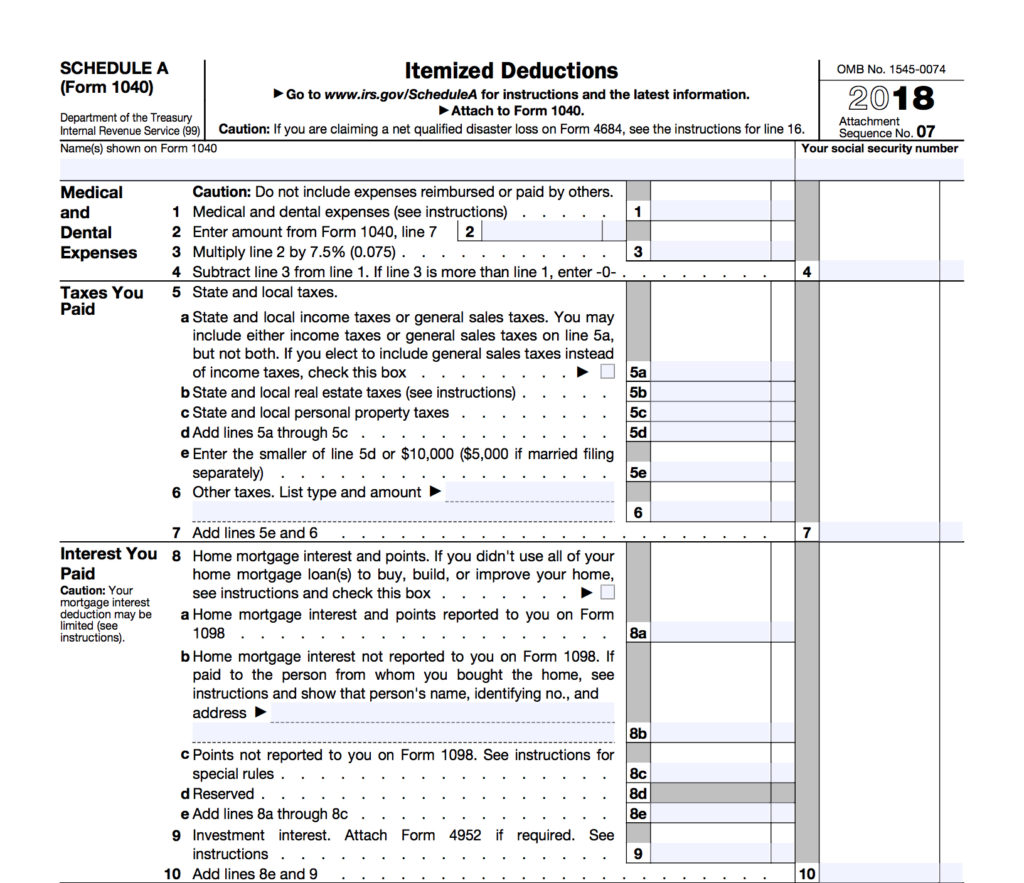

Medical Expense Deduction Federal Income Tax You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal

Medical Expense Deduction Federal Income Tax

Medical Expense Deduction Federal Income Tax

https://i1.rgstatic.net/publication/46488602_An_analysis_of_the_medical_expense_deduction_under_the_US_income_tax_system/links/5bd0675792851c1816bcded3/largepreview.png

T17 0093 Reduce Threshold For Medical Expense Deduction From 7 5 To 5

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t17-0093.gif

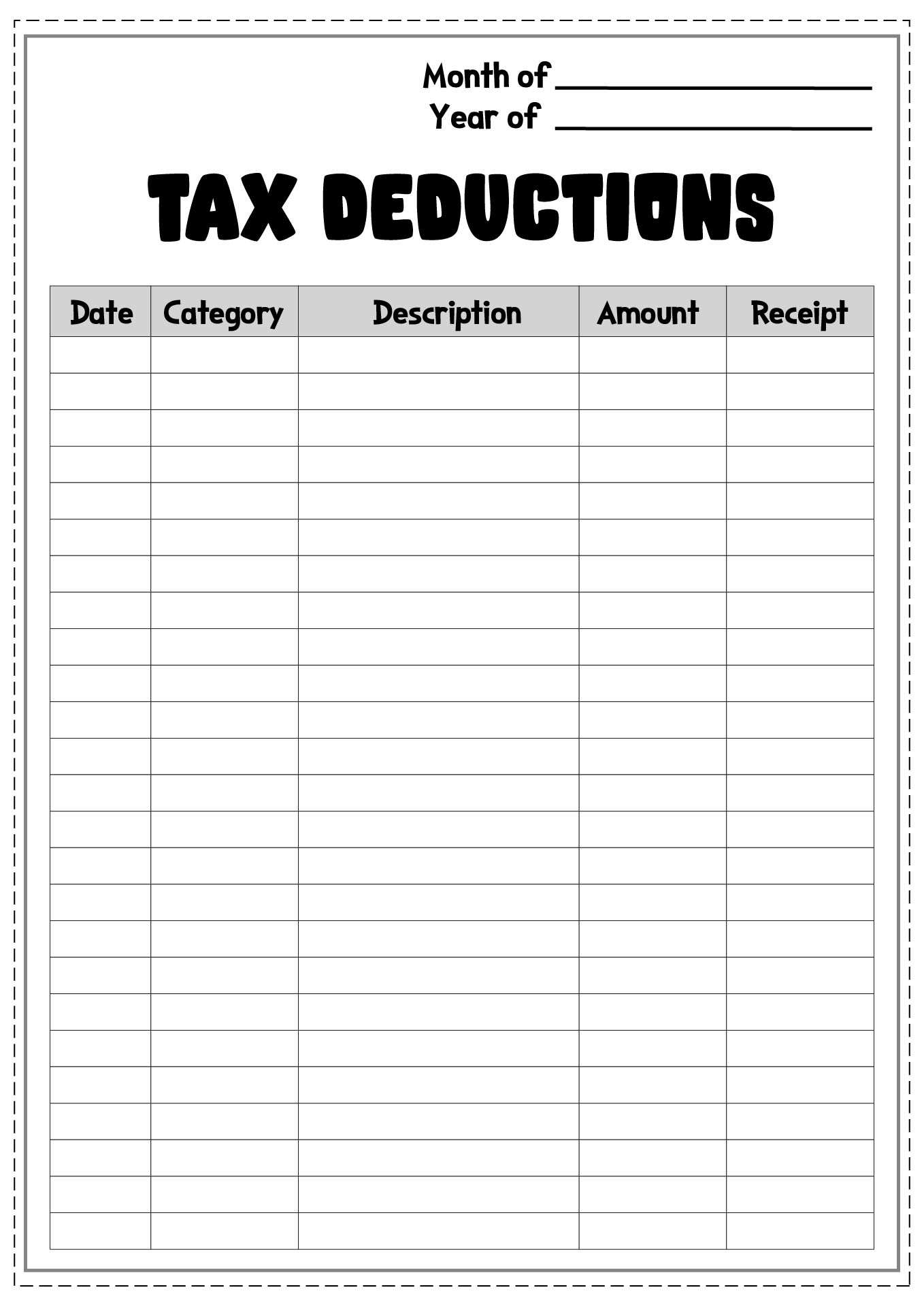

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/itemized-deductions-worksheet_449334.png

There are plenty of qualifying medical expenses that you can claim on your taxes However you can only deduct expenses that exceed 7 5 of your adjusted gross This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in

If your unreimbursed out of pocket medical bills in 2020 exceeded 7 5 percent of your adjusted gross income AGI you may be able to deduct them on your For example if you itemize your AGI is 100 000 and your total medical expenses are 9 000 you can deduct only 1 500 of medical expenses on Schedule

Download Medical Expense Deduction Federal Income Tax

More picture related to Medical Expense Deduction Federal Income Tax

1040 Deductions 2016 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1040-deductions-2016-1024x883.jpg

Itemized Tax Deduction Worksheet Oaklandeffect Deductions Db excel

https://db-excel.com/wp-content/uploads/2019/09/itemized-tax-deduction-worksheet-oaklandeffect-deductions.png

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/2015-itemized-tax-deduction-worksheet-printable_449272.png

While many out of pocket medical bills are deductible you have two hurdles to overcome before you can benefit from claiming medical bills on your federal If you itemize deductions and you have unreimbursed expenses for necessary medical or dental care you may be able to claim a tax deduction if they

Key takeaways If you itemize deductions you can deduct unreimbursed medical and dental expenses that exceed 7 5 of your adjusted gross income AGI You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical

What Is A Tax Deduction Definition Examples Calculation

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Capture349.jpg?w=2048&ssl=1

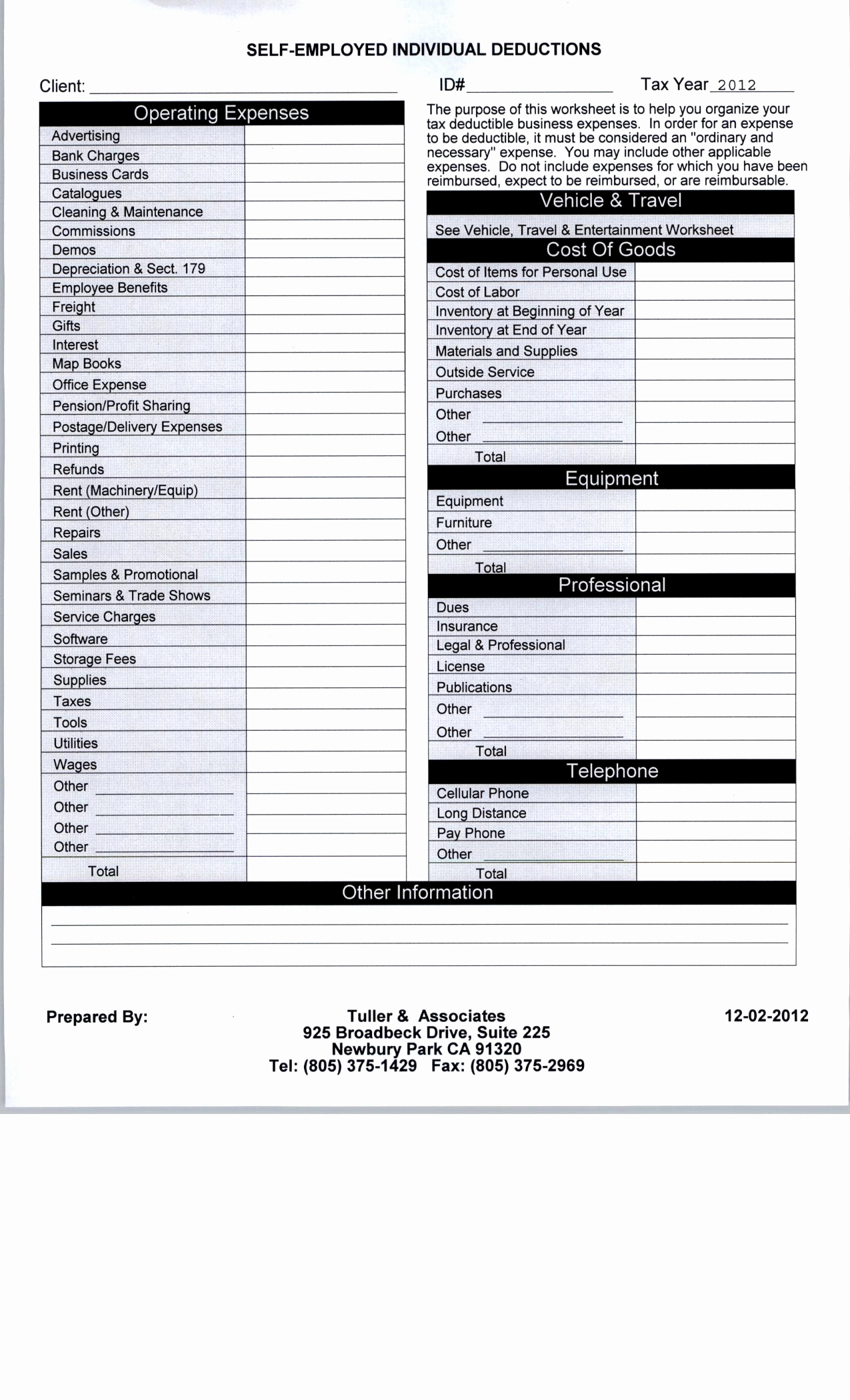

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/04/self-employed-tax-deductions-worksheet.jpg

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This

https://www.nerdwallet.com/article/taxes/medical...

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross

Pin Di Worksheet

What Is A Tax Deduction Definition Examples Calculation

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

The Master List Of All Types Of Tax Deductions infographic Free

Printable Itemized Deductions Worksheet

Deductions Worksheet Fill Online Printable Fillable Blank PdfFiller

Deductions Worksheet Fill Online Printable Fillable Blank PdfFiller

Business Expense Spreadsheet For Taxes New Self Employed Tax And

[img_title-15]

[img_title-16]

Medical Expense Deduction Federal Income Tax - This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in