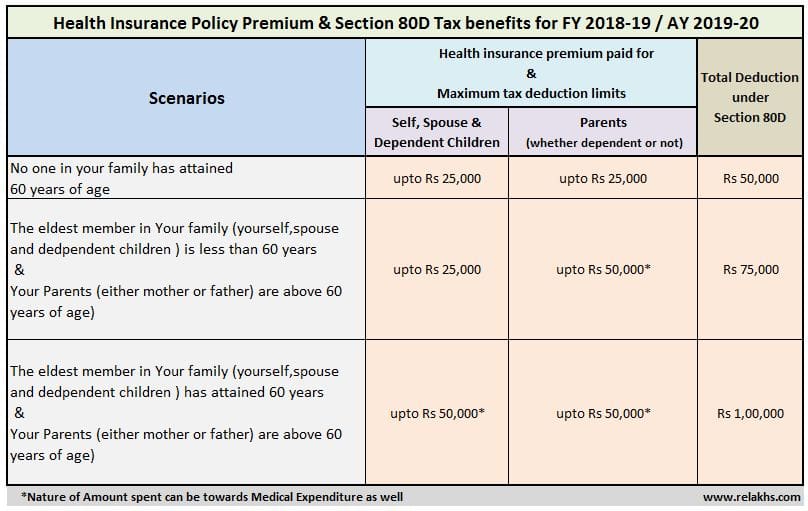

Medical Insurance Rebate In Income Tax Web 24 mars 2017 nbsp 0183 32 Income tax department with a view to encourage savings and investments amongst the taxpayers have provided various deductions from the taxable income under

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income Web 21 sept 2020 nbsp 0183 32 Section 80D Deduction Medical Insurance Premium In the present scenario due to arise of Covid 19 many people are purchasing Health Insurance

Medical Insurance Rebate In Income Tax

Medical Insurance Rebate In Income Tax

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

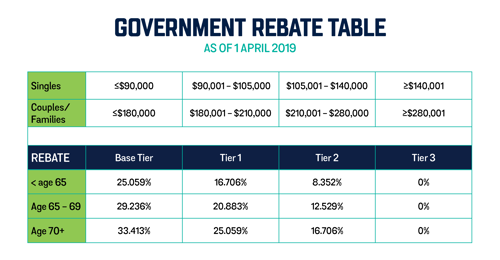

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

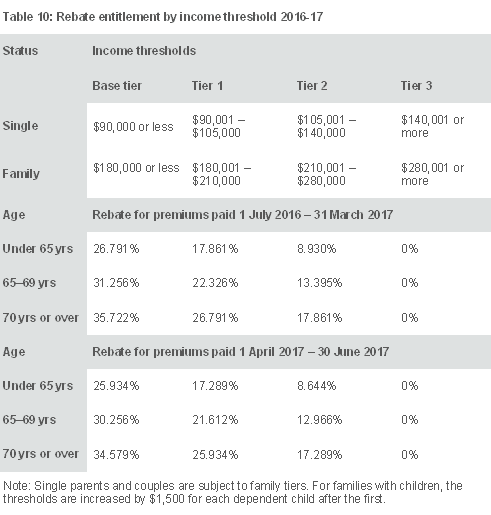

Medicare Levy Surcharge Private Health Insurance What s The Link

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

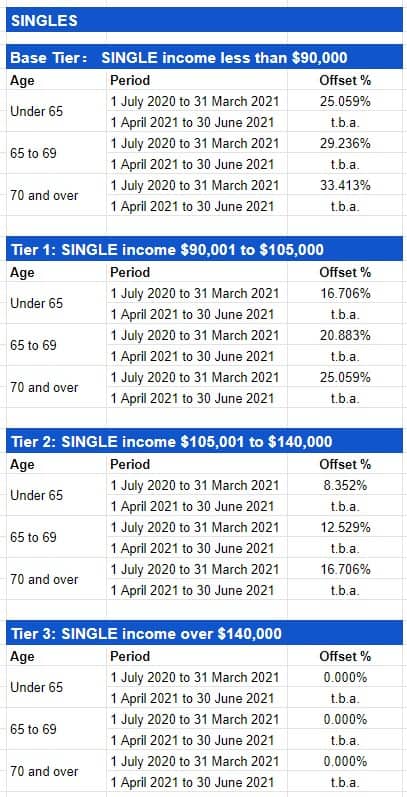

Web Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the Income Tax Act Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

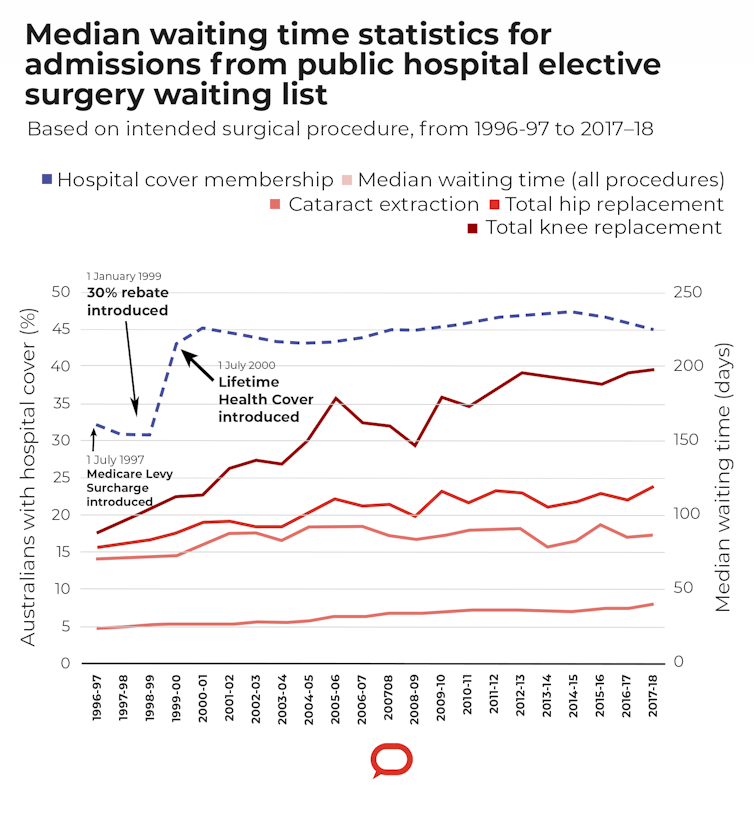

Web If you meet the eligibility requirements for a private health insurance rebate you can claim your rebate as either a premium reduction which lowers the policy price charged by your Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return

Download Medical Insurance Rebate In Income Tax

More picture related to Medical Insurance Rebate In Income Tax

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

How Does Private Health Insurance Affect My Tax Return Compare Club

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Web Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they have Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained

Web 29 avr 2020 nbsp 0183 32 Medical Insurance premium Preventive health checkup sub limit of Rs 5000 of Self Spouse and dependent Children 25 000 Medical Insurance premium Preventive health checkup sub limit of Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

https://1.bp.blogspot.com/-e7M8q_wmnrg/V24ELtVM3WI/AAAAAAAAGaI/tPaf_vkBm-gAVt0-4k8bDqVODrYOTlkawCLcB/s1600/Tax%2BBenefit%2Bof%2BBuying%2BHealth%2BInsurance%2Bin%2BIndia%2BNRI.png

https://cleartax.in/s/80c-80-deductions

Web 24 mars 2017 nbsp 0183 32 Income tax department with a view to encourage savings and investments amongst the taxpayers have provided various deductions from the taxable income under

https://economictimes.indiatimes.com/wealth/t…

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

Anthem Releases Medical Loss Ratio Rebate Information Hometown

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

What Should Happen To The Private Health Insurance Rebate This Election

ISelect What You Need To Know Tax Rebates On Health Insurance And

What s The Distinction Between PMI And Home Loan Defense Insurance

What s The Distinction Between PMI And Home Loan Defense Insurance

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

Private Health Insurance Tax Offset AtoTaxRates info

Health Insurance Tax Benefits Under Section 80D

Medical Insurance Rebate In Income Tax - Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return