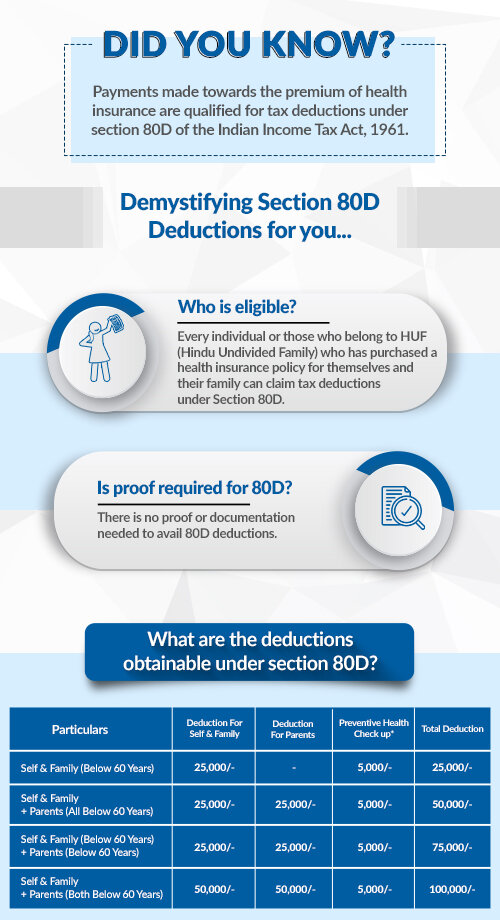

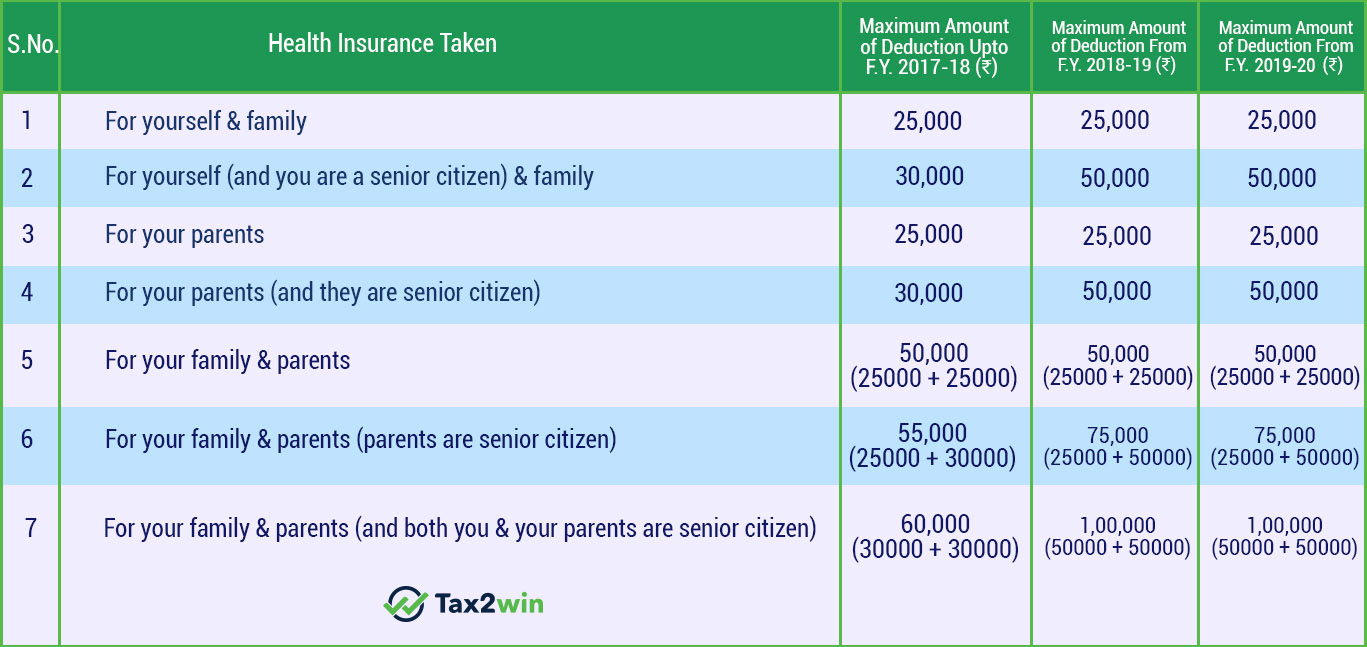

Medical Insurance Premium 80d Exemption Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the

Income Tax Department Tax Tools Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical

Medical Insurance Premium 80d Exemption

Medical Insurance Premium 80d Exemption

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Section 80D Deduction For Medical Insurance Health Checkups 2019

https://www.paisabazaar.com/wp-content/uploads/2017/04/02-5.jpg

Section 80D Deduction In Respect Of Health Or Medical Insurance

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim To maximise Section 80D benefits the person can go for a cashless OPD offering of Rs 15 000 at a premium of Rs 11 000 with GST thus saving Rs 4000 Besides getting the

Medical insurance paid to an insurance company is allowed under section 80D While medical allowance received from the employer is exempted up to Rs Section 80D of the Income tax act allows you to take tax deductions for the expenses incurred towards healthcare

Download Medical Insurance Premium 80d Exemption

More picture related to Medical Insurance Premium 80d Exemption

Section 80D Deduction Medical Insurance Premium

https://taxguru.in/wp-content/uploads/2020/09/Medical-Insurance-Premium.jpg

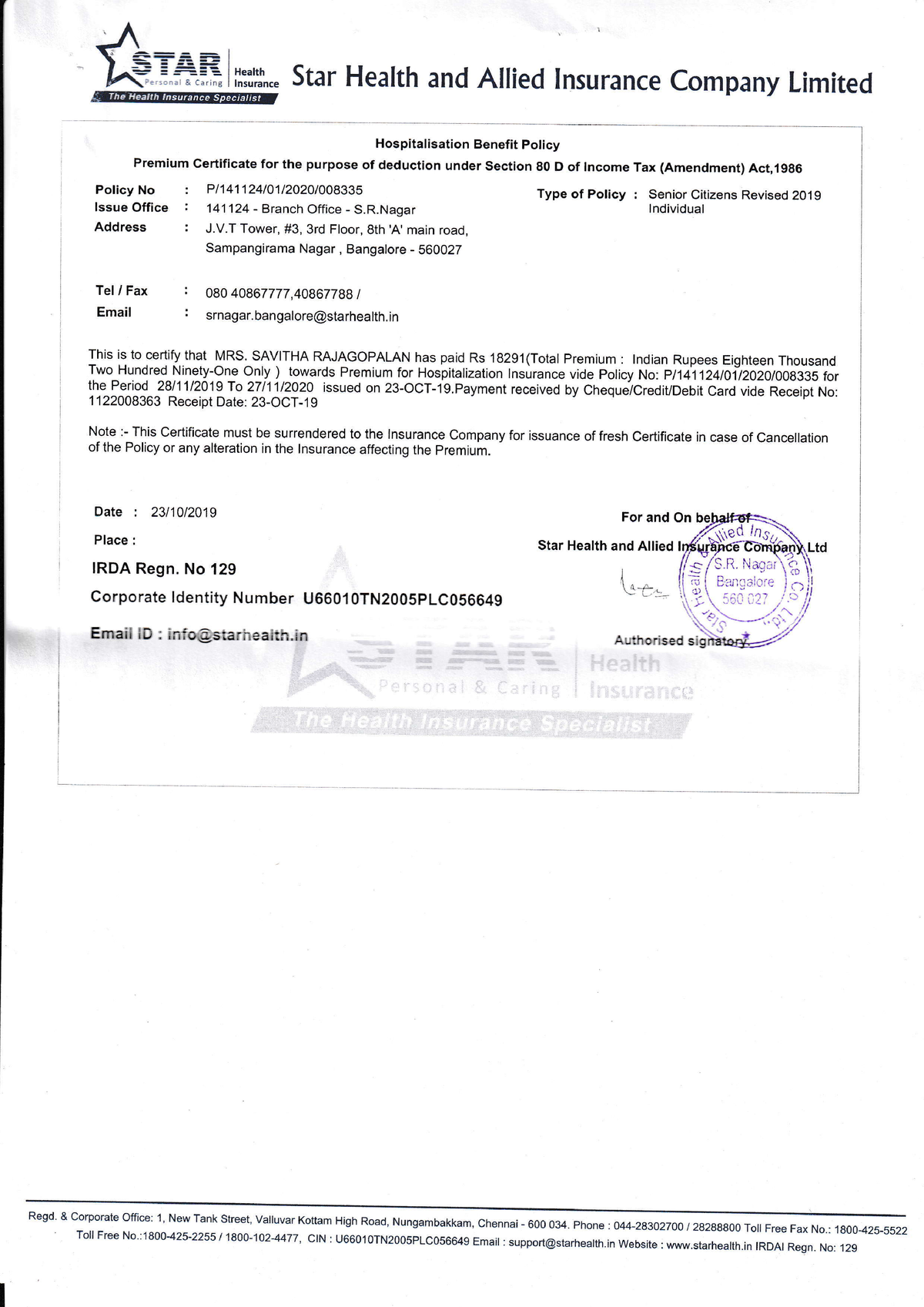

Start health insurance 80D scnal Caring Health Lnsurance Star

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f8fb6a2517e8fd7caf0b33579ee04817/thumb_1200_1697.png

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

https://imgv2-2-f.scribdassets.com/img/document/442594448/original/090873fdc7/1704447541?v=1

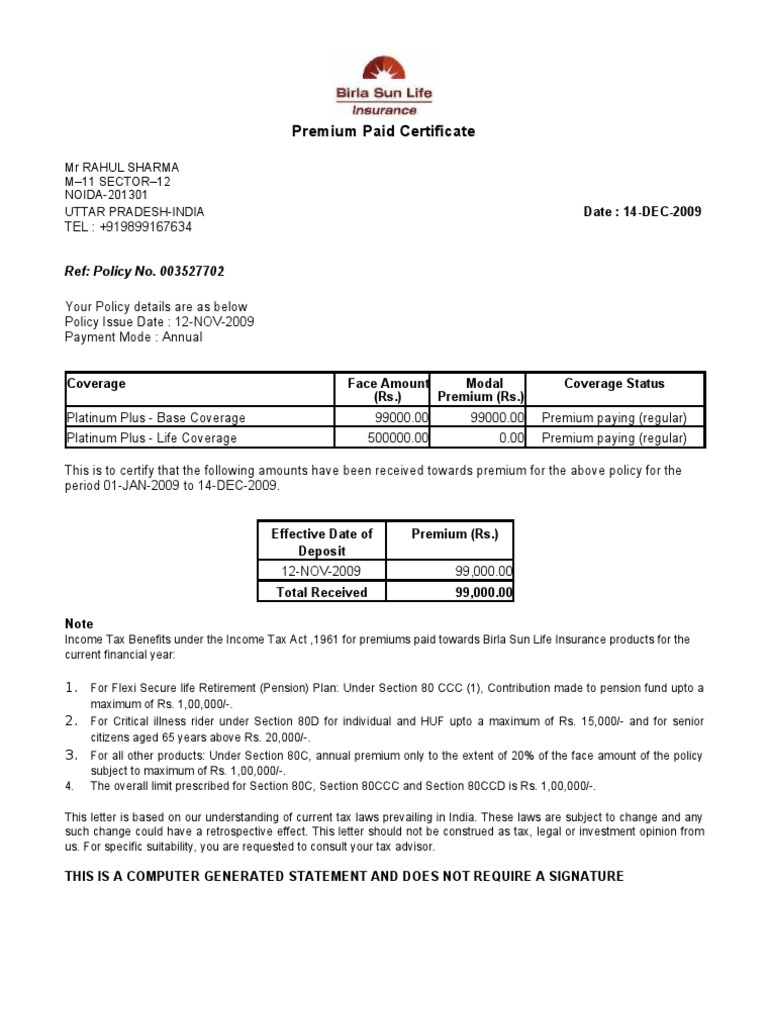

Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than cash of medical insurance premium paid by an Individual or a The Central Government of India provides provisions for taxpayers to claim deductions and benefits in respect to health insurance premium paid under Section 80D of the Income Tax Act A tax

The maximum amount of deduction that individuals can claim on health insurance policy premiums for themselves and their family members spouse Section 80D of the Income tax Act offers deduction on the health insurance premium paid during the financial year The premium must be paid for self spouse

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

https://www.policybazaar.com/health-insurance/section80d-deductions

Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Income Tax Department Tax Tools Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Premium Paid Certificate PDF

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

Nitin PDF PDF

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Anything To Everything Income Tax Guide For Individuals Including

Is Proof Required For Claiming Medical Expenses Under 80D Bajaj Allianz

Section 80D Income Tax Deduction For Medical Insurance Preventive

Medical Insurance Premium 80d Exemption - Yes Under section 80D it allows the policyholder to save tax by claiming medical insurance incurred on self spouse dependent parents as a deduction from