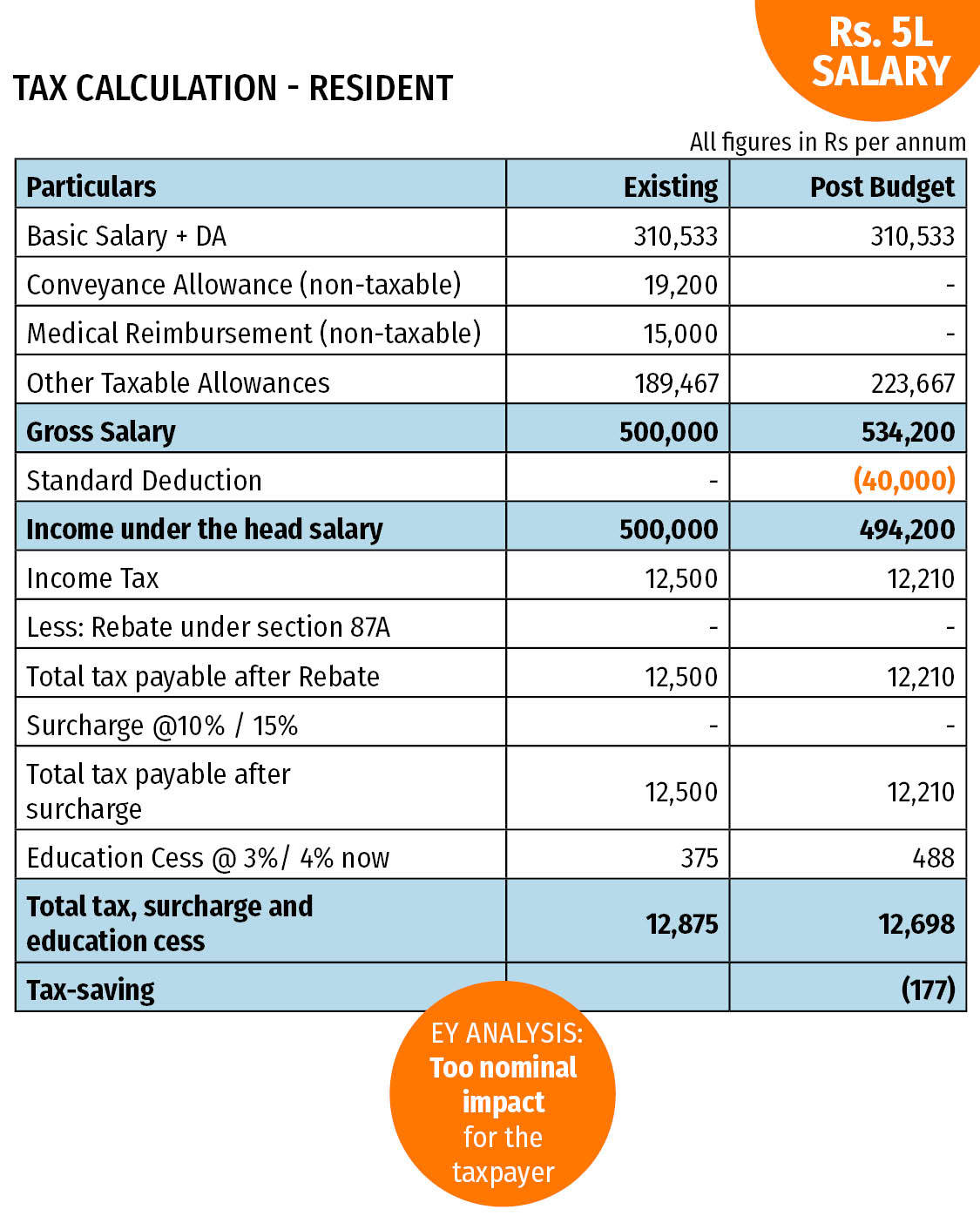

Medical Expenses Tax Deduction India As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn

Medical Expenses Tax Deduction India

Medical Expenses Tax Deduction India

https://i.ytimg.com/vi/JJk66LUeodE/maxresdefault.jpg

Can I Deduct Medical Expenses On My Tax Return SKP Advisors

https://skpadvisors.com/wp-content/uploads/2022/01/Medical-expenses_rsz.jpg

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

https://i.pinimg.com/originals/27/f7/8f/27f78f785ee4e5bf3dc13c6451ad6ed4.jpg

The medical expenditure incurred by an employer for an employee or on family members with respect to certain diseases and ailments as specified in Rule 3A of the Income Tax Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if

Download Medical Expenses Tax Deduction India

More picture related to Medical Expenses Tax Deduction India

Can You Claim A Tax Deduction For Medical Expenses OVLG

https://www.ovlg.com/sites/files/uploaded_files/Can-you-claim-a-tax-deduction-for-medical-expenses.jpg

How To Claim The Medical Expense Deduction On Your Taxes

https://cdn.aarp.net/content/dam/aarp/money/taxes/2019/03/1140-medical-expenses.jpg

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914496/resident_gti_5l_salary-std-ded.jpg

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children Claiming Tax Deductions on Medical Expenses Given the increasing cost of medical care in India it is imperative that all salaried individuals remain aware of avenues to enjoy tax

Explore Section 80DDB of the Income Tax Act in India your guide to deductions for medical expenses Learn eligibility deduction limits documentation more Section 80D All about tax deductions available for senior citizens on medical expenses made Know your eligibility for tax benefits limits mode of payment

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

Can We Claim Medical Expenses Tax Return In India Tax Walls

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

https://cleartax.in/s/income-tax-benefit-employee...

As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

Qualified Business Income Deduction And The Self Employed The CPA Journal

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

How Does Tax Deduction Work In India Tax Walls

Medical Expenses Tax Deduction YouTube

Medical Expenses Tax Deduction Ppt Powerpoint Summary Example Topics

How Much Is The Medical Expenses Tax Deduction Home Biz Tax Lady

How Much Is The Medical Expenses Tax Deduction Home Biz Tax Lady

Income Tax Deduction For Medical Expenses

WSJ Tax Guide 2019 Medical Expenses Deduction WSJ

Standard Business Deduction 2022 Home Business 2022

Medical Expenses Tax Deduction India - Section 80DDB of the Income Tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax