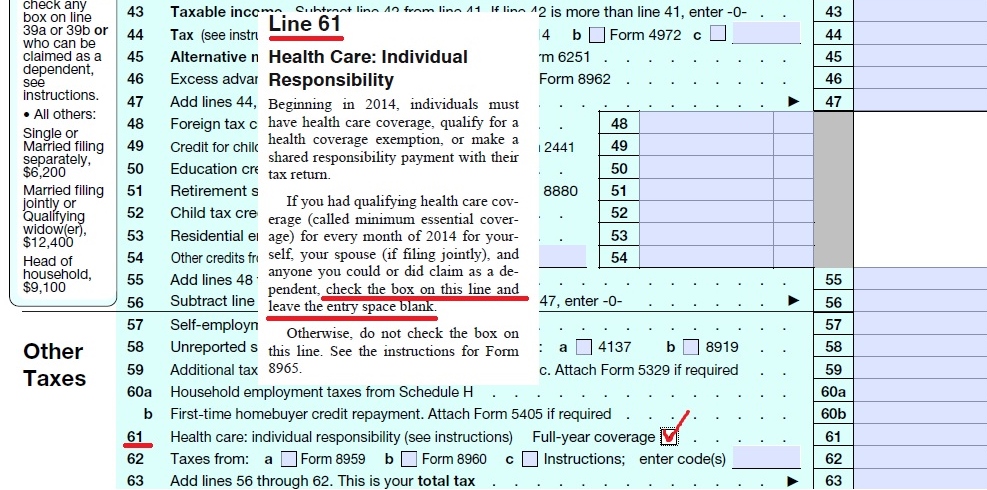

Medical Insurance Tax Rebate Web The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on

Web 4 mars 2019 nbsp 0183 32 What is a health insurance tax credit A premium tax credit also called a premium subsidy lowers the cost of your health insurance The discount can be applied Web 5 oct 2022 nbsp 0183 32 The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it

Medical Insurance Tax Rebate

Medical Insurance Tax Rebate

https://i1.wp.com/hometowninsurancepros.com/wp-content/uploads/2020/08/Anthem-2019-MLR.jpg?resize=790%2C1024&ssl=1

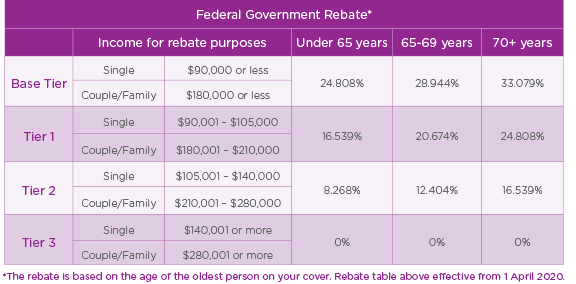

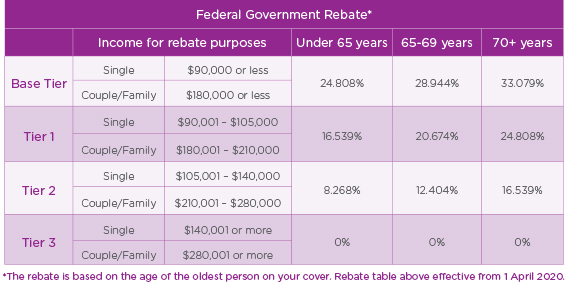

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

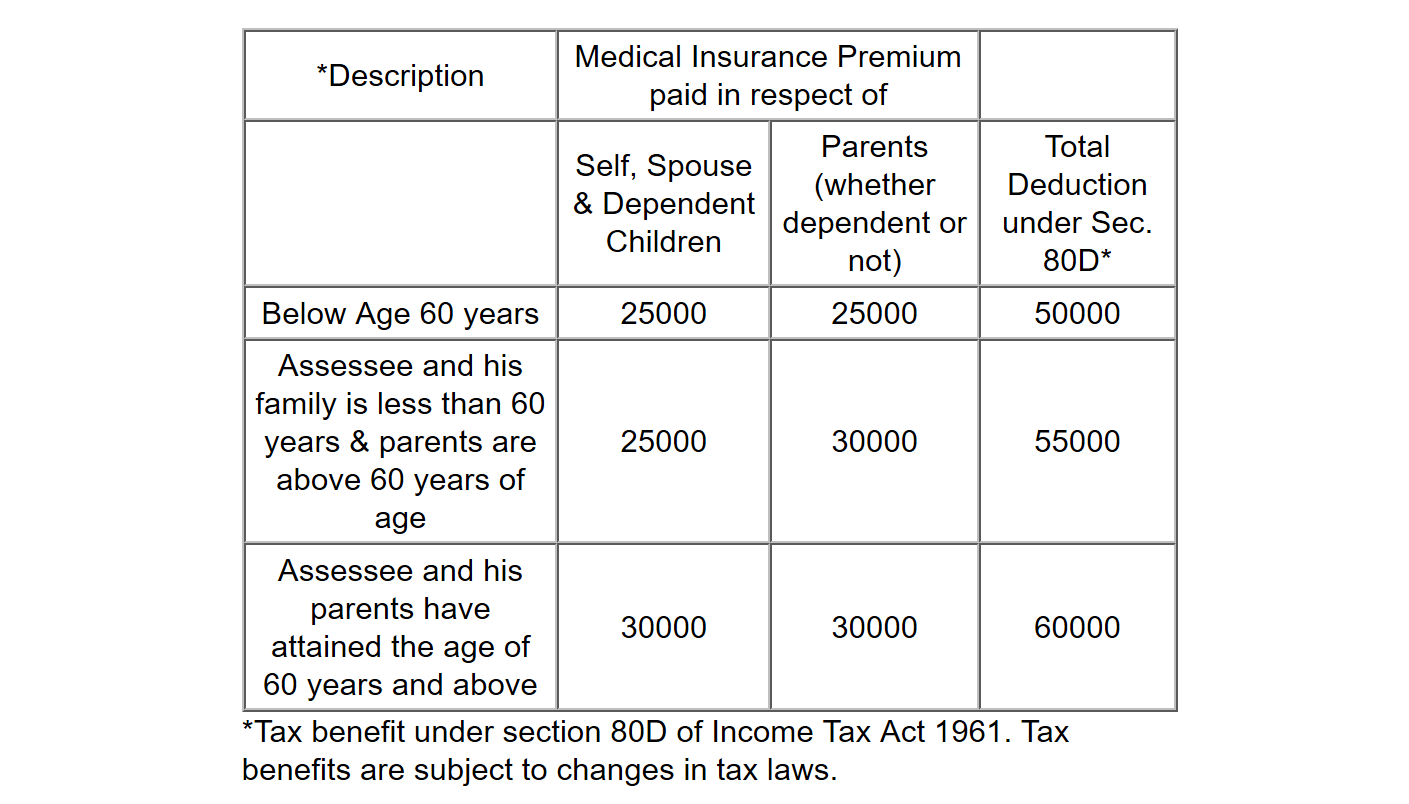

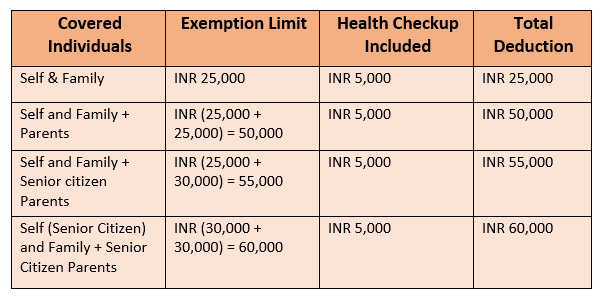

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Web When you apply for coverage in the Health Insurance Marketplace 174 you estimate your expected income for the year If you qualify for a premium tax credit based on your Web 12 ao 251 t 2022 nbsp 0183 32 An estimated 8 2 million policyholders are expected to receive a piece of 1 billion in rebates by Sept 30 from various insurers according to an estimate from the

Web 24 f 233 vr 2022 nbsp 0183 32 A1 The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance Web How to apply More information Introduction You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief

Download Medical Insurance Tax Rebate

More picture related to Medical Insurance Tax Rebate

How Does Private Health Insurance Affect My Tax Return Compare Club

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

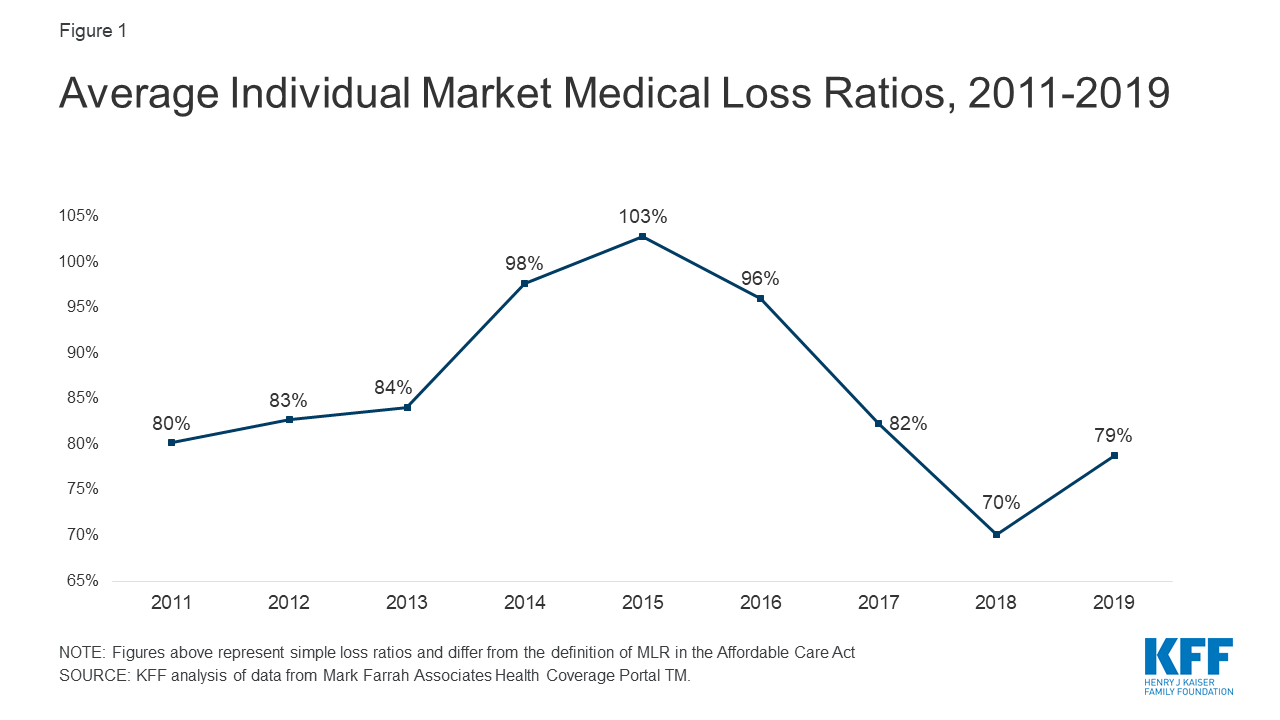

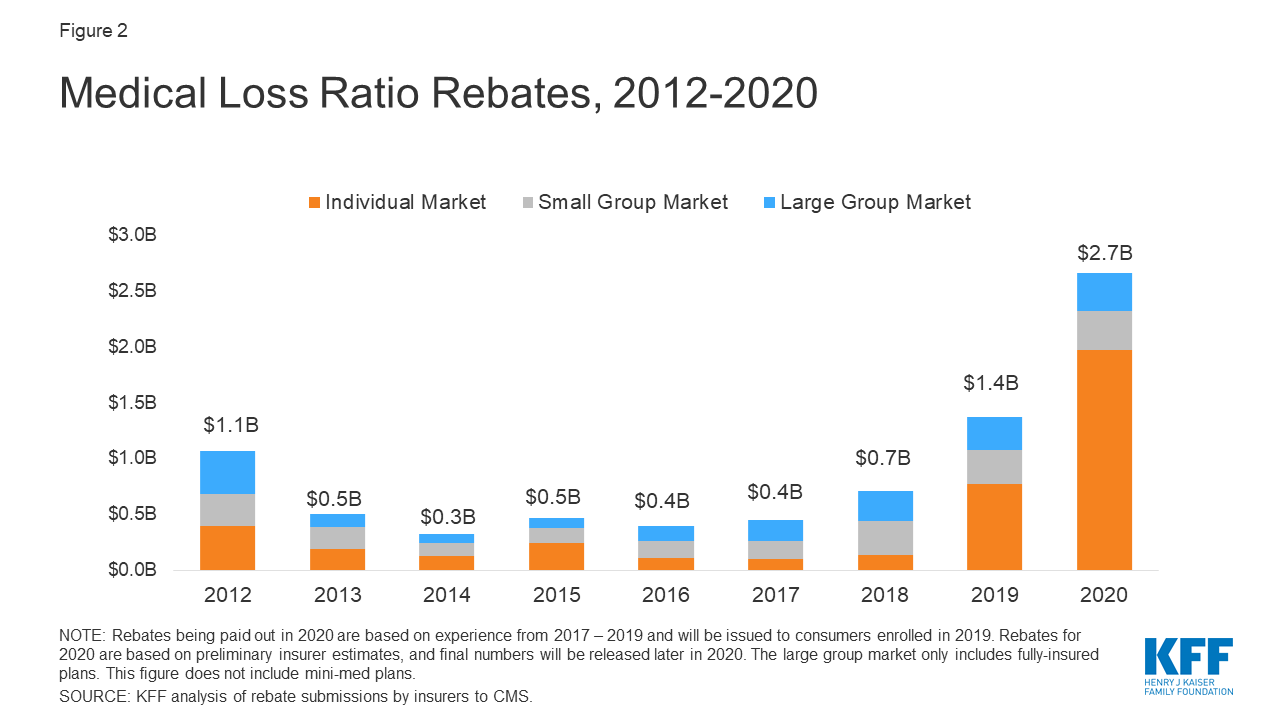

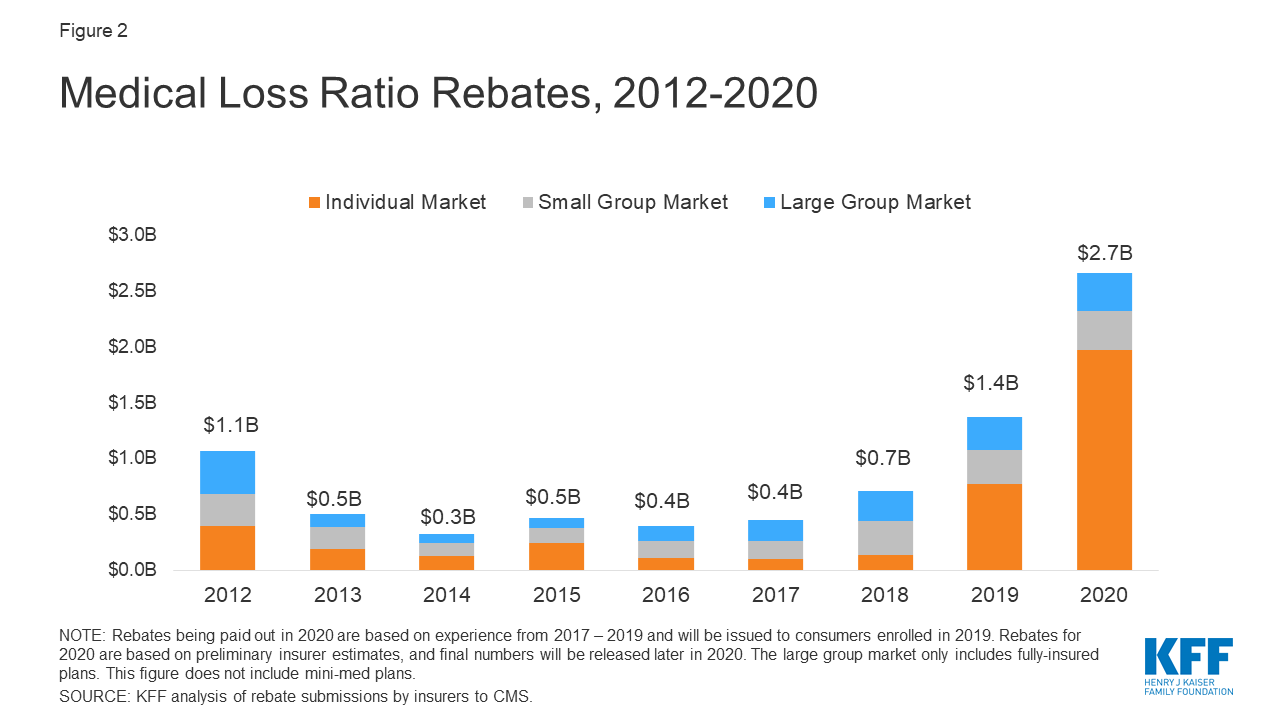

Data Note 2020 Medical Loss Ratio Rebates KFF

https://www.kff.org/wp-content/uploads/2020/04/9346-02-Figure-1.png

Web After determining that it is required to pay MLR rebates on both types of policies issued by Insurance Company during 2011 Insurance Company pays the rebates to the Web 18 mai 2021 nbsp 0183 32 The new law provides a corresponding tax credit for the entities that maintain group health plans such as employers multiemployer plans and insurers The 100

Web 12 juil 2023 nbsp 0183 32 You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self Web 16 juil 2012 nbsp 0183 32 Based on data for 2011 the federal government says insurers will rebate about 1 1 billion to 12 8 million Americans The average rebate for households that get

Who Will Get Health Insurance Rebate Checks Anceinsru

https://www.kff.org/wp-content/uploads/2020/04/9346-02-Figure-2.png

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

https://1.bp.blogspot.com/-e7M8q_wmnrg/V24ELtVM3WI/AAAAAAAAGaI/tPaf_vkBm-gAVt0-4k8bDqVODrYOTlkawCLcB/s1600/Tax%2BBenefit%2Bof%2BBuying%2BHealth%2BInsurance%2Bin%2BIndia%2BNRI.png

https://www.irs.gov/affordable-care-act/individuals-and-families/the...

Web The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on

https://www.valuepenguin.com/health-insurance-tax-credit

Web 4 mars 2019 nbsp 0183 32 What is a health insurance tax credit A premium tax credit also called a premium subsidy lowers the cost of your health insurance The discount can be applied

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

Who Will Get Health Insurance Rebate Checks Anceinsru

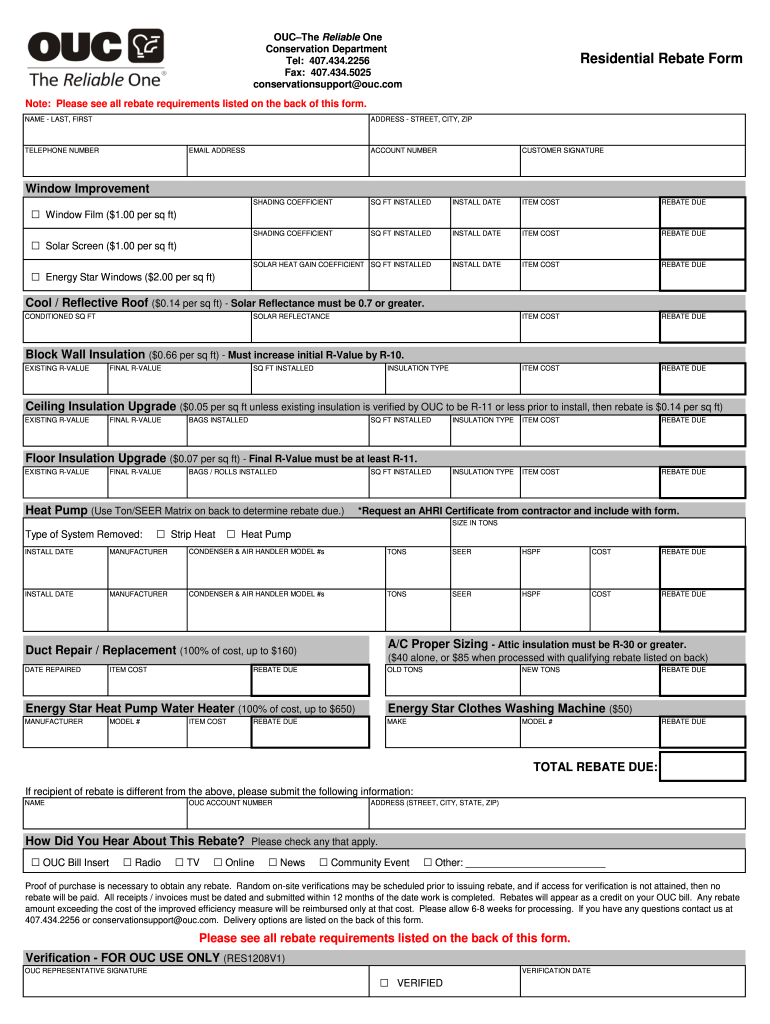

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

IRS Form For Health Insurance Easy To Insure Me

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Medical Claim Medical Claim Tax

Medical Claim Medical Claim Tax

Health Insurance Premium Receipt Insurance

Premium Receipt Fill Out Sign Online DocHub

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

Medical Insurance Tax Rebate - Web How to apply More information Introduction You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief