Medical Expenses Income Tax Rebate Web 24 oct 2022 nbsp 0183 32 For this section the medical expenses that you can claim for serious diseases include the treatment of Acquired Immune Deficiency Syndrome AIDS

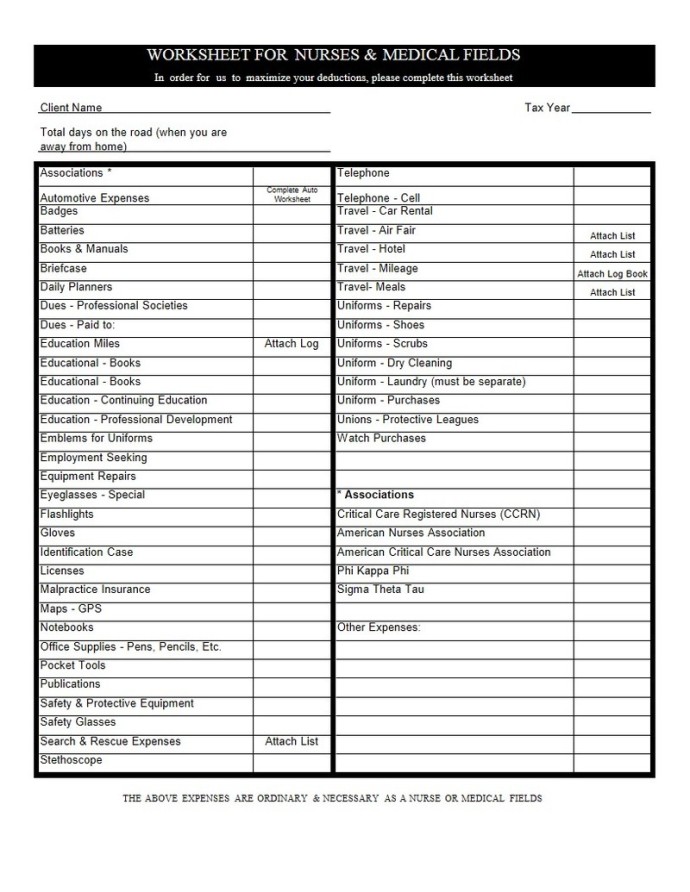

Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self

Medical Expenses Income Tax Rebate

Medical Expenses Income Tax Rebate

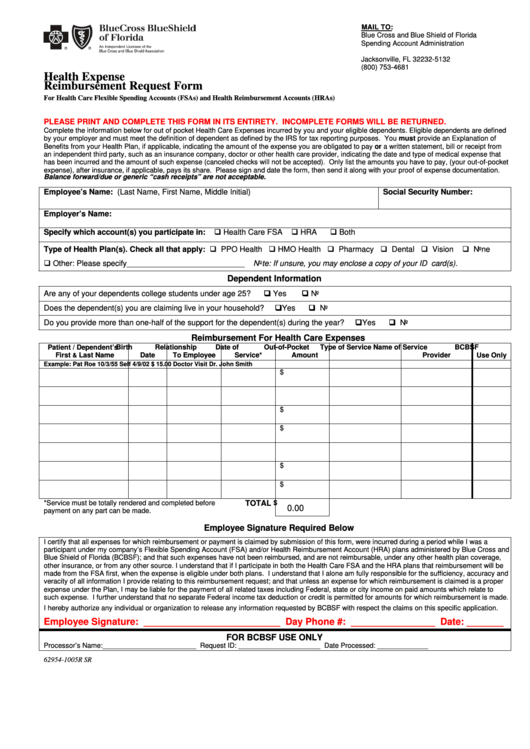

https://data.formsbank.com/pdf_docs_html/236/2364/236477/page_1_thumb_big.png

Http www anchor tax service financial tools deductions medical

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

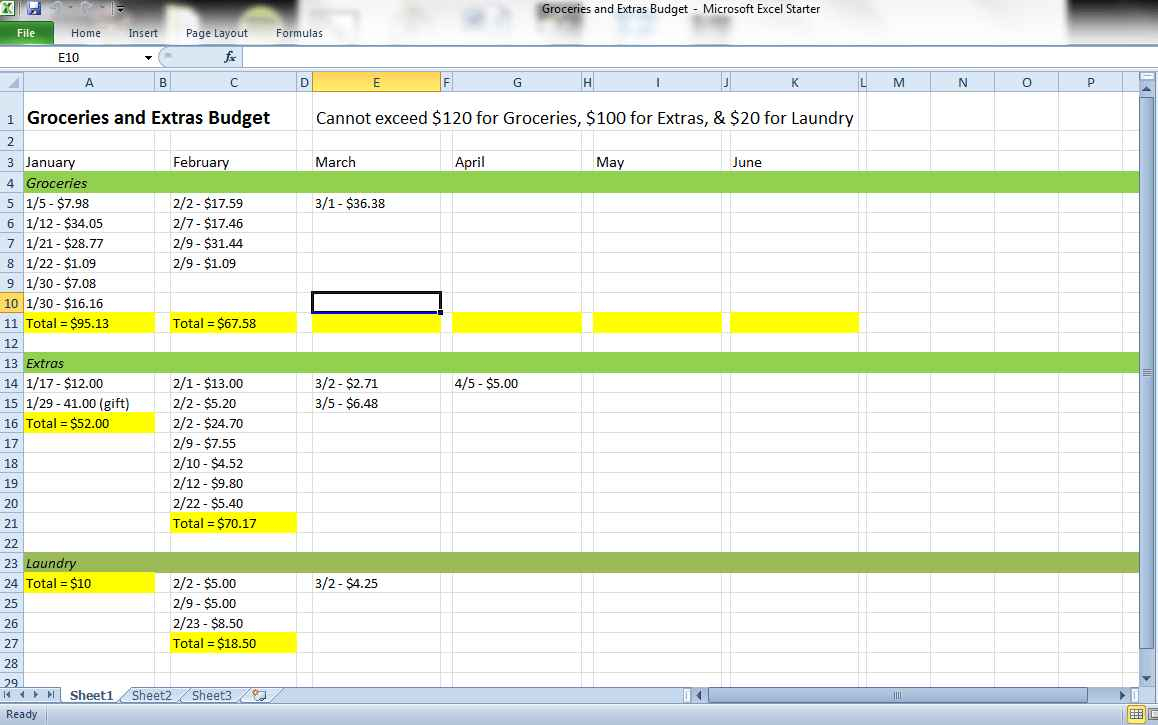

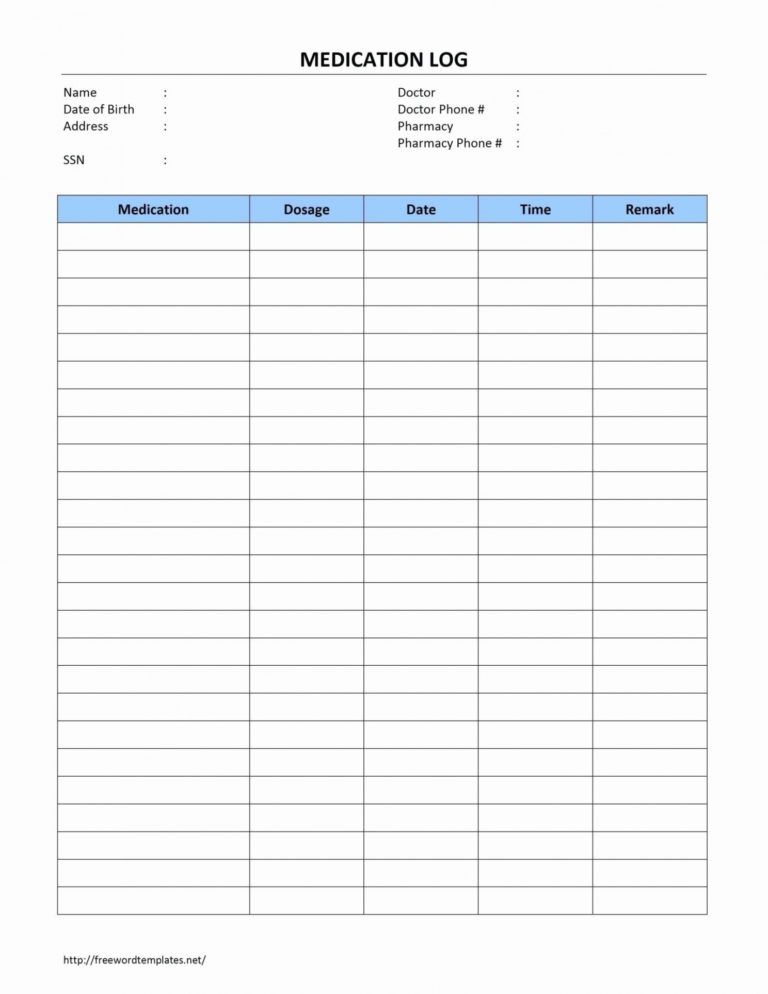

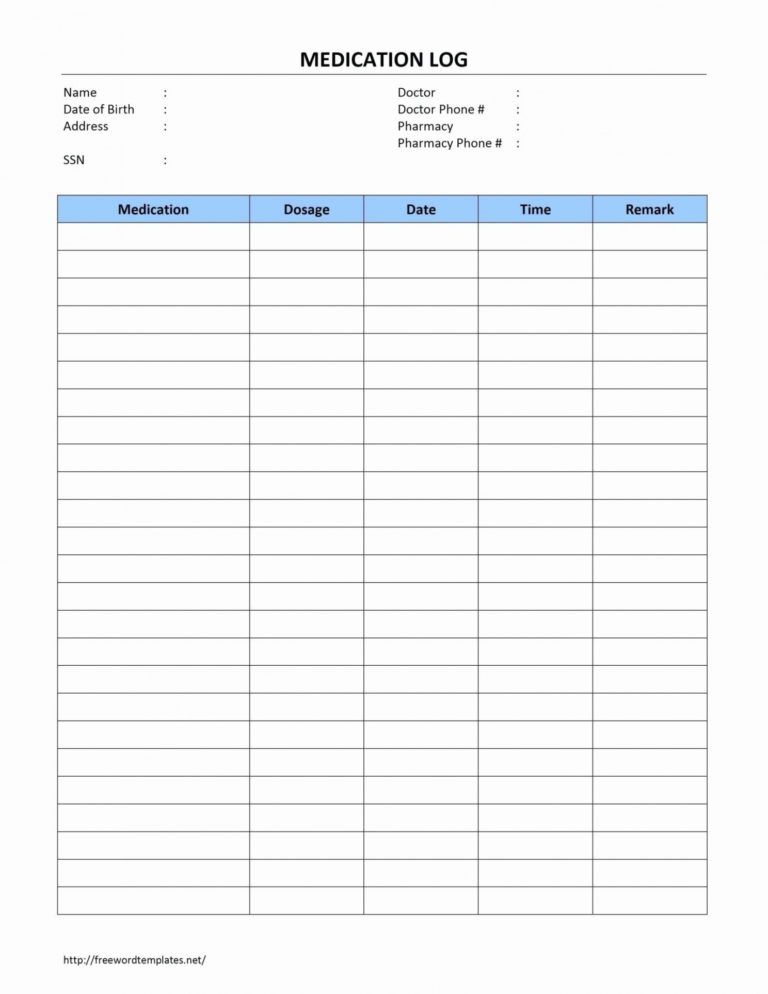

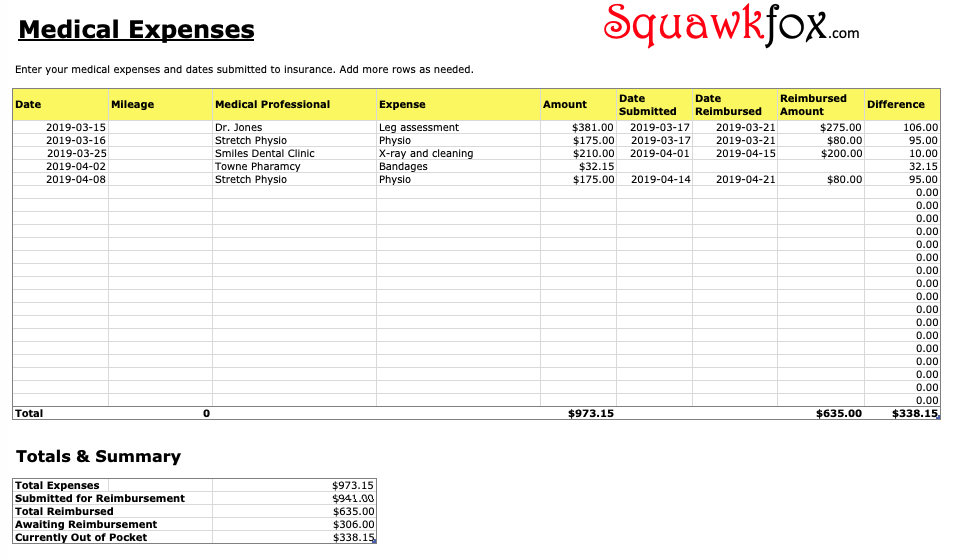

Keep Track Of Medical Expenses Spreadsheet Db excel

https://db-excel.com/wp-content/uploads/2019/01/keep-track-of-medical-expenses-spreadsheet-regarding-track-expenses-and-keep-track-of-medical-expenses-spreadsheet.jpg

Web 16 ao 251 t 2023 nbsp 0183 32 Rates Tax relief on medical and health expenses is given at the standard rate of 20 However tax relief on nursing home expenses can be claimed at your Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a

Web 20 sept 2020 nbsp 0183 32 If any of your family members is a person with disability you may claim deductions on medical expenditures irrespective of his her age Deductions up to Rs Web 12 juin 2020 nbsp 0183 32 1 Income Tax treatment in case of self financed medical expenses In case of self financed medical expenses i e from own source there is no income to the person who has incurred expenses

Download Medical Expenses Income Tax Rebate

More picture related to Medical Expenses Income Tax Rebate

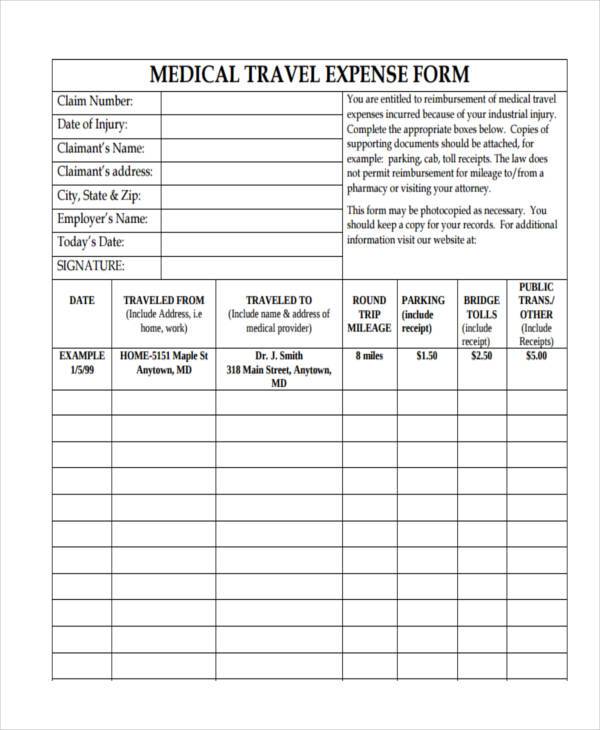

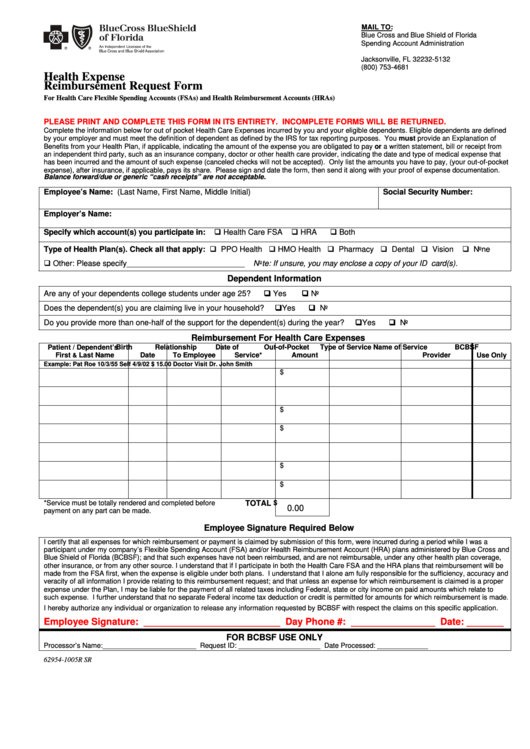

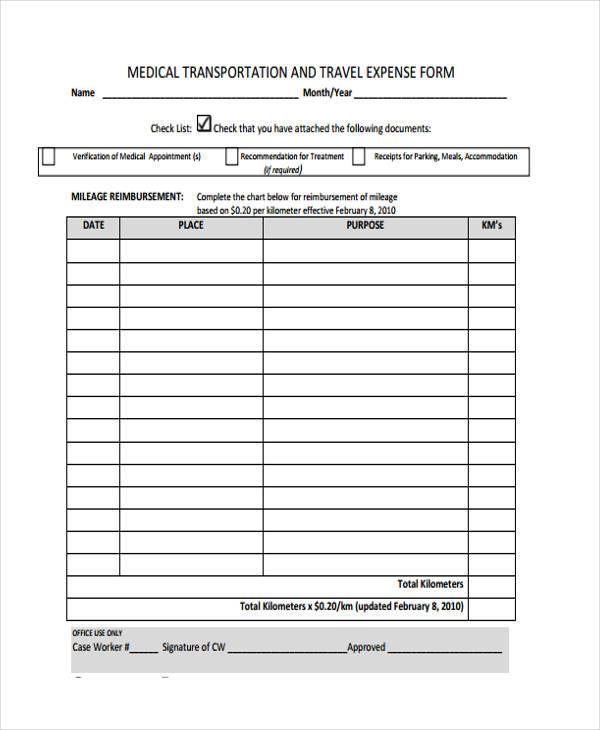

FREE 11 Medical Expense Forms In PDF MS Word

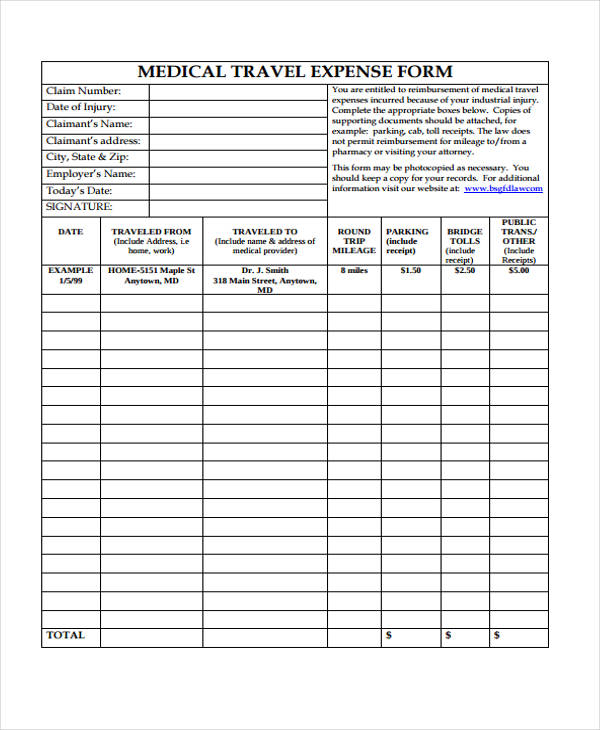

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Travel-Expense-Form.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Schedule A Medical Expenses Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-worksheet-home-design-ideas-home.jpg

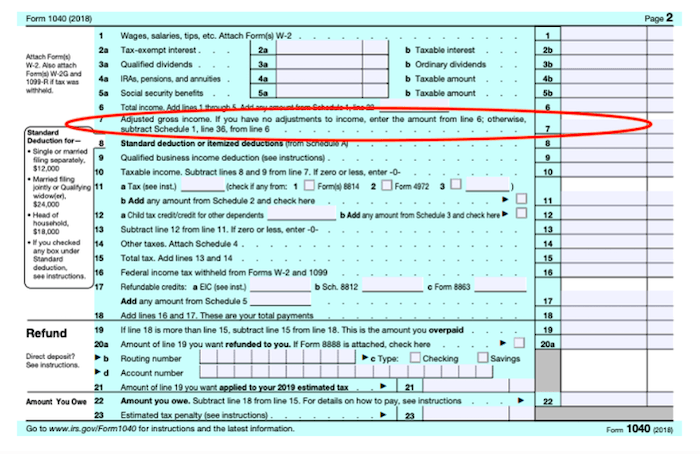

Web 12 f 233 vr 2023 nbsp 0183 32 Key Takeaways In 2022 the IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your Web If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross income You can deduct the cost of

Web 31 oct 2020 nbsp 0183 32 Section 80DDB Section 80DDB of the Income Tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

Printable Excel Spreadsheet For Medical Expenses To Track Template

https://wssufoundation.org/wp-content/uploads/2020/12/printable-excel-spreadsheet-for-medical-expenses-to-track-template-medical-expense-log-template-doc-768x994.jpg

FREE 44 Expense Forms In PDF MS Word Excel

https://images.sampleforms.com/wp-content/uploads/2017/03/Medical-Travel-Expense-Form1.jpg

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

Web 24 oct 2022 nbsp 0183 32 For this section the medical expenses that you can claim for serious diseases include the treatment of Acquired Immune Deficiency Syndrome AIDS

https://www.indiafilings.com/learn/income-tax-deduction-medical-expenses

Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

Printable Excel Spreadsheet For Medical Expenses To Track Template

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Taxes From A To Z 2019 M Is For Medical Expenses

Can I Claim Medical Expenses Without Receipts

Reba Dixon Is A Fifth grade School Teacher Who Earned A Salary Of

Reba Dixon Is A Fifth grade School Teacher Who Earned A Salary Of

Medical Expense Template Megiaaume

2007 Tax Rebate Tax Deduction Rebates

Printable Itemized Deductions Worksheet Customize And Print

Medical Expenses Income Tax Rebate - Web 13 f 233 vr 2019 nbsp 0183 32 In case 1 as no reimbursement is received by you either from the employer or insurer therefore from Rs 60 000 expenditure you can claim a maximum deduction