Medical Expenses Income Tax Exemption Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

Medical Expenses Income Tax Exemption

Medical Expenses Income Tax Exemption

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

All You Need To Know About Claiming Medical Expenses On Your Personal

https://www.dmtax.ca/wp-content/uploads/2022/12/medical-expenses.jpg

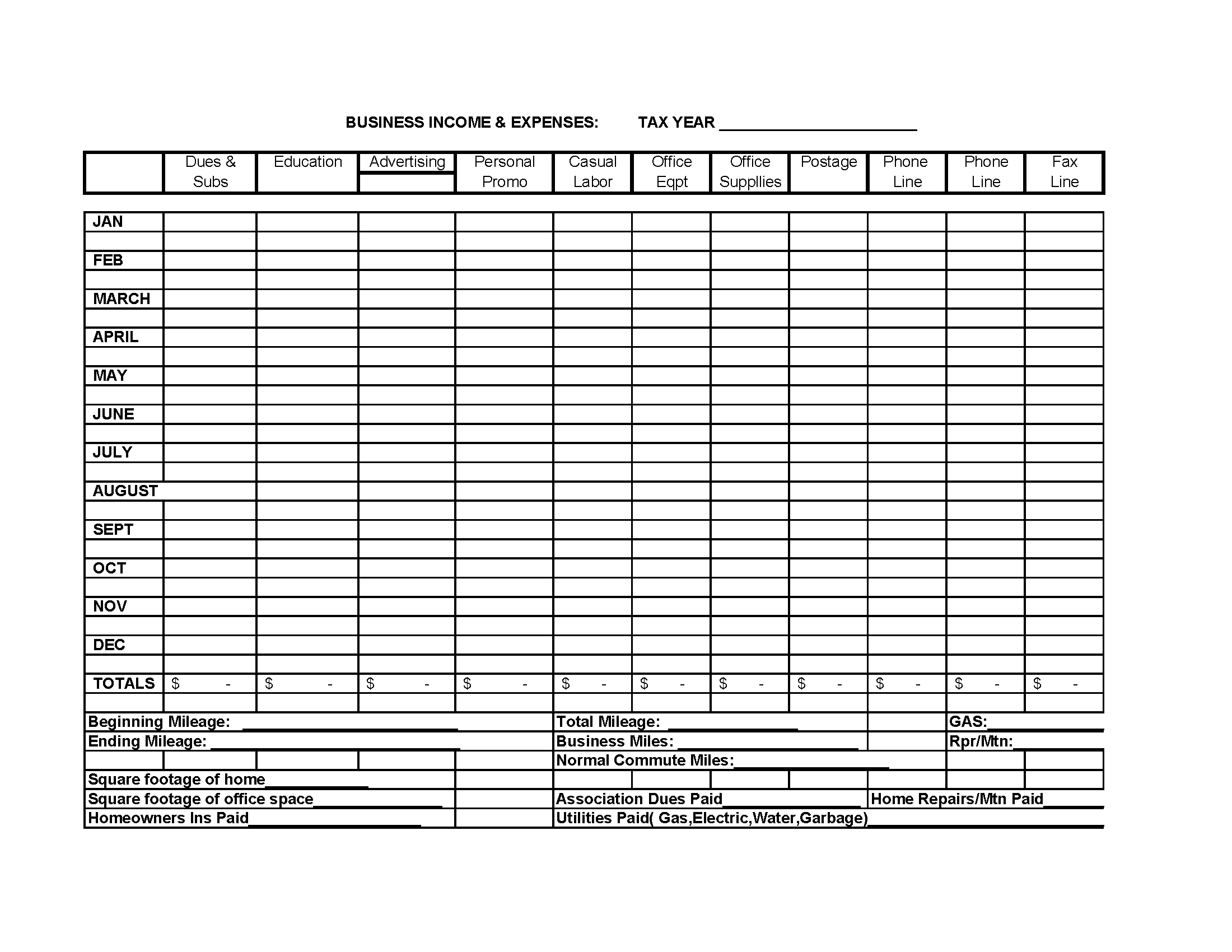

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related To claim deduction under Section 80DD you will need to submit a certificate in Form 10IA attested by medical authority This certificate is for certifying the person

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040

Download Medical Expenses Income Tax Exemption

More picture related to Medical Expenses Income Tax Exemption

Claim 80D Deduction On Medical Expenses Income Tax Act Senior

https://i.ytimg.com/vi/nf0AjBPfoT0/maxresdefault.jpg

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/business-income-expense-spreadsheet-template_449267.png

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens

You can raise a claim of up to Rs 75 000 in a single financial year under Section 80DD of the Income Tax Act on the medical expenses incurred while getting a Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Get More Tax Exemptions For Income Tax In Malaysia IMoney

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020-768x2384.png

https://economictimes.indiatimes.com…

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are

https://tax2win.in/guide/section-80d-ded…

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance

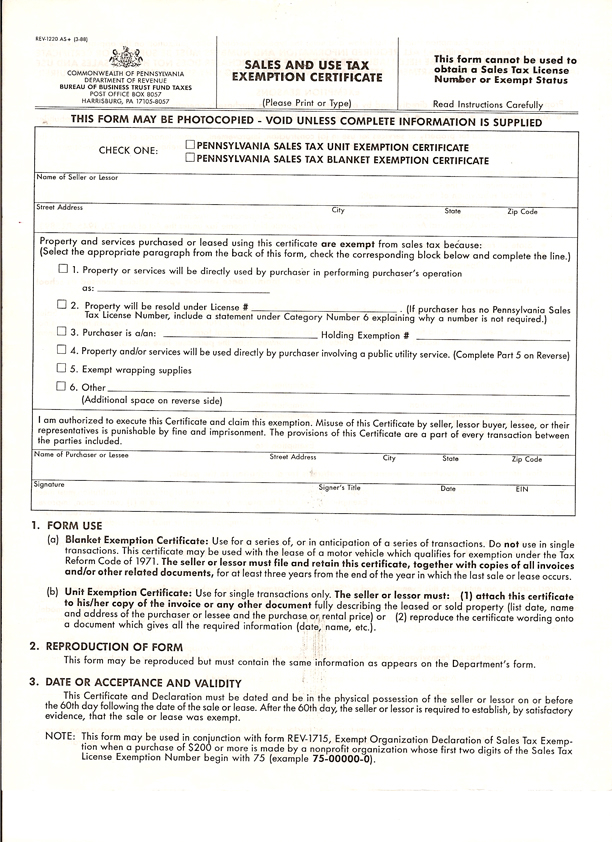

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

Preventive Check Up 80d Wkcn

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

All You Need To Know On Exempted Income In Income Tax Ebizfiling

Medical Expenses And Taxes What Can You Claim Filing Taxes

Medical Expenses And Taxes What Can You Claim Filing Taxes

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

What Is The Difference Between Tax Expense And Taxes Payable

Income Tax Benefits On National Pension Scheme All You Need To Know

Medical Expenses Income Tax Exemption - You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related