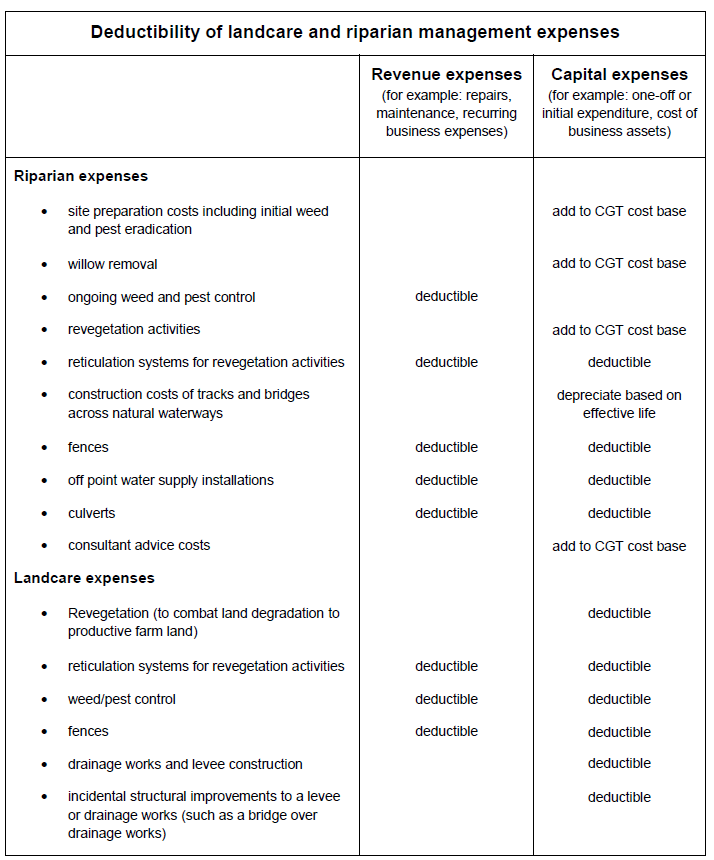

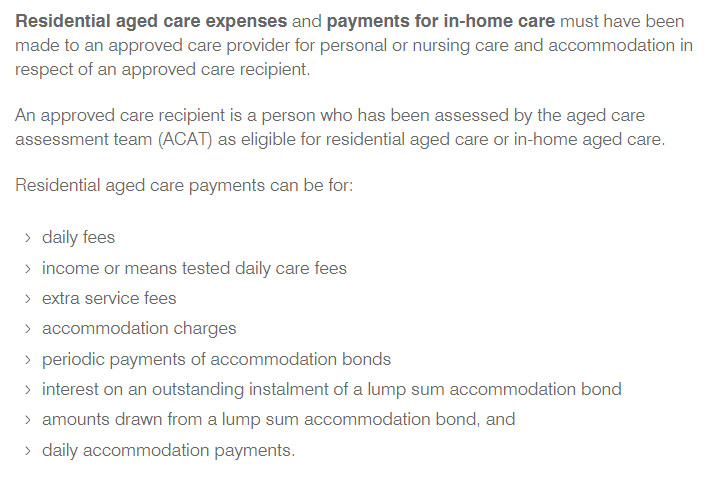

Medical Expenses Tax Rebate Web You could claim the medical expenses tax offset for net eligible expenses relating to disability aids attendant care aged care Net expenses are your total eligible medical

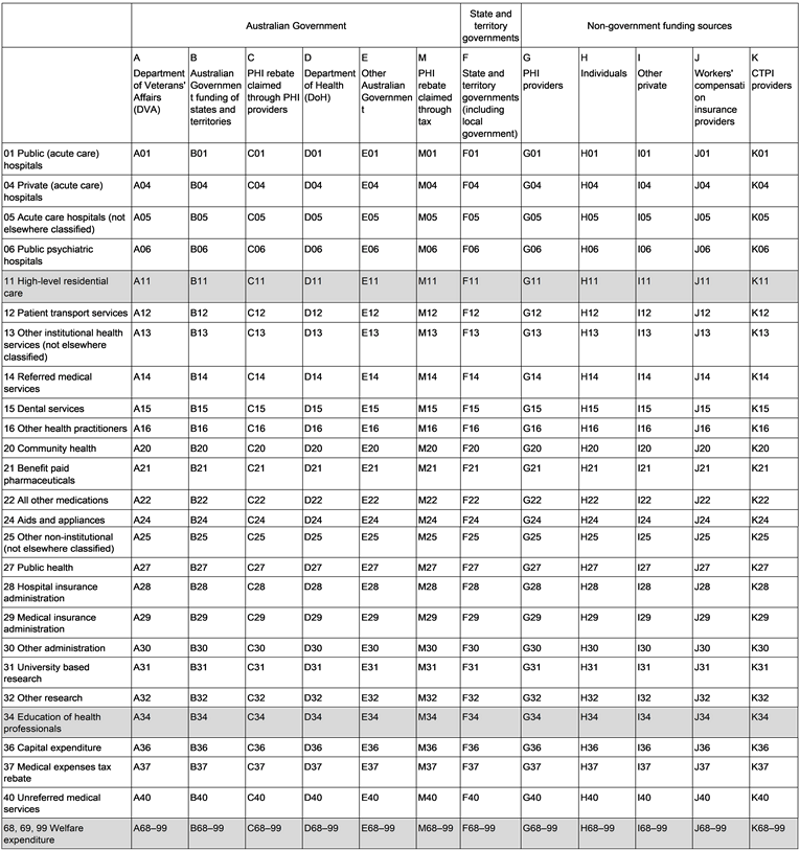

Web 24 avr 2023 nbsp 0183 32 The Ultimate Medical Expense Deductions Checklist Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 April 24 2023 11 31 AM OVERVIEW Claiming medical Web 16 ao 251 t 2023 nbsp 0183 32 Rates How to apply More information Introduction You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the

Medical Expenses Tax Rebate

Medical Expenses Tax Rebate

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

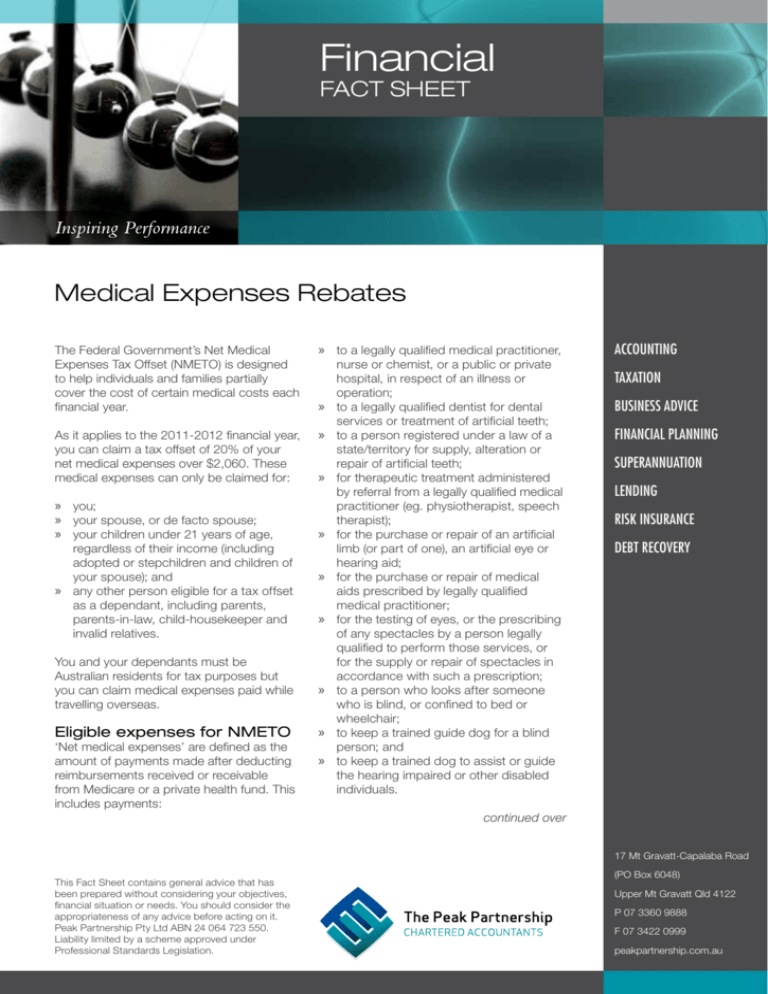

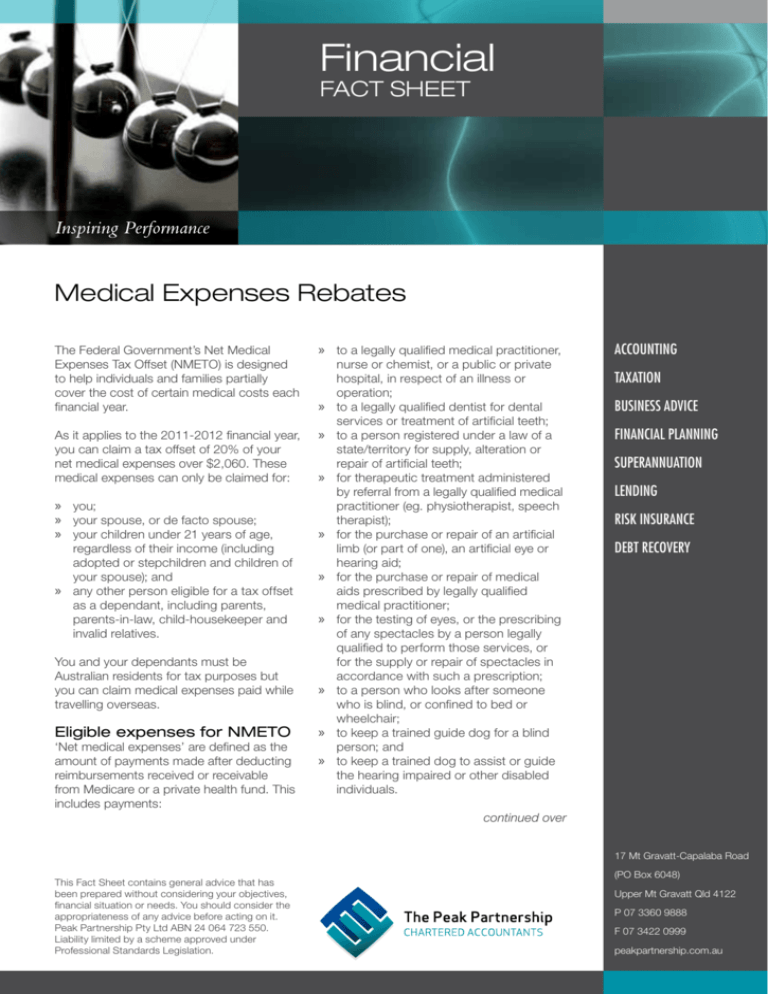

Health Expenditure Australia 2019 20 Compilation Of Health Expenditure

https://www.aihw.gov.au/getmedia/269f5024-7d7c-4760-bbf8-871d5654c2b4/HEA-table1.png.aspx

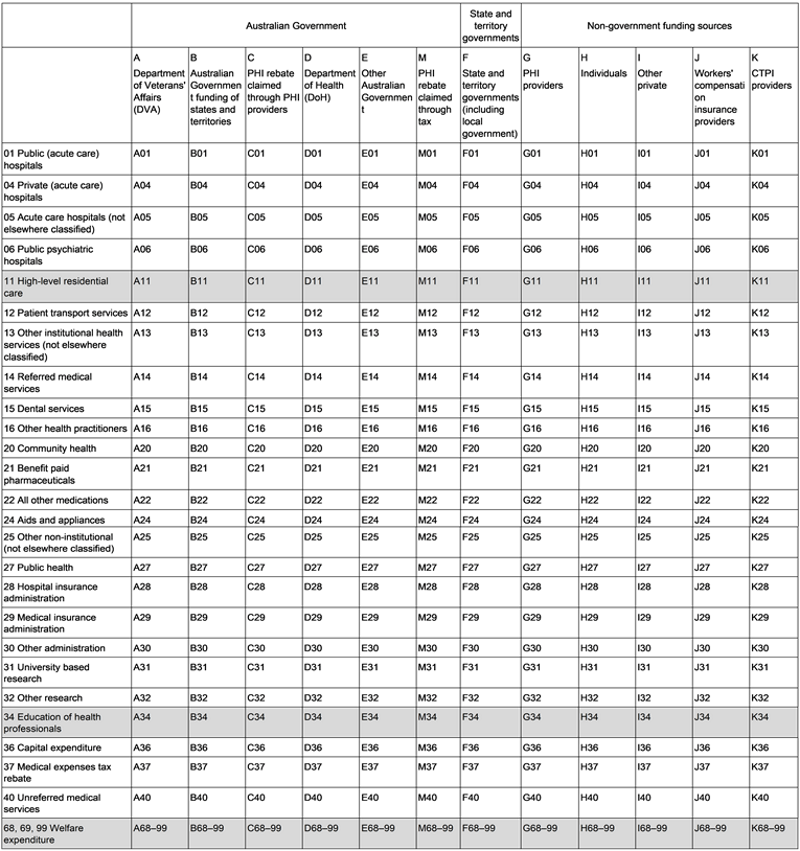

FREE 47 Claim Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2017/03/Medical-Expenses-Claim-Form2.jpg

Web How to claim medical expenses You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 Federal tax Line 33099 You can claim the total Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a

Web If medical expenses incurred for senior citizens taxpayer family and parents are not covered under any medical insurance you can claim a deduction for the said expenses Web 1 juil 2019 nbsp 0183 32 The medical expenses tax rebate is calculated as follows NMETO 2018 19 20 of eligible expenses only above the threshold of 2 377 except for higher income

Download Medical Expenses Tax Rebate

More picture related to Medical Expenses Tax Rebate

.png)

Medical Expense Deduction 2020 Ruxoler

https://uploads-ssl.webflow.com/5e57eb33765372f7d30e19f9/5e60276cf755ee1ecad92ae8_How%2520to%2520Calculate%2520Your%2520Adjusted%2520Gross%2520Income%2520(AGI).png

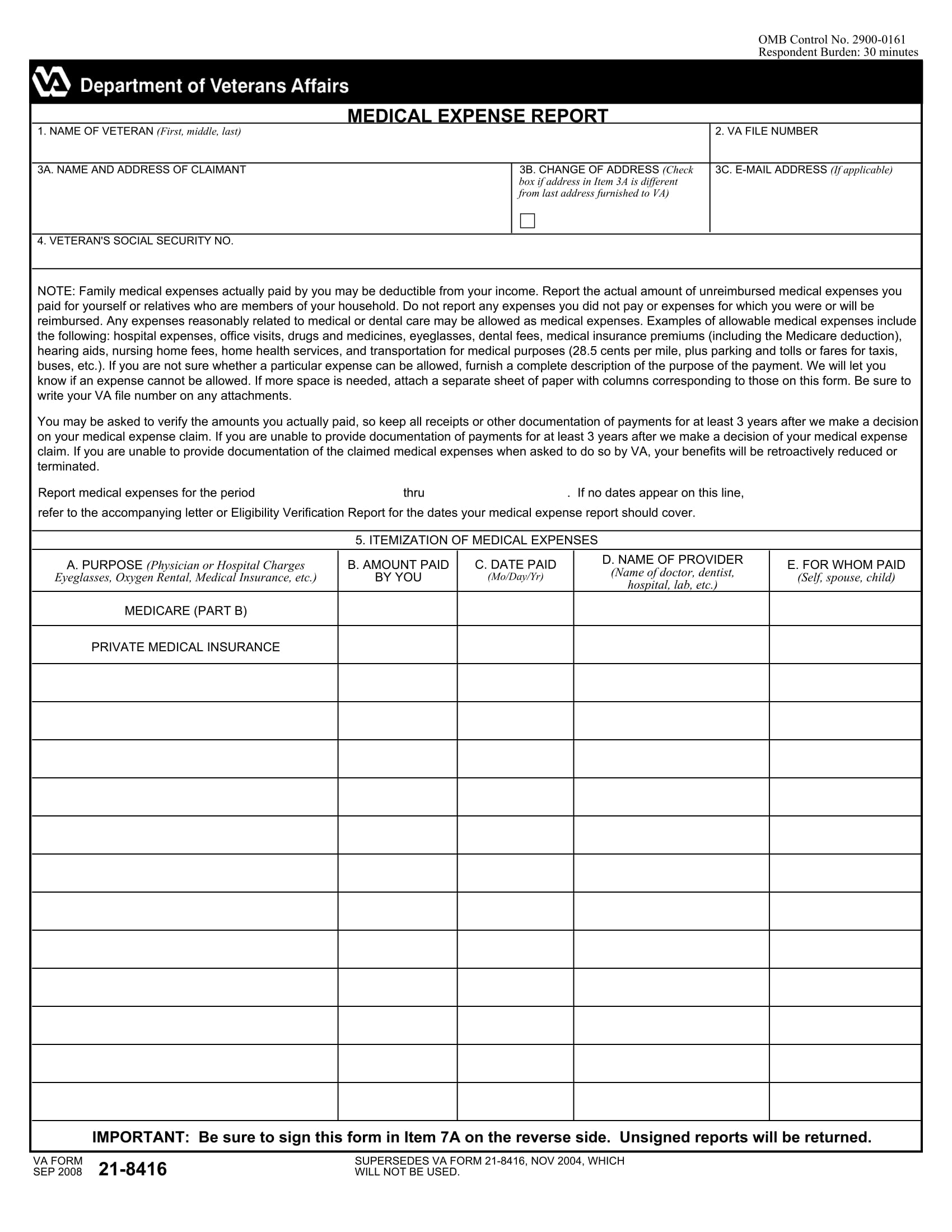

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Expense-Report-Form.jpg

EXCEL TEMPLATES Spreadsheet To Track Medical Expenses

https://i.pinimg.com/736x/0c/7a/d3/0c7ad3d0b638d7e009b3055c47d48959.jpg

Web 1 8 In 2012 13 the offset was 20 per cent of net medical expenses over 2 120 for single taxpayers with adjusted taxable income for rebates of 84 000 or less and families with Web 22 f 233 vr 2023 nbsp 0183 32 A Medical Scheme Fees Tax Credit also known as an MTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person

Web 12 f 233 vr 2023 nbsp 0183 32 This leaves you with a medical expense deduction of 2 100 5 475 minus 3 375 This amount can be included on your Schedule A Itemized Deductions As a result of the Tax Cuts and Jobs Web Find out more about the medical expenses tax offset Work out the amount of medical expenses offset you can claim for the 2015 16 to 2018 19 income years Last modified

FREE 13 Expense Report Forms In MS Word PDF Excel

https://images.sampleforms.com/wp-content/uploads/2017/11/Medical-Expense-Report-Form-1.jpg

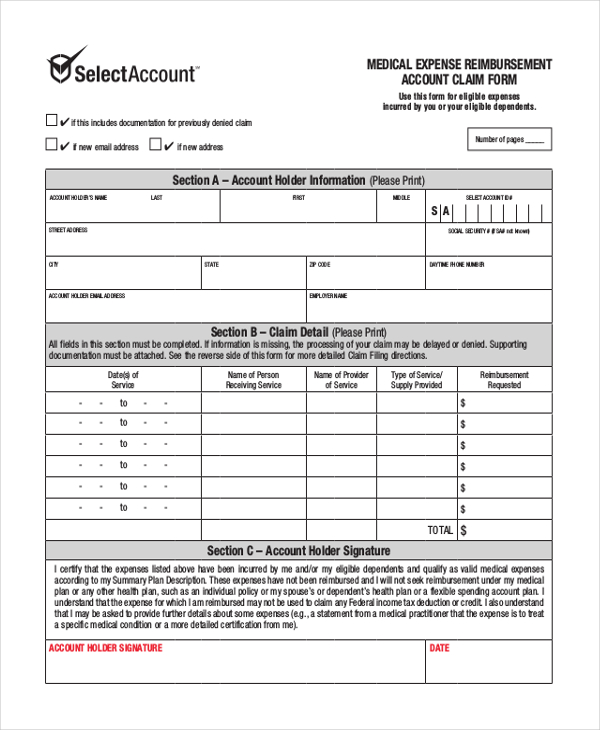

FREE 12 Sample Medical Reimbursement Forms In PDF Excel Word

https://images.sampleforms.com/wp-content/uploads/2016/08/MEDICAL-EXPENSE-REIMBURSEMENT-ACCOUNT-CLAIM-FORM.jpg

https://www.ato.gov.au/.../Tax-offsets/Medical-expenses-tax-offset

Web You could claim the medical expenses tax offset for net eligible expenses relating to disability aids attendant care aged care Net expenses are your total eligible medical

https://turbotax.intuit.com/tax-tips/health-care/…

Web 24 avr 2023 nbsp 0183 32 The Ultimate Medical Expense Deductions Checklist Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 April 24 2023 11 31 AM OVERVIEW Claiming medical

FREE 44 Expense Forms In PDF MS Word Excel

FREE 13 Expense Report Forms In MS Word PDF Excel

Australian Tax Deductions For Doctors

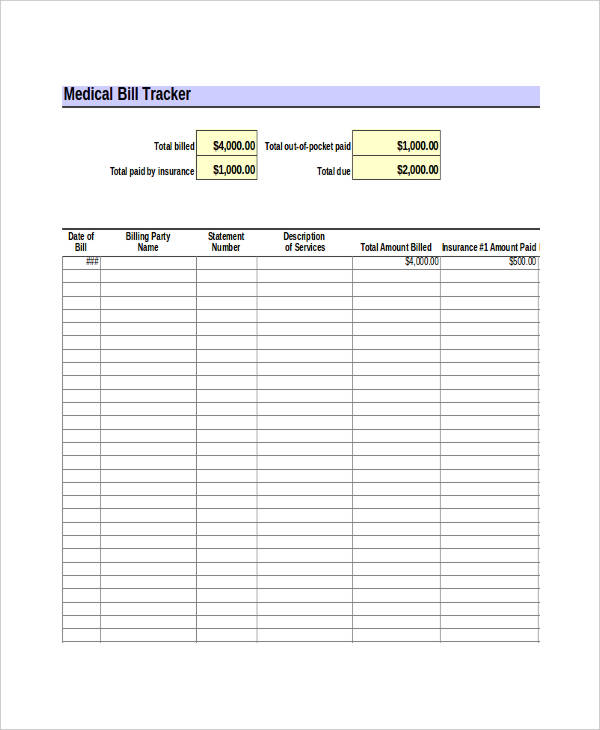

10 Patient Medical Bill Tracker Sample Excel Templates

Medical Expense Tracker Individuals Can Use This Chart To Track

Free Printable Expense Sheet

Free Printable Expense Sheet

Claiming The Medical Offset Tax Rebate

33 Expense Sheet Templates

Expense Tracker Excel Template Dopspin

Medical Expenses Tax Rebate - Web 22 f 233 vr 2023 nbsp 0183 32 Medical Tax Credit Rates for the 2019 to 2024 tax years 22 February 2023 See changes from last year Medical Tax Credit Rates for the 2013 to 2018 tax years