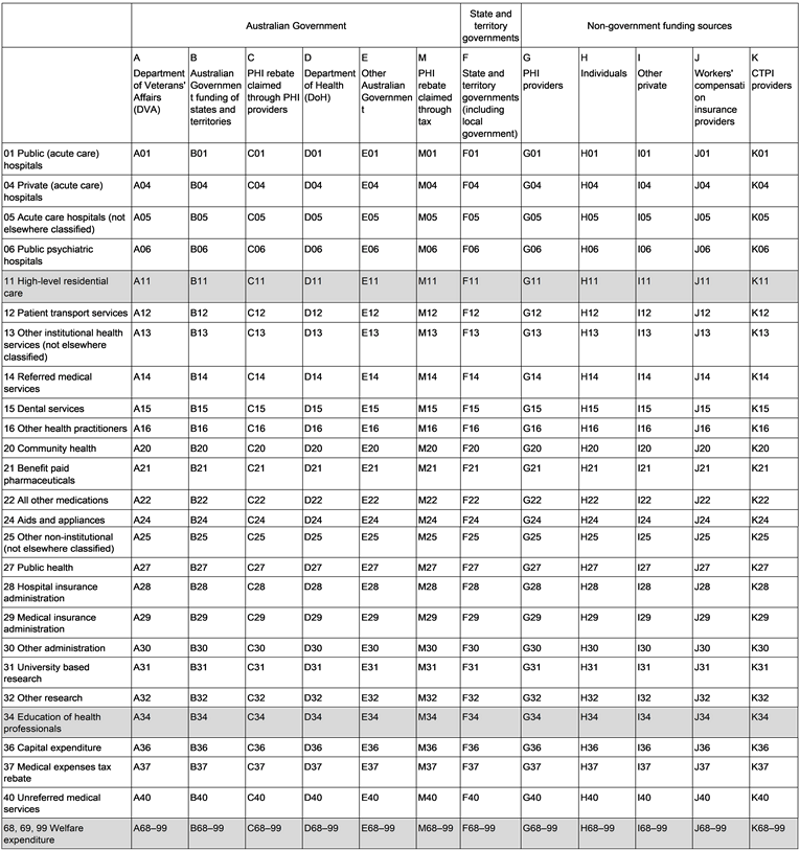

Health Expenditure Australia 2019 20 Compilation Of Health Expenditure

https://www.aihw.gov.au/getmedia/269f5024-7d7c-4760-bbf8-871d5654c2b4/HEA-table1.png.aspx

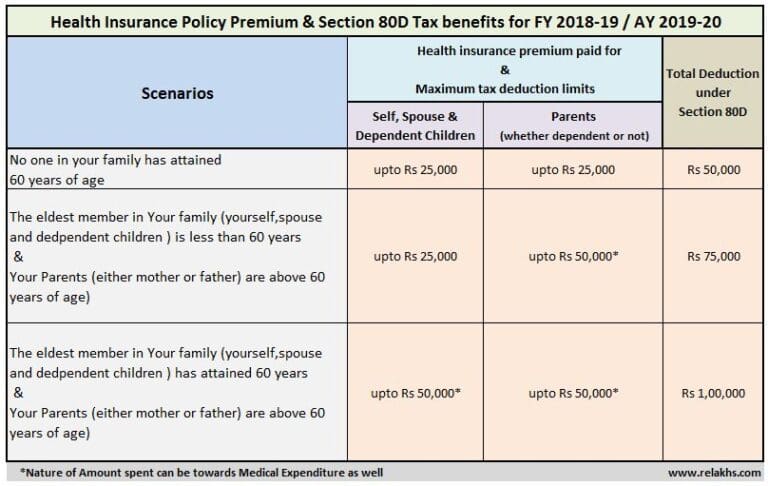

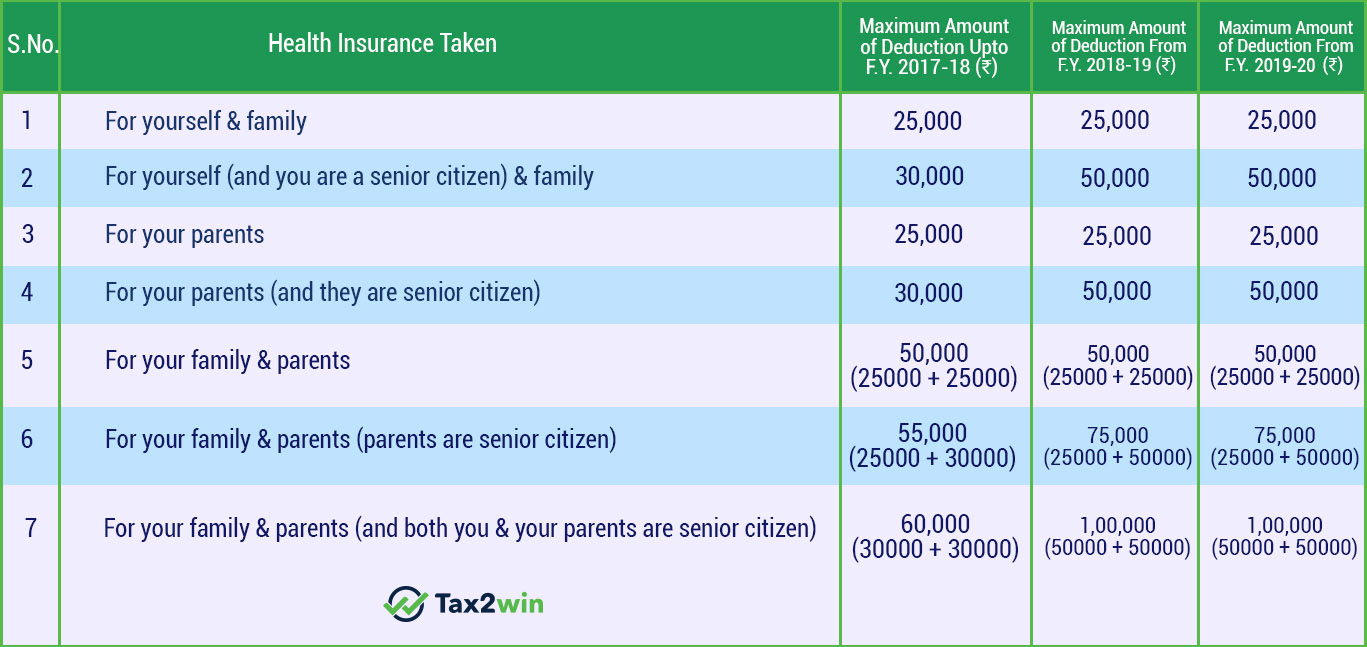

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills-768x486.jpg

Web 10 mars 2020 nbsp 0183 32 Tous les b 233 n 233 ficiaires de l Assurance maladie sont rembours 233 s partiellement des frais de consultation d un m 233 decin Hors parcours de soins le taux de Web Gr 226 ce aux r 233 ductions fiscales donnez 224 la recherche m 233 dicale les moyens d innover pour sauver des vies en faisant un don d 233 ductible 224 la Fondation pour la Recherche

Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a Web 19 mars 2021 nbsp 0183 32 Hence if you have crossed the age of 60 you can claim the maximum deduction of up to Rs 50 000 on your medical expenses Additionally if you have

Download Medical Expenditure Tax Rebate

More picture related to Medical Expenditure Tax Rebate

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Get Tax Benefits Upto Rs 1 00 000 On Health Insurance Premium And Other

https://cdn.slidesharecdn.com/ss_thumbnails/sec-80d-191214131517-thumbnail.jpg?width=640&height=640&fit=bounds

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

Web 13 f 233 vr 2019 nbsp 0183 32 The deduction under this section is available only for expenditures incurred for medical treatment of specified diseases All specified diseases for which this Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and

Web 29 avr 2020 nbsp 0183 32 The Income Tax Act 1961 has given tax benefits of Medical insurance as well as regular medical expenditure which are as under There are three items of Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If

The Figure Shows The Coefficient On Tax Rebate At Time T 1 first Row

https://www.researchgate.net/profile/Paolo-Surico/publication/228222751/figure/fig4/AS:669492430508044@1536630842986/The-figure-shows-the-coefficient-on-tax-rebate-at-time-t-1-first-row-tax-rebate-at.png

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

https://economictimes.indiatimes.com/wealth/t…

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 The deduction u s 80DDB for the expenditure on the medical treatment of the specified diseases can be claimed by Resident Individuals Indian or foreign citizen

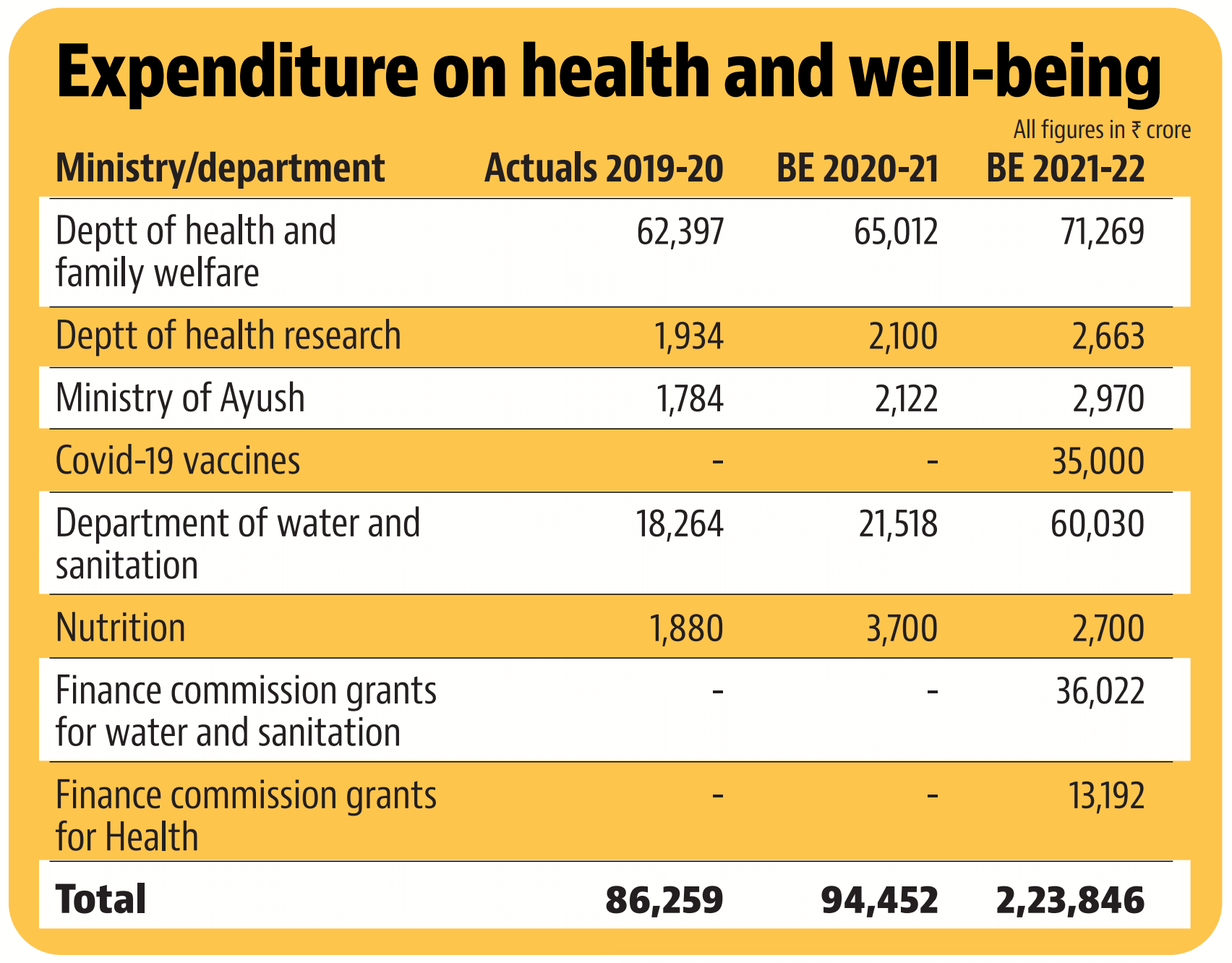

Budget UPSC Budget UPSC 2021 HEALTH BUDGET UPSC 2021

The Figure Shows The Coefficient On Tax Rebate At Time T 1 first Row

Can Medical Expenses Be Claimed Under Section 80D

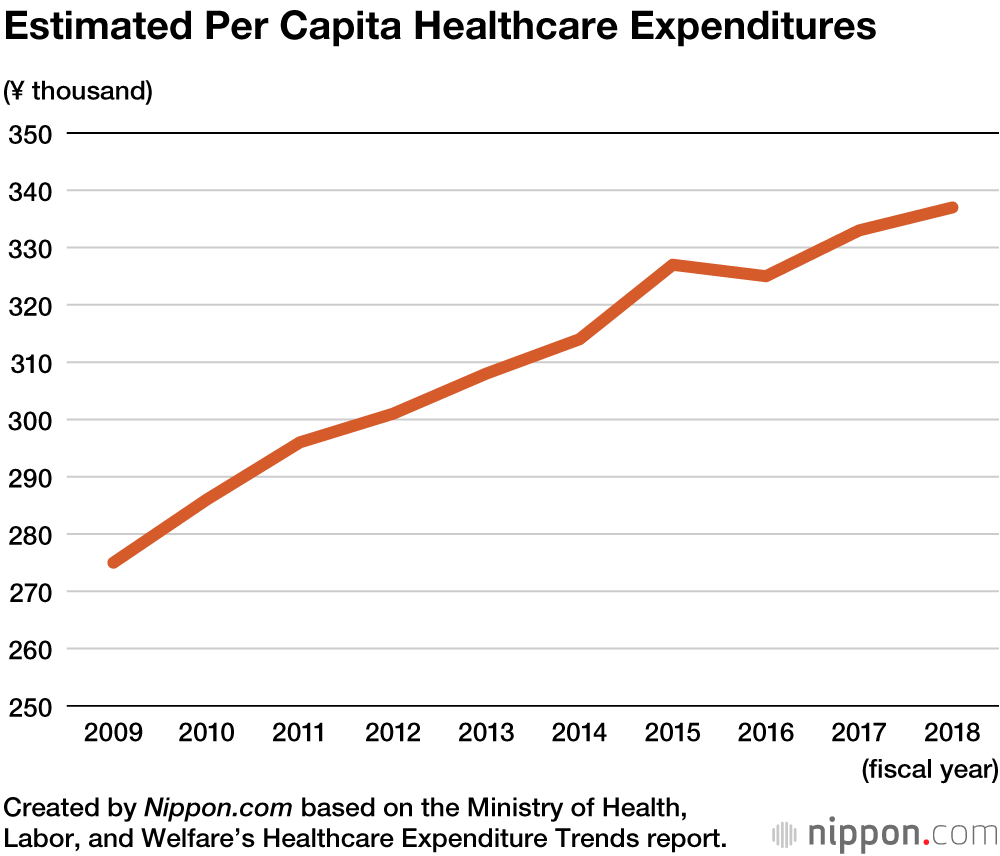

Growing Medical Woes Japan s Healthcare Expenditures Rise To Record

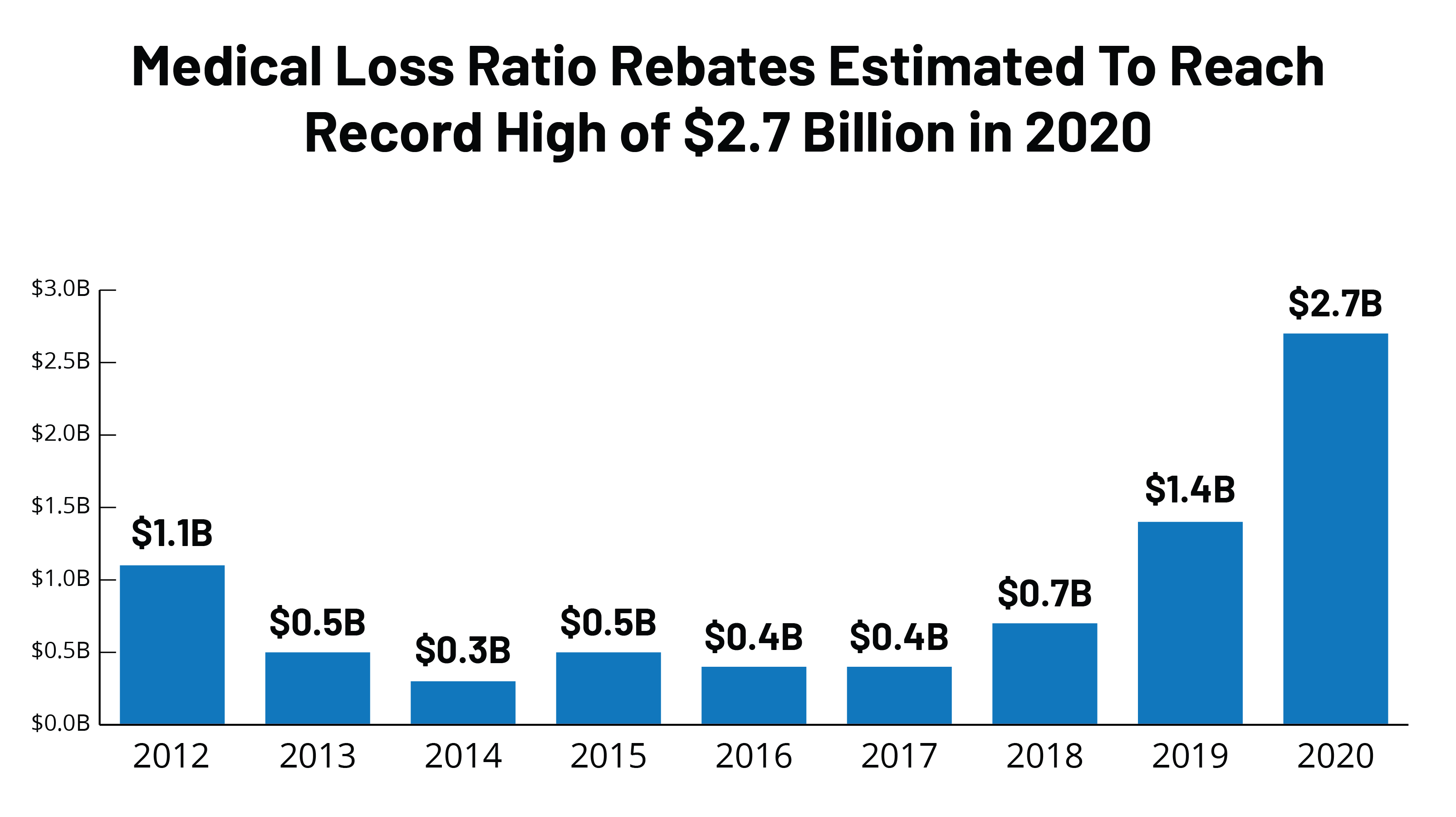

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

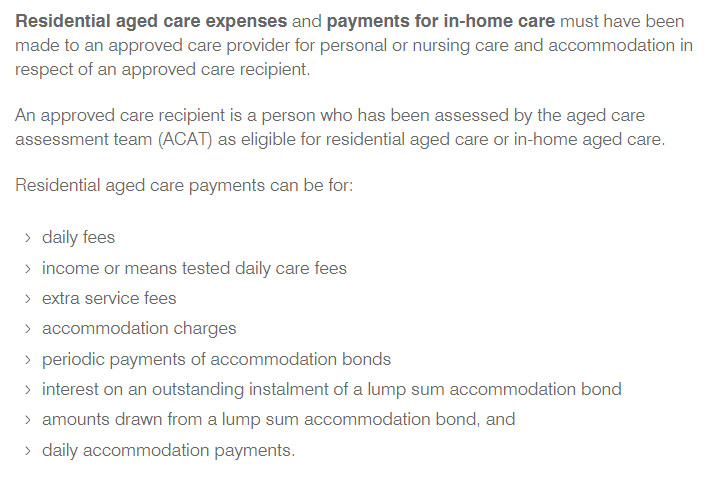

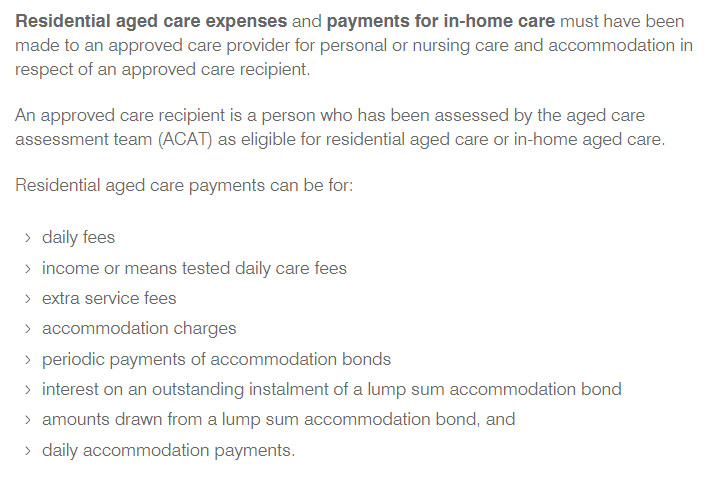

Claiming The Medical Offset Tax Rebate

Claiming The Medical Offset Tax Rebate

Section 80D Income Tax Deduction For Medical Insurance Preventive

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Income Tax Deduction For Medical Treatment IndiaFilings

Medical Expenditure Tax Rebate - Web 12 juin 2020 nbsp 0183 32 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer