Medical Insurance Relief Tax Credit Revenue Web 13 Feb 2023 nbsp 0183 32 Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from

Web 9 M 228 rz 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 Web To make a claim in the current tax year please follow these steps Sign into myAccount Click on the Manage your tax 2023 link in PAYE Services Select Add new credits

Medical Insurance Relief Tax Credit Revenue

Medical Insurance Relief Tax Credit Revenue

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/student-loan-1562083488.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax

https://wtop.com/wp-content/uploads/2022/08/shutterstock_1425899771-scaled-e1661301925948.jpg

Medical Insurance Tax Relief Claim Tax Back On Your Health Insurance

https://www.mytaxrebate.ie/wp-content/uploads/2020/10/Medical-Insurance-Relief-Blog-Image-e1602499719822.png

Web This page see tax relief on medical insurance premiums Gaeilge myAccount ROS LPT The Premium Tax Credits The Foundation Internal Revenue Service Relief Web 18 Mai 2021 nbsp 0183 32 IRS provides guidance on premium assistance and tax credit for continuation health coverage IR 2021 115 May 18 2021 WASHINGTON The

Web The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on Web 21 Jan 2022 nbsp 0183 32 The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased

Download Medical Insurance Relief Tax Credit Revenue

More picture related to Medical Insurance Relief Tax Credit Revenue

Insurance Relief Connecticut House Democrats

https://www.housedems.ct.gov/sites/default/files/field/image/shutterstock_373492012-health-insurance-e1491415000969.jpg

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

How Does Credit Score Impact Insurance Rates

https://assets.metromile.com/wp-content/uploads/2019/11/25212640/Untitled-design-32-1536x864.jpg

Web 5 Okt 2022 nbsp 0183 32 You must meet the following requirements to qualify for the premium tax credit Have a household income between 100 and 400 of the federal poverty level File a tax return with a filing status that s not Web On Revenue my Medical Insurance Relief tax credit is currently set to 305 for 2022 so maybe I don t need to do anything further but thought I d double check I have health

Web Section 470 Taxes Consolidation Act 1997 TCA provides for income tax relief in respect of payments made to authorised insurers under relevant contracts in respect of medical Web How to claim Making a claim for the current year Sign into myAccount Click the Manage your tax link in PAYE Services Select Claim tax credits Select Dependent Relative

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

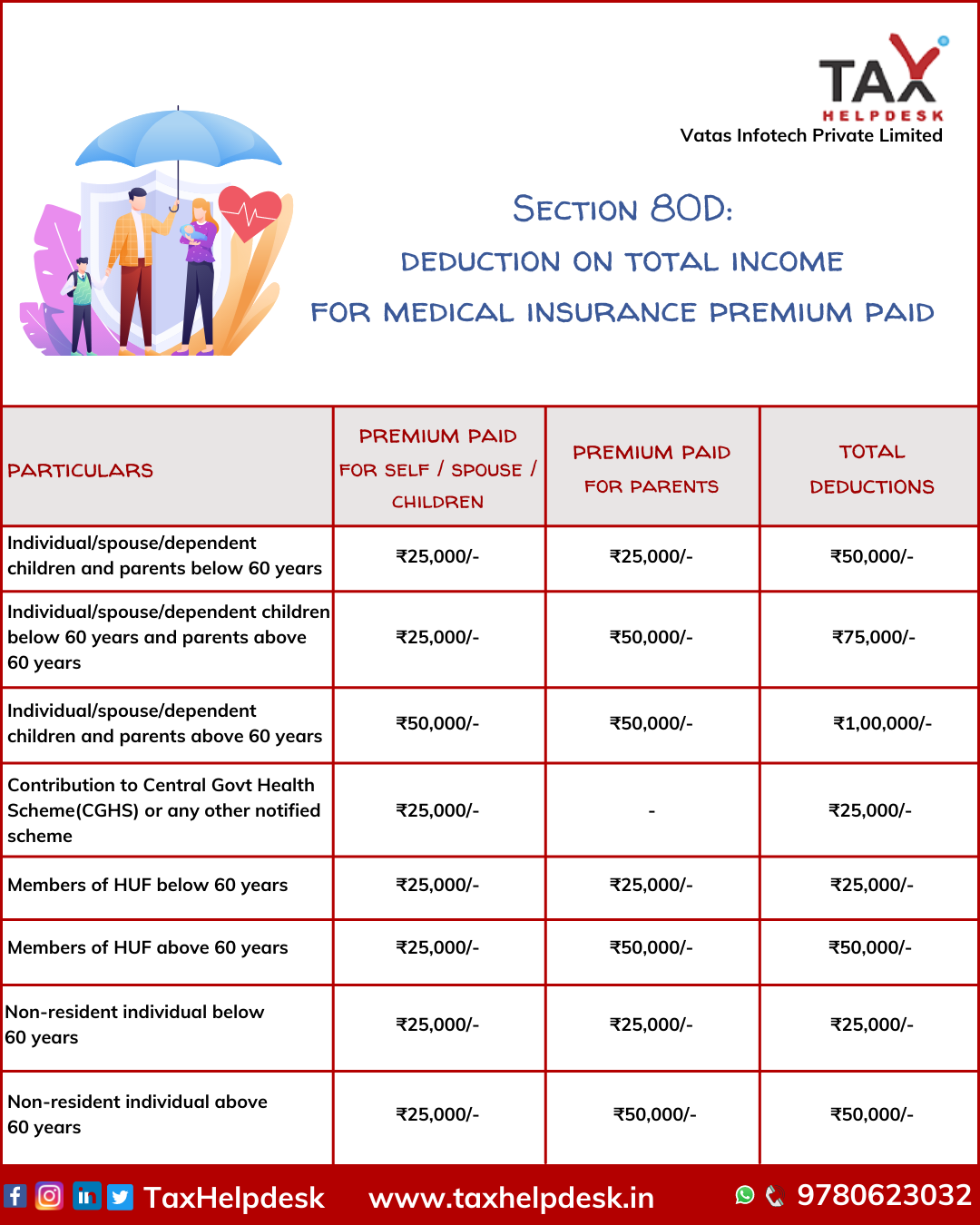

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/tax-benefits-on-medical-insurance.png

https://www.revenue.ie/.../illness-and-injury/medical-insurance.aspx

Web 13 Feb 2023 nbsp 0183 32 Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exempti…

Web 9 M 228 rz 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40

Startup Business Loans With No Revenue Global Connect Pro Financial

Malaysia Personal Income Tax Relief 2022

Jobs Available At Insurance Relief Hosted By Digi Me

Relief From Taxation In Income From Retirement Benefit Account

Guide To Premium Tax Credits For Health Insurance How To Save Money

Personal Tax Relief 2021 L Co Accountants

Personal Tax Relief 2021 L Co Accountants

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Changes To Medical Insurance Relief For

How Does The Medical Expense Tax Credit Work In Canada

Medical Insurance Relief Tax Credit Revenue - Web 9 M 228 rz 2020 nbsp 0183 32 How do I claim Medical Insurance Tax Relief To claim Medical Insurance Relief just fill in our Full Review Form This form will provide us with the