Medical Insurance Rebate Under Income Tax Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 WASHINGTON The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for

Web The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from

Medical Insurance Rebate Under Income Tax

Medical Insurance Rebate Under Income Tax

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

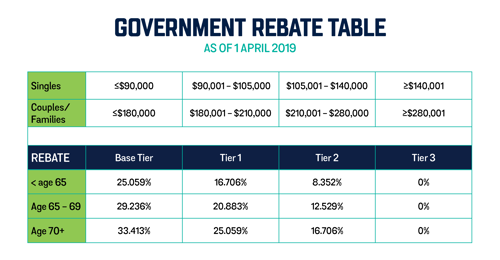

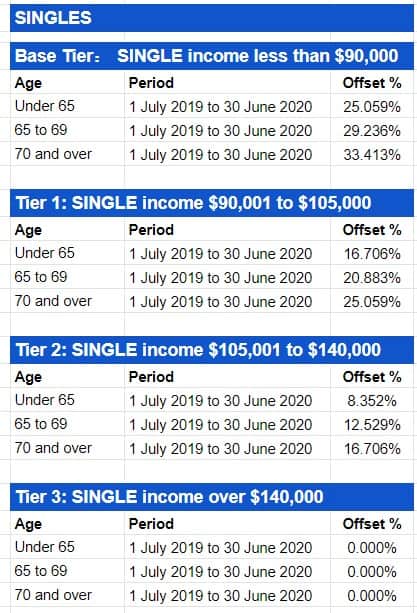

Australian Government Private Health Insurance Rebate Insurance

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

Web 5 oct 2022 nbsp 0183 32 The Good Brigade Getty Images The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with Web 23 avr 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act

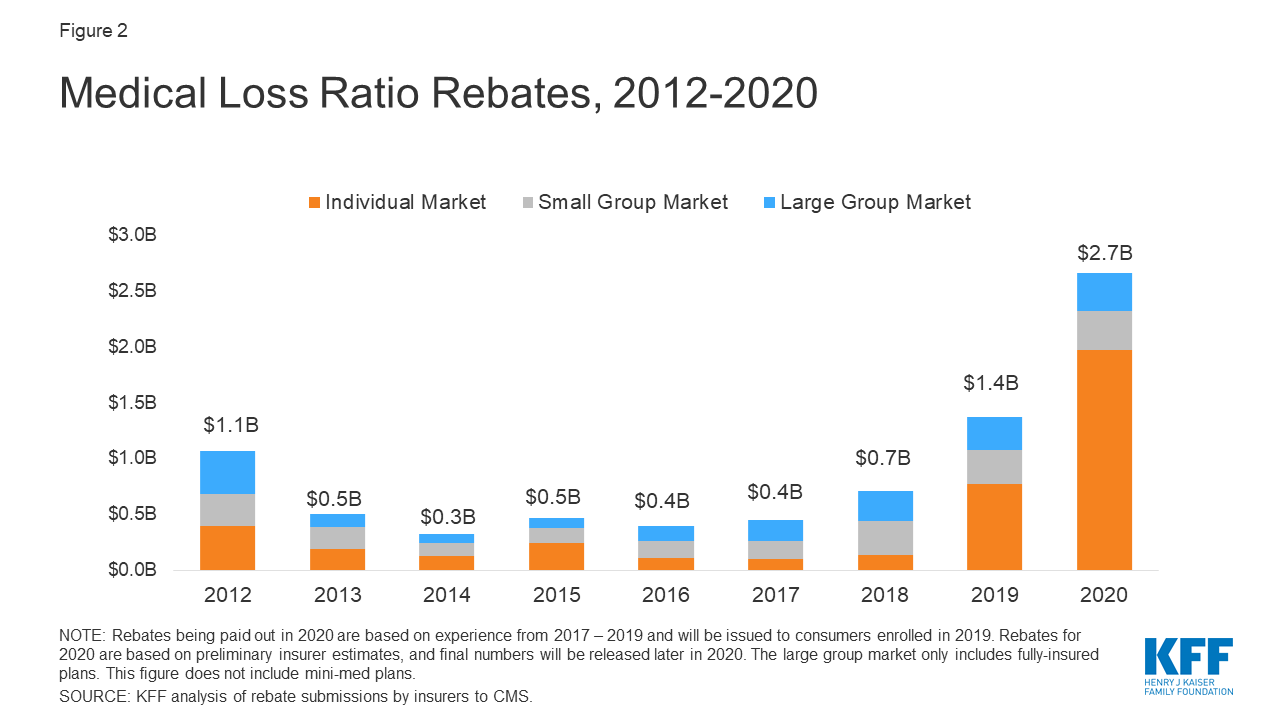

Web Frequently asked questions on the federal tax consequences to an insurance company that pays a MLR rebate and an individual policyholder who receives a MLR rebate as well Web 27 janv 2023 nbsp 0183 32 Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance

Download Medical Insurance Rebate Under Income Tax

More picture related to Medical Insurance Rebate Under Income Tax

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s Web 4 mai 2018 nbsp 0183 32 Income Tax Guidance Tell HMRC about changes to your employer paid medical insurance If your employer pays for your medical insurance you can check

Web Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they have Web 16 juil 2012 nbsp 0183 32 published July 15 2012 American health insurance companies are about to shower over 1 billion in rebates on policyholders refunding premiums paid in 2011

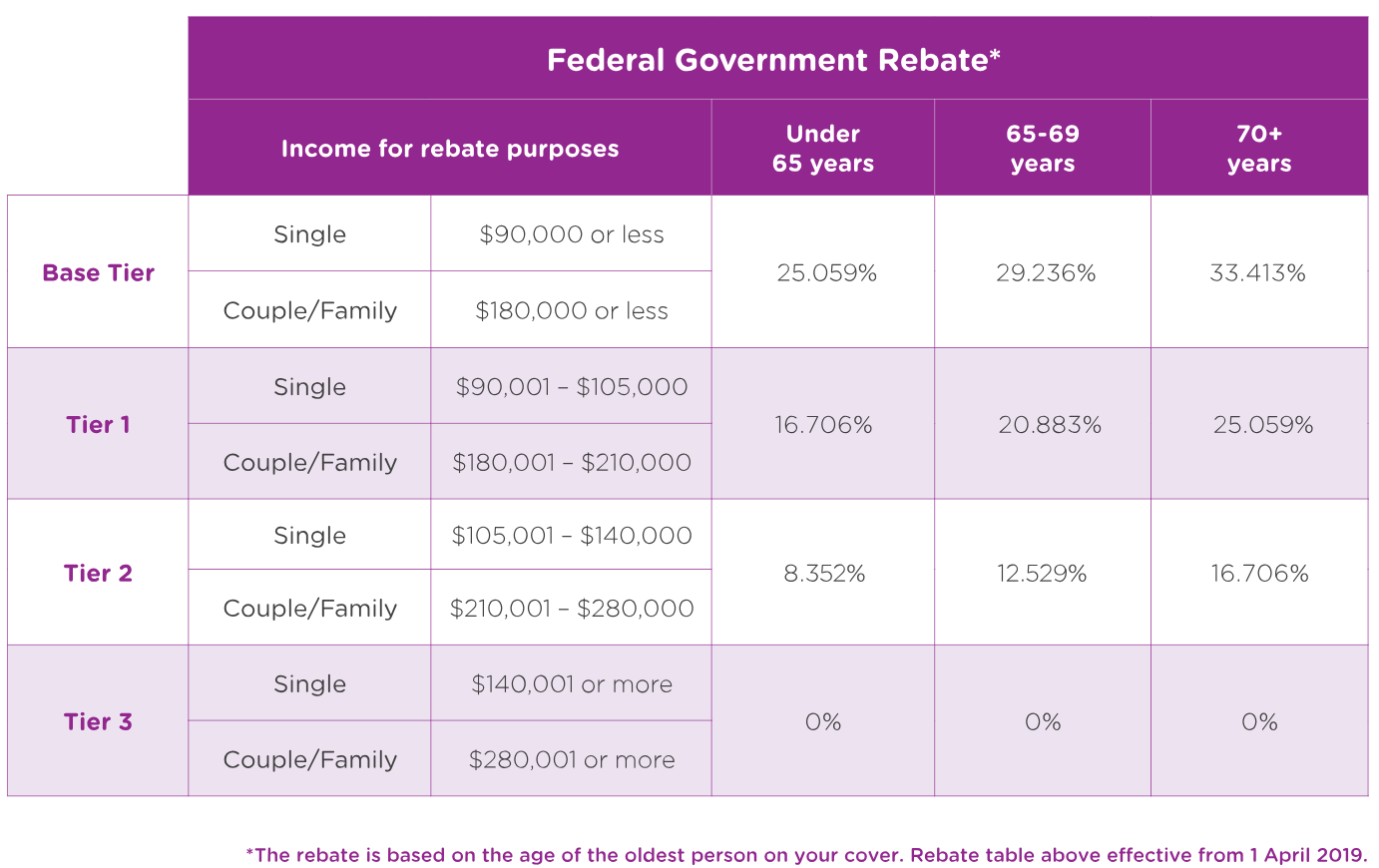

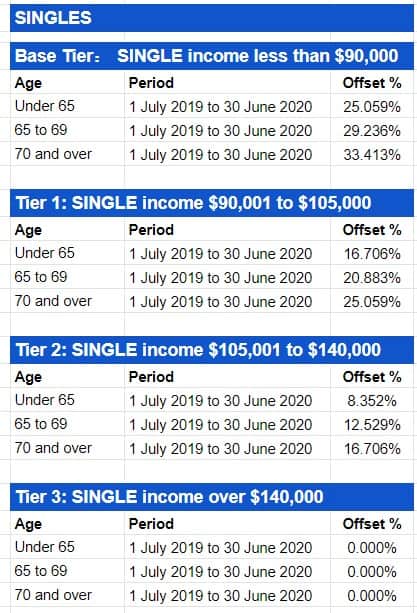

Private Health Insurance Tax Offset Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2020/05/Private-Health-Insurance-Rebate-Percentages-SINGLES-2019-20.jpg

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

https://www.irs.gov/newsroom/irs-provides-guidance-on-premium...

Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 WASHINGTON The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for

https://www.irs.gov/affordable-care-act/individuals-and-families/the...

Web The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Private Health Insurance Tax Offset Atotaxrates info

Medicare Levy Surcharge Private Health Insurance What s The Link

Tax And Rebates HBF Health Insurance

Who Will Get Health Insurance Rebate Checks Anceinsru

How Does Private Health Insurance Affect My Tax Return Compare Club

How Does Private Health Insurance Affect My Tax Return Compare Club

What s The Distinction Between PMI And Home Loan Defense Insurance

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

ISelect What You Need To Know Tax Rebates On Health Insurance And

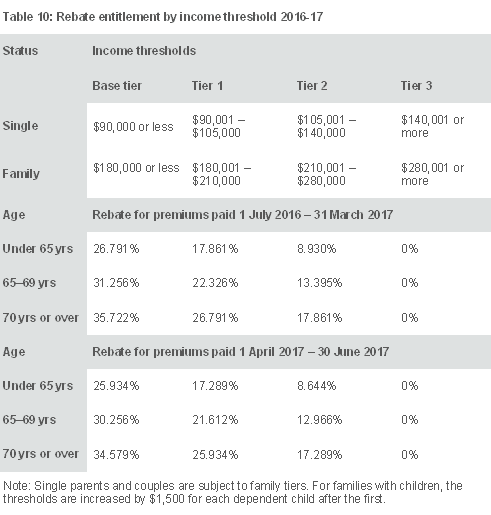

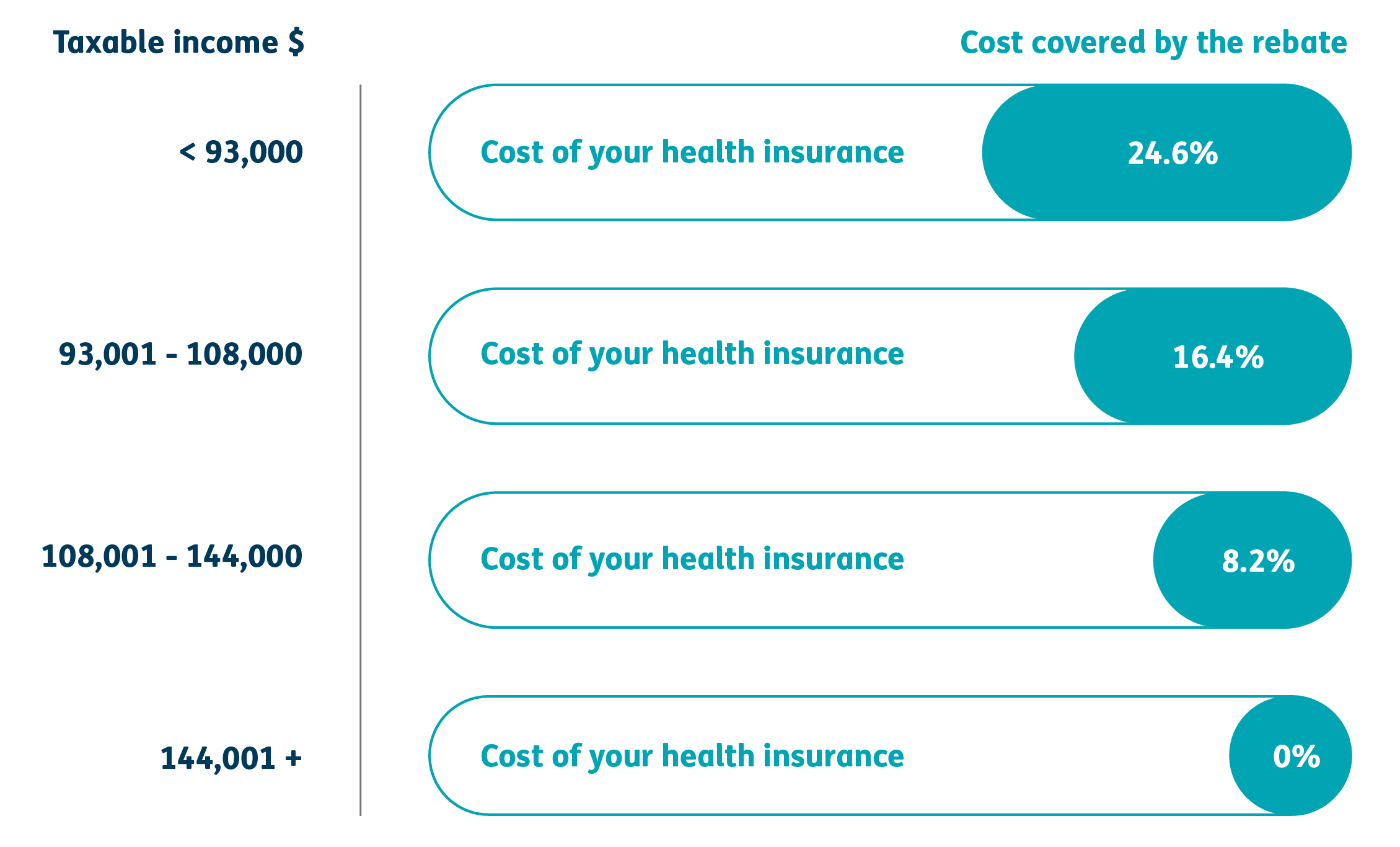

Medical Insurance Rebate Under Income Tax - Web The private health insurance rebate is income tested This means that if your income is higher than the relevant income threshold you may not be eligible to receive a rebate