Medical Expenses Tax Deduction South Africa This means that your contributions to a medical aid as well as a portion of your qualifying expenses certain medical related spend is converted to a tax credit which is deducted from your overall tax liability the amount of tax you have to pay SARS

A tax credit is a non refundable rebate This means that a portion of your qualifying expenses in this case medical related spend is converted to a tax credit which is deducted from your overall tax liability the amount of tax you have to pay SARS A Medical Scheme Fees Tax Credit also known as an MTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person pays

Medical Expenses Tax Deduction South Africa

Medical Expenses Tax Deduction South Africa

https://financegourmet.com/blog/wp-content/uploads/2021/11/adjusted-gross-income.jpg

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Historically South Africa utilised a deduction system to facilitate tax relief for medical expenditure Allowances subject to certain limits were permitted to be deducted from income Use our medical aid credits calculator to work out how much of your medical spending you can claim back from tax

This guide provides general guidelines regarding the deductibility of medical expenses for income tax purposes It does not delve into the precise technical and legal detail that is often associated with tax and should therefore not be used as a legal All registered South African taxpayers can claim back for qualifying medical expenses that are not covered by their health insurance plans Bloom s MediTax consultations can assist you with the collation of all your documents that prove these medical expenses and will submit basic tax returns on your behalf provided your membership fees are

Download Medical Expenses Tax Deduction South Africa

More picture related to Medical Expenses Tax Deduction South Africa

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Canada

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

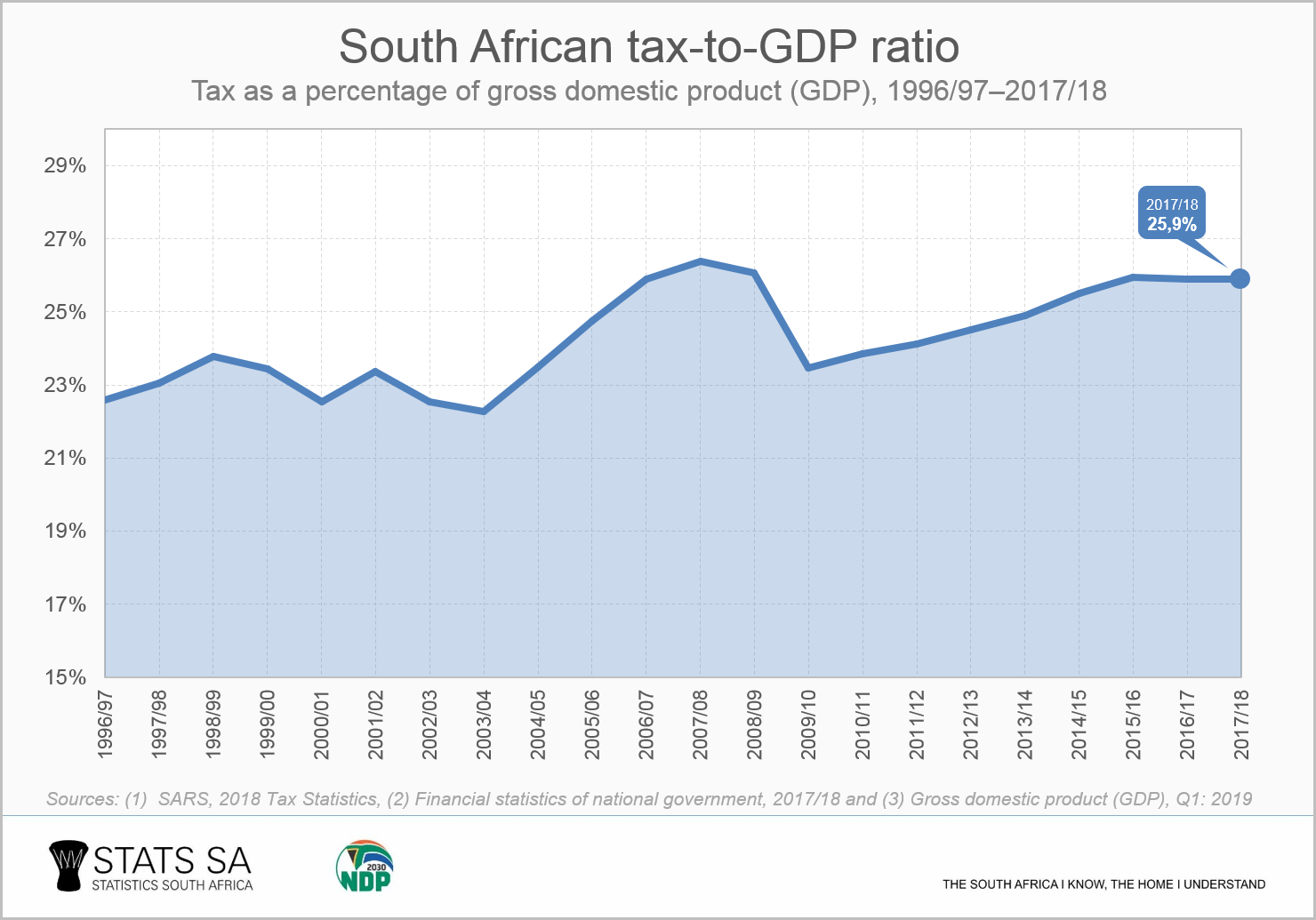

How Much Tax Money Is There Per Year In Sa Davis Thaverom67

https://www.statssa.gov.za/wp-content/uploads/2019/06/pie3.png

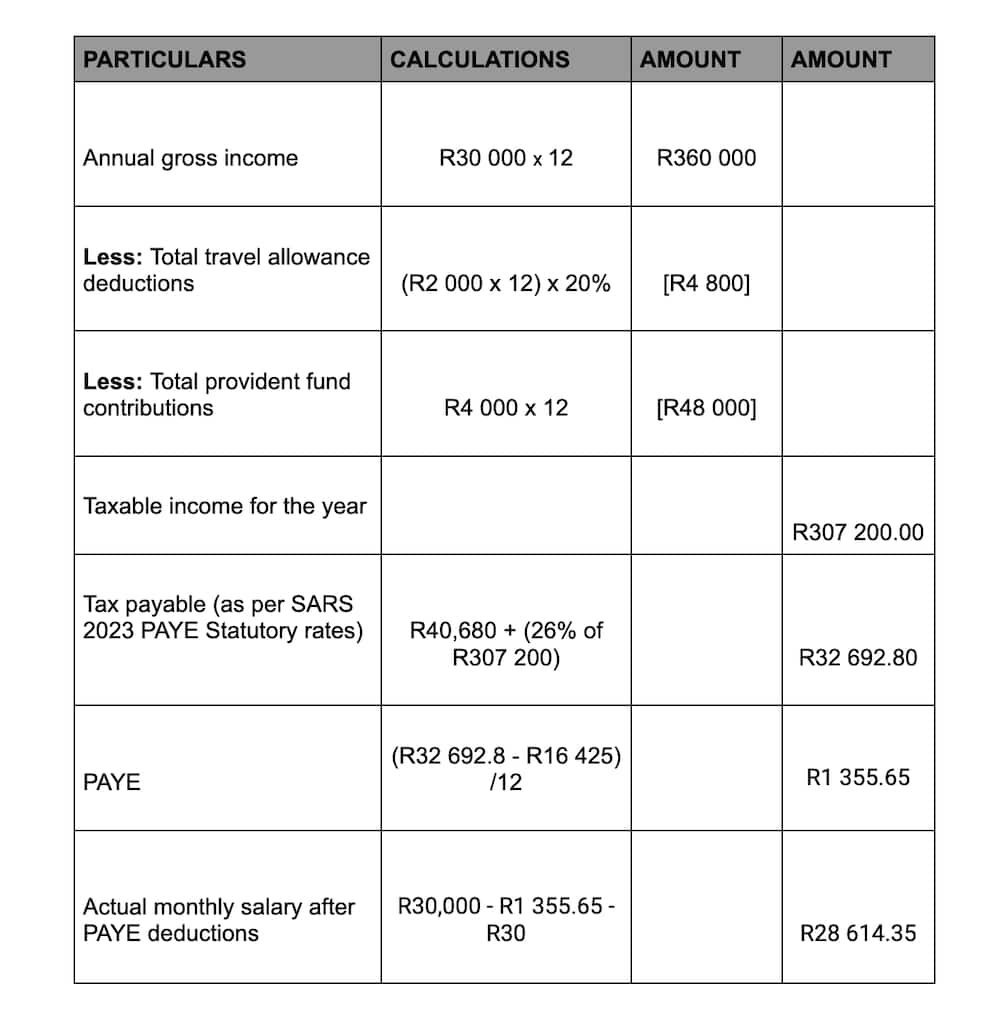

Income Tax In South Africa The Ultimate Guide Online Accountant

https://accountantonline.co.za/wp-content/uploads/2023/07/income-tax-return-deduction-refund-concept.webp

Effective 1 March 2012 South Africa applies has a tax credit system whereby relief for medical expenditure is granted as a reduction when determining the tax payable to the South African Revenue Service SARS In terms of paragraph 12B of the Seventh Schedule to the Income Tax Act medical expenses not contributions paid by the employer on behalf of the employee is a taxable benefit The value of the amount paid by the employer must be completed under codes 3813 benefit and 4024 medical expenses

A tax bill Historically South Africa utilised a deduction system to facilitate tax relief for medical expenditure Allowances subject to certain limits were permitted to be deducted from income for contributions to medical schemes as well as This is a complete guide to medical aid tax credit in South Africa In this in depth guide you ll learn What is medical aid tax credit What are the SARS medical tax credits How does SARS eFiling work How do you calculate your medical aid tax credit When should you submit your medical aid tax

How Much Is The Medical Expenses Tax Deduction Https homebiztaxlady

https://i.pinimg.com/736x/fe/e3/7f/fee37fa0f435990244736be3da81feb1.jpg

:max_bytes(150000):strip_icc()/GettyImages-1369691789-60f2d1e7c76c48af92a0dd9112f881dd.jpg)

Tax Deduction Tables 2017 South Africa Brokeasshome

https://www.thebalancemoney.com/thmb/6NAA0t1hf_qWk2lig-JFrbisYfc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-1369691789-60f2d1e7c76c48af92a0dd9112f881dd.jpg

https://www.taxtim.com/za/guides/medical-expenses-tax

This means that your contributions to a medical aid as well as a portion of your qualifying expenses certain medical related spend is converted to a tax credit which is deducted from your overall tax liability the amount of tax you have to pay SARS

https://www.taxtim.com/za/blog/what-medical...

A tax credit is a non refundable rebate This means that a portion of your qualifying expenses in this case medical related spend is converted to a tax credit which is deducted from your overall tax liability the amount of tax you have to pay SARS

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

How Much Is The Medical Expenses Tax Deduction Https homebiztaxlady

Are You Eligible For A Medical Expense Tax Deduction Reis Reis

Qualified Business Income Deduction And The Self Employed The CPA Journal

Sars Monthly Income Tax Tables 2022 Brokeasshome

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

How To Make A Payslip In Excel South Africa Printable Form Templates

Medical Deduction Thresholds For 2023 And 2024 Important Update EIN

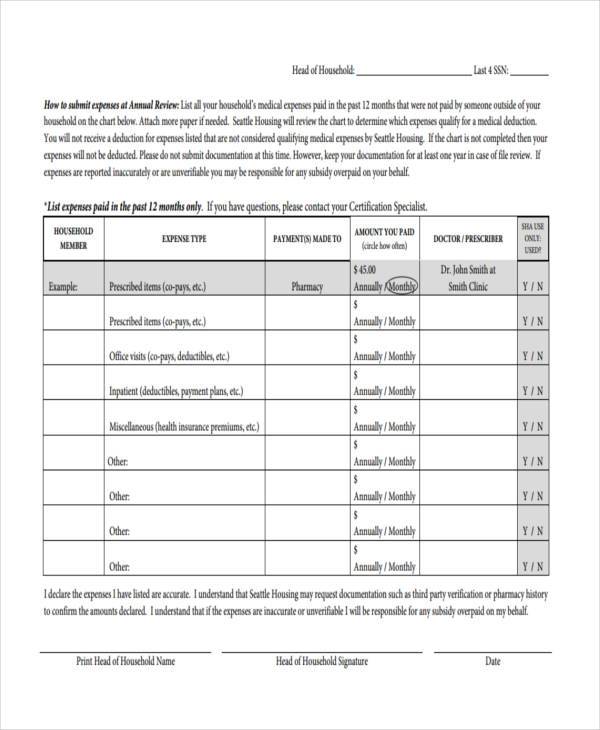

FREE 8 Sample Medical Expense Forms In PDF MS Word

Medical Expenses Tax Deduction South Africa - The first step is ensuring your medical expenses qualify for a tax deduction Generally SARS will only allow you to claim expenses related to medication hospital bills and specific specialist treatments Additionally you must have receipts or other proof of payment for all expenses to claim them on your tax return